STUART, FLA. — RK Centers has purchased Pineapple Commons, a 256,000-square-foot open-air shopping center located at 2502 N.W. Federal Highway in Stuart, a coastal city about 40 miles north of West Palm Beach. Kimco Realty sold the property to RK Centers for $48.5 million. Dennis Carson of CBRE represented Kimco in the transaction. Built in 2005, Pineapple Commons’ tenant roster includes City Furniture, Ashley Furniture, Best Buy, Ross Dress for Less, Ulta Beauty, PetSmart, Marshalls, Shoe Carnival, Starbucks, Chipotle and 15 other dining, service and specialty retail shops.

Southeast

Charlotte’s Underlying Fundamentals Support Strong Industrial Development, Forward Sales

by John Nelson

In a constantly evolving and unprecedented era, Charlotte is an extremely well-positioned industrial market experiencing significant rent growth, an influx of new capital and development in new frontiers. As of first-quarter 2022, Charlotte was nearing an all-time low vacancy rate and rental rate growth reached more than 12 percent year-over-year. Needless to say, Charlotte has become a prime target for industrial investors, developers and tenants. Staggeringly low vacancy, strong tenant demand and rapid rent growth are trends the industrial real estate sector is experiencing around the county. While these trends are not necessarily unique to Charlotte, they are having a particularly large impact on how Charlotte is growing. These strong underlying leasing fundamentals accompanied by land scarcity left Charlotte under-supplied with developers on the hunt for land. A recent announcement by the Silverman Group is a great example. After closing on a 200-acre site just 30 minutes northeast of Charlotte in Rowan County, the Silverman Group announced a speculative industrial development capable of up to 1.9 million square feet and quickly signed a lease with Macy’s for an e-commerce distribution center spanning 1.4 million square feet. On the west side of Charlotte in Gaston County, NorthPoint Development has seen similar …

Berkadia Arranges $100M Construction Loan for Gardens Residence Apartments in North Miami, Florida

by John Nelson

NORTH MIAMI, FLA. — Berkadia has arranged a $100 million construction loan for the development of The Gardens Residence, a 358-unit midrise apartment community located at 1155 N.E. 126th St. in North Miami. Churchill Real Estate provided the two-year, floating-rate loan to the borrower, Omega Real Estate Management. Charles Foschini, Christopher Apone and Robert Ludice of Berkadia’s Miami office arranged the financing, which includes two one-year extension options and is interest-only for the full loan term, including extensions. In addition to the financing, the North Miami CRA is providing $15 million in subsidies. The Gardens Residence is part of Omega’s plan to transform a seven-acre assemblage into a mixed-use community named The Gardens District that will include offices, shops and restaurants. The nine-story apartment community will feature studio, one-, two- and three-bedroom apartments ranging from 511 square feet to 1,270 square feet. Amenities will include a ground-floor café with outdoor terrace seating, rooftop pool with rentable poolside cabanas, gym, yoga studio, bike lockers and workshop stations and structured parking with 528 stalls. Ten percent of units will be reserved for families earning at or below 80 percent of area median income.

NAP Gains County Approval for Redevelopment of Avenue East Cobb Shopping Center in Metro Atlanta

by John Nelson

MARIETTA, GA. — North American Properties (NAP) has gained unanimous approval from the Cobb County Board of Commissioners for its redevelopment plan of the Avenue East Cobb, an open-air shopping center located in the northeast Atlanta suburb of Marietta. Plans call for a portion of the central building near Kale Me Crazy to be demolished to make way for an 8,000-square-foot area called The Plaza that will be surrounded by restaurants with patios. The Plaza will feature a covered, raised stage for performances; an LED screen for broadcasting live events; and a deck with soft, flexible seating. Connected to The Plaza will be a 500-square-foot concierge building with optional valet that will be offered seasonally and during large-scale events. Two 2,500-square-foot, standalone retail and restaurant buildings will also be constructed adjacent to the concierge station. Additionally, NAP has secured new leases with Warby Parker, New York Butcher Shoppe and Tempur-Pedic, as well as a Kendra Scott pop-up and Vanilla Café. The Cincinnati-based developer will begin the permitting process immediately with plans to host a public groundbreaking celebration later this fall. NAP is partnering with PGIM Real Estate for the redevelopment of Avenue East Cobb, which Atlanta-based Cousins Properties opened in …

Four Stones Begins Construction on Phase II of Kern’s Bakery Mixed-Use Project in Knoxville

by John Nelson

KNOXVILLE, TENN. — Four Stones Real Estate has begun construction on Phase II of Kern’s Bakery, a 16-acre mixed-use redevelopment of a former bakery of the same name in Knoxville. The second phase will redevelop a historic 75,000-square-foot building into a food hall, market, offices, rooftop bars and outdoor gathering spaces. Tenants announced include Flourish Flowers, Archer Paper Goods, F45, Mae Lee’s Boutique and Drop Zone Distilling, as well as an 18-merchant food hall that will include coffee, Italian, Southern and breakfast purveyors, among others. The second phase will also include multiple bars, stages, gathering spaces, a dog park and direct access to the proposed G&O Railway track. The project team behind Kern’s Bakery include Timothy Matin of TMA Real Estate; project designer Joey Staats of Knoxville’s Johnson Architecture; civil engineers Fulghum, MacIndoe and Associates; and project manager Jaron Dowalter of BurWil Construction Co. Phase I was the 310-unit Flagship Kerns apartment community, which is now open and fully occupied, and Phase III is still in the design phase.

