CHARLOTTE, N.C. — Trinity Partners has arranged the sale of a 58,064-square-foot office building located at 6201 Fairview Road in Charlotte’s SouthPark office submarket. An affiliate of Charlotte-based Big V Property Group purchased the office building from an affiliate of The Daniels Co., an investment firm based in Bluefield, W.Va. Roger Cobb of Selwyn Property Group represented the buyer in the transaction. Dunn Mileham, David Morris and Eric Jennings of Trinity Partners represented the seller. The sales price was not disclosed. The office building was 59 percent leased at the time to sale, and Big V plans to relocate its Charlotte office to the fourth floor.

Southeast

Walker & Dunlop Arranges $150M Refinancing for New Mixed-Use Property in Fort Lauderdale

by John Nelson

FORT LAUDERDALE, FLA. — Walker & Dunlop has arranged a $150 million loan for the refinancing of Quantum at Flagler Village, a newly built mixed-use development in Fort Lauderdale. The property houses two 15-story towers comprising 337 apartments, 20,884 square feet of retail space, a five-story parking garage and a nine-story Courtyard by Marriott hotel that features 137 rooms and a rooftop pool and bar. Joe Hercenberg led the Walker & Dunlop Capital Markets team that arranged a fixed-rate, five-year loan on behalf of the borrower, Prime Group US-PMG Asset Services. The loan refinances a construction loan that Walker & Dunlop closed four years ago.

WASHINGTON, D.C. — PRP has acquired Spring Valley Village, a 95,000-square-foot shopping center in Washington, D.C.’s Spring Valley neighborhood. The undisclosed seller sold the property for $47.5 million. Originally constructed in 1939 and renovated in 2017, the center comprises six buildings that were 98 percent leased at the time of sale to tenants including Crate & Barrel, Millie’s Restaurant, Capital One Bank, Starbucks, Small Door Veterinary, Compass Coffee and Blue Lane. Spring Valley Village is listed on the National Register of Historic Places.

ATLANTA — Northland has partnered with Ascent Property Management to purchase Glenwood at Grant Park, a 216-unit apartment community located in Atlanta’s Grant Park neighborhood. The seller and sales price were not disclosed. Built in 2016, the midrise property features a mix of studio, one- and two-bedroom apartments. Amenities include a 24-hour business center, fitness center, bocce ball court, coffee bar, resort-style pool and courtyard, pet washing station, a resident lounge and game room, package lockers, EV charging stations and access to the Atlanta BeltLine. This is Northland’s ninth acquisition in Georgia since entering the market in 2020.

North American Properties, Politan Group to Open New Food Hall at Forum Peachtree Corners in Metro Atlanta

by John Nelson

PEACHTREE CORNERS, GA. — Cincinnati-based mixed-use developer and operator North American Properties (NAP) has partnered with New Orleans-based Politan Group for a new food hall at The Forum Peachtree Corners, a mixed-use redevelopment in metro Atlanta. Set to open in summer 2024, the new Politan Row at The Forum is the second food hall between NAP and Politan Group as the duo opened Politan Row at Colony Square in Midtown Atlanta two years ago. The nearly 10,000-square-foot food hall will feature space for seven independent food-and-beverage concepts, a central Bar Politan, private event venue and an outdoor patio fronting the greenspace. Politan Group is also activating the adjacent jewel box with a standalone restaurant and wine bar. Bell-Butler is designing the food hall. Other uses coming to The Forum Peachtree Corners include a 125-room hotel, 381 apartments and a structured parking deck.

Cushman & Wakefield Brokers Sale of 677,789 SF Industrial Park in Deerfield Beach, Florida

by John Nelson

DEERFIELD BEACH, FLA. — Cushman & Wakefield has brokered the sale of Quiet Waters Business Park, an infill industrial park in South Florida’s Deerfield Beach. PGIM Real Estate sold the seven-building, 677,789-square-foot property for an undisclosed price. The buyer was also not disclosed. Mike Davis, Dominic Montazemi, Rick Brugge, Rick Colon, Greg Miller, Cassandra Hernandez and Chloe Strada of Cushman & Wakefield represented the seller in the transaction. Matthew McAllister, Christopher Thomson, Chris Metzger and Rick Etner of Cushman & Wakefield’s South Florida Industrial Team will handle the property’s leasing assignment going forward. Quiet Waters is situated along the planned expansion of SW 10th Street, which will offer more direct connectivity to I-95, Sawgrass Expressway and the Florida Turnpike. The park houses 30 tenants and features a wide range of bay sizes with dock-high and grade-level loading.

Balfour Beatty Plans $240M Student Housing Project at William & Mary in Williamsburg, Virginia

by John Nelson

WILLIAMSBURG, VA. — Balfour Beatty Campus Solutions, a developer and operator of college and university real estate and infrastructure projects, has released plans for on-campus student housing options at William & Mary, a public research university in Williamsburg. The developer formed a public-private partnership with the school to bring the $240 million project to fruition. The new student housing accommodations will exceed 1,200 new beds. The general contractors, which includes Balfour Beatty’s buildings division and Richmond-based Kjellstrom+Lee, plan to break ground this month and open for student occupation in 2025. The first phase will deliver 935 beds at West Woods on the west side of William & Mary that will feature modern living units and community spaces, as well as a 50,000-square-foot dining hall. The second phase will feature 269 beds in a new facility adjacent to the school’s Lemon and Hardy Halls along Jamestown Road. The residence halls will be heated using geothermal heating and air conditioning in support of the school’s Climate Action Roadmap, which aims for a carbon-neutral campus by 2030. Lemon and Hardy Halls will also be transitioned to geothermal heating and cooling as part of the project. The design-build team includes VDMO Architects and CMTA. …

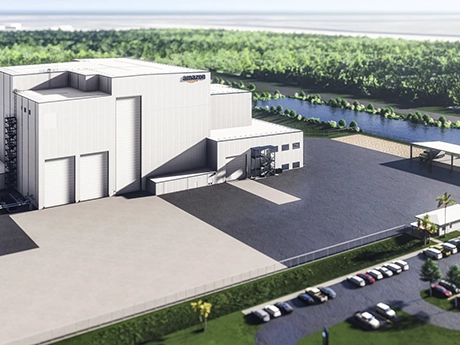

CAPE CANAVERAL, FLA. — Amazon is underway on the construction of a $120 million satellite processing facility at Space Florida’s Launch and Landing Facility within Kennedy Space Center in Cape Canaveral. Upon completion, the development will total 100,000 square feet with a 100-foot high bay clean room. The facility will be used to receive and prepare Blue Origin and United Launch Alliance (ULA) satellites as part of Amazon’s Project Kuiper, a 3,200-satellite project that will provide broadband connection to underserved communities globally. Amazon will use the facility to receive shipments, conduct final preparation ahead of launches, connect satellites to custom dispensers from space tech firm Beyond Gravity and integrate the loaded dispensers with launch vehicles. Amazon’s investment is expected to create 50 news jobs on Florida’s Space Coast. A timeline for delivery was not disclosed.

Northmarq Arranges $70M Refinancing for Two Multifamily Communities in Miami Lakes, Florida

by John Nelson

MIAMI LAKES, FLA. — Northmarq has arranged a $70 million loan for the refinancing of two multifamily communities located in Miami Lakes. Built in 1997 and 2000, the properties total 500 units. Jeff Robertson of Northmarq secured the 10-year permanent financing through Empower Annuity Life Insurance Co. on behalf of the borrower, Graham Cos. The names and addresses of the communities were not disclosed.

NASHVILLE, TENN. — Walker & Dunlop has brokered the sale of The Guthrie North Gulch, a 271-unit apartment community located at 600 11th Ave. N in Nashville. Russ Oldham of Walker & Dunlop represented the undisclosed seller in the transaction, and Stephen Farnsworth, Hanes Dunn and Jessie Bland of Walker & Dunlop arranged Freddie Mac financing on behalf of the buyer, GF Properties. The sales price and loan amount were not disclosed. Units at the property include apartments in one-, two- and three-bedroom layouts. Amenities include a fitness center, dog park and a recording studio.