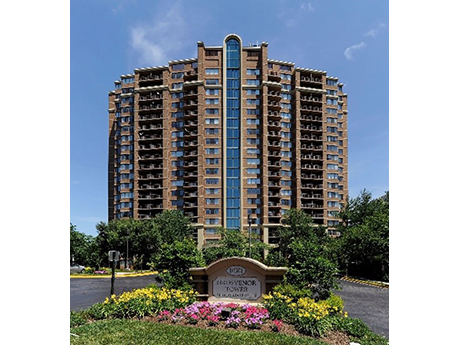

BETHESDA, MD. — Grosvenor and an unnamed investment partner have acquired a 21-story apartment tower in North Bethesda that coincidentally shares a name with the private investor. Grosvenor Tower is located at 10301 Grosvenor Place and features 237 apartments. The acquisition price was not disclosed, but the Washington Business Journal reports that the asset traded for $95 million and that Grosvenor plans to invest $10 million to upgrade the property. The property was originally built in 1987, renovated in 2008 and includes 80 one-bedroom, one-bath apartments and 157 two-bedroom, two-bath apartments. Grosvenor has engaged Bozzuto Management to oversee day-to-day property management. The buyer plans to enhance energy and water efficiency at Grosvenor Tower as part of its $10 million value-add program.

Southeast

CHARLESTON, S.C. — Capital Square has broken ground on 529 King Street ROOST Apartment Hotel, a five-story luxury apartment hotel located in the Garden District of Charleston. The hybrid property will feature 50 extended stay apartments in studio, one-, two- and three-bedroom floor plans. The property will operate under the ROOST Apartment Hotel brand, a division of Method Residential. The final development will total approximately 32,000 net rentable square feet, including an “open-air living room courtyard” and a rooftop lounge that will be open to the public. Capital Square’s project partners include architect Morris Adjmi & LS3P, general contractor BL Harbert and Method Residential as the retail leasing agent and co-developer of the property. 529 King is situated within an opportunity zone, and Capital Square is funding the project in part with proceeds from its fourth qualified opportunity zone fund, CSRA Opportunity Zone Fund IV LLC. The Richmond-based developer and investor expects to open the property in summer 2023.

MIAMI — International law firm Sidley Austin LLP has signed a 60,000-square-foot office lease at 830 Brickell, a 55-story office tower nearing completion in Miami’s Brickell district. The building, developed in partnership by OKO Group and Cain International, is the first standalone office tower to be built in Brickell in over a decade. The office building is nearly 70 percent leased ahead of its late-2022 completion to tenants including Microsoft, New York-based insurance firm A-CAP, private equity firm Thoma Bravo, CI Financial, Marsh Insurance, AerCap and WeWork, among others. Brian Gale, Ryan Holtzman and Andrew Trench of Cushman & Wakefield represented the landlords in the lease deal. Jeff Gordon and Barbara Black of JLL represented Sidley Austin.

NASHVILLE, TENN. — Kroger plans to open a new 40,000-square-foot distribution center on Polk Avenue in Nashville, which will extend the grocer’s delivery services to Middle Tennessee. The “spoke” facility will work in conjunction with the Atlanta fulfillment center that the grocer operates along with UK-based grocery delivery platform Ocado. According to Tennessee Gov. Bill Lee, the new Kroger facility will support 180 new jobs. Kroger worked with the Tennessee Valley Authority, Nashville Area Chamber and Tennessee Department of Economic and Community Development for the project. A construction timeline or exact address were not disclosed, but The Tennessean reports that the site is located at 1116 Polk Ave. on the south side of town.

ARCADIA, FLA. — SRS Real Estate Partners’ Investment Properties Group has arranged the $13.9 million sale of Arcadia Crossing, a Publix-anchored shopping center about 40 miles east of Sarasota in Arcadia. Kevin Yaryan of SRS’ Orlando office worked with Kyle Stonis and Pierce Mayson of the firm’s Atlanta office to represent the buyer in the transaction. The seller was self-represented. Both parties requested anonymity. The 67,608-square-foot property is situated on 8.2 acres at the intersection of SE Highway 70 and Hog Bay Avenue. In addition to Publix, the center’s tenant roster includes Publix Liquors and Harbor Freight, among others.