JONESBORO, ARK. — Mumford Co. has brokered the sale of a 98-room Courtyard by Marriott hotel in Jonesboro. An entity doing business as McCain Lodging Jonesboro LLC purchased the hotel from Hunt Properties of Jonesboro LLC. The sales price was not disclosed, but Mumford Co. says the hotel sold for full list price. Steve Kirby, Ed James and George Arvantis of Mumford Co. represented the seller in the transaction, and Arvantis procured the buyer. Built in 2018, the four-story Courtyard by Marriott features meeting space, laundry services, a convenience store, restaurant and a fitness center, according to the property website.

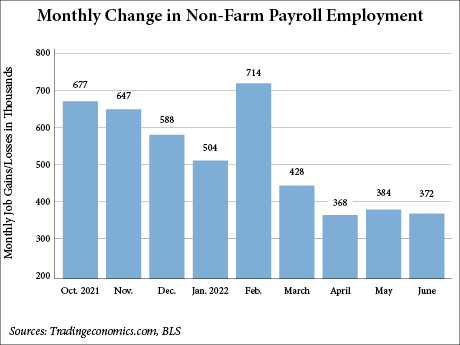

US Economy Adds 372,000 Jobs in June, April and May Revisions Total 74,000 Fewer Jobs

by John Nelson

WASHINGTON, D.C. — Total nonfarm payroll employment rose by 372,000 in June, while the U.S. unemployment rate stayed steady at 3.6 percent for the fourth consecutive month, according to the U.S. Bureau of Labor Statistics (BLS). Employment gains outstripped the prediction of Dow Jones economists for 250,000 jobs in June, according to CNBC. The BLS also revised employment gains in April down from 436,000 to 368,000 and May from 390,000 to 384,000, a total of 74,000 fewer jobs in the two-month period. June’s employment gains are in line with the new three-month rolling average of 374,000 jobs. June job gains were led by professional and business services (74,000), leisure and hospitality (67,000), healthcare (57,000) and transportation and warehousing (36,000). Employment showed little change in construction, retail trade and government employment. The unemployment rate and number of unemployed persons (5.9 million) mirror February 2020 levels, which was the last month unaffected by the COVID-19 pandemic. Total employment is down 0.3 percent from pre-pandemic levels, with private employment ahead by 140,000 jobs and government employment behind by 664,000 jobs, according to the BLS.

Bank OZK, JVP Provide $97.2M Construction Financing for Fort Lauderdale Apartment Tower

by John Nelson

FORT LAUDERDALE, FLA. — Bank OZK and JVP Management have provided $97.2 million in construction financing for the development of One River, a 34-story apartment tower located at 629 SE 5th Ave. in Fort Lauderdale. Keith Kurland of Walker & Dunlop arranged the financing, which comprises a senior loan from Bank OZK and a mezzanine loan from JVP Management, on behalf of the developers, OKO Group and Cain International. The co-developers have also recently topped off 830 Brickell, a 55-story office tower in Miami. Designed by Adrian Smith + Gordon Gill Architecture and architect of record Dorsky + Yue International, One River will feature 251 high-end apartments and 2,600 square feet of ground-level retail space. Amenities will include a resort-style rooftop pool deck; fitness center with yoga, spinning and Pilates rooms; spa with sauna and steam facilities; outdoor fitness deck and barbecue terrace; lounges for gaming and coworking; package room; bike storage; and a dog spa. OKO and Cain plan to begin vertical construction this summer and deliver the property in September 2024.

WEST PALM BEACH, FLA. — Tortoise Properties LLC has obtained an $88.5 million construction loan for a new multifamily development in downtown West Palm Beach. Acore Capital provided the loan to Tortoise, a privately held developer based in Palm Beach County. The unnamed property will comprise two eight-story towers located at 740 and 840 N. Dixie Highway that will be connected via a skybridge over Eucalyptus Street. The luxury apartment community will feature 264 studio, one- and two-bedroom residences, as well as 3,400 square feet of retail space and 371 parking spaces. The project team includes architect MSA Architects, general contractor Verdex Construction, landscape architect EDSA, project manager Hensel Phelps, civil engineer Keshavarz & Associates, structural engineer McNamara Salvia, general engineer WGI, property manager Castle Residential and entitlements and permitting overseer Managed Land Entitlements. No construction timeline was disclosed.

FAIRFAX, VA. — KBS has sold Redwood Plaza I, II and III, a three-building office complex spanning 207,000 square feet in Fairfax. Arlington, Va.-based Network Realty Partners purchased the metro D.C. assets from KBS for $23 million. Jim Meisel, Matt Nicholson, Andrew Weir, Kevin Byrd and Dave Baker of JLL brokered the transaction. KBS has owned the Redwood Plaza buildings for more than 20 years and recently renovated the assets with new lobbies, a conference center, catering kitchen and community pantry and coffee. The campus also now includes a tenant lounge that offers arcade games, shuffleboard, free Wi-Fi, craft beer on tap and a 24-hour café.