RIVERSIDE, ALA. — Berkadia has arranged a $13 million loan for the refinancing of RiverHouse Apartments, a multifamily community located in Riverside. Located at 300 Riverhouse Loop, the property comprises 144 units and was recently renovated. Tom Genetti of Berkadia secured the financing through Fannie Mae on behalf of the borrower, Birmingham-based The Oakley Group.

Southeast

HARVEY, LA. — Marcus & Millichap has brokered the $4.5 million sale of Travelodge by Wyndham – New Orleans, a 212-room hotel located in Harvey, roughly seven miles outside downtown New Orleans. Constructed in 1971 on 3.8 acres at 2200 Westbank Expressway, the hotel comprises 125,539 square feet. David Altman, Adam Sklaver and Philip Kates of Marcus & Millichap marketed the property, which sold in auction, on behalf of the seller, New York-based Hong Park.

DANIA BEACH, FLA. — CBRE has secured the sale of two adjacent hotels within the 102-acre Dania Pointe mixed-use development in Dania Beach, an oceanfront city in Broward County. The properties, Hyatt House and Hyatt Place, total 292 rooms and are surrounded by more than 1 million square feet of office and retail space, as well as 1,000 apartments within Dania Pointe. Florida-based Kolter Hospitality purchased the hotels for an undisclosed price. Christian Charre, Paul Weimer and Jennifer Jin of CBRE represented the undisclosed seller in the transaction.

MACON, GA. — Colorado-based Spartan Investment Group has purchased Max Storage, a 515-unit self-storage facility located at 1955 Dove St. in Macon. The seller and sales price were not disclosed. The buyer plans to rebrand the property to FreeUp Storage Macon Dove Street. The 10-building asset totals 66,705 rentable square feet, about a third of which is climate-controlled. The facility also features a 13,800-square-foot warehouse that Spartan plans to lease. The Macon facility is the 15th FreeUp property in Georgia and fourth in Macon.

Cushman & Wakefield Arranges $13.3M Sale of Retreat at Palm Pointe Apartments in North Charleston

by John Nelson

NORTH CHARLESTON, S.C. — Cushman & Wakefield has arranged the $13.3 million sale of Retreat at Palm Pointe, a 112-unit apartment community located at 2561 Fassitt Road in North Charleston. Prospect Lane acquired the property from Cohen Investment Group. John Phoenix, Richard Gore, Tyler Fish and Pat O’Brien of Cushman & Wakefield represented the seller in the transaction. Donny Rosenberg of Greystone originated a Fannie Mae acquisition loan on behalf of the buyer.

Marcus & Millichap Brokers $5.9M Sale of Retail Strip Center in Treasure Island, Florida

by John Nelson

TREASURE ISLAND, FLA. — Marcus & Millichap has brokered the $5.9 million sale of Treasure Island Plaza, a 20,000-square-foot retail strip center located at 118 107th Ave. in Treasure Island, a city in the Tampa Bay metro area. Built in 1981, the property was leased to 11 tenants at the time of sale. The buyer, an unnamed investment firm based in Miami, plans to redevelop the one-acre parcel into a mixed-use building with 40 residences atop 10,000 square feet of retail space. Evan Cannan and Reid Thedford of Marcus & Millichap’s Tampa office brokered the transaction.

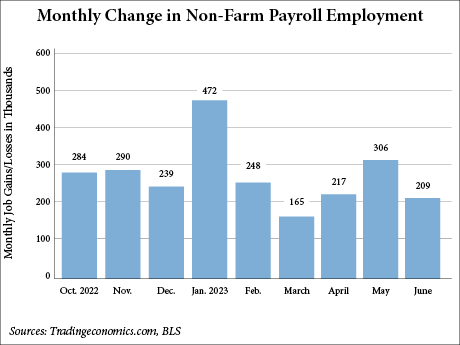

WASHINGTON, D.C. — Nonfarm employment in the United States increased by 209,000 jobs in June, according to the Bureau of Labor Statistics (BLS). The total, which is the lowest figure since December 2020 when jobs fell by 268,000, fell below estimates from economists surveyed by Dow Jones, who had predicted the economy to gain 240,000 jobs last month, according to CNBC. The unemployment rate also ticked down 10 basis points to 3.6 percent. The BLS reports the unemployment rate has ranged from 3.4 to 3.7 percent since March 2022. The June gains were nearly 100,000 fewer than the May total, which the BLS has revised down to 306,000 jobs. The BLS also revised down employment for April, with the two months combining for 110,000 fewer jobs than previously reported. Job gains for 2023 have averaged 278,000 jobs per month, which is a 43.5 percent decline from the average monthly gains of 399,000 jobs in 2022. For June, the government added 60,000 new jobs, most of which was concentrated at the state and local levels. The figure is about average for government job gains in 2023 (63,000 per month) and was the leading employment sector for the month. Government employment is …

Despite shifts toward remote and hybrid work, office rents continue to rise in North Carolina’s Triangle region. Among the 25 largest office markets in the country, Raleigh experienced the second-highest rent growth between 2019 and 2022 — a testament to continued tenant demand. We’re also seeing renewed interest in trophy assets, where the average asking rent has reached an all-time high of $43.35 per square foot. Additionally, the first quarter showed a 280,000-square-foot increase in total office supply, indicating investor confidence in Raleigh’s resilience. Compared to rival markets, Raleigh wasn’t overbuilt pre-pandemic. The market doesn’t have millions of square feet of vacant space downtown and is more balanced than its competitors, leaving plenty of opportunity for future growth. Another indicator of Raleigh’s growth trajectory is the 32 percent year-over-year increase in tours given by JLL’s Office Agency Leasing team this year. Given the current economic headwinds, we know that prospects are taking longer to make decisions about their space. However, we also know they are actively evaluating their options and making long-term plans for their team’s future needs. At buildings within our portfolio, badge swipes last quarter reached a post-pandemic peak utilization of 68 percent – just 13 percent shy …

ATLANTA — Novare Group, in collaboration with BCDC and ELV Associates, has opened Populus Westside, a multifamily community located in the Upper Westside neighborhood of Atlanta. Situated at 1315 Northwest Drive, the property features 286 units and amenities including outdoor grills, a pet park, clubhouse, fitness center and a swimming pool. An initiative by Invest Atlanta, the City of Atlanta’s economic development arm, as part of a property tax incentive program will make 15 percent of the residences available at reduced rents to individuals and families earning between 60 and 80 percent of the area median income (AMI). The community is located along the proposed extension of the Proctor Creek Greenway, which will offer access to Westside Park and the Atlanta BeltLine. RAM Partners will manage the property, which was designed by Dynamik Design.

NARANJA, FLA. — JQ Group has completed the development of Madison Point Apartments, a mixed-use multifamily community located at 26021 S. Dixie Highway in Naranja, roughly 30 miles outside Miami. ANF Group Inc. served as the general contractor on the project, which features 263 apartments and 14,355 square feet of commercial space across four buildings. Apartments span 637 to 1,175 square feet in one-, two- and three-bedroom layouts. Amenities at the community include a swimming pool, community center, playground, fitness center, library, media center and approximately 200 parking spaces.