METAIRIE, LA. — The Richards family has begun construction of The Commons of Clearview City Center, a new 10,476-square-foot retail project in the New Orleans suburb of Metairie. The property will be situated within the 100-acre Clearview City Center, which is a redevelopment of the former Clearview Mall. Set to come on line in March 2023, The Commons will house a 4,000-square-foot restaurant occupied by brunch eatery Ruby Slipper, as well as other concepts that have not yet been announced. The project includes the demolition of the existing structure at 4236 Veterans Blvd. In addition to The Commons, projects underway at Clearview City Center include Target’s renovation of its 160,000-square-foot store; Ochsner Health’s new Super Clinic set to open in October; and The Metro at Clearview, a five-story apartment community set for completion in October 2023. Other uses at Clearview City Center include a new branch of Regions Bank, Bed Bath & Beyond and Walk On’s Sports Bistreaux, among other stores and restaurants. Kirsten Early of SRSA Commercial Real Estate is handling the leasing assignment on behalf of the Richards family, which has owned the site since 1968.

Southeast

ODENTON, MD. — San Francisco-based Hamilton Zanze has purchased Echelon at Odenton Apartments, a 244-unit garden-style multifamily community located at 315 Nevada Ave. in Odenton, a suburb of Baltimore. Built in 2016, the apartment community was 97 percent occupied at the time of sale. The seller and sales price were not disclosed. Situated on 6.6 acres, Echelon at Odenton comprises two five-story residential buildings housing units ranging from 759 to 1,456 square feet, as well as a single-story clubhouse. Amenities include a theater, barbecue and grilling areas, clubhouse, TV lounge and bar, playground, game room, pool and covered bike storage.

The Raleigh-Durham office market is poised for future growth as it exits the pandemic, however the question for us all is when. Re-occupancy of buildings by office users has been stubborn in the current post-pandemic environment. Despite the sluggish activity since the beginning of the year, there have been bright spots with companies becoming more strategic about their office space decisions as they return, especially in newer projects that offer best-in-class experiences. Moving forward, there will be economic and geopolitical headwinds that may interfere with the pace of recovery. However, investors and developers continue to the see the value in the market due to our highly educated workforce, favorable business climate and one of the fastest growing population centers in the country. The return of the workplace is the main driving factor for the activity in the office leasing market. As companies execute their re-occupancy plans, they are reevaluating their existing buildings, footprints and workspaces in a way that we have never seen before. Forward thinking organizations are making decisions to create unique spaces where their employees want to come to work, rather than a space where they have to come to work. We have quickly seen that one size …

Realty Trust Group Opens 91,000 SF Healthcare Clinic at UT Medical Center in Knoxville

by John Nelson

KNOXVILLE, TENN. — Realty Trust Group has opened the University of Tennessee Medical Center’s New Advanced Orthopaedic Institute, a 91,000-square-foot clinic in Knoxville. The freestanding property is situated within University of Tennessee Research Park at Cherokee Farms, which is across Alcoa Highway from UT Medical Center’s main campus. The clinic is operated by the University Orthopaedic Surgeons (UOS) and OrthoTennessee, which relocated from the main UT Medical Center campus to the new facility. Fourteen UOS and OrthoTennessee surgeons will practice at the new location and offer clinical, imaging, diagnostic, surgical, rehabilitative care and therapy services. In addition to developer Realty Trust Group, the project team included Barber McMurry Architects and general contractor Christman Co.

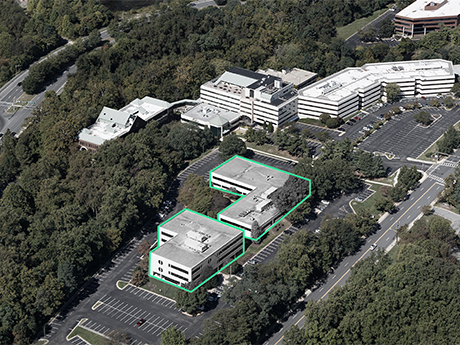

ROCKVILLE, MD. — CBRE has negotiated the $25.5 million sale of Research Square, a two-building office complex located at 1500 and 1550 Research Blvd. in Rockville, a suburb of Washington, D.C. The seller is Westat, an employee-owned research company based in Rockville. Tommy Cleaver, Dan Grimes and Stuart Kenny of CBRE represented Westat in the transaction. The buyer was not disclosed. CBRE says that the properties, which were fully vacated at the time of sale, represent a “premier life sciences conversion opportunity” as the Washington-Baltimore Corridor ranked No. 2 in CBRE’s Life Sciences Research Talent 2022 report.

