ATLANTA — A joint venture between Atlantic Residential, FIDES Development, Capital City Real Estate and Mitsui Fudosan America has broken ground on a 28-story apartment tower in Midtown Atlanta. Located at 1441 Peachtree St., the unnamed tower will comprise 350 luxury apartments and provide walkability to the Atlanta Arts MARTA station, Museum of Design Atlanta, Savannah College of Art and Design and the Breman Jewish Heritage Museum, as well as Pershing Point Park, Ansley Park and Piedmont Park. Designed by Niles Bolton Associates, the apartment tower’s amenities will include coworking spaces, a fitness center, wine bar and lounge, private dining area, pool with a sundeck and a rooftop bar and lounge, as well as two restaurants in the lobby. Apartments will come in studio, one-, two- and three-bedroom floor plans, many featuring balconies or terraces. The project team includes landscape architect and civil engineer Kimley-Horn and general contractor Brasfield & Gorrie. Gregg Shapiro and Matt Casey of JLL worked on behalf of the borrower to arrange the joint venture equity through Mitsui Fudosan America. The ownership plans to deliver the first units in June 2024.

Southeast

Alliance Residential Opens 264-Unit Prose Stevens Pointe Apartments in St. Cloud, Florida

by John Nelson

ST. CLOUD, FLA. — Alliance Residential has opened Prose Stevens Pointe, a 264-unit apartment community located at 3010 Camber Drive in St. Cloud. The Central Florida property features one- and two-bedroom apartments that range in size from 835 to 1,180 square feet, and monthly lease rates range from $1,500 to $1,845 per month. Units feature kitchens with white shaker-style cabinets, satin nickel hardware, granite countertops, entertainment islands, pantries and Whirlpool stainless steel appliances. All bedrooms have walk-in closets, and all bathrooms feature linen pantries. All units also include entry/coat closets, washer and dryer closets with appliances and wood-style plank flooring throughout. Amenities include a pool with sunshelves, chaise lounges, grilling stations, a dog park with a pet washing station, catering kitchen, entertainment lounge, business center with coworking spaces, fitness center and concierge services provided by Parcel Pending.

Colliers Arranges $38.1M Sale of Grand Central at Kennedy Mixed-Use Development in Tampa

by John Nelson

TAMPA, FLA. — Colliers has arranged the sale of 115,899 square feet of office and retail space within Grand Central at Kennedy in Tampa’s Channel District. An affiliate of Maryland-based Mosaic Realty Partners purchased the shops and offices for $38.1 million, which is the largest retail transaction in Tampa’s core districts in terms of sales price, according to Colliers. In addition to the 60,329 square feet of retail space and 55,570 square feet of office space, the transaction includes a transfer of interest in the management for the property’s two parking garages that comprise 862 spaces. Grande Central at Kennedy was developed in 2007 and four tenants — retailers CVS/pharmacy and Crunch Fitness and office users Kraft Heinz Foods and Quality Carriers (a division of CSX Corp.) — occupied 80 percent of the gross leasable space at the time of sale. Other tenants include Massage Envy and several bars and restaurants, including Cena, City Dog Cantina, Pour House and Maloney’s Irish Pub. Grand Central at Kennedy also includes condos that were not part of the sale. Mike Milano, Nicholas Coccodrilli and Brandon Rapone of Colliers’ West Florida Retail Investment Team represented the seller, Mercury Advisors, the original developer of the …

Highwoods Properties Sells 298,037 SF Airpark East Office Park in Greensboro, North Carolina

by John Nelson

GREENSBORO, N.C. — Highwoods Properties has sold Airpark East Office Park, a 298,037-square-foot office park situated along Albert Pick Road in Greensboro. Locally based investor Deep River Partners purchased the four-building office campus. The sales price was not disclosed, but Winston-Salem Journal reports the property traded for $20.3 million. The news outlet also reported Airpark East was 88.2 percent leased at the time of sale to tenants including Volvo Financial Services. Ben Kilgore of CBRE|Raleigh and Greg Wilson of CBRE|Triad represented Highwoods in the sales transaction. CBRE|Triad is the leasing agent of Airpark East, which features a conference center, café, walking trails, an amphitheater and wooded picnic areas.

ORLANDO, FLA. — Marcus & Millichap has brokered sale of Oak Ridge Plaza, a 75,701-square-foot shopping center located at 2332 W. Oak Ridge Road in Orlando. Aloma International Properties Inc. purchased the property from an entity doing business as 2332 West Oak Ridge Road LLC for $12.3 million. Nick Ledvora of Marcus & Millichap’s Orlando office procured the buyer in the transaction. Oak Ridge Plaza was 97 percent leased at the time of sale to 19 tenants, including Family Dollar, Biomat USA, La Familia Pawn, United Temps and Boost Mobile.

ArizonaFloridaGeorgiaIndustrialKentuckyMidwestMissouriNorth CarolinaSouth CarolinaSoutheastTennesseeTexasTop StoriesVirginiaWestern

MDH Partners Sells 58-Property Sunbelt Logistics Portfolio Located Across 10 States for $1.3B

by Katie Sloan

ATLANTA — MDH Partners has sold its 58-property Sunbelt Logistics Portfolio to an undisclosed global institutional investor for $1.3 billion. MDH will retain an ownership stake in the portfolio and will continue to operate the properties. The portfolio spans 9.7 million square feet of industrial space across 10 states, including 11 properties in Georgia; 10 properties in Florida; eight properties in Texas; seven properties each in Arizona and Missouri; four properties each in Tennessee and North Carolina; two properties each in South Carolina and Virginia; and one property in Kentucky. The final two properties include nearly 675,000 square feet of newly constructed buildings in Nashville and Charlotte that were constructed with CarbonCure, a technology for the concrete industry that introduces recycled carbon dioxide into fresh concrete to reduce its carbon footprint. The portfolio consists of modern, state-of-the-art industrial and bulk distribution properties with an average size of 169,000 square feet. The properties feature average clear heights of 30 feet with 130-foot truck courts. The portfolio was 97 percent occupied at the time of sale by more than 100 regional, national and international tenants with an average remaining lease term of 5.7 years. “This diversified portfolio provides immediate scale and operating …

