FORT LAUDERDALE, FLA. — Marcus & Millichap has brokered the sale of a four-property, 669-unit affordable housing portfolio located throughout Florida. The properties sold for a combined total of $91.8 million. Evan Kristol of Marcus & Millichap’s Fort Lauderdale office represented the private sellers, Benjamin Mallah and Benjamin Mallah II, as well as the buyer, a national owner and operator of affordable housing communities. The properties include The Overlook at Monroe in Sanford; Villas at Cove Crossing Apartments in Lake Worth; St. Luke’s Apartments in Lakeland; and Sonrise Villas Apartments in Fellsmere. Constructed between 1994 and 2007, the LIHTC properties range in size between 94 and 240 units. All were originally developed with affordable tax credits and have long-term income and rent restrictions, which Kristol says the new ownership will retain for “years to come.”

Southeast

MEMPHIS, TENN. — Westmount Realty Capital has purchased Shelby Oaks Corporate Park, a portfolio of office/showroom and distribution facilities in Memphis totaling 480,911 square feet. Shelby Oaks is Westmount’s first purchase in Memphis and second acquisition in Tennessee. The seller and sales price were not disclosed. The corporate park is located one mile away from the I-240/I-40 interchange and near downtown Memphis and Memphis International Airport. Situated within a 640-acre wooded area that includes three lakes and a jogging trail, Shelby Oaks was built in several phases between 1979 and 2005 and was 95 percent leased at the time of sale to 78 tenants. The portfolio includes a total of 16 buildings: four distribution buildings with drive-in and dock doors and 12 office/showrooms. Buildings range from 12,000 to 90,000 square feet and are home to a variety of industries like telecommunications, medical, service and manufacturing companies.

NASHVILLE, TENN. — Bradley Arant Boult Cummings LLP has signed a long-term lease to move its Nashville office to One22One, a new high-rise office building located at 1221 Broadway in the city’s Gulch district. The locally based law firm plans to occupy 100,000 square feet of office space across the top four floors by late 2023. The tenant retained Savills for its search for new office space. The developer and landlord, Brentwood, Tenn.-based GBT Realty, delivered the $140 million, 24-story tower last month. Featured amenities at One22One include outdoor space for business and social gatherings, a fitness center and retail space. FirstBank occupies 52,000 square feet of office space on floors 13 and 14 that will include the headquarters of FB Financial Corp. (NYSE: FBK), the parent company of FirstBank.

ROSWELL, GA. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the $10.3 million sale of Mansell Oaks, a 43,190-square-foot shopping center in the north Atlanta suburb of Roswell. Zach Taylor of IPA represented the seller, an entity doing business as PLC Mansell LLC, in the transaction. Peachtree Industrial Partners LLLP is the buyer. Mansell Oaks’ tenant roster includes LongHorn Steakhouse, Bird Watcher Supply and Animal Emergency Center of North Fulton. “Well-located, unanchored retail strips with reasonable rents have become nearly as sought after as grocery anchored centers, and the cap rates are reflecting this demand,” says Taylor.

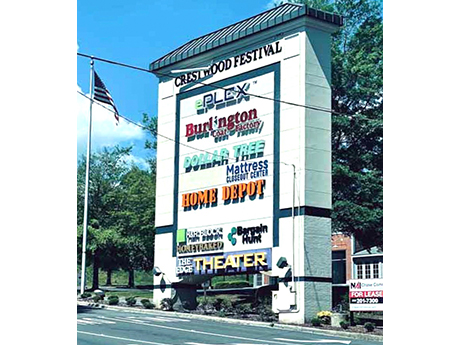

BIRMINGHAM, ALA. — Eastern Union has secured $7 million in acquisition financing for Crestwood Festival Centre in Birmingham. Marc Tropp of Eastern Union arranged the financing on behalf of the buyer, CityWide Properties, which intends to invest $1.5 million in capital improvements at the 299,707-square-foot shopping center. The five-year loan includes a fixed interest rate of 4.6 percent with one year of interest-only payments. The investor purchased the property, which is shadow-anchored by The Home Depot, for $9.4 million. Built in 1989 on 41 acres, Crestwood Festival Centre comprises 44 retail suites and nearly 1,000 parking spaces. Notable tenants include Phoenix Theatres The Edge 12 Birmingham, Burlington, Mattress Warehouse and Dollar Tree.

