CHARLOTTE, N.C. — Maersk, a global integrated logistics and shipping company, has selected Charlotte for its North American corporate headquarters. The company will invest $16 million in Mecklenburg County and will grow its Charlotte workforce to 1,300 jobs. The location of the company’s new offices and identity of the landlord were not disclosed. Maersk is a subsidiary of Danish firm A.P. Moller-Maersk and was founded in 1904. The new headquarters in Charlotte will house key corporate functions — including finance, human resources, commercial strategy and technology — for its 10,000 North American employees. Maersk’s lease is the second headquarters relocation for Charlotte within a week as Scout Motors, a subsidiary of Volkswagen, announced its $206 million investment to move its regional headquarters to Charlotte.

Southeast

NAPLES, FLA. — CBRE has brokered the sale of Altis Santa Barbara, a 242-unit apartment community located at 4710 Altis Drive in Naples. Northland purchased the property for an undisclosed price. Robert Given, Neal Victor and Chris Smiles of CBRE represented the seller, a joint venture sponsored by Altman, in the transaction. Tracy Kennedy, Tony Stein and Ryan Hall with CBRE assisted Northland with acquisition financing. Delivered in 2024, Altis Santa Barbara offers one-, two- and three-bedroom units, as well as private patios or balconies for all units and direct-access garages for select units.

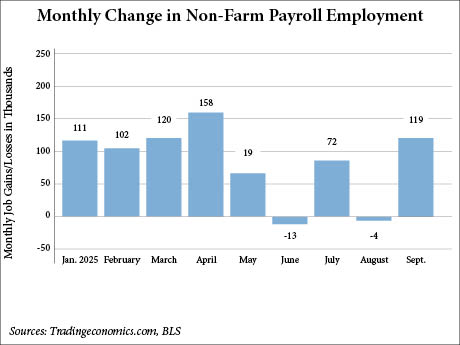

WASHINGTON, D.C. — The U.S. economy has added 119,000 jobs in September, according to a report from the U.S. Bureau of Labor Statistics (BLS). The latest jobs data was delayed by more than six weeks due to the recently concluded shutdown of the federal government, which lasted 44 days. The September figure exceeded forecasts of 50,000 new jobs by Dow Jones economists, according to CNBC. The BLS will postpone the jobs report data for both October and November, with plans to release the two reports simultaneously on Dec. 16. The September jobs report was originally scheduled to release on Oct. 3; the October jobs report was scheduled for Nov. 7; and the November jobs data was set to debut on Dec. 5. In addition to the delays, the BLS has revised down the jobs data for July and August by a combined 33,000 jobs. The July jobs report was revised from 79,000 to 72,000 jobs, and the August report was downwardly revised from 22,000 jobs to -4,000 jobs. The unemployment rate also increased to 4.4 percent, which is the highest level for the rate since October 2021. For September, employment was led by the healthcare sector (+43,000), bars and restaurants …

DURHAM AND MORRISVILLE, N.C. — Pharmaceutical developer and manufacturer Novartis (NYSE: NVS) has announced a $771 million expansion of its footprint in North Carolina’s Research Triangle. According to the company, the expansion will create 700 new jobs in Durham and Wake counties and more than 3,000 indirect jobs by the end of 2030. The North Carolina expansion is part of the Swiss company’s pledge to invest $23 billion in U.S. infrastructure over the next five years. Doubling the company’s operational presence to more than 700,000 square feet, the expansion will significantly increase manufacturing capacity. The expansion will comprise new construction as well as the renovation of existing facilities across three sites in Durham and Morrisville. The new hub will include a new site in Durham housing two new facilities for manufacturing biologics and sterile packaging and a new site in Morrisville for the production of solid dosage tablets and capsules, as well as an expansion of an existing Durham facility to support sterile filling of biologics into syringes and vials. One of the new facilities will be located at Pathway Triangle, occupying 202,000 square feet at the 1 million-square-foot campus in Morrisville. CBRE represented both Novartis and the landlord, King …

Commercial real estate is in the middle of one of its biggest transitions. For years, the challenge was finding data. Now, the challenge is knowing what to do with it. Artificial intelligence (AI) is starting to change that. The conversation has shifted from if we should be using AI to how we can use it in a way that actually improves business outcomes. REBusinessOnline recently spoke with Rob Finlay, founder and CEO of Defease With Ease | Thirty Capital, and Trevor Albarran, VP of product at Lobby AI, about how AI is changing decision-making in commercial real estate (CRE), what early adopters have learned and what leaders should be focusing on next. REBusinessOnline (REBO): What’s the biggest opportunity facing CRE executives today? Rob Finlay: It depends on the context, but right now, AI is the most powerful tool a real estate executive can have in their arsenal. AI finally gives principals — the people paid to think — the space to actually do that. When I started in real estate, I was paid to do. But as my role evolved, my value shifted to thinking — being strategic, motivating teams, and making high-level decisions. AI amplifies that ability. It takes …

