WASHINGTON, D.C. — Mesirow, a financial services firm based in Chicago, has provided the $275 million refinancing for the National Aeronautics and Space Administration (NASA) headquarters offices in Washington, D.C. Located at 300 E St. SW, the nine-story office building spans more than 600,000 square feet and was built in 1991, according to LoopNet Inc. The borrower is a partnership between Hana Alternative Asset Management and Ocean West Capital Partners. Proceeds from the financing provided the partnership with fixed-rate debt that is interest-only for the full term. The loan has a 2028 maturity date, which is coterminous with NASA’s lease. With the funds, the Hana and Ocean West partnership is recapitalizing its equity interest at the property, which is subject to the sixth-largest lease by the General Services Administration (GSA), the federal government’s independent agency that oversees certain operations like office and research space. (The GSA is the leaseholder for NASA.) Mesirow served as placement agent and administrative agent on the financing. Cushman & Wakefield arranged the financing on behalf of the borrower and negotiated terms between the borrower and Mesirow. Mesirow was founded in 1937 and offers credit tenant lease and structured debt products to borrowers. The company’s services …

Southeast

At the mid-year mark, industrial occupancy in the greater Richmond area remains strong, closing with an overall occupancy rate of 98.5 percent in the categories being tracked (Class A, B, select C vacant and investor-owned product with a minimum of 40,000 square feet total RBA). Class A occupancy remained steady at 97 percent at the end of the second quarter. Class B occupancy also remained steady at 94 percent at the end of the first quarter. CoStar Group reports overall industrial occupancy at 96.8 percent for product of all sizes, including investor-owned facilities, but excluding flex space (minimum 50 percent office). There remains a shortage of space in the 25,000- to 50,000-square-foot range as most spec buildings being built are larger single-tenant buildings. Richmond’s strategic Mid-Atlantic location along Interstate 95 provides access to 55 percent of the nation’s consumers within two days’ delivery by truck, and in addition to being the northernmost right to work state on the Eastern seaboard, Virginia has once again been named as the No. 1 state for business by CNBC. Metro Richmond has a civilian labor force of almost 700,000 (1.03 million population) with unemployment rates at 3.7 percent as of June. With 12 Fortune …

Content PartnerFeaturesLeasing ActivityLoansMidwestMultifamilyNortheastSoutheastTexasWalker & DunlopWestern

How to Maintain Multifamily Investment Momentum in the Face of Rising Interest Rates

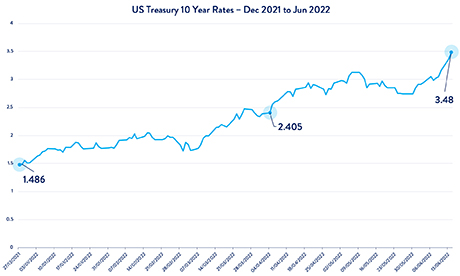

By Melissa Jahnke, associate director of operations, Walker & Dunlop The Federal Reserve raised interest rates by 75 basis points in June and then another 75 basis points in July, sending shockwaves across the commercial real estate industry. Fortunately, there are opportunities and solutions to bypass these potential roadblocks. Specifically, investors in a segment of multifamily housing known as small balance lending (SBL), encompassing five- to 150-unit properties, have several options to realize their aspirations for financing multifamily portfolios. View a higher resolution version of the timeline above here. During a recent webcast “Financing Amid Rising Rates: Best Approaches for $1M-$15M Multifamily Loans,” Walker & Dunlop’s market experts spoke about navigating today’s financing landscape. The expert panel included Allison Williams, senior vice president and chief production officer; Allison Herrera, senior director of SBL; and Tim Cotter, director of capital markets. These experienced professionals have found ways to make deals happen in a wide variety of financing environments and have shared their perspectives and guidance. If you are an owner of five- to 150-unit properties that require loans between $1 million to $15 million, the following will help you navigate today’s financial environment and build your momentum. Step 1: Consider the …

TAMPA, FLA. — JLL has provided $262 million in Freddie Mac loans for the refinancing of a portfolio of six Southeastern multifamily properties totaling 1,494 units. Tampa-based Carter Multifamily owns the properties, which are located in Maryland, Virginia and Alabama. The portfolio comprises all garden-style assets, including: the 326-unit Park at Kingsview Village in Germantown, Md. the 240-unit Stonecreek Club in Germantown, Md. the 336-unit Hunt Club in Gaithersburg, Md. the 220-unit Springwoods at Lake Ridge in Woodbridge, Va. the 180-unit Windsor Park in Woodbridge, Va. the 192-unit Oaks of St. Clair in Moody, Ala. Melissa Marcolini Quinn and Lee Weaver of JLL originated the debt through Freddie Mac. Each of the loans was features a seven-year term and a floating interest rate. JLL, which will service the loans, also secured $40 million in new equity as part of the larger recapitalization of the portfolio. The equity partner was not disclosed. “Despite turbulent debt markets, we were able to facilitate a refinance of the portfolio with favorable senior financing from Freddie Mac, which was attracted to the deal due to the portfolio’s contribution to its mission and the borrower’s strong track record,” says Quinn. — Taylor Williams

