ATLANTA — CTO Realty Growth, a retail REIT based in Daytona Beach, Fla., has purchased Madison Yards, a new retail development in Atlanta’s Inman Park district. The developer, locally based Fuqua Development, sold the 162,500-square-foot project to CTO Realty Growth for $80.2 million. Located at 905 Memorial Drive along the Atlanta Beltline’s Eastside Trail, Madison Yards was 98 percent leased at the time of sale to tenants including anchors Publix and AMC Theatres. Other tenants include AT&T, First Watch and Orangetheory Fitness. Fuqua delivered the property in 2019, as well as an attached apartment community that was not part of the transaction.

Southeast

Northridge Capital Purchases 18-Story Gateway Plaza Office Tower in Downtown Richmond

by John Nelson

RICHMOND, VA. — Northridge Capital LLC has purchased Gateway Plaza, an 18-story trophy office building located at 800 E. Canal St. in downtown Richmond. The Washington, D.C.-based investor acquired the 328,581-square-foot property from an affiliate of New York-based LXP Industrial Trust for an undisclosed price. Chris Lingerfelt, Daniel Flynn, Ryan Clutter and Andrew Weir of JLL represented the seller in the transaction. Additionally, the buyer has retained JLL for leasing and property management services. Built in 2015, Gateway Plaza was 97.6 percent leased at the time of sale to legal, banking, energy products, financial services, real estate and consulting firms, including anchor McGuireWoods.

Crescent Communities, KB Venture to Redevelop Historic Alpharetta School as 160,000 SF Office Campus

by John Nelson

ALPHARETTA, GA. — Crescent Communities and KB Venture Partners have formed a partnership for the adaptive reuse of the former Baily-Johnson School in Alpharetta. The duo will transform the formerly segregated school, which served black students in north Fulton County from its opening in 1950 to its closing in 1967, into a three-building office campus totaling 160,000 square feet. The office campus will include a new 120,000-square-foot mass timber office building, as well as the redevelopment of the main school building and gymnasium. The new campus, dubbed Garren, is named after the school’s namesakes, George Bailey and Warren Johnson. The 4.4-acre site was most recently used as a maintenance facility for Fulton County Schools. Once complete, tenants at Garren will be in close proximity to Avalon and downtown Alpharetta and have access to several amenities on the campus, including outdoor gathering areas, private tenant patios, a tenant lounge, fitness centers, locker room with showers and bike storage. John Zintak and Porter Henritze of Cushman & Wakefield are handling the leasing assignment. A construction timeline was not disclosed.

TAMPA, FLA. — JLL has provided a $76.7 million Freddie Mac loan for the refinancing of Hamilton Point on Egypt Lake, a 638-unit apartment community located at 6900 Concord Drive in west Tampa. Elliott Throne and Kenny Cutler of JLL originated the 10-year, floating-rate loan on behalf of the undisclosed borrower. Situated near several public beaches and Hyde Park Village, Hamilton Point on Egypt Lake features one-, two- and three-bedroom units that average 858 square feet in size. Amenities include two swimming pools, a lakefront sand volleyball court, clubhouse that can be reserved for events, fitness center, two tennis courts, reserved covered parking, a children’s playground and an onsite laundry facility.

LINCOLNTON, N.C. — A joint venture between Magma Equities and Prudent Growth Partners has purchased The Oaks Apartment Homes, a 111-unit multifamily community located in the Charlotte suburb of Lincolnton. The duo purchased the property from the undisclosed seller in an off-market transaction for $17.8 million. Built in 2002, The Oaks comprises one-, two- and three-bedroom apartments located on an 11.7-acre site. Community amenities include a fitness center, basketball court, grilling area, playground and a dog park. The community was 97 percent occupied at the time of sale.

BEND, ORE., AND CLARKSVILLE, TENN. — Invesco Real Estate Income Trust (INREIT) has acquired two self-storage portfolios in Bend and Clarksville for a combined purchase price of $42 million. The two-story, single-story, drive-up self-storage properties in Bend total 62,805 square feet across 674 units. The portfolio includes a 49,523-square-foot, 550-unit property that is 98.7 percent occupied, at 20230 Powers Road, as well as 345 Cleveland Ave., a 13,282-square-foot, 124-unit facility that is 100 percent occupied. Located in Clarksville, the three single-story, drive-up self-storage properties total 204,425 square feet across 1,347 units. The portfolio includes 1280 Parkway Place, a 67,350-square-foot, 505-unit facility that is 95.6 percent occupied; 4351 Guthrie Highway, an 80,275-square-foot, 471-unit facility that is 96.6 percent occupied; and 117 Old Excell Road, a 56,800-square-foot, 371-unit facility that is 97.8 occupied. The names of the sellers were not released.

