PLANTATION, FLA. — SRS Real Estate Partners has brokered the $7.4 million sale of Bank of America Plaza, a 13,000-square-foot retail building located at 7001 W. Broward Blvd. in Plantation. Situated in South Florida’s Broward County, the property was built in 2004 and leased to Bank of America. Brandon Woulfe of SRS represented the seller, an entity doing business as 7001 Plantation 2009 LP, in the off-market transaction. Don Ginsburg of Katalyst Real Estate represented the buyer, Barron Real Estate.

Southeast

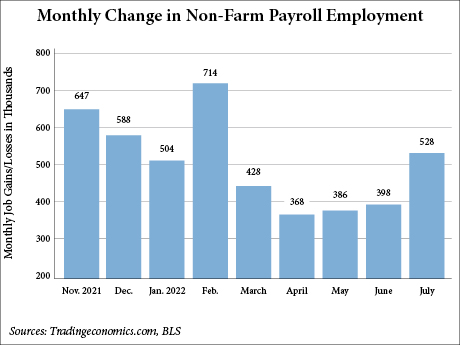

WASHINGTON, D.C. — Total U.S. nonfarm payroll employment rose by 528,000 in July, while the employment rate ticked down to 3.5 percent, according to the U.S. Bureau of Labor Statistics (BLS). Employment gains more than doubled the prediction of Dow Jones economists, who forecast the U.S. economy would add 258,000 jobs and the unemployment rate would remain unchanged at 3.6 percent for the fifth consecutive month, according to CNBC. July represents the highest monthly employment total since February, which totaled 714,000 jobs. July job gains were led by leisure and hospitality (96,000), an employment sector that remains 1.2 million jobs below pre-pandemic levels in February 2020 (a 7.1 percent loss). Other sectors that saw notable additions last month include professional and business services (89,000), healthcare (70,000), government (57,000), construction (32,000) and manufacturing (30,000). Additionally, the BLS revised job gains in May and June by a combined +28,000 jobs. The change in total nonfarm payroll employment for May was revised up by 2,000 (from 384,000 to 386,000), and the change for June was revised up by 26,000 (from 372,000 to 398,000).

Rockpoint, Ivanhoe Cambridge Sell Mary Brickell Village Mixed-Use Property in Miami for $216M

by John Nelson

MIAMI — Boston-based Rockpoint and Montreal-based Ivanhoe Cambridge have sold Mary Brickell Village, a Publix-anchored mixed-use property in Miami’s Brickell district. RPT Realty purchased the 200,503-square-foot development for $216 million. Danny Finkle, Chris Angelone, Matthew Lawton, Eric Williams and Kim Flores of JLL represented the sellers in the transaction. Situated on 5.2 acres at 901 S. Miami Ave., Mary Brickell Village’s tenant roster includes Miami’s only LA Fitness Signature Club, as well as Moxie’s, North Italia, P.F. Chang’s, Shake Shack, Blue Martini, Starbucks, Massage Envy, Candela Gastro Bar and EWM Realty. The mixed-use property also includes an 875-space parking garage. Originally constructed in 2008, Mary Brickell Village underwent renovations between 2018 and 2020.

Syndicated Equities Trades Johns Hopkins Laboratory Building in Laurel, Maryland for $53M

by John Nelson

LAUREL, MD. — Syndicated Equities, a private real estate investment firm based in Chicago, has sold the Johns Hopkins University Applied Physics Laboratory in Laurel. An unnamed, Florida-based investor purchased the property for $53 million in a 1031 exchange. Syndicated Equities purchased the laboratory facility in January 2011 in a joint venture with Middleton Partners, which is also based in Chicago. During its ownership, Syndicated Equities executed two long-term leases and made significant improvements to the asset, including installing a new roof.

FORT MYERS, FLA. — Stonemont Financial Group and joint venture partner Geis Cos. have closed on their purchase of 35 acres in Fort Myers for the development of a 500,000-square-foot, Class A industrial park. The project, known as Legacy at Oriole Road, is slated for completion in second-quarter 2023. The development will include two 250,000-square-foot warehouses designed to accommodate users as small as 37,000 square feet. The buildings will feature 32-foot clear heights, 72 trailer parking stalls and above-standard bay spacing. The property offers proximity to I-75, Route 41 and other major thoroughfares.

PLANTATION, FLA. — SRS Real Estate Partners has brokered the $7.4 million sale of Bank of America Plaza, a 13,000-square-foot retail building located at 7001 W. Broward Blvd. in Plantation. Situated in South Florida’s Broward County, the property was built in 2004 and leased to Bank of America. Brandon Woulfe of SRS represented the seller, an entity doing business as 7001 Plantation 2009 LP, in the off-market transaction. Don Ginsburg of Katalyst Real Estate represented the buyer, Barron Real Estate.

WASHINGTON, D.C. — Total U.S. nonfarm payroll employment rose by 528,000 in July, while the employment rate ticked down to 3.5 percent, according to the U.S. Bureau of Labor Statistics (BLS). Employment gains more than doubled the prediction of Dow Jones economists, who forecast the U.S. economy would add 258,000 jobs and the unemployment rate would remain unchanged at 3.6 percent for the fifth consecutive month, according to CNBC. July represents the highest monthly employment total since February, which totaled 714,000 jobs. July job gains were led by leisure and hospitality (96,000), an employment sector that remains 1.2 million jobs below pre-pandemic levels in February 2020 (a 7.1 percent loss). Other sectors that saw notable additions last month include professional and business services (89,000), healthcare (70,000), government (57,000), construction (32,000) and manufacturing (30,000). Additionally, the BLS revised job gains in May and June by a combined +28,000 jobs. The change in total nonfarm payroll employment for May was revised up by 2,000 (from 384,000 to 386,000), and the change for June was revised up by 26,000 (from 372,000 to 398,000).

Poettker Construction Breaks Ground on 946,348 SF Industrial Complex in Metro Charlotte

by John Nelson

GASTONIA, N.C. — Poettker Construction has broken ground on the second phase of Gateway 85, an industrial park located 22 miles west of Charlotte in Gastonia. NorthPoint Development is the project developer for both tilt-wall facilities. Phase II comprises Building 4, a 241,114-square-foot warehouse located on 15 acres at 3145 Aberdeen Blvd., and Building 7, a 705,234-square-foot warehouse located on 40 acres at 3301 Lineberger Road. Preparation of the 55-acre development will entail the relocation of an existing road that goes through the site and reworking the intersection, as well as site clearing and hauling away excess dirt. No construction timeline was disclosed. Poettker Construction is nearing completion on a similar project for NorthPoint in Salisbury, N.C.

Lotus Capital Arranges $70M Acquisition, Construction Financing for Bay Harbor Islands Residential Project in Miami

by John Nelson

MIAMI — Lotus Capital Partners LLC has arranged a $70 million acquisition and construction financing package for a waterfront condominium project on Bay Harbor Islands in Miami. The sponsor is a partnership between Pearl Property Group and L3C Capital Partners, which is acquiring a one-acre site facing the Bay Harbor waterway that currently consists of 30 condos. Lotus arranged the dual-structure loan through MSD Partners to provide acquisition financing for the borrower to purchase the site and funds to construct a new residential project. The borrower plans to demolish the existing condos and build 46 ground-up condos averaging 2,800 square feet. The development will also include a fitness center, resort-style club pool overlooking the water and a marina.

MEMPHIS, TENN. — Berkadia has arranged a $45 million Fannie Mae refinancing loan for Residences at Lakeview, an 827-unit apartment community located at 2774 S. Mendenhall Road in Memphis. Mitch Sinberg, Brad Williamson, Matthew Robbins, Scott Wadler and Mike Basinski of Berkadia originated the 10-year, fixed-rate loan on behalf of the borrower, a joint venture between New York City-based Atlas Real Estate Partners and Washington, D.C.-based West End Capital Group. Atlas-West End purchased the property in February 2021 and recently completed a value-add program at the community. Built in 1969, Residences at Lakeview features one-, two-, three- and four-bedroom units ranging from 400 to 1,628 square feet. Community amenities include a newly built clubhouse and pool, fitness center, four playgrounds, a dog park, onsite maintenance and management and package services.