DURHAM, N.C. — Virginia Beach, Va.-based Armada Hoffler Properties has sold two single-tenant retail properties in Durham for a combined $23.9 million. The assets include a 120,000-square-foot store at 1700 N. Pointe Drive that is leased to The Home Depot and a 148,663-square-foot store at 1510 N. Pointe Drive leased to Costco. The adjacent, triple-net-leased stores are situated within two miles of Duke University and downtown Durham. Alex Sharrin, Alex Geanakos and Michael Roberts of JLL represented Armada Hoffler in the transaction. An unnamed investment firm based in New York City purchased both stores.

AUGUSTA, GA. — Berkadia has arranged the $16.8 million sale of Terraces at Summerville, a 120-unit apartment community located at 817 Hickman Road in Augusta. Mark Boyce and Blake Coffey of Berkadia’s Charleston office represented the seller, Nebraska-based Burlington Capital Group, in the transaction. The buyer was Tennessee-based JBT Holdings. Built in 1972, Terraces at Summerville was 95 percent occupied at the time of sale. According to Apartments.com, the property features a pool, fitness center, laundry facilities, tennis court, clubhouse and picnic area.

GREENVILLE, S.C. — Institutional Property Advisors, a division of Marcus & Millichap, has brokered the $10.7 million sale of Cherrydale Market, a newly built, 70,635-square-foot shopping center in Greenville. The property houses three tenants: Burlington, Ulta Beauty and Five Below. Zach Taylor of IPA arranged the transaction on behalf of the seller, an entity doing business as Cherrydale 245 LLC. The buyer was Agree Realty, a net lease retail REIT based in Bloomfield Hills, Mich. “We procured the equity for the developer to get the property out of the ground and sourced an active REIT willing to commit to a pre-sale during construction,” says Taylor.

BALTIMORE — Klein Enterprises, an investment and development firm based in Baltimore, has purchased a portfolio of nine grocery-anchored shopping centers in the Mid-Atlantic. The portfolio spans 800,000 square feet of retail space and was 80 percent leased at the time of sale. Cedar Realty Trust sold the portfolio for an undisclosed price in conjunction with the broader asset acquisition of Cedar’s grocery-anchored portfolio by a joint venture between DRA Advisors and KPR. United Bank provided an undisclosed amount of debt financing for the acquisition. As part of the transaction, Klein is acquiring seven stabilized shopping centers and two centers actively under redevelopment: Valley Plaza in Hagerstown, Md., and Yorktowne Plaza in Cockeysville, Md. The other seven centers in the portfolio include: • The Shoppes Arts District located in Hyattsville, Md. • Oakland Mills located in Columbia, Md. • Elmhurst Square located in Portsmouth, Va. • General Booth Plaza located in Virginia Beach, Va. • Kempsville Crossing located in Virginia Beach, Va. • Oak Ridge Shopping Center located in Suffolk, Va. • Swede Square located in East Norriton, Pa.

ATLANTA — Miami-based Westside Capital Group has purchased The Lofts at Twenty25, a 16-story high-rise apartment tower located at 2025 Peachtree Road in Atlanta. The unnamed developer sold the 623-unit property, which was originally built in 1951 and completely redeveloped in 2021, for $136 million. Situated between Atlanta’s Buckhead and Midtown districts, Lofts at Twenty25 features one-bedroom apartments ranging from 430 square feet to 600 square feet. Unit interiors feature eight- to 10-foot ceilings, wood-style plank flooring, quartz countertops and stainless steel appliances, walk-in closets and barn-style doors. Amenities include a 5,000-square-foot fitness center, swimming pool, movie theater, convenience store and coffee shop, dog park and dog wash, swimming pool, billiards and game room, office and conference rooms, bike storage, putting green, laundry facility and dry cleaning service, EV charging stations and 405 parking spaces.