Finding a balance between density and amenities has never been simple for residential developers, but rising interest rates, density restrictions and an increased desire to solidify multifamily projects within the community mean that there is much to be gained from creative approaches to this old problem. Starting the process of planning early, using zoning to the developer’s advantage and creating an adaptable, sustainable and welcoming place for tenants can allow for a successful project with a lower overall price tag. This method can solve some of the trickier problems faced by multifamily developers, including density, parking and zoning considerations. Starting Off Right — Creating a Master Site Plan Success in multifamily is easier to achieve if the project starts with a shared team vision from the outset, says Bill Rearden, principal at Bohler, a land development design and consulting firm. Rearden explains that Bohler has its own planning, landscape architecture and survey teams and works with many industry partners for environmental and geotechnical due diligence. “We work with these teams in the very early stages to understand what the configuration of a property is and what its constraints are. We know upfront any underlying zoning a property might have, so …

Southeast

BohlerContent PartnerDevelopmentFeaturesLeasing ActivityMidwestMultifamilyNortheastSoutheastTexasWestern

WASHINGTON, D.C. — Boston Properties Inc. (NYSE: BXP) has sold 601 Massachusetts Avenue, an approximately 480,000-square-foot office building in Washington, D.C., for $531 million. The buyer was not disclosed, but the Washington Business Journal reports that it was an affiliate of Mori Trust Co., a real estate development and investment firm based in Tokyo. Boston Properties originally developed the 11-story property in 2015. The firm will continue to provide property management services at 601 Massachusetts, which was 98 percent leased at the time of sale. 601 Massachusetts Avenue is situated in Washington, D.C.’s Mount Vernon Triangle neighborhood. Nearby attractions include the White House, Capital One Arena, Metro stations and the Walter E. Washington Convention Center. According to online property listings, the property includes a nine-story glass atrium, onsite fitness center, roof terrace and retail space leased to RPM Italian, Soul Cycle and lunch restaurant Devon & Blakely. Boston Properties structured the disposition as part of a reverse like-kind exchange under Section 1031 of the Internal Revenue Code with its $730 million acquisition in May of Madison Centre, a 37-story office tower in Seattle. “This disposition demonstrates continued investor demand for premier, well-leased office properties,” says Owen Thomas, chairman and CEO …

The high quality of life and relatively low cost of living in Richmond, coupled with sustained investment in live-work-play infrastructure, has led to population growth and a surge in investor interest in the city. The job market is showing strong signs of recovery with an unemployment rate of 3.2 percent, which is 40 basis points below the national average. Although office-using employment remains elevated at 3 percent from pre-pandemic levels, office vacancy rates remain relatively stable at 11.2 percent. Live-work-play rules the day Richmond has become a hot spot for millennials, boasting a low cost of living, high quality of life and amenity-rich neighborhoods. While the broader Richmond market has recorded 10 percent population growth since 2010, key submarkets in the urban core are growing at a faster pace, with Scott’s Addition recording 23 percent population growth during the same period. Developers have capitalized on this increased demand for city living, building out the urban core with multifamily and mixed-use developments in trendy submarkets. Scott’s Addition and Manchester — which have more breweries per capita than any other neighborhood — have added a combined 3,000 apartment units in the last five years, with an additional 1,300 units currently under construction. …

NASHVILLE, TENN. — Subtext, a residential development firm, has broken ground on LOCAL Midtown, a 15-story apartment building located at 1904 Hayes St. in Nashville’s Midtown district. The property will comprise 307 apartments in a mix of studios, one-, two- and three-bedroom layouts. Designed by Dynamik Design, LOCAL Midtown will feature 10,000 square feet of amenity space, including a coffee bar and micro-market on the first floor, music studio and recording booth on the fifth floor and several spaces on the sixth floor, such as a media lounge, speakeasy, collaboration spaces, gaming room, fitness center with coach-led classes, library and outdoor amenity deck with a swimming pool. The 15th floor will feature a sky lounge and deck with views of downtown Nashville. A five-level covered parking garage will also be available to residents. The general contractor, Brinkmann Constructors, expects to deliver LOCAL Midtown in 2024. Subtext and Brinkmann recently completed LOCAL Boise in Idaho. The new venture is the first Nashville project for both St. Louis-based firms.

CONCORD, N.C. — Choate Construction has broken ground on a new broadcast facility for NASCAR in Concord, a northeast suburb of Charlotte. The racing organization is moving its live event productions operations from Charlotte to the new 58,000-square-foot facility, which is situated near NASCAR’s existing research-and-development property. The new tilt-wall concrete facility will house NASCAR’s TV and radio production studios, as well as a broadcast equipment room, mechanical system and chemical fire suppression systems. NASCAR’s live event production operation has more than doubled in size since 2018, according to the organization. The project team includes Redline Design Group, ACRO Development Services, Barrett Woodyard and Associates Inc. and Bennett & Pless Inc.

