LAKELAND, FLA. — Northmarq has arranged the sale of The Caroline, a recently completed apartment community comprising 228 units in Lakeland, roughly 40 miles east of Tampa. Luis Elorza, Justin Hofford and Kevin Mosher of Northmarq represented the buyer, Topaz Capital Group, which acquired the property for an undisclosed price. Located at 1906 Griffin Road, the community features units in one-, two- and three-bedroom layouts, with an average unit size of 1,161 square feet. Amenities include a clubhouse, pool, an outdoor kitchen and entertainment space, pet park, fitness center, playground and wetland boardwalk.

Southeast

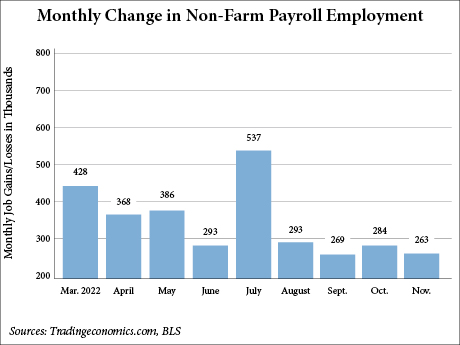

WASHINGTON, D.C. — The U.S. economy added 263,000 jobs in November, and the unemployment rate remained unchanged at 3.7 percent, according to the U.S. Bureau of Labor Statistics (BLS). The employment gains beat Dow Jones economists’ expectations of 200,000 new jobs, reports CNBC. Meanwhile, average hourly wages jumped 0.6 percent for the month, according to the BLS, double the estimate of economists. Furthermore, the 5.1 percent annual growth in wages exceeded the expectation of 4.6 percent. CNBC also reports that the better-than-expected wage growth may put even greater pressure on the Federal Reserve to continue its path of rate hikes, which Fed officials have been signaling as likely ahead of the December Federal Open Markets Committee (FOMC) meeting. Many media outlets report that economists are expecting the central bank to boost the federal funds rate by 50 basis points before the end of the year, raising the target range to between 4.25 and 4.5 percent. However, some other media sources indicate that strong wage growth is another sign of inflation and could push the Fed to boost the rate by 75 basis points. Big gains in leisure and hospitality In November, the employment sector with the biggest surge was leisure and …

Increased interest rates and challenging insurance costs would normally stifle a multifamily market. However, an inventory constrained by a lack of land, supply chain issues, labor shortages and the increased cost of homeownership have contributed to a further stabilization of the metro New Orleans multifamily market. The overall vacancy factor for our seven primary submarkets that make up metro New Orleans are in the 5 to 6 percent range. We anticipate occupancy rates to steadily increase going forward as new construction has stalled and rising interest rates have delayed many tenants from transitioning to homeownership. Overall rental rates in the metro average in the $1,250 to $1,350 per month range. The rents represent a 3.5 percent increase over the past 12 months. It should be noted that some submarkets have seen considerably higher increases. The highest rental rates reported in the metro for garden-style communities are in Eastern St. Tammany Parish, where the newest inventory exists. The highest rents in New Orleans are downtown in the CBD/Warehouse District. These communities comprise mid-rise and high-rise developments and command rents exceeding $2.50 per square foot. The downtown market experienced some softness during the COVID-19 pandemic but made a robust recovery once restrictions …

SJC Ventures Tops Out Second Phase of $750M Interlock Mixed-Use Development in Atlanta

by John Nelson

ATLANTA — SJC Ventures has topped out the second phase of The Interlock, a $750 million mixed-use project located in Atlanta’s West Midtown district. The second phase, built by Choate Construction and anchored by a 42,000-square-foot Publix, features 275,000 square feet of commercial space and 670 units of student housing for Georgia Tech students. Construction on the second phase began in May 2021. Additionally, four new retailers have inked leases at The Interlock. Pinky Promise Champagne Bar, The X Pot — a Korean barbecue and hot pot restaurant, City Nails and GoodVets will join the tenant lineup. Previously announced tenants include Starbucks Coffee, Kura Revolving Sushi Bar, Salon Lofts and Five Guys. Stream Realty Partners is managing leasing for the office space at the development on behalf of SJC Ventures.

