NASHVILLE, TENN. — JLL has secured the $106 million sale of Abberly Riverwalk, a 304-unit, three-story apartment community in Nashville that is nearing completion. Matthew Lawton, Brian Dawson and Nick Brown of JLL represented the buyer, HHHunt, in the transaction. Travis Anderson and Warren Johnson of JLL arranged a $62 million, floating-rate acquisition loan on behalf of the buyer. The seller was not disclosed, but Wood Partners previously announced its groundbreaking of the property under a different name, Alta Riverwalk. Set for a July completion, Abberly Riverwalk will feature studio, one- and two-bedroom offerings with an average size of 799 square feet. Community amenities will include a sundeck courtyard, outdoor firepit, coworking space, outdoor kitchen and grills, golf simulator, putting green, pet spa and a 24/7 fitness club. The community is situated off U.S. Highway 12 along the Cumberland River and features an entrance to The Greenway, a 200-mile interconnected trail throughout the metro Nashville area.

Southeast

Charles Street, ACRES Receive $63M Construction Financing for Student Housing Project Near Florida State University

by John Nelson

TALLAHASSEE, FLA. — A joint venture between Charles Street Development and ACRES Realty Funding has received $63 million in construction financing for Renegade Apartments, a 153-unit student housing development in Tallahassee. The community will be located blocks from Florida State University’s campus at 501 Chapel Drive. Bayview Asset Management originated the financing, funding the debt stack through its wholly owned subsidiaries Bayview PACE and Oceanview Life and Annuity Co. The project’s design-build team includes Humphreys & Partners, HPA Design Group and Ruscilli Construction Co. Renegade Apartments is scheduled for completion in 2024 and will be leased and managed by Asset Living.

PEMBROKE PINES, FLA. — Avison Young’s Florida Capital Markets Group has negotiated the $23 million sale of Pembroke Centre, a 29,350-square-foot strip retail center located at 304-306 SW 145th Ave. in Pembroke Pines, a city in South Florida’s Broward County. David Duckworth, Michael Fay, John Crotty and Brian de la Fé of Avison Young represented the seller, PP Omni Ventures, an affiliate of Hart Lyman Cos. that developed the property, in the transaction. Monolith Real Estate Property Management represented the buyer, an entity doing business as OMAX Invest LLC. Situated on four acres near I-75 and Pines Boulevard, Pembroke Centre was fully leased at the time of sale to Pubbelly Sushi, Firebirds Wood Fired Grill and Xfinity Store by Comcast. The property sits on an outparcel with a shared entrance to Shops at Pembroke Gardens, an open-air retail and entertainment destination.

RICHMOND, VA. — Berkadia has brokered the sale of Laurel Pines Apartments, a 120-unit, garden-style multifamily property located at 4123 E. Wood Harbor Court in Richmond. Drew White, Carter Wood and Cole Carns of Berkadia represented the seller, Colorado-based Four Mile Capital, in the transaction. The buyer, Colorado-based Highlands Vista Group, purchased the property for an undisclosed price. Matt Schildwachter of Berkadia’s Denver office arranged a 10-year, fixed-rate, Freddie Mac loan on behalf of Highlands Vista. Laurel Pines features one-, two- and three-bedroom floor plans with private patios or balconies. Community amenities include a swimming pool, clubhouse, fitness center, laundry facilities and a playground.

TREASURE ISLAND, FLA. — Marcus & Millichap has arranged the sale of Treasure Bay Resort & Marina, an 83-room hotel located at 11125 Gulf Blvd. in Treasure Island, part of the Tampa Bay metro area. Ben Mallah, a private investor, purchased the hotel for $18.2 million in an all-cash transaction. Ahmed Kabani and Kian McLean of Marcus & Millichap’s Miami office represented the seller in the deal. Treasure Bay Resort features a hurricane-resistant exterior, pool, Jacuzzi and a marina.

