LAURENS, S.C. — Patterson Real Estate Advisory Group has secured an undisclosed amount of joint venture equity for the development of Building A at Hunter Industrial Park in Laurens, a new industrial development situated roughly 35 miles southeast of Greenville and Spartanburg. The financial intermediary arranged the financing through The Guardian Life Insurance Co. of America on behalf of the borrower, Appian Investments/NAI Earle Furman. Patterson also arranged construction financing through First Carolina Bank on behalf of the borrower. Construction is scheduled to begin immediately.

Southeast

Forman Capital Provides $22.5M Financing for Build-to-Rent Residential Community in South Georgia

by John Nelson

CENTERVILLE, GA. — Forman Capital has provided a $22.5 million loan for the lot acquisition and construction of a build-to-rent (BTR) residential community located at 3930 US Highway 41 in Centerville, about 21 miles south of Macon, Ga. Upon completion, the first phase of the development will comprise 109 single-family rental homes in two-, three- and four-bedroom layouts, with monthly rents expected to range from $1,900 to $2,400. Parkland Homebuilders, an affiliate of Alpharetta, Ga.-based Parkland Communities, is the borrower and developer. Plans for the community include four phases and a total of 317 homes.

SALISBURY, MD. — KLNB has brokered the $14.2 million sale of College Square Shopping Center in Salisbury. Tenants at the center, which was 97 percent leased at the time of sale, include Dollar Tree, BioLife Plasma, Ace Hardware and Planet Fitness. Chris Burnham, Vito Lupo, Andy Stape and Jake Furnary of KLNB’s Retail Capital Markets team arranged the sale on behalf of the seller, Rockford Capital Partners, which has owned the property since 2015. The buyer was not disclosed.

CBRE Arranges $12.9M Refinancing for Publix-Anchored Wynnehaven Plaza in Navarre, Florida

by John Nelson

NAVARRE, FLA. — CBRE has arranged a $12.9 million loan for the refinancing of Wynnehaven Plaza, a 64,995-square-foot shopping center located at 10040 Navarre Parkway in Navarre. A 48,387-square-foot Publix grocery store anchors the center, which was completed earlier this year. Seven other tenants occupy the fully leased property, including a coffee shop, primary care clinic, ice cream parlor and a nail salon. Richard Henry, Mike Ryan, Brian Linnihan and Taylor Crowder of CBRE secured the financing on behalf of the borrower, Atlanta-based Branch Properties, through 40|86 Mortgage Capital.

Central Florida retail is alive, well and growing, thanks in large part to Florida’s continuing resilience to the nation’s economic challenges. Thousands of people are moving to the state each week, the Orlando area’s economy continues to diversify beyond tourism and residents continue to show confidence with their retail spending. That said, there are significant challenges facing new retail developments, due to the cost of construction and other inflationary pressures. We expect this to be a major issue for the rest of this year, and it will require thoughtful planning for everyone involved in these projects. As we look at the remainder of 2023, we see two big takeaways: • For brick-and-mortar retail, it’s important for developers and owners to bring in concepts that are new and fresh. In some cases, this involves established retailers getting creative with their spaces, like what Macy’s is doing with its new Market by Macy’s concept, which uses a smaller footprint than traditional Macy’s stores. • To make new retail developments happen, developers, landlords and tenants need to be inventive in how they structure deals, whether it’s sharing in construction cost overages or giving tenants more time to get their spaces ready. With that …

Walker & Dunlop Arranges Construction Financing for 614,586 SF Facility at Piedmont Triad International Airport in Greensboro

by John Nelson

GREENSBORO, N.C. —Walker & Dunlop has arranged construction financing and joint venture equity for the development of Lynxs GSO Technix, a build-to-suit maintenance and repair operations (MRO) facility at Piedmont Triad International Airport in Greensboro. Upon completion, the development will feature a 218,200-square-foot building with an MRO hangar, paint hangar and office and support space, as well as a 396,386-square-foot apron for aircraft fueling, defueling and washing. Lynxs GSO will also include seven bays with six standard hangars and one paint hangar. Tom Fish and Drew Van Norman of Walker & Dunlop secured the financing on behalf of the borrower, Lynxs Group. An affiliate of UK-based Marshall Aerospace will occupy the facility.

GW, Virtus Real Estate Capital Break Ground on 279-Unit Apartment Community in Charlottesville, Virginia

by John Nelson

CHARLOTTESVILLE, VA. — GW Real Estate Partners and Virtus Real Estate Capital have broken ground on a 279-unit apartment community located at the entrance to North Pointe, a 224-acre mixed-use development in Charlottesville. Dubbed The Ridge at North Pointe, the community will comprise seven three-story buildings with units in one-, two- and three-bedroom floor plans averaging 988 square feet, as well as 502 parking spaces. Delivery is scheduled for the second quarter of 2024. United Bank provided construction financing for the project.

Cushman & Wakefield Brokers Sale-Leaseback of 183,509 SF Manufacturing Facility in Monroe, North Carolina

by John Nelson

MONROE, N.C. — Cushman & Wakefield has brokered the sale-leaseback of a 183,509-square-foot manufacturing facility located at 1710 Airport Road in Monroe. Circor International sold the property, which will continue to serve as the headquarters for the company’s IMO Pump brand. Built in 1979, the building was expanded in 2008. Rob Cochran, Bill Harrison, Nolan Ashton and Tommy Whitmore of Cushman & Wakefield represented Circor International in the transaction. Monroe Airport Industrial LLC, an affiliate of Welcome Group, acquired the facility for an undisclosed price. Ted Kakambouras of Welcome Group and Allen de Olazarra of Equity Real Estate Partners represented Welcome Group in the transaction. Jason Hochman, Ron Granite and Bradley Geiger of Cushman & Wakefield secured acquisition financing on behalf of the buyer.

NEW ORLEANS —SRSA Commercial Real Estate has arranged the sale of Algiers Plaza, a 228,000-square-foot shopping center located at 4100 General De Gaulle Drive in New Orleans. Tenants at the property include Winn-Dixie, Walgreens, Ross Dress for Less, T.J. Maxx, Petco, Five Below and Chick-fil-A. Steve Reisig, Kirsten Early and Christopher Robertson Jr. of SRSA, along with Scott DeYoung and Jeff Conover of Faris Lee Investments, represented the seller, N3 Real Estate, in the transaction. The buyer and sales price were not disclosed.

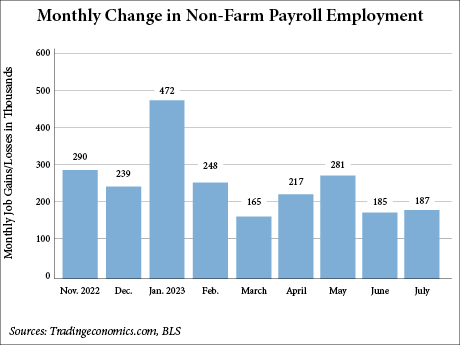

WASHINGTON, D.C. — Total nonfarm employment in the United States rose by 187,000 jobs in July, according to the Bureau of Labor Statistics (BLS). This marks slower growth than predicted by economists, reports CNBC, with the Dow Jones estimating an increase of 200,000. July’s job growth shows little change from June, which the BLS revised down by 24,000 to 185,000. Healthcare added 63,000 jobs in July and social assistance added 24,000 jobs. Employment in financial activities increased by 19,000. Construction employment also increased by 19,000 jobs, and leisure and hospitality fields showed little change, with an increase of 17,000. The unemployment rate remained steady, with a slight decrease to 3.5 percent from the 3.6 percent rate in June.