ORLANDO, FLA. — Urban Network Capital Group (UNCG) plans to break ground on Visions Orlando, a 42-acre residential and hospitality community in Orlando, in the second quarter of 2023. The $170 million project will feature three components: Illusions, Reflections and Inspirations. Illusions will feature 48 single-family homes in seven- and eight-bedroom layouts, with prices beginning at $799,000. Reflections will comprise 132 townhomes featuring five- and six-bedroom layouts. Pricing for the townhomes will start at $629,000. Inspirations will be the condo hotel component of the development, with 181 one- and two-bedroom units. Prices for these units will begin at $235,000. The property will feature the Disney Good Neighbor Program qualification for the condo hotel and the Disney Vacation Home Rental Program qualification for the single-family residences and townhomes. Initial completions are scheduled for the second quarter of 2024. A 12,000-square-foot clubhouse will feature amenities including a gym, Pilates rooms, yoga deck, steam room, sauna, restaurant, bar, lounges, movie theater, kids room, arcade, business center and driving simulators. Outdoor amenities will include a pool with a waterpark, Jacuzzis, hot tubs, cabanas, a playground, croquet lawn, golf putting, a bikeshare and tennis, volleyball and pickleball courts.

Magnus Begins Construction on Two Buildings at 803 Industrial Park in Columbia, South Carolina

by John Nelson

COLUMBIA, S.C. — Magnus Development Partners has broken ground on two buildings at 803 Industrial Park, a development in Columbia adjacent to the Columbia Metropolitan Airport. Dubbed Gateway One and Gateway Three, the buildings comprise 252,720 square feet each. Delivery is scheduled for the second quarter of 2023. Magnus will break ground on a third building, the 408,240-square-foot Gateway Two, in the second quarter of 2023. Magnus also plans to develop the Gateway Four building, details of which were not disclosed, at a later date. Colliers manages leasing and marketing at the park on behalf of Magnus.

LADSON, S.C. — JLL Capital Markets has arranged the sale of TradePark East, a newly constructed industrial campus comprising 837,400 square feet in Ladson, roughly 15 miles outside of Charleston. Patrick Nally, Pete Pittroff, Dave Andrews and Josh McArdle of JLL brokered the transaction on behalf of the seller, Trinity Capital Advisors. A partnership between TPG Capital and Dogwood Industrial Properties acquired the property, which was fully preleased during construction, for an undisclosed price.

FaverGray, Chance Partners Break Ground on 288-Unit Apartment Community in Wildwood, Florida

by John Nelson

WILDWOOD, FLA. — FaverGray and development partner Chance Partners have broken ground on The Juliette at Wildwood, a 288-unit multifamily development in Wildwood, approximately 50 miles northwest of Orlando. The project marks the second joint venture between the two companies. Situated on a 21.9-acre site, the community will feature amenities including a pool, clubhouse with a fitness room and coworking area, a dog park and dog spa and bocce ball court. Delivery is scheduled for the fourth quarter of 2024.

University of Tampa Breaks Ground on Multipurpose Building, Including 600-Bed Residence Hall

by John Nelson

TAMPA, FLA. — The University of Tampa has broken ground on a 10-story, 460,000-square-foot multipurpose building that will be the largest facility on campus when completed in 2024. The property will feature a 600-bed residence hall, 37 faculty offices, five classrooms, study rooms, study lounge designated for military veterans, a ground-level Starbucks, four levels of parking and spaces dedicated for the school’s Office of Diversity, Equity and Inclusion, Institute for Sales Excellence and the International Programs Office. Additionally, students living in the building will have access to a 9,000-square-foot “sky park.” The design-build team includes Baker Barrios Architects and KWJ Architects. The University of Tampa has an estimated student enrollment of 10,600 for the current academic year, which is the 91-year-old university’s largest student body to date.

BALTIMORE — Vivo Living, an affiliate of adaptive reuse developer Vivo Investments LLC, has purchased a vacant two-tower hotel property in Baltimore that was previously a dual-branded Radisson and Holiday Inn. The company plans to convert the 23- and 27-story towers into an apartment development comprising 708 units, the vast majority of which will be studio units ranging between 300 and 350 square feet. Vivo Living will also update the property’s amenity package, including gyms, yoga/mindfulness studios, pool, convenience store, renovated lobby, outdoor barbecue areas, self-storage space and banquet/coworking space. Vivo Living has tapped locally based Urban Design Group to design the adaptive reuse project. Parkview Financial provided a $45 million construction loan to Vivo Living to fund the redevelopment.