TAMPA, FLA. — Eagle Property Capital (EPC) and Belay Investment Group have sold Captiva Club Apartments, a 361-unit multifamily community located at 4401 Club Captiva Drive in Tampa. Built in 1973, the property comprises apartments in one-, two- and three-bedroom floor plans. Amenities at the community include a clubhouse, two swimming pools, two dog parks, a business center and onsite laundry. The partners acquired the property in 2016 and implemented $4.3 million in capital improvements, including the addition of 17 new units. The buyer and sales price were not disclosed.

Southeast

APAH Opens 150-Unit Oakwood Meadow Affordable Seniors Housing Community in Alexandria, Virginia

by John Nelson

ALEXANDRIA, VA. — The Arlington Partnership for Affordable Housing (APAH), along with its development partners, has opened Oakwood Meadow Senior Residences in Alexandria. The affordable housing development features 150 one- and two-bedroom apartments for qualifying adults ages 62 and older who earn between 30 and 60 percent of the area median income (AMI). Located on a site that was formerly a stormwater retention pond, this project is part of a public-private partnership between APAH and Fairfax County Redevelopment and Housing Authority (FCRHA). In addition to the contribution of public land, Fairfax County and the FCRHA invested $5.3 million in local Housing Blueprint funding, nearly $12.6 million in bond financing and an undisclosed amount in project-based vouchers. Additional financing includes both 4 and 9 percent Low-Income Housing Tax Credits (LIHTC) awarded by Virginia Housing and nearly $30 million in equity investments from Bank of America.

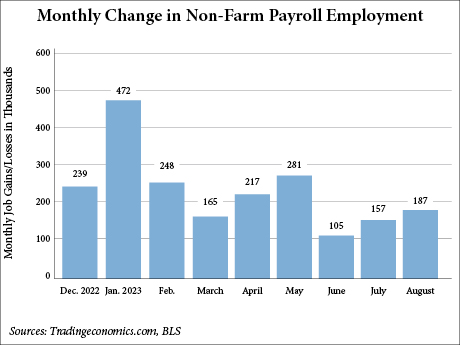

US Economy Adds 187,000 Jobs in August, Beating Expectations But Falling Below Average Growth

by John Nelson

WASHINGTON, D.C. — Total nonfarm employment in the United States increased by 187,000 in August, according to the Bureau of Labor Statistics (BLS). These findings reflect greater growth than anticipated, with economists previously predicting an increase of 170,000, according to CNBC. Despite this, 187,000 remains below the average monthly gain of 271,000 over the prior 12 months. The healthcare, leisure and hospitality and social assistance sectors added 71,000, 40,000 and 26,000 positions, respectively. Construction employment increased by 22,000, and employment in the professional and business services saw a modest increase of 19,000. Transportation and warehousing lost 34,000 jobs in August, and employment in other sectors saw little change. The unemployment rate for August is 3.8 percent, marking a 30-basis-point increase from July and the highest unemployment level since February. Additionally, the BLS significantly revised down the nonfarm employment numbers for June and July. With revisions, combined employment in the two months was 110,000 lower than previously reported. According to CNBC, the August report largely aligns with Federal Reserve’s expectations, and the central bank is expected to refrain from increasing interest rates at its September meeting. However, the Fed is expected to make a final increase for the year in October.

Cullinan Properties Delivers $100M Veterans Affairs Mental Health Clinic in Metro Tampa

by John Nelson

TEMPLE TERRACE, FLA. — Cullinan Properties has completed the development of the U.S. Tampa Veterans Affairs (VA) Mental Health Clinic in Temple Terrace, roughly 10 miles outside of Tampa. Cullinan broke ground on the $100 million project in late 2021. The facility, which totals 150,000 square feet, will begin seeing patients in January 2024. Situated on 20 acres, the development features a 120,000-square-foot clinic, 265 consult rooms, 60 patient rooms, an activities courtyard, full-service kitchen, dining room and social activities room. The General Services Administration (GSA), along with the VA, selected the project team, including Hoar Construction and Leo A Daly as the general contractor and architect, respectively. Lincoln Harris is the facility manager.