CHARLOTTE, N.C. — Simon Property Group, the Indianapolis-based mall giant and retail REIT, has purchased Phillips Place, a 134,000-square-foot, open-air shopping center in Charlotte’s SouthPark neighborhood. The seller and sales price were not disclosed. Simon also owns the nearby SouthPark Mall. Phillips Place’s tenant roster includes more than 25 retail shops and restaurants, including alice+ olivia, Peter Millar, rag & bone, Ralph Lauren, Veronica Beard, RH Gallery (as well as its rooftop restaurant) and The Palm. The center is part of a mixed-use campus that includes a 180-room Hampton Inn & Suites hotel that Simon also owns and apartments. Simon’s plans for any redevelopment opportunities at Phillips Place were not released.

Vulcan Elements Signs Full-Building Industrial Lease at CrossPoint Logistics Center in Metro Raleigh

by John Nelson

BENSON, N.C. — Vulcan Elements, a rare earth magnet manufacturer, has signed a full-building lease at CrossPoint Logistics Center, a speculative industrial facility in the south Raleigh suburb of Benson. The developer, Edgewater Ventures, broke ground on the facility in 2022. Vulcan Elements plans to expand the current 501,215-square-foot facility to more than 1 million square feet and create 1,000 new jobs. CrossPoint Logistics Center is the largest speculative industrial facility ever constructed within the Raleigh-Durham MSA, according to Edgewater Ventures. Ed Brown of NAI Tri Properties and Anna Lea Stroud of A. Stroud & Co. represented Vulcan Elements in the lease transaction. Al Williams, Matthew Greer, Lee Allen and Diane Jones of JLL represented Edgewater Ventures.

CHESAPEAKE, VA. AND ELIZABETH CITY, N.C. — Newbrook Capital Properties has purchased a two-property multifamily portfolio in Chesapeake and Elizabeth City for $58.2 million. The seller was not disclosed. The properties include Green Tree, a 208-unit, garden-style community located at 749 Green Tree Circle in Chesapeake, and Emerald Lake, a 132-unit, garden-style property located at 1500 Emerald Lake Circle in Elizabeth City. The properties are 1990s vintage and sit roughly 40 miles apart. The portfolio acquisition grows Newbrook Capital’s assets under management to $400 million. The firm plans to invest in value-add capital improvements and has tapped StoneCreek to manage the portfolio. Hunter Bowling and Paul Marley of Cushman & Wakefield represented the seller for Emerald Lake in the transaction, and Drew White and Carter Wood of Berkadia represented the seller for Green Tree.

ATLANTA — Hunter Hotel Advisors has negotiated the sale of the Hyatt House Atlanta/Cobb Galleria, a 149-room, extended stay hotel located in Atlanta’s Cumberland/Galleria submarket. The property is situated in close proximity to Cobb Galleria Centre, Cumberland Mall, Cobb Energy Performing Arts Centre, The Battery Atlanta and Truist Park, home ballpark of the Atlanta Braves. Hospitality Asset Procurers (HAP) purchased the hotel and has selected its affiliate company, ROHM Group, to manage the hotel. The institutional seller and sales price were not disclosed. Mayank Patel of Hunter Hotel Advisors brokered the transaction.

TALLAHASSEE, FLA. — Berkadia has arranged the sale of Grove Park, a 324-unit apartment community located at 3148 Dick Wilson Blvd. in Tallahassee. The Class A community was developed in 2021 and 94 percent occupied at the time of sale. David Etchison of Berkadia represented the seller, Alabama-based TrimCor, in the transaction. Brad Williamson and Wes Moczul of Berkadia arranged acquisition financing through MF1 Capital on behalf of the buyer, Miami-based Monument Capital Management. The sales price and loan amount were not disclosed. Grove Park features one-, two- and three-bedroom layouts ranging from 1,219 to 2,120 square feet in size, including single-story duplexes with fenced yards. Amenities include a clubhouse with café bar, TV lounge, business center and rentable conference room and event space. Other amenities include a saltwater zero-entry pool and sundeck, fitness center, cedar sauna, playground and a bark park.