JACKSONVILLE, FLA. — CBRE has arranged the acquisition of Airport Industrial Park, a 230,000-square-foot warehouse distribution center in Jacksonville. Located at 14467 Duval Place W, the property was 100 percent leased to 51 tenants at the time of sale. Ben Stewart and Kyle Fisher of CBRE’s Industrial & Logistics team represented the buyer, a joint venture between East Capital Partners and Tramview Capital Management, in the transaction. An entity doing business as BRC Florida Holdings sold the property for an undisclosed price. CBRE will manage leasing at the center, which includes spaces ranging in size from 2,250 to 10,000 square feet.

Southeast

Against the backdrop of rising interest rates, recent financial stress and murkiness over the Federal Reserve’s ultimate direction and economic implications, dealmaking in the first half of 2023 has remained exceedingly challenged across all real estate sectors as wide bid-ask spreads persist. However, compared to other spaces, rental housing in the Southeast remains relatively healthy from a fundamentals perspective, despite supply-driven softening in the near term. This trend is evident in many major markets, including cities like Atlanta. Occupancy and rent growth remain healthy in Atlanta. The rental vacancy rate for Atlanta as of January 2023 reached 5.4 percent, a 0.9 percent decrease over the previous year, based on data from the U.S. Census Bureau. This falls below the national average of 5.8 percent for the fourth quarter of 2022. The median rental rate in January 2023 was also up 4.3 percent year-over-year, reaching $1,941. Population growth, employment opportunities, infrastructure investments, a business-friendly environment and other demand drivers continue to intensify Atlanta’s need for housing; and long term, the outlook for rental housing in the metro is very strong. More than 6 million people now live in the region, according to recent Census data. The Atlanta Regional Commission predicts more …

ATLANTA — Selig Enterprises and joint venture partner GID will open Westbound at The Works, a 306-unit apartment community located within The Works mixed-use development, this October. Located in Atlanta’s Upper Westside neighborhood, the five-story property features residences ranging in size from 731 to 1,353 square feet in one- and two-bedroom layouts, with a 547-space parking garage. Amenities include an open-air TV lounge, fitness center, club room, sports bar, coworking center, communal kitchens and a pool courtyard. RJTR is the project architect, and Brasfield & Gorrie is the general contractor. Wells Fargo provided financing for the development. RangeWater will manage and lease the property, with monthly rates beginning at $1,840, according to the community’s website. Developed in phases by Selig, The Works also features retail and entertainment space, including a food hall, as well as 125,000 square feet of adaptive reuse office space.

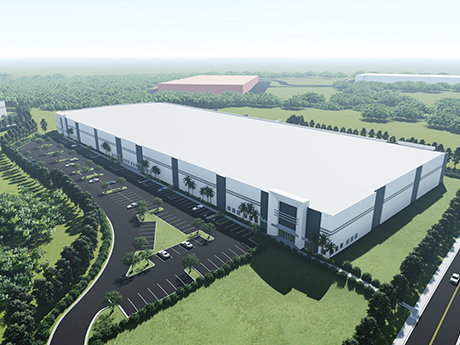

Woodmont, Butters, PCCP Break Ground on 303,364 SF Industrial Project in South Florida

by John Nelson

JUPITER, FLA. — Woodmont Industrial Partners, Butters Construction & Development and PCCP LLC have broken ground on the first building of a 303,364-square-foot industrial project in Palm Beach County. Situated within Palm Beach Park of Commerce in Jupiter, the building, the first of eight, will feature 40-foot clear heights, 60-foot speed bays, 43 dock high doors, two drive-in doors, roughly 196-foot truck courts and 26 trailer parking spaces. Construction of the project is expected to be complete in the second quarter of 2024. The joint venture acquired the property, located at 15430 Corporate Road N, in December 2021.

AUGUSTA, GA. —Ivey Group and Batson-Cook Development Co. (BCDC) have formed a joint venture partnership for the development of West Park Townhomes, a 262-unit build-to-rent residential community in Augusta. Situated on 29 acres at Wheeler Road, the project is scheduled for delivery beginning in the first quarter of 2024. Amenities at the community will include a clubhouse, swimming pool, fitness room and a pet park. SRP Federal Credit Union will provide construction financing, with Parse Capital as a preferred equity investor. Ivey South Construction will serve as general contractor, and Patterson Real Estate Advisory Group represented the joint venture as the capital placement broker.

