ORLANDO, FLA. — Lincoln Property Co. Southeast (LPC Southeast) and Innovatus Capital Partners are putting the finishing touches on the $2.5 million overhaul of Westwood Corporate Center in Orlando. LPC Southeast manages the five-story, 125,000-square-foot office building on behalf of Innovatus Capital, which owns the property. Located at 6649 Westwood Blvd., Westwood Corporate Center now includes a two-story, all-glass lobby that features a coffee bar with an adjacent, tech-enabled training/conference center that is available to all tenants. Other upgrades include new touchless entry and purified HVAC system by Wynd Technologies, as well as new outdoor seating that surrounds a landscaped corridor to the neighboring tower that features ping pong tables and a life-size chess board. Additionally, a new private fitness center will offer exercise pods for those who don’t want to work out in groups, as well as instructors offering group classes for fitness programs including yoga and Zumba. The upgrades come on the heels of Marriott Vacation Club vacating its headquarters at Westwood Corporate Center after 20 years of tenancy.

Southeast

TAMPA, FLA. — RD Management LLC and Core Spaces have opened Hub Tampa, a 359-unit student housing community located at the corner of University Square and Club drives in Tampa. The $65 million, off-campus property is situated near the University of South Florida (USF) and features 900 student housing beds. Amenities include a health and wellness center, rooftop pool and a study and work center, as well as an activities and events area. The student housing property is part of a mixed-use redevelopment of University Mall named RITHM. The 113-acre campus will include new Sprouts Farmers Market and Burlington stores that are set to open in 2023, as well as an extended stay Marriott hotel.

ASHLAND, VA. — Merritt Properties has acquired Crescent Business Center, a five-building industrial park totaling 262,256 square feet in Ashland, about 10 miles north of Richmond. An affiliate of Thalhimer Realty Partners Inc. doing business as Crescent Business Center LC sold the asset for $41.3 million. Eric Robison of Cushman & Wakefield | Thalhimer represented the seller in the transaction. Crescent Business Center is situated along I-95 on 20 acres and features an additional 19 acres for future development. The park was fully leased at the time of sale to tenants including Trane U.S., Electronic Systems, Motion Industries and Sunbelt Rentals.

JLL Brokers Sale of 244,768 SF Acadiana Square Shopping Center in Lafayette, Louisiana

by John Nelson

LAFAYETTE, LA. — JLL has brokered the sale of Acadiana Square, a 244,768-square-foot shopping center located at 5700 Johnston St. in Lafayette. Jim Hamilton, Ryan West and Brad Buchanan of JLL represented the sellers, DRA Advisors and RCG Ventures, in the transaction. Property Commerce Dividend Fund acquired the center for an undisclosed price. Acadiana Square was 95 percent leased at the time of sale to tenants such as Burlington, Home Furniture Co. of Lafayette, T.J. Maxx, PetSmart, Office Depot and Party City. The previous ownership executed new leases or renewals totaling over 87,000 square feet at Acadiana Square in the past 18 months, according to JLL.

MOBILE, ALA. — CLK, a Long Island-based commercial real estate investment firm, has acquired The Park Apartments, a 201-unit multifamily community located at 1 Country Lane in Mobile. Lakewood, N.J.-based Walden Asset Group sold the property for $15.8 million, or $78,600 per unit. Aaron Jungreis and David Wildes of Rosewood Realty Group represented both the buyer and seller in the off-market transaction. Built in 1975, Park Apartments features 20 two-story buildings, a pool, fitness center, playground and a picnic area. The property is situated on 11.5 acres within three miles of the Mobile Regional Airport and the University of Southern Alabama. The community was 95 percent occupied at the time of sale.

ATLANTA — CP Group, a Boca Raton, Fla.-based office real estate investment firm, has debuted its “worCPlaces” flexible office program within its Atlanta portfolio. The concept is now available for occupancy within Lakeside Office Park and One and Two Ravinia, office properties that are located in the city’s Central Perimeter office submarket. Eric Ross, Sabrina Gibson and Stewart Thrash of CBRE will serve as leasing agents for the new worCPlaces on behalf of CP Group, which is the second-largest office landlord in the state of Georgia. Designed by Gensler and ASD|Sky, worCPlaces are amenitized workspaces that are move-in ready for office tenants. Within the Atlanta portfolio, the new spaces that have come on line include 12 individual spec suites ranging from 1,800 to 9,700 square feet on the fifth, ninth and 11th floors at One and Two Ravinia. Several of the suites include new furniture while others can be furnished by worCPlaces. Additionally, 10 spec suites ranging from 1,400 square feet to 4,600 square feet and a newly completed coworking space are all contained within a standalone, two-story building at Lakeside Office Park, a five-building, 406,000-square foot office development. The coworking spaces at Lakeside also include available furnishings; in-building, digitally …