SAVANNAH, GA. — Atlanta-based Capital Development Partners has started construction of Central Port Logistics Center at Rockingham, a 5.4 million-square-foot speculative industrial development in the coastal Georgia city of Savannah. Central Port Logistics Center at Rockingham will consist of seven buildings, with Phase I of the project comprising a roughly 1.1 million-square-foot cross-dock warehouse. According to the development team, that building will be the largest warehouse ever constructed on a speculative basis in Savannah. Completion of Phase I is slated for 2023. Phase II of the project will feature a 982,000-square-foot, rail-served building, a construction timeline for which was not disclosed. Subsequent phases of the project will deliver both cross-dock and rear-load storage and distribution facilities. “Central Port Logistics Center at Rockingham is the last large-scale industrial infill site in Savannah with unmatched access to the port, excellent rail service and immediate connectivity to major highways,” says John Knox Porter Jr., CEO of Capital Development Partners. “These facilities will provide a significant location advantage for our customers.” Bill Sparks, executive vice president of CBRE’s Savannah office, which is marketing the development for lease, also said that the proximity and access to various pieces of major infrastructure would be a game-changer …

JACKSONVILLE, FLA. — Berkadia has brokered the $66 million sale of Topaz Villas, a 444-unit multifamily community located at 5327 Timuquana Road in Jacksonville. Greg Rainey of Berkadia’s Jacksonville office led the transaction on behalf of the sellers, Topaz Capital Group and The Lynd Co. Mitch Sinberg, Brad Williamson and Wesley Moczul of Berkadia arranged $53 million in acquisition financing on behalf of the buyer, ROI Capital Group, which plans to rebrand the community. Voya Investment Management provided the three-year, floating-rate loan with extension options and interest-only payments. The loan includes approximately $5.3 million in future funding for capital improvements. Topaz Villas offers one-, two- and three-bedroom apartments that range from 500 to 1,400 square feet in size. Community amenities include two swimming pools, a fitness center, bark park, playground, tennis court and 24-hour emergency maintenance. The property is situated within Ortega Farms, a suburban neighborhood along the Ortega River, and offers convenient access to I-295 and the Naval Air Station Jacksonville.

STOCKBRIDGE, GA. — Birmingham, Ala.-based Growth Capital Partners (GCP) has recently signed Dollar General Corp., the Goodlettsville, Tenn.-based national discount retailer, to a full-building industrial lease in metro Atlanta. GCP’s Fund II purchased the recently vacated property, located at 500 Business Center Drive in Stockbridge, in March. The 712,040-square-foot property is situated in the South I-75 Atlanta industrial submarket and features 30-foot clear heights, 74 dock doors and seven rail doors. The center is expected to be fully operational in the fourth quarter and will employ approximately 50 Dollar General employees. Reed Davis, Bob Currie and Brad Pope of JLL represented GCP in the lease negotiations, and Scott Delphy of Food Properties Group represented Dollar General. GCP’s Fund II includes 1.9 million square feet of bulk distribution properties in Georgia and Tennessee and 1.9 million square feet of industrial development projects currently under construction in the Carolinas, Florida, Tennessee and Texas. In addition to the Stockbridge facility, Dollar General recently invested $480 million to expand its distribution network with three new facilities planned in Arkansas, Oregon and Colorado.

BOYNTON BEACH, FLA. — PEBB Enterprises and joint venture partner Banyan Development have sold Mainstreet at Boynton, a grocery-anchored retail center in Boynton Beach that the companies delivered in 2021. The co-developers sold the 52,152-square-foot property to an entity doing business as West Parkway Realty LLC for $33 million. Danny Finkle and Eric Williams of JLL represented PEBB and Banyan in the sale, which does not include other components of the mixed-use Mainstreet development, such as its 158-unit Congregate Living Facility and numerous outparcels occupied by tenants including Wawa, Aspen Dental and Synovus Bank. Located at 6405 W. Boynton Beach Blvd. in South Florida’s Palm Beach County, Mainstreet at Boynton was fully leased at the time of sale to tenants including Sprouts Farmers Market, AT&T, Crown Wine & Spirits, F45, Capitol Carpet & Tile and GoodVets.

AREP Acquires 200,000 SF Office Building in Old Town Alexandria, Plans Multifamily Conversion

by John Nelson

ALEXANDRIA, VA. — American Real Estate Partners (AREP) has acquired 1101 King Street, a 200,000-square-foot office building in Old Town Alexandria, a historic neighborhood in metro Washington, D.C. The McLean, Va.-based investor purchased the office condominiums within the building simultaneously from seven individual owners for an undisclosed price. AREP plans to convert the property to 200 apartments, with 17,500 square feet of commercial space on the ground floor, as well as amenities including a club room, fitness center and a rooftop terrace. The firm restructured the office leases to allow for the conversion program and is keeping existing retail tenants Orangetheory Fitness and Paris Baguette throughout the redevelopment process. AREP has selected Cooper Carry to lead the project redevelopment design and RD Jones for the interior work. Construction is set to begin in July 2023.