JUPITER, FLA. — JLL Capital Markets has brokered the $39.1 million sale of Bluffs Square Shoppes, a 123,917-square-foot shopping center located in Jupiter. Constructed in 1986, the property is anchored by Publix. Other tenants at the center, which was 98 percent leased at the time of sale, include Walgreens, Uncle Eddie’s, Anthony’s Women Apparel, Goodwill, The UPS Store, Toojay’s Deli and Cafe Solé. Danny Finkle, Jorge Portela, Eric Williams and Kim Flores of JLL represented the seller, Sterling Organization, in the transaction. BPS Partners acquired the property.

CRBC to Break Ground on 26-Story Office Tower, Parking Garage in Downtown West Palm Beach

by John Nelson

WEST PALM BEACH, FLA. — Cohen Brothers Realty Corp. of Florida (CRBC) plans to soon break ground on West Palm Point, a 26-story office tower located at the intersection of Okeechobee and Quadrille boulevards in downtown West Palm Beach. Situated near the Intracoastal Waterway, the 2.4-acre development will comprise a full city block and includes an adjacent, 10-story parking structure that will feature a rooftop gathering area with a café, shaded seating and a water feature. Designed by Pelli Clarke & Partners and Nichols Brosch Wurst Wolf, the office building will have a landscaped rooftop park, 14,416 square feet of ground-floor retail space, multiple fast-casual restaurants, a fitness center and conference rooms. John Criddle, Joe Freitas and Max Pawk of CBRE will lead local marketing and leasing efforts in partnership with Marc Horowitz from Cohen Brothers in New York. CRBC plans to begin construction on West Palm Point in the fourth quarter, with expected tenant occupancy beginning in the third quarter of 2026.

ANNAPOLIS, MD. — District Hospitality Partners has purchased Westin Annapolis, a 225-room hotel located in historic downtown Annapolis. The property, which underwent an extensive renovation in 2020, is situated along the Chesapeake Bay near the United States Naval Academy, Navy-Marine Corps Memorial Stadium and Maryland State House. The seller and sales price were not disclosed. Westin Annapolis features 13 meeting rooms totaling 19,000 square feet, an indoor pool and a fitness center. HEI Hotels & Resorts will continue to manage the hotel on behalf of District Hospitality, which plans to make renovations to the property’s bar, restaurant and lobby. Eastdil Secured arranged an undisclosed amount of acquisition financing through Wells Fargo Bank on behalf of the buyer.

NORCROSS, GA. — CIP Real Estate has signed Hyundai and Walgreens to leases at Gwinnett Commons, a 1.3 million-square-foot industrial park in the Atlanta suburb of Norcross. A division of Hyundai preleased a newly delivered, 88,500-square-foot distribution facility at 1760 Corporate Drive. The property features 28-foot clear heights and dock- and grade-level loading with oversize doors. Walgreens preleased an 89,500-square-foot facility at 1700 Corporate Drive that CIP plans to deliver in October. The automated warehouse will feature above-standard office finishes and 32-foot clear heights. CIP built both facilities on a speculative basis before preleasing to Hyundai and Walgreens. The properties represent $25 million in total construction costs. The design-build team includes general contractor Ordner Construction and architect Randall Paulson Architects. Pinnacle Bank provided construction financing.

PANAMA CITY BEACH, FLA. — The St. Joe Co. has opened Camp Creek Inn, a 75-room hotel located at 684 Fazio Drive in Panama City Beach. The property is situated on the grounds of the developer’s Watersound Club, a private members club that features an 18-hole golf course, 11,000-square-foot wellness center, tennis courts, pickleball courts and a resort-style pool with a hot tub, lazy river, waterslide and the Bark N’ Brine dining venue. Camp Creek Inn features two dining venues, an outfitter shop, executive meeting rooms and locker rooms for use by hotel guests and Watersound Club members. The property is the fifth hotel that St. Joe Co. has opened this year.