ATLANTA — Armada Hoffler has entered into a purchase agreement to acquire the commercial portion of The Interlock, a nine-acre mixed-use development in Atlanta’s West Midtown district. The seller and developer, locally based SJC Ventures, has agreed to sell about 311,000 square feet of office and retail space at The Interlock for $215 million. Armada Hoffler served as the general contractor for The Interlock. The acquisition includes offices anchored by Georgia Advanced Technology Ventures, a cooperative organization of nearby Georgia Tech, as well as retail space leased to Puttshack and Velvet Taco, among other tenants. The acquisition also includes an 835-space parking garage and Rooftop L.O.A., a 38,000-square-foot rooftop destination that includes a full-service restaurant, indoor and outdoor bars, an event pavilion and swimming pool. The commercial portion of The Interlock is currently 89 percent leased, with another 6 percent of space spoken for. Not included in the sale is the 161-room Bellyard hotel or the project’s multifamily or student housings components. Armada Hoffler plans to fund the acquisition using $100 million of new fixed-rate financing, the conversion of its existing mezzanine loan into equity and the issuance of units of limited partnership interest in the company’s operating partnership to …

Southeast

LEBANON, TENN. — Texas-based Griffin Partners is underway on the development of a 2 million-square-foot industrial project in Lebanon, roughly 30 miles east of Nashville. Dubbed Earhart Industrial Park, the property will comprise two large speculative warehouses. The first warehouse will total 863,573 square feet and feature 367 car parking spaces and 196 trailer parking spaces. Totaling nearly 1.2 million square feet, the second building will include 448 car parking spaces and 284 trailer spaces. Both warehouses will have depths of 640 feet and clear heights of 40 feet. Melissa Alexander, W.B. Scoggin, Casey Flannery and Warren Snowdon of Foundry Commercial’s Industrial Services team will handle leasing at the development, which is scheduled for delivery in the third quarter of 2024.

LAWRENCEVILLE AND LILBURN, GA. — CBRE’s Self Storage Advisory Group has brokered the $43.6 million sale of a portfolio comprising three self-storage properties within metro Atlanta’s Gwinnett County. Located at 2600 Lawrenceville Highway and 1475 Grayson Highway in Lawrenceville and 3950 Five Forks Trickum Road in Lilburn, the properties total 242,500 square feet and 1,912 units. The occupancy rate was 94 percent at the time of sale. CBRE represented the seller, Gwinnett Self Storage, in the transaction. Wentworth Property Co. acquired the portfolio.

ROANOKE, VA. — Montecito Medical has acquired a 209,000-square-foot medical office property located in Roanoke. Situated within Tanglewood Center — an 800,000-square-foot mixed-use development that also features retail, dining and entertainment space — the building is leased to Carilion Children’s Clinic. The seller and sales price were not disclosed.

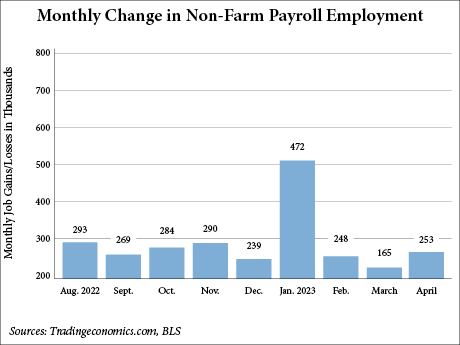

WASHINGTON, D.C. — Nonfarm employment in the United States rose by a total of 253,000 positions in April, according to the U.S. Bureau of Labor Statistics (BLS). This number reflects an increase from last month’s number, beating Wall Street Estimates of 180,000. Employment in February and March was revised down by a total of 149,000. Meanwhile, the jobless rate fell to 3.4 percent in April, matching the lowest reading since 1969. The low unemployment rate keeps upward pressure on wages, which grew 4.4 percent in April from a year earlier, according to The Wall Street Journal. That was slightly higher than a 4.3 percent annual increase in March. Sectors that saw increases in employment included professional and business services, healthcare, leisure and hospitality and social assistance. Average monthly gain in the professional and business services across the prior six months was 25,000, with April seeing the addition of 45,000 jobs. Healthcare employment increased by a comparable 40,000 positions. This is in keeping with the average monthly gain of 47,000 across the prior six months. Leisure and hospitality, social assistance and financial activities added 31,000, 25,000 and 23,000 jobs in April, respectively. Additionally, government employment increased by 23,000. This is a slowdown …