Arbor Realty TrustBuild-to-RentContent PartnerDevelopmentFeaturesLeasing ActivityMidwestMultifamilyNortheastSingle-Family RentalSoutheastTexasWestern

Arbor Report Finds Rental Housing Insulated from Economic Contraction, Risk Factors Endure

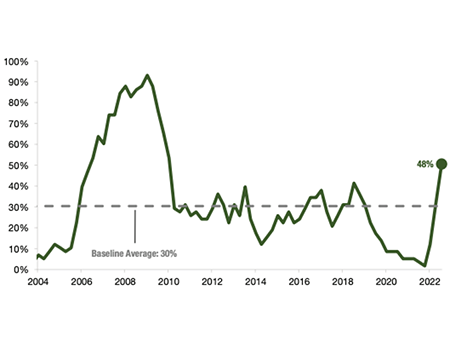

— By Ivan Kaufman, founder, chairman and CEO of Arbor Realty Trust, Inc.; and Sam Chandan, a professor of finance and director of the Chen Institute for Global Real Estate Finance at the NYU Stern School of Business Rental housing is uniquely positioned to withstand tremendous economic headwinds. Although some observers point to the slowdown in apartment rent growth as a sign of growing weakness, this trend is a cyclical feature that is not reflective of any structural change in the profile of demand or supply. It is normal to expect a period of slowing rent growth while there is uncertainty in the economic outlook. In-depth findings on these trends, plus a thorough economic outlook for 2023 and a complete breakdown of risk factors, are detailed in Arbor Realty Trust Special Report Spring 2023: Navigating a Corrective Environment, from which this article is excerpted. While no asset class is immune from the challenges of higher interest rates, the presence of amortization, which spreads out a loan into a series of fixed payments over time, makes the multifamily sector less likely to see mounting distress. All Department of Housing and Urban Development (HUD)-conforming multifamily loans are fully amortizing. Moreover, Fannie …

FRANKLIN, KY. — LioChem e-Materials LLC, a subsidiary of Toyo Ink SC Holdings Co. Ltd., will develop a new speculative manufacturing facility at 310 Ronnie Clark Drive in Franklin’s Interstate Industrial Park. Hal Johnson, Jamie Newell and Tak O’Haru of NAI Ready represented LioChem in the site selection and purchase of 26 acres for the project. The facility, which is projected to create 141 jobs, will produce carbon nanotube (CNT) dispersions — the cathode conductive material used to enhance the performance of lithium-ion batteries — for use in electric vehicles.

Berkadia Arranges Equity for Three Southeast Apartment Communities Totaling 875 Units

by John Nelson

NEW YORK CITY — Berkadia has arranged programmatic equity on behalf of The Sterling Group for the recapitalization of three apartment communities in the Southeast. Cody Kirkpatrick, Noam Franklin and Chinmay Bhatt of Berkadia JV Equity & Structured Capital secured the undisclosed amount of financing through a global institutional investor. Properties included in Sterling’s recapitalization include Wellsley Park at Deane Hill in Knoxville, Tenn.; Apartments @ Eleven240 in Charlotte, N.C.; and Enclave at Bailes Ridge in Indian Land, S.C. The communities comprise 358, 271 and 246 units, respectively.

Northmarq Facilitates $38.1M Construction Financing for Seniors Housing Project in Metro Richmond

by John Nelson

MIDLOTHIAN, VA. — Northmarq has arranged a $38.1 million construction loan for the development of Lake Forest at Swift Creek, a 176-unit seniors housing project at 5950 Harbour Lane in Midlothian, roughly 15 miles outside of Richmond. The borrower, The Holladay Corp., is developing the community, which will comprise one building on 11.7 acres that is designed for active adults ages 55 and older. Keith Wells, Hunter Wood, Reina Abboud and Mike Lowry of Northmarq’s Richmond office secured the financing through Sandy Spring Bank. Delivery is scheduled for 2024.

Montecito Medical Receives $31.2M Acquisition Financing for Healthcare Property in Columbia

by John Nelson

COLUMBIA, S.C. — Montecito Medical Real Estate has received a $31.2 million loan for the acquisition of a cancer treatment center located in Columbia. First Citizens Bank’s Healthcare Finance group, part of the CIT division, provided the financing. The facility is currently leased to South Carolina Oncology Associates (SCOA).