Arbor Realty TrustContent PartnerFeaturesLeasing ActivityMidwestMultifamilyNortheastSoutheastTexasWestern

Arbor: Multifamily Market Well-Positioned to Withstand Economic Headwinds

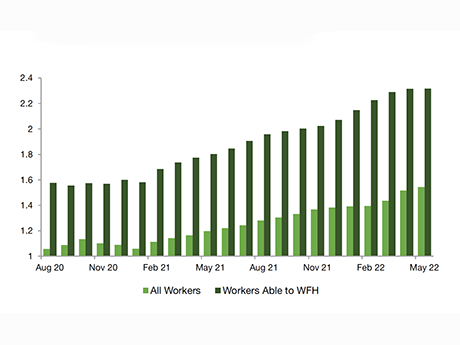

While rising interest rates, inflation and economic volatility have hurt many sectors of the economy, the rental housing market has maintained solid footing, according to Arbor Realty Trust’s Summer 2022 Special Report: Rental Housing Market Exhibits Cyclical Stability, Contains Structural Questions. The report was written by Ivan Kaufman, Arbor’s chairman and CEO, and Sam Chandan, founder of Chandan Economics. In a time of economic uncertainty, renting has become more appealing. Households seeking an affordable place to live, those who are delaying homeownership and others who prefer the flexibility and amenities associated with multifamily units all add to the increasing numbers of potential renters. Less traditional factors may also increase interest in renting, especially outside of tier-one markets. The expansion of work-from-home (WFH) culture is likely to be another reason rental demand is high right now. Meanwhile, the flexibility to work where the cost of living is lower and space is at less of a premium is pushing some renters who work remotely to explore living outside traditional hotspots. Economic Uncertainty Spreads as Interest Rate, Inflation Rise The Arbor Realty Trust report highlights a host of factors that are leading to economic uncertainty. Inflation (and its secondary effects) are contributing to …

Flaherty & Collins to Develop $103M Apartment Community in Downtown Cape Coral, Florida

by John Nelson

CAPE CORAL, FLA. — Flaherty & Collins Properties plans to break ground on The Cove at 47th, a $103 million mixed-use project in downtown Cape Coral. The development will include 327 luxury apartments, 19,000 square feet of ground-floor commercial space and a 585-space parking garage, with 125 spaces reserved for the public. Apartments will come in studio, one-and two-bedroom configurations. The development will also include a steakhouse and sushi concept, Blu Sushi, that will serve as the anchor tenant. The project also includes a resident rooftop sky deck, rooftop bar and resort-style amenities, including a beach-entry saltwater pool with lap lanes, coworking suites, fitness center, pet spa and private electric vehicle charging stations. The project team includes general contractor DeAngelis Diamond and architectural firm Baker Barrios Architects. First Financial Bank and Huntington Bank are providing construction financing to Flaherty & Collins, which expects to open first units in about 16 months and all units by late summer 2024.

WASHINGTON, D.C. — Grosvenor has obtained an $82.1 million loan to refinance 1500 K Street, a 262,190-square-foot mixed-use building in Washington, D.C. Eastdil Secured arranged the loan through Helaba on behalf of Grosvenor. Built in 1928, 1500 K Street comprises offices and retail space. The property is situated near the McPherson Square Metro station and the White House, as well as Washington, D.C.’s downtown and East End districts. Grosvenor recently invested $20 million to renovate the property, including updates to the lobby, fitness center, tenant lounge, HVAC system, roof and rooftop lounge.

EMERSON, GA. — Lincoln Property Co. Southeast (LPC Southeast) plans to break ground on LakePoint 75, a 305,000-square-foot distribution center in Emerson, a city near the north Atlanta suburb of Cartersville. The property will be situated off Joe Frank Harris Parkway, a half-mile from I-75 and 28 miles from I-285. The facility will feature 36-foot clear heights, 67 dock-high doors, 37 trailer parking spaces and 170 auto parking spaces. The complex will also include grills, outdoor activity space, communal seating and open-air meeting space. LPC Southeast plans to deliver the property in fall 2023.