First National Realty Acquires Brook Highland Plaza Shopping Center in Birmingham for $77M

by John Nelson

BIRMINGHAM, ALA. — First National Realty Partners has purchased Brook Highland Plaza, a 549,500-square-foot shopping center located in Birmingham. The seller and sales price were not disclosed, but the Birmingham Business Journal reports the property traded for $77 million. The transaction marks the Red Bank, N.J.-based investor’s second grocery-anchored center acquisition in Alabama. Brad Buchanan and Jim Hamilton of JLL’s Atlanta office represented the seller in the transaction. A 127,000-square-foot Lowe’s Home Improvement store and a 23,400-square-foot Sprouts Farmers Market anchor Brook Highland Plaza. Other tenants include Burlington, Best Buy, HomeGoods, Petco, Dollar Tree, Ulta Beauty, Five Below and Ashley Furniture. The property has about 11,650 square feet of space available, according to First National Realty Partners.

Portman Holdings, Harrison Street Recapitalize Coda Mixed-Use Tower in Atlanta’s Tech Square

by John Nelson

ATLANTA — Locally based development firm Portman Holdings has formed a joint venture with Chicago-based alternative real estate asset management firm Harrison Street to recapitalize Coda, a 664,000-square-foot mixed-use tower located at 756 W. Peachtree St. in Atlanta’s Technology Square. As part of the partnership, Harrison Street is purchasing a stake in the tower, which Portman delivered in 2019 adjacent to the Georgia Tech campus, from the Atlanta-based company for an undisclosed amount. Comprising educational, research, office and retail space, Coda serves more than 700 Georgia Tech faculty, staff and researchers, as well as tech firms including Cisco, AutoDesk and Keysight Technologies. The asset was 98 percent leased at the time of the recapitalization and features an onsite data center that is owned and operated by DataBank, as well as the Collective Food Hall.

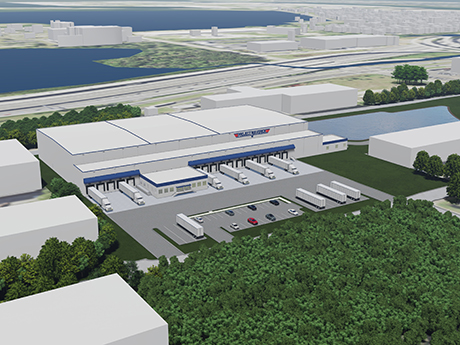

Sansone Group, Mandich to Develop 110,476 SF Spec Cold Storage Facility in Downtown Tampa

by John Nelson

TAMPA, FLA. — A partnership between St. Louis-based Sansone Group and Miami-based Mandich Group has purchased a 7.3-acre site in downtown Tampa’s Ybor City district. The developers plan to build a speculative cold storage facility at the site that will include 45-foot clear heights and span 110,476 square feet upon completion, which is set for 2024. The property, dubbed Tampa Cold Logistics, will be situated near I-4, Port Tampa and Tampa International Airport. Tippmann Group is the general contractor for the project, and Eric Swanson on Avison Young helped facilitate the deal, which is Sansone’s first partnership with Mandich Group.

NAI Earle Furman Brokers Sale of 25-Story Landmark Office Tower in Downtown Greenville

by John Nelson

GREENVILLE, S.C. — NAI Earle Furman has brokered the sale of the Landmark Building, a 25-story office tower located at 301 N. Main St. in downtown Greenville. Built in 1966, the property spans 331,000 square feet and is the tallest building in the city. A locally based investment group managed by CAPA Management purchased the tower from a Columbia, S.C.-based entity doing business as Tower on Main LLC. The sales price was not disclosed. Keith Jones, McNeil Epps, Jake Van Gieson and Gaston Albergotti of NAI Earle Furman represented the buyer in the transaction. The locally based brokerage and services firm has also been retained to manage and lease the building. First Reliance Bank provided an undisclosed amount of acquisition financing for the deal. The buyer plans to make immediate capital improvements to the tower.