ORLANDO, FLA. — Marcus & Millichap has brokered the $6.3 million sale of a store located at 3212 Curry Ford Road in Orlando. The 13,824-square-foot retail property is net leased to CVS/pharmacy. Gabriel Britti, Ricardo Esteves and Ronnie Issenberg of Marcus & Millichap’s Miami office represented the seller, a limited liability company, and the buyer. Both parties requested to remain anonymous.

Southeast

Lancaster County Council Approves Phase II of RedStone Mixed-Use Development in Metro Charlotte

by John Nelson

INDIAN LAND, S.C. — The Lancaster County Council has approved developer MPV Properties’ plans for the second phase of RedStone, a mixed-use development in the Charlotte suburb of Indian Land. Phase II will comprise 350 apartments, 20 townhomes and 24,000 square feet of retail space. Located at the intersection of U.S. Highways 521 and 160, the second phase will be situated adjacent to Phase I, a shopping center that opened in 2016 and includes 80,000 square feet of existing retail and restaurant space, as well as the RedStone 14 Cinemas. Between the two phases will be an event lawn that MPV plans to activate with live music, farmers markets and other public events. The developer has begun leasing the retail space at Phase II, which will break ground in fall 2023. Michael Bilodeau and Steve Vermillion of MPV Properties, along with Jason McArthur of Mission Properties, are leading the development of RedStone Phase II. Robbie Adams and Joey Morganthall of MPV Properties are responsible for retail leasing.

RALEIGH, N.C. — Chevy Chase, Md.-based FCP has purchased Grand Arbor Reserve, a 297-unit apartment community located at 2419 Wycliff Road in Raleigh. Howard Jenkins of CBRE represented the undisclosed seller in the $48 million transaction. Situated near I-440 and the UNC Rex Hospital, Grand Arbor Reserve comprises mostly two- and three-bedroom apartments. Amenities include a swimming pool, fitness center, playground, dog park and a volleyball court. The property was originally built in 1969, according to Apartments.com.

MIAMI — JLL has arranged the sale of Deerwood Town Center, a grocery-anchored shopping center spanning 205,853 square feet in Miami. Core Investment Management purchased the property from Courtelis Co. for nearly $44.9 million. Courtelis has owned the center since it delivered the first phase in 1985, according to JLL. Danny Finkle, Eric Williams and Kim Flores of JLL brokered the transaction. Deerwood Town Center was fully leased at the time of sale to tenants including Fresco y Mas, Amped Fitness, Pet Supermarket and TD Bank. The center is located at 12095 SW 152nd St., which is situated across from the Zoo Miami.

MELVILLE, N.Y. — Melville-based A&G Real Estate Partners has secured the sales of 21 properties in Maryland, Delaware and Florida at a real estate bankruptcy auction. All assets were formerly owned by the late Zebulon J. and Beatrice Brodie. In the Aug. 16 bankruptcy auction, 19 properties in Maryland and one each in Delaware and Florida fetched a total of $18.4 million. The transactions included: the $6.7 million sale to different buyers of four contiguous, largely undeveloped properties in a busy commercial district on Legion Road in Denton, Md.; the $1.5 million sale of the Carter Building at 300 Market St. in downtown Denton; the $2.1 million sale of the Alexander Building at 315 High St. in Chestertown, Md.; and the $2.2 million sale of 300 Bulle Rock Farm Lane in Centreville, Md., which is a family compound formerly owned by John Raskob, builder of the Empire State Building in Manhattan. “A&G’s comprehensive marketing campaign for this middle-market disposition triggered inquiries from more than 560 prospective buyers across the country, and nearly 50 of those interested parties eventually placed baseline, qualifying and/or prevailing bids, some for multiple properties,” says Emilio Amendola, co-president of A&G. After two rounds of bidding, 13 …

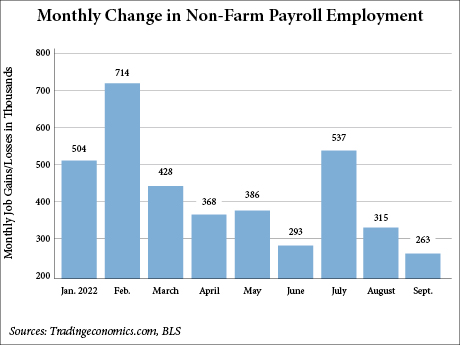

US Economy Adds 263,000 Jobs in September, Unemployment Rate Contracts to 3.5 Percent

