NASHVILLE, TENN. — Dairy Farmers of America (DFA), represented by Tarek El Gammal and Vincent Lefler of Newmark, has sold a 3.2-acre parcel in Nashville. Bosa Development acquired the land for $66 million. Located at 1401 Church St., the site is part of the Midtown submarket and will be developed as a mixed-use property. John Shaunfield, Kyle Jett and Chris Murphy of Newmark’s Dallas office also provided transactional support. Details about the construction timeline or project design were not disclosed.

Southeast

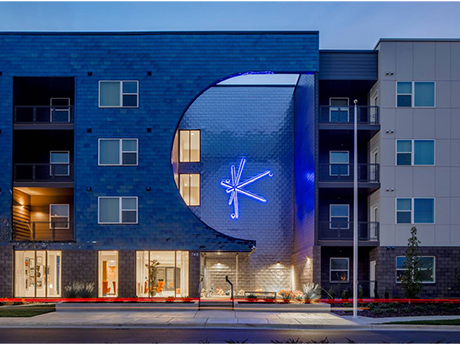

HUNTSVILLE, ALA. — Doster Construction Co., in partnership with Chicago-based developer Heartland Real Estate Partners, has completed the development of Constellation, an apartment community located in downtown Huntsville. Designed by Chicago-based Built Form Architects, Constellation features 219 luxury units in studio, one-, two- and three-bedroom layouts. Construction on the development, which is now open for leasing, began in late 2020. Rental rates at Constellation range from $1,117 to $3,709 per month, according to Apartments.com.

PENSACOLA, FLA. — JLL has arranged the sale of Pensacola Square, a 142,767-square-foot shopping center located in Pensacola. Brad Peterson and Whitaker Leonhardt of JLL represented the seller, an affiliate of Atlanta-based RCG Ventures LLC. Pensacola Square, which was 95 percent leased at the time of sale, is anchored by Big Lots and shadow-anchored by Hobby Lobby. Tenants at the property include American Freight Outlet, Beall’s Outlet and Petland. A private Florida-based family office acquired the shopping center for an undisclosed price.

VIRGINIA BEACH, VA. — Matthews Real Estate Investment Services has brokered the sale of a 13,225-square-foot store located at 1701 Independence Blvd. in Virginia Beach. The single-tenant property was leased to CVS/pharmacy at the time of sale Preston Schwartz and Chad Kurz of Matthews represented the private seller in the transaction. Jason Maier of Stan Johnson Co. represented the undisclosed buyer, which acquired the property for $10.6 million. CVS/pharmacy has a little over 12 years remaining on the lease.

Alliance Residential Acquires 12 Acres in Tampa for Waterfront Multifamily Development

by John Nelson

TAMPA, FLA. — Alliance Residential Co. has acquired a 12-acre property located at 5105 W. Tyson Ave. in Tampa for $15. 8 million. Mark Eilers and Ed Miller of Colliers brokered the sale on behalf of the undisclosed seller. The Arizona-based developer plans to use the site for the development of Broadstone Westshore, a 325-unit luxury apartment community. To be developed in partnership with Santander Bank, Broadstone Westshore will comprise apartments ranging in size from 593 to 1,520 square feet, as well as a clubhouse, pool, fitness center, dog park and wash station, podcast studio, business center and media lounge. Construction is scheduled to begin within the next few weeks, with the first units expected to be ready in April 2024.

GAFFNEY, S.C. — New York-based Treeline has acquired a 36-acre site in Gaffney, a city in South Carolina roughly equidistant between Greenville, S.C., and Charlotte. Treeline was self-represented in the transaction, in which they acquired the property from Hart Consumer Products Inc. The land will be used for the development of a 300,000-square-foot, $30 million industrial facility dubbed Victory Crossing. The project will mark Treeline’s third industrial facility in the Southeast. Choate Construction Co. will serve as general contractor for the development, with Warren Snowdon of Foundry Commercial acting as the exclusive leasing agent for the property, which will house manufacturing and warehouse/distribution tenants.

SUITLAND, MD. — OneWall Communities has acquired Gateway Station — formerly Allentown Apartments — a 178-unit affordable multifamily property located in the Washington, D.C., suburb of Suitland. CBRE Affordable Housing arranged the transaction, in which RailField Realty Partners sold the property for $23 million. Built in 1963 and renovated in 2007, Gateway Station features eight buildings comprising apartments in a mix of studio, one-, two- and three-bedroom layouts. Community amenities include a swimming pool, onsite laundry facilities and a playground. The property currently operates under the Low Income Housing Tax Credit (LIHTC) program, which reserves units at various income restrictions. Connecticut-based OneWall plans to preserve Gateway Station’s affordability during its ownership.

JACKSONVILLE, FLA. — Merritt Properties has acquired 16 acres off of First Coast Expressway in Jacksonville for the development of a business park comprising 158,400 square feet. The development will feature four single-story, flex/light industrial buildings ranging from 21,600 to 57,600 square feet. Construction is slated to begin before the end of this year, with the first phase including three buildings along Armstrong Lane.

MCDONOUGH, GA. — Northmarq has arranged the sale of Towne Crest Village, a 20,053-square-foot retail center located in McDonough, approximately 30 miles south of Atlanta. Jeff Enck of Northmarq represented the private Florida-based buyer in the transaction. An individual Los Angeles-based investor sold the property for $5.7 million. Built in 2005, Towne Crest was 100 percent leased at the time of sale to a mix of local businesses including service retailers and restaurants.

JLL Brokers $258M Sale of Two Abberly-Branded Apartment Communities in Decatur, Georgia

by Jeff Shaw

DECATUR, GA. — JLL Capital Markets has brokered the $258 million sale of two five-story, wrap-style apartment communities located in the northeast Atlanta suburb of Decatur. Development and management company HHHunt acquired Abberly Skye for $163 million and Abberly Onyx for $95 million. Northwood Ravin was the seller for both transactions. The two communities are located on the same block around a newly built shopping center anchored by a Sprouts Farmers Market and across the street from a recently renovated shopping center anchored by a Walmart Supercenter. Both properties are approximately seven miles from Midtown Atlanta. Abberly Skye was developed in 2020. The community offers 450 studio, one-, two- and three-bedroom units. Individual units include walk-in showers, glass-front kitchen cabinets, quartz countertops in kitchens and bathrooms, stainless steel appliances and balconies with walk-up patio options. Community amenities at Abberly Skye include a golf simulator, swimming pool, sauna, business center, podcasting room, fitness areas, TV lounge and gaming courtyard. Abberly Onyx was developed in 2017 and comprises 250 units. The building offers studio, one-, two- and three-bedroom floor plans, as well as community amenities such as a rooftop swimming pool, sauna, climbing gym, two-story outdoor lounge, indoor and outdoor game areas, …