Cordish, Caesars Reveal Plans for 223-Acre Mixed-Use Project in Pompano Beach, Florida

by John Nelson

POMPANO BEACH, FLA. — The Cordish Cos. and Caesars Entertainment Inc. (NASDAQ: CZR) are co-developing The Pomp, a 223-acre mixed-use development in Pompano Beach. The property’s name pays homage to the former Pompano Park racetrack on the project site, which is located 35 miles north of Miami and 10 miles north of Fort Lauderdale. Upon completion, The Pomp will feature 1.3 million square feet of retail and entertainment space, as well as 4,000 residential units, two hotels and approximately 1.4 million square feet of office space. The project will include the existing Harrah’s Pompano Beach casino, which is owned by Caesars. Cordish’s Live! brand will anchor the development’s entertainment and dining component. Called Live! at The Pomp, the brand will offer more than 25,000 square feet of food-and-beverage venues, including a Sports & Social and PBR Cowboy Bar. Sports & Social will occupy a 18,000-square-foot space with features such as an LED media wall, emcees and DJs, live fan-cams, competitions and games. The 7,000-square-foot PBR Cowboy Bar will offer music, bars and a mechanical bull. The venues will open into a central plaza that will host live music, family-friendly events, cultural celebrations, festivals, social activities and experiences and additional dining options. “It’s …

NAP, Nuveen Break Ground on Mixed-Use Redevelopment of Forum Peachtree Corners in Metro Atlanta

by John Nelson

PEACHTREE CORNERS, GA. — North American Properties (NAP), a mixed-use developer and owner based in Cincinnati, has partnered with Nuveen Real Estate to begin the redevelopment of The Forum Peachtree Corners. The duo acquired the north-suburban Atlanta shopping center in March 2022 and are breaking ground on the project that will add a 125-room boutique hotel, 381 apartments, experiential retailers, eateries, structured parking and new public spaces to the site. In addition to these uses, the developers will implement concierge services and valet offerings to patrons. Prior to the groundbreaking, NAP and Nuveen rebranded the property (formerly known as The Forum on Peachtree Parkway) and invested in upgrades to maintenance, security and software, as well as rolled out an event calendar. The construction timeline was not disclosed, but the developers plan to deliver the redevelopment in phases, beginning with the retail- and pedestrian-focused upgrades.

Northmarq Brokers $40M Sale of Addison at Rossview Apartments in Clarksville, Tennessee

by John Nelson

CLARKSVILLE, TENN. — Northmarq has brokered the $40 million sale of Addison at Rossview, a 205-unit apartment community located at 200 Holland Drive in Clarksville, about 45 miles northwest of Nashville. David Stollenwerk, Bryan Schellinger, Ben Crawford and Brenden Bercaw of Northmarq represented the seller, a locally based developer, and procured the buyer, Timberland Partners, in the transaction. Daniel Trebil and Jesse Lemos of Northmarq arranged a 10-year, fixed-rate Fannie Mae acquisition loan on behalf of Timberland. Built in 2016, Addison at Rossview features one-, two- and three-bedroom apartments, as well as a saltwater swimming pool, playground, dog park, coffee bar, community clubhouse, business center, four-acre park and walking trail and garages.

HTG, AM Affordable Housing Complete 72-Unit Seniors Housing Community in Fort Walton Beach, Florida

by John Nelson

FORT WALTON BEACH, FLA. — Housing Trust Group (HTG) and AM Affordable Housing have completed construction of Shoreline Villas, a 72-unit affordable housing community catering to seniors age 62 and older in Fort Walton Beach. Apartments at Shoreline Villas are reserved for age- and income-qualifying residents who earn at or below 33 and 60 percent of the area median income (AMI), with rents ranging from $587 to $1,300 per month. The three-story garden-style community features a 3,155-square-foot clubhouse. Residents also have access to literacy training, financial assistance and employment assistance services onsite. Funding sources for Shoreline Villas include $10.4 million in 9 percent Low-Income Housing Tax Credit (LIHTC) equity from JP Morgan Chase and Raymond James as syndicator, as well as a $11.9 million construction loan and $5.1 million permanent loan, both provided by JP Morgan Chase Bank. The design-build team for Shoreline Villas includes general contractor HTG Hennessy LLC, architect PQH Group, engineering firm Choctaw Engineering, landscape architect Booth Design Group, interior designer Stiles Interior and Builders Design and surveyors Panhandle Associates.

Greystone Provides $10.4M Acquisition Loan for Park Estates Apartments in Decatur, Georgia

by John Nelson

DECATUR, GA. — Greystone has provided a $10.4 million Fannie Mae loan for the acquisition of Park Estates, a 100-unit apartment community located in the Atlanta suburb of Decatur. Dan Sacks and Avi Kozlowski of Greystone’s New York office arranged the non-recourse, fixed-rate loan on behalf of the borrower, an entity doing business as Park Estates FO LLC. Meridian Capital – New York acted as correspondent on the deal. The five-year loan featured full-term interest-only payments. Built in 1985, Park Estates comprises 13 garden-style buildings housing two-bedroom apartments.