by John Nelson

WASHINGTON, D.C. — Total U.S. nonfarm payroll employment rose by 263,000 in September, and the unemployment rate contracted 20 basis points to 3.5 percent, according to the U.S. Bureau of Labor Statistics (BLS). Monthly job growth has averaged 420,000 year-to-date in 2022, compared with 562,000 per month in 2021. The September performance fell narrowly short of the Dow Jones estimate of 275,000 but exceeded expectations for the unemployment rate, which the economists expected to remain at 3.7 percent, according to CNBC. Leisure and hospitality added 83,000 jobs in September, which is on par with the average monthly job gain over the first eight months of the year. Other notable gains were in the healthcare sector (+60,000), professional and business services (+46,000), manufacturing (+22,000) and construction (+19,000). Additionally, the BLS revised the employment gains for July upward by 11,000 to 537,000; the August figure was unchanged at 315,000. Lawrence Yun, chief economist for the National Association of Realtors, says the job gains in September for the office-using sectors were encouraging, but he emphasizes that the lack of office workers in downtown districts will continue to have a ripple effect on other economic sectors. “The traditional office-using jobs in the professional business …

RREAF Holdings, DLP Capital, 3650 REIT Acquire 10-Property Multifamily Portfolio for $500M

by Jeff Shaw

DALLAS — RREAF Holdings, DLP Capital and 3650 REIT have partnered to acquire a portfolio of 10 multifamily properties across the Southeast for $500 million. This is the partnership’s third portfolio acquisition this year. The seller was not disclosed. The communities were built between 1998 and 2012 and total approximately 2,750 units, with a 93 percent collective occupancy. The properties include Glen at Polo Park in Bentonville, Ark.; River Pointe in Maumelle, Ark.; Echo Ridge and Pheasant Run in Indianapolis; Traditions at Westmoore in Oklahoma City; 5iftyOne at Tradan Heights in Stillwater, Okla.; Waterford Place in Greenville, N.C.; Reserve at Long Point in Hattiesburg, Miss.; Village Mill Creek in Statesboro, Ga.; and Broad River Trace in Columbia, S.C. The buyers plan to implement renovations to all units. New upgrades to property amenities will include electric automobile charging stations, dog parks, pickleball courts and business centers. Pools, tennis courts, outdoor kitchens, entertainment areas, clubhouses and lighting will also be updated. The portfolio acquisition will introduce capital into workforce rental units in the region. According to the National Multifamily Housing Council, 4.3 million more apartments are needed by 2035 to meet the demands for rental housing. “The affordable housing crisis pervades every state …

Newmark Brokers $96.5M Sale of Alta Union Apartments in Nashville’s The Nations Neighborhood

by John Nelson

NASHVILLE, TENN. — Newmark has brokered the $96.5 million sale of Alta Union, a newly constructed, 283-unit apartment community located at 5800 Centennial Blvd. in Nashville. Weinstein Properties purchased the property from the developer, Wood Partners. Tarek El Gammal and Vincent Lefler of Newmark represented the seller in the transaction. Located in The Nations neighborhood, Alta Union features a two-story clubhouse with outdoor terraces on the second level, a swimming pool, courtyard, private offices for rent and individual and group coworking spaces.

CALHOUN, GA. — Seefried Properties has purchased a 56-acre site in Calhoun with plans to develop Grove 75 Logistics Center, a 738,720-square-foot industrial facility. The spec facility is expected to be completed in the third quarter of 2023. The Class A building will feature 40-foot clear heights, 167 dock-high cross-docking doors (including four drive-in doors), trailer and auto parking spaces, LED interior lighting, ESFR sprinklers and office space. Located on Union Grove Road, the site is located a half-mile from I-75 and near the newly developed Appalachian Regional Port. Project partners include general contractor The Conlan Co., civil engineer Southland Engineering and architectural firm Atlas Collaborative. Joseph Kriss, Tripp Ausband and Doug Smith of Seefried will handle the marketing and leasing for Grove 75 Logistics Center.

Foundry Commercial Arranges 125,008 SF Office Lease at McEwen Northside in Nashville’s Cool Springs District

by John Nelson

FRANKLIN, TENN. — Foundry Commercial has arranged a 125,008-square-foot office lease at McEwen Northside, a 45-acre mixed-use campus in Nashville’s Cool Springs submarket. Located in the city of Franklin, the development features 1 million square feet of office space, 113,000 square feet of restaurants and specialty retail, a 150-room hotel, 770 luxury apartment units and green spaces. The tenant, procurement and supply chain management organization OMNIA Partners, will occupy all five floors of office space at the project’s Block A building starting in early 2023. The building also houses 19,000 square feet of retail and restaurant space on the ground level. OMNIA is relocating from its current headquarters, which is also in Franklin. Vince Dunavant of Foundry Commercial represented the tenant in the lease negotiations. The landlord is Boyle Investment Co., co-developer of McEwen Northside alongside Northwood Ravin.