QTS Buys 615 Acres in Fayetteville, Georgia for ‘World’s Largest Multi-Tenant Data Center Campus’

by John Nelson

FAYETTEVILLE, GA. — Quality Technology Services (QTS), a data center owner and operator, has acquired 615 acres in Fayetteville, about 25 miles south of Atlanta. The Overland Park, Kan.-based firm plans to develop the world’s largest multi-data center campus on the site, according to CBRE. The square footage and construction timeline for the campus were not released. Tim Huffman and Mike Lash of CBRE represented the seller, the Fayette County Development Authority, in the deal. The duo also procured QTS, which acquired the assemblage for $153.8 million, or approximately $250,000 per acre. Atlanta’s data center market has seen strong demand as the market recorded a vacancy rate of 3.6 percent as of second-quarter 2022, according to CBRE research. The market is currently home to 249.5 megawatts (MW) of data center capacity, a 71.7-MW increase from the first half of 2021.

ALPHARETTA, GA. — Lincoln Rackhouse, the data center division of Lincoln Property Co., and Principal Real Estate Investors, the real estate investment arm for Principal Global Investors, have partnered to purchase a 185,000-square-foot data center. Originally built and occupied by cell phone giant Blackberry in 2009, the data center sits on a 38-acre site at 4905 N. Point Parkway in Alpharetta, less than two miles from the Avalon mixed-use development and about 25 miles north of Atlanta. The seller and sales price were not disclosed. The data center’s current capacity is 7 megawatts (MW) but is expandable up to 13 MW, and the site can accommodate a new ground-up data center that can support 30 MW of capacity. St. Louis-based Ascent will continue to provide facilities management, engineering and construction services to the site. Digital Crossroad and CBRE’s Atlanta-based data center solutions team will provide marketing and leasing services for the new ownership.

WILDWOOD AND LADY LAKE, FLA. — Strategic Storage Growth Trust III Inc. has purchased two self-storage facilities in The Villages, a master-planned community in Central Florida spanning 5,600 acres. California-based Strategic Storage Growth Trust III is a private company that intends to qualify as a REIT sponsored by an affiliate of SmartStop Self Storage REIT. The self-storage assets include a 1,010-unit property at 5688 Florida Highway 44 in Wildwood and a 750-unit facility at 175 Rolling Acres Road in Lady Lake. The 187,400-square-foot portfolio represents the first acquisition for Strategic Storage Growth Trust III since it launched in May 2022. The seller and sales price were not disclosed.

Colliers Arranges $12.5M Sale of Quality Inn Hotel, IHOP Restaurant in West Palm Beach

by John Nelson

WEST PALM BEACH, FLA. — Colliers has arranged the sale of the 135-room Quality Inn Palm Beach International Airport hotel and an adjacent IHOP restaurant in West Palm Beach. Index Investment Group purchased the assets from Cherry Cove Hospitality for $12.5 million. Mark Rubin and Bastian Laggerbauer of Colliers’ South Florida Investment Services team represented the buyer, and Richard Lillis of Colliers’ Hotels USA division represented the seller in the off-market transaction. Index will assume operations of the hotel immediately and continue to operate it under the Quality Inn flag. The hotel and 5,408-square-foot IHOP are located at 1503-1505 Belvedere Road, roughly two miles from both Palm Beach International Airport and downtown West Palm Beach.

BATON ROUGE, LA. — Matthews Real Estate Investment Services has brokered the $7.3 million sale of Acadian Place Apartments, a 120-unit multifamily property located at 855 S. Flannery Road in Baton Rouge. John Solari of Matthews represented the undisclosed seller in the transaction. A private investor based in New York purchased the property. Acadian Place is situated within walking distance to Flannery Road Park, an elementary school, Shopper’s Value Food and multiple restaurants. According to Apartments.com, the gated property was built in 1973 and features a pool, laundry facilities, playground, clubhouse and onsite property management.

CAPE CORAL, FLA. — A partnership between Shoreham Capital, Bridge Investment Group and Wynkoop Financial has purchased 26 acres in the southwest Florida city of Cape Coral for the development of a $120 million apartment community. Named Siesta Lakes, the 412-unit property will include one-, two- and three-bedroom floor plans with private balconies, open living areas and high-end finishes. Community amenities will include a gym, pool, dog park, pickleball courts and a business center. The co-developers plan to break ground in the fourth quarter.