WOODBRIDGE, VA. — A joint venture between Ideal Realty Group, Rock Creek Property Group and The Sigmund Cos. has purchased a portfolio of four regional shopping centers in Woodbridge’s Dale City neighborhood. An affiliate of Interstate Management Inc. sold the properties, which total 470,000 square feet, for $52.8 million. The properties include Center Plaza, Mapledale Plaza, Forestdale Plaza and Glendale Plaza, all of which are located within three miles of each other along Dale Boulevard. The centers were 90 percent leased at the time of sale to tenants include Giant Food, Truist Bank, CVS, Ace Hardware, Advance Auto Parts, Wells Fargo and Dollar General. The new ownership is working with MV+A Architects to renovate the interiors and exteriors of the portfolio. KLNB has been selected for the portfolio’s leasing assignment, and TSCG has been tapped to handle property management services.

CHARLOTTE, N.C. — FCP has provided $13.9 million in preferred equity for the development of Easton at Mountain Island, a 240-unit apartment community located along Garron Point Drive in Charlotte. FCP provided the capital to the developer, Waypoint Residential, through its Structured Investments platform, which has invested approximately $640 million to date. When complete, Easton at Mountain Island will be situated on nearly 20 acres near the Catawba River and Charlotte Douglas International Airport.

TAMPA, FLA. — Marcus & Millichap has arranged the $7.3 million sale of a freestanding store located at 8701 W. Hillsborough Ave. in Tampa. The 64,031-square-foot retail property is net leased to Publix. Situated on 6.3 acres at the intersection of Memorial Highway and Hillsborough Avenue, the store was built in 1977 as an Albertsons. Evan Cannan and Reid Thedford of Marcus & Millichap’s Tampa office represented the seller, a private investor whose family has owned the land for nearly a century. Dean Zang, David Crotts, and Josh Ein of Marcus & Millichap’s Washington, D.C., office procured the buyer, which provided a bid that was $1.3 million higher than the highest off-market bid.

Taylor McMinn Retail Group Brokers $1.2M Sale of Store in Kinston, North Carolina Leased to Advance Auto Parts

by John Nelson

KINSTON, N.C. — The Taylor McMinn Retail Group, a retail investment sales team within Marcus & Millichap, has brokered the $1.2 million sale of a 7,000-square-foot store in Kinston leased to Advance Auto Parts. The retailer, which has operated at the store since it was built in 2003, recently signed a new 10-year lease at the property. The Advance Auto Parts is situated on a 0.7-acre site at 302 W. Vernon Ave., about 85 miles north of Wilmington, N.C., via I-40. Don McMinn of Taylor McMinn represented the undisclosed seller in the transaction. The buyer was an out-of-state 1031 investor. “Investment-grade tenants with lower rents and price points continue to receive strong demand in an environment where debt is a challenge,” says McMinn.

ATLANTA — The demand metrics of seniors housing are extremely compelling, given the demographics of Americans aging into the product type. But that demand is not necessarily translating directly to occupancy at senior living properties. This disparity between leads and move-ins is just one of the gaps that the panelists highlighted throughout the “Power Panel” at France Media’s InterFace Seniors Housing Southeast conference that touched on marketing, generational differences and family expectations. Hosted Aug. 16 at the Westin Buckhead in Atlanta, the panel offered insight into the state of the industry, as seen through the eyes of C-Suite executives. Participants included Iyvonne Byers, CFO of Priority Life Care; Judd Harper, president of The Arbor Co.; Doug Schiffer, president and chief operating officer of Allegro Senior Living; Shelley Esden, president and CEO of Sonata Senior Living; and Terry Rogers, president and CEO of Westminster Communities of Florida. John Lariccia, CEO of WelcomeHome Software, served as the moderator. Follow the lead Esden said that the “big discrepancy between the rise in the number of leads and the rise in move-ins” can be partly accounted for by the prevalence of digital marketing and automation, particularly in the post-COVID landscape. For this reason, she …

IMS Development Acquires 130 Acres in Huntsville, Plans Mixed-Use Campus With 800 Residences

by John Nelson

HUNTSVILLE, ALA. — Tuscaloosa, Ala.-based IMS Development has purchased 130 acres on the north side of Huntsville from the University of Alabama in Huntsville Foundation. The site is located at the corner of State Routes 255 and 53 and Blake Bottom Road. The buyer plans to build a mixed-use campus on the site dubbed North Valley, which will comprise 800 residences and 20 acres of commercial space. IMS Development says potential uses for the commercial component could include big-box retailers, hotels, restaurants, convenience stores and entertainment venues. Eric St. John of Crunkleton Commercial Real Estate assisted IMS in the land acquisition. The construction timeline was not released.