JACKSONVILLE, FLA. — Birmingham, Ala.-based Graham & Co. has purchased 21 acres in Jacksonville’s Westside submarket for the development of a two-building, 250,800-square-foot warehouse and distribution center project. Named after its location, W. 12th/Edgewood Logistics Center is slated to break ground in early 2023 and wrap up construction by the end of the year. Equity partners in the deal include private equity firm Graham Capital and a local investment group led by Sam Easton. The industrial facilities will feature 32-foot clear heights, ESFR sprinklers and a concrete tilt-wall construction and can accommodate tenants from 25,000 square feet to full-building occupiers, according to Graham & Co. The project team includes The Conlan Co. and Randall-Paulson Architects as the project’s design/build team, and England-Thims & Miller will serve as the civil engineer. SouthState Bank is providing construction financing. Mark Scott, John Cole and Andrew Hawkins of Foundry Commercial will market the property for lease. The land acquisition marks the third transaction by Graham & Co. in Jacksonville’s Westside submarket since 2021.

LOUISVILLE, KY. — Inxeption, a Silicon Valley-based industrial commerce and supply chain digitization firm, has opened its new offices at PNC Tower in downtown Louisville. The firm, which supports software and several apps for the logistics industry, is occupying 18,000 square feet on the 29th floor. Inxeption says the new regional headquarters space will be able to accommodate up to 200 employees over the next five years. Kentucky Gov. Andy Beshear and Louisville Mayor Greg Fischer are scheduled to appear at a ribbon-cutting ceremony for the office. Inxeption’s operations, sales and technology employees at PNC Tower will have immediate access to the nearby Fourth Street Live! and Louisville Slugger Field, home of the Louisville Bats Minor League Baseball team. “In the last two years, Inxeption has integrated itself into the business community in Louisville, a crucial logistics hub,” says Josh Allen, Inxeption’s chief compliance officer and first Louisville employee. “We continue to undergo substantial growth, so we have strategically renewed our commitment to the city by relocating to a space that can scale as we expand our supply chain operations in support of more industrial businesses.” The new offices come on the heels of Inxeption’s latest financing round at a …

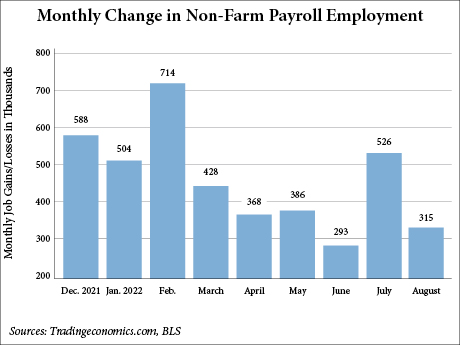

WASHINGTON, D.C. — Total U.S. nonfarm payroll employment rose by 315,000 in August, and the unemployment rate ticked up to 3.7 percent, according to the U.S. Bureau of Labor Statistics (BLS). While in line with Dow Jones economist estimates of 318,000 jobs, August represents the second-lowest monthly gain since April 2021, according to CNBC. Additionally, the 20-basis-point increase in the unemployment rate is the first monthly hike this year. The change in total nonfarm payroll employment for June was revised down by 105,000 jobs, from 398,000 to 293,000, and the change for July was revised down by 2,000, from 528,000 to 526,000, according to the BLS. Professional and business services led all employment sectors in hiring with 68,000 added jobs in August. Healthcare employment rose by 48,000, the retail sector added 44,000 jobs, manufacturing added 22,000 and financial activities added 17,000 jobs. Employment rose in the leisure and hospitality sector by 31,000, which is down significantly from its monthly average in 2022 of 90,000 jobs.

Cushman & Wakefield Brokers $36.9M Sale of Union Cross Industrial Center in Winston-Salem

by John Nelson

WINSTON-SALEM, N.C. — Cushman & Wakefield has brokered the sale of Union Cross Industrial Center, a two-building industrial portfolio located at 4980 and 4991 Millennium Drive in Winston-Salem. Front Street Capital sold the 340,000-square-foot portfolio to Westcore for $36.9 million. Rob Cochran, Nolan Ashton, Bill Harrison, Stewart Calhoun, Casey Masters, Bobby Finch, Jason Ofsanko and Hap Royster of Cushman & Wakefield represented the seller in the transaction. Both assets were built in 2019 and were fully leased at the time of sale to single tenants. Earlier this summer, Front Street also sold the nearby, 610,000-square-foot Union Cross Distribution Center for $64 million. Cushman & Wakefield brokered that deal as well.

MIAMI — Swiss investment firm Empira Group has purchased a half-acre site west of Miami’s Brickell district for the development of CoralGrove Brickell, an 85-unit apartment community. The asset will be situated in the city’s The Roads neighborhood upon completion, which is anticipated for 2025. Max La Cava, Simon Banke and Danielle Fernandez of JLL brokered the land sale on behalf of the seller, an unnamed investment firm based in South America. Empira plans to demolish the existing apartments on the site by the end of the year and break ground on the new apartment project in the second half of 2023. Designed by Revuelta Architecture International, CoralGrove Brickell will comprise one-, two-, and three-bedroom apartments, as well as a fitness center, rooftop pool, gourmet kitchen and a game room. The property will also feature 900 square feet of retail space on the ground floor.