NEW ORLEANS — Servio Capital has purchased the California Building, a luxury condominium property at the corner of Tulane Avenue and Rampart Street in New Orleans, for $40 million. Designed in 1949 and built in 1950, the property is one of the oldest standing international-style buildings in the city. Previously home to the Hibernia Bank operation center, the building has since been converted to multifamily housing and features amenities including a media room, fitness center, business center and a game room. The seller was not disclosed.

Southeast

SPARTANBURG, S.C. — Hughes Commercial Property is underway on its I-26 Logistics Center, a 226,800-square-foot industrial facility located in Spartanburg. Scheduled for completion in the second quarter of 2023, the facility will feature 32-foot clear heights, 60 dock doors, two drive-in doors, 53 trailer parking spaces and 225 car parking spaces. Other industrial and distribution companies located in the park include Walmart Return Center, Master Gardener and Yusen Logistics. Harper General Contractors is coordinating construction, and Lee & Associates will manage leasing at the property.

MELBOURNE, FLA. — A joint venture between CrossMarc Services LLC and MCB Real Estate — in partnership with Peaceable Street Capital — has purchased Post Commons, a 202,050-square-foot shopping center located in Melbourne. Anchored by a 44,270-square-foot Publix store, as well as a Beall’s and Pet Supermarket, the center was 96 percent leased at the time of sale. Other tenants at the property include Burlington and Five Below. Marcus & Millichap represented the undisclosed seller in the transaction. Flavia Kanyago of CrossMarc will handle leasing at the center.

ORLANDO, FLA. — One Stop Housing has purchased the Ambassador Hotel, a 155-room hotel located at 929 W. Colonial Drive in Orlando, from Sammy Investments Orlando for $7.1 million. The buyer plans to convert the hotel into an affordable housing community. When completed, the property will feature a mix of studio, one- and two-bedroom apartments. Construction is scheduled to begin this year. Glen Jaffee of Cushman & Wakefield represented the seller and procured the buyer in the $7.1 million acquisition. The Orlando City Council approved zoning for the Ambassador Hotel to be redeveloped into an affordable housing community in late July. Once complete, the community will become the eighth hotel conversion for One Stop Housing.

Content PartnerFeaturesIndustrialLeasing ActivityLoansMidwestMultifamilyNAINortheastOfficeRetailSoutheastTexasWestern

Experts Turn to Opportunistic Moves, Lending During Uncertainty of Economic Downturn

As we shift through economic uncertainty and changes in the market, commercial real estate businesses are planning for a range of scenarios — and looking to historical trends to make predictions. REBusinessOnline sat down with two industry experts to talk about how this period of uncertainty compares to previous eras and where there may be benefits and opportunities in the current landscape. Jay Olshonsky, president and CEO, and Cliff Moskowitz, executive vice president, at NAI Global spoke about the commercial real estate outlook and the challenges it is likely to face in the immediate future. REBusiness: Looking at the current environment, how does it compare to previous periods of uncertainty? What might be the impacts on commercial real estate? Olshonsky: To start with, we are in a recession. We’ve already had two quarters of negative GDP growth. I think the most fundamental difference between this cycle and a lot of other cycles is that we have extremely low unemployment, differentiating this moment from others, for example, 2009. Even though the most recent job numbers were lower, they were still fairly strong. Jobs create the demand for commercial real estate at all levels, but especially at the services level. We do …

Middle Street Partners Acquires Land in South Daytona, Florida for 389-Unit Multifamily Project

by John Nelson

SOUTH DAYTONA, FLA. — Charleston-based Middle Street Partners has purchased 23.4 acres in South Daytona for the development of a 389-unit multifamily community. Justin Basquill, Luke Wickham, Shelton Granade and Sean Williams of Institutional Property Advisors (IPA), a division of Marcus & Millichap, facilitated the land sale. The site is located off US Highway 1 with direct views of the Intracoastal Waterway. The name and details about the project were not disclosed, but Middle Street said the property will feature three- and five-story apartment buildings.

LAGRANGE, GA. — Alliance Residential Co. has purchased 22.3 acres in LaGrange with plans to develop Prose LaGrange, a 315-unit apartment community. Designed by Dynamik Design, the community will feature one- and two-bedroom units averaging 992 square feet. Amenities will include a fitness center, resort-style pool, grilling stations, coworking spaces, clubhouse, business center, pet park and a 24/7 LuxerOne parcel management system. The property will have direct access crosswalks to WellStar West Georgia Medical Center, which houses 1,800 medical employees, as well as a new Publix-anchored shopping center. Alliance Residential plans to open first units at Prose LaGrange in fall 2023. This will be Alliance Residential’s first project in the LaGrange area, second Prose project along Interstate 85 South and fifth Prose community in Georgia. The Arizona-based developer recently opened Prose Fairview, a 318-unit apartment community in Covington, Ga.

Cushman & Wakefield | Thalhimer Brokers $4.6M Sale of Retail Strip Center in Lynchburg, Virginia

by John Nelson

LYNCHBURG, VA. — Cushman & Wakefield | Thalhimer has brokered the $4.6 million sale of Shops at Phillips Circle, a retail strip center located at 19399 Forest Road in Lynchburg. Built in 2018, the center was fully leased at the time of sale to tenants including Starbucks Coffee, East Coast Wings and Nothing Bundt Cakes. The Charles and Margaret Levin Family LP based in Washington, D.C., purchased the property from Riverbend Development. Catharine Spangler, John Pritzlaff and Jenny Stoner of Thalhimer represented the seller in the transaction.

LEXINGTON, KY. — Academy Sports + Outdoors has opened an 80,000-square-foot store within South Park Shopping Center, a retail center located at 3200 Nicholasville Road in Lexington. Kaden Cos. is the landlord of South Park, which also houses Ulta Beauty, Best Buy, Burlington and Value City Furniture. The new store is the sixth Academy Sports location in Kentucky and its first in Lexington. Academy Sports plans to open nine stores this year and another 80 to 100 new locations over the next five years. The Katy, Texas-based company currently operates 264 stores across 17 states.

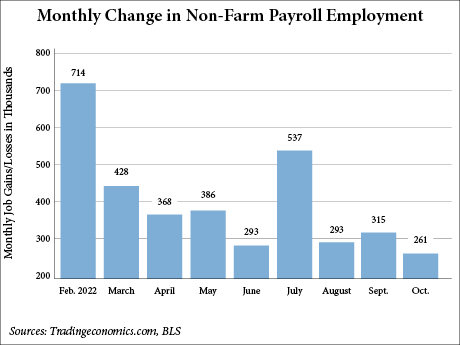

WASHINGTON, D.C. — Total U.S. nonfarm payroll employment rose by 261,000 in October, and the unemployment rate ticked back up 20 basis points to 3.7 percent, according to the U.S. Bureau of Labor Statistics (BLS). Monthly job growth has averaged 407,000 year-to-date in 2022, compared with 562,000 per month in 2021. The October performance beat the Dow Jones estimate of 205,000 but the economists expected the unemployment rate to remain at 3.5 percent, according to CNBC. Healthcare led all employment sectors in adding October jobs with 53,000, which is slightly ahead of its average monthly gain thus far this year (47,000). Professional and businesses services added 43,000 jobs in October and manufacturing grew by 32,000. Leisure and hospitality added 35,000 jobs, which is far below the sector’s average monthly job gain over the first nine months of the year (78,000). Additionally, the BLS revised the employment gains for August down by 23,000, from 315,000 to 292,000. The September figure was revised upward by 52,000, from 263,000 to 315,000.