BLACK CREEK, GA. — Rooker, an Atlanta-based industrial developer and construction management firm, has broken ground on Seaport 16 Trade Center, a 797-acre industrial campus situated about 25 miles from the Port of Savannah in Black Creek. The multi-phased project has the capacity for 7.1 million square feet of logistics space across 10 facilities at full buildout. Rooker has begun construction on Building 1, an 868,160-square-foot speculative building that is expandable to 1.6 million square feet and is scheduled for completion in 2023. Solution Property Group is Rooker’s marketing partner for the project and represented the developer in its land acquisition in 2021. Thomas & Hutton is the civil engineer for Seaport 16, and POH Architects will provide architectural design. Morgan Corp. is the site work contractor. The development will be located at the intersection of Olive Branch Road and Ga. Highway 80, a little over three miles from I-16. The campus will also be situated about five miles from Hyundai’s new electric vehicle assembly and battery factory, which is expected to come on line in 2025.

ATLANTA — Hudson Capital Properties (HCP) has sold Hudson Ridge Apartments, a 434-unit multifamily community located at 3505 Windy Ridge Lane in Atlanta’s Cumberland-Galleria submarket. An affiliate of New York-based L+M Fund Management purchased the community for $143.5 million. Kevin Geiger of CBRE represented HCP, which purchased the property in 2016 and executed a community-wide renovation, in the transaction. Built in 1998, Hudson Ridge features one-, two- and three-bedroom apartments, some of which feature detached garages and offer views of the nearby Truist Park, the home ballpark of the Atlanta Braves. Amenities at Hudson Ridge include a clubhouse with a lounge, resort-style pool and sundeck, tennis court, business center and a fitness center.

Chartwell Hospitality, Rockbridge Underway on 292-Room Hilton Hotel at Nashville International Airport

by John Nelson

NASHVILLE, TENN. — Chartwell Hospitality and partner Rockbridge have been selected by the Metropolitan Nashville Airport Authority (MNAA) to develop a Hilton-branded hotel at Nashville International Airport. The duo began vertical construction earlier this month on the property, which will feature 292 guest rooms, about 16,000 square feet of meeting space and a rooftop pool and bar. Other amenities will include a fitness center on the top floor, as well as a cafe, lobby bar and full-service restaurant on the ground level for guests and travelers. The hotel will be the tallest building at the airport campus. The project team includes locally based general contractor Crain Construction. Targeted completion or opening dates were not disclosed by Chartwell, which is also part of a development team for two hotels underway at John F. Kennedy International Airport in New York City.

SPRING HILL, TENN. — Lee & Associates’ Nashville office has brokered the $52 million sale of a 276,056-square-foot industrial facility located at 3555 Cleburne Road in Spring Hill. San Diego-based STOS Partners purchased the property from Effingham, Ill.-based Agracel Inc. Brett Wallach and William Sisk of Lee & Associates represented both parties in the transaction. The property, which is STOS’ first acquisition in the metro Nashville area, was fully leased at the time of sale on a triple-net basis to tenants including automotive firm Fourecia.

PALMETTO, FLA. — Stonemont Financial Group has broken ground on Palmetto Industrial Park, a 427,000-square-foot industrial facility located in the Sarasota suburb of Palmetto. Situated near I-75 and I-275 in Manatee County, the property will feature three rear-load facilities, each spanning more than 100,000 square feet. The speculative buildings will feature 32-foot clear heights and the campus will feature 354 car parking spaces and 127 trailer parking spaces. General contractor Landmark Construction Services plans to deliver Palmetto Industrial Park in the second quarter of 2023.