ARLINGTON, VA. — Development and construction firm Skanska has completed the construction of a 245,000-square-foot medical office building in Arlington on behalf of VHC Health. The Outpatient Pavilion facility includes physical therapy examination and treatment rooms, radiology and imaging suites, examination clinics and six operating rooms. Additionally, there is 22,000 square feet of space dedicated to women’s health services. Skanska previously delivered an adjacent parking garage, featuring capacity for more than 1,600 cars, in 2021.

Southeast

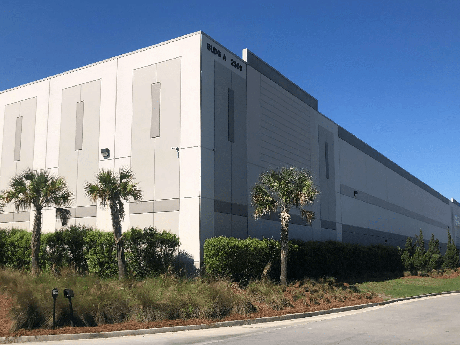

Cushman & Wakefield Secures 216,317 SF Industrial Lease at Osprey Logistics Park in Coral Springs, Florida

by John Nelson

CORAL SPRINGS, FLA. — Cushman & Wakefield has arranged a 216,317-square-foot lease at Osprey Logistics Park, a 427,515-square-foot industrial development currently underway in Coral Springs. Matthew McAllister and Christ Metzger of Cushman & Wakefield’s South Florida Industrial Team represented the landlord and developer, Foundry Commercial, in the leasing negotiations. Steve Wasserman and Erin Byers of Colliers represented the tenant, CTS Engines. CTS Engines will move its headquarters to Building 2 upon completion of the project, which is scheduled for late 2023. The building features 36-foot clear heights, 235-foot building depth, a 180-foot truck court, R-19 insulated roof deck, an ESFR sprinkler system and office space.

When reflecting on Charlotte’s multifamily market over the past few years, several major trends drove unprecedented transaction volume — record-level rent growth, positive absorption despite a consistently robust pipeline of deliveries, strong population growth from high in-migration and rapidly increasing homeownership costs pricing residents out of the market. Charlotte has been a popular relocation destination for individuals and families, particularly from the Northeast, Midwest and other parts of the Southeast who are drawn to the low cost of living, warm climate and strong economy. Zillow ranks Charlotte as the No. 1 housing market for 2023, signaling a continued rise in home values and subsequent increased demand for rental housing from the growing population. In-migration has made Charlotte experience explosive growth and bolstered the population to over 2.7 million residents by year-end 2022, a 5.6 percent increase since 2018 compared to the national rate of 1.3 percent. Equally impressive is regional job growth, with non-farm payrolls increasing 7.9 percent over the same time frame. Much of Charlotte’s multifamily growth is attributed to capital investment from new employers across the metro, including Albemarle Corp.’s $180 million investment into a new research campus in University City bringing 200 new jobs, as well as …

Berkadia Arranges $47M Construction Loan for Apartment Development in Fayetteville, North Carolina

by John Nelson

FAYETTEVILLE, N.C. — Berkadia has arranged a $47 million construction loan for The One at Hope Mills, a 360-unit, garden-style apartment community that will be located at 3680 Elk Road in Fayetteville. Mitch Sinberg, Brad Williamson, Scott Wadler and Matt Robbins of Berkadia’s South Florida office arranged financing on behalf of the Miami-based borrower, One Real Estate Investment (OREI). City National Bank of Florida and Abanca provided the floating-rate loan. Construction will begin in the third quarter, and the property is scheduled for completion in the second half of 2024. The design-build team includes general contractor Berkley Hall Cos., architect BSB Design and civil engineer Site Design Inc. Upon completion, The One at Hope Mills will feature a mix of one-, two- and three-bedroom units, as well as a resort-style pool, outdoor cabana with TVs, a game room with billiards and shuffleboard and a modern fitness center.

OCALA, FLA. — Stonemont Financial Group and US Capital Development have completed the development of a $28 million speculative industrial facility located in Ocala, about 37 miles south of Gainesville, Fla. Situated on 35 acres, Topline Logistics Facility totals 457,000 square feet and features 36-foot clear heights, 95 dock doors, four drive-in doors and 110 trailer parking spaces. Construction on the project began in March of last year. HDA Architects designed the property, and Frampton Construction served as general contractor.

JACKSONVILLE, FLA. — Olympus Property has acquired Presidium Town Center, a 370-unit multifamily community located in the Deerwood Park neighborhood of Jacksonville. The property was developed in 2021 by Texas-based multifamily developer Presidium. The buyer has rebranded the community as Olympus Preserve at Town Center. The property offers apartments in studio, one-, two- and three-bedroom layouts and amenities including a swimming pool, rooftop lounging deck, fitness center and indoor and outdoor fireplaces. Rents start at $1,611, according to the community website. The sales price was not disclosed.

GARDEN CITY, GA. — Dermody Properties has acquired a 312,000-square-foot logistics facility located at 2509 Dean Forest Road in Garden City, about three miles west of the Port of Savannah’s Garden City Terminal. Yokohama Off-Highway Tires America Inc. and GFA Inc. occupy the property, which features 32-foot clear heights, 89 dock-high doors, three drive-in doors, 74 trailer parking spaces, T-5 lighting and ESFR fire protection. Britton Burdette, Matt Wirth, Jim Freeman, Dennis Mitchell and Mitchell Townsend of JLL arranged the transaction. The seller and sales price were not disclosed.

NASHVILLE, TENN. — Switchyards, a coworking concept based in Atlanta, will open an 8,000-square-foot club at 1101 Chapel Ave. in the Eastwood neighborhood of Nashville. Located within a historic building that formerly housed a church, the space will feature a café, work stations, two libraries, eight soundproof phone booths and three meeting rooms. The landlord is locally based Vintage South Development. Switchyards Eastwood is scheduled to open in September.

Berkadia Arranges $217.2M Recapitalization of Multifamily Portfolio in Central Florida

by John Nelson

ORLANDO, FLA. — Berkadia has arranged debt and equity financing totaling $217.2 million for the recapitalization of a three-property multifamily portfolio in Central Florida totaling 1,139 units. The properties include 400 North in Maitland, M2 at Millenia in Orlando and Venetian Apartments in Fort Myers. 400 North and M2 at Millenia were built in 2019, and Venetian Apartments was built in 2018. Brad Williamson, Scott Wadler and Matthew Robbins of Berkadia’s South Florida office secured the financing on behalf of the borrower, a joint venture between JSB Capital Group and BLD Group. The financing package included a 10-year, fixed-rate Freddie Mac loan totaling $185.4 million and $31.8 million in preferred equity from Related Fund Management.

LV Collective Delivers 565-Bed Whistler Student Housing Tower Near Georgia Tech in Midtown Atlanta

by John Nelson

ATLANTA — LV Collective has delivered Whistler, a 565-bed student housing community located in the Midtown neighborhood of Atlanta near the Georgia Tech campus. The 277,457-square-foot property is located at 859 Spring St. NW, on the edge of Midtown’s Tech Square district. The community offers 168 units in studio to five-bedroom configurations with bed-to-bath parity. Shared amenities include a second-floor study mezzanine with private study spaces, conference rooms and a podcast room; Daydreamer Coffee café; dog spa; fitness center with cardio and weightlifting equipment, yoga and spin studios and a sauna; and a 24th-floor deck with an infinity pool and hot tub. Whistler was developed through a partnership between LV Collective and ELV Associates Inc. Variant Collaborative provided interior design services for the project, and Niles Bolton Associates served as architect. JE Dunn was the general contractor, and Asset Living will manage the community. Move-in for residents is scheduled to begin on Aug. 11, in time for Georgia Tech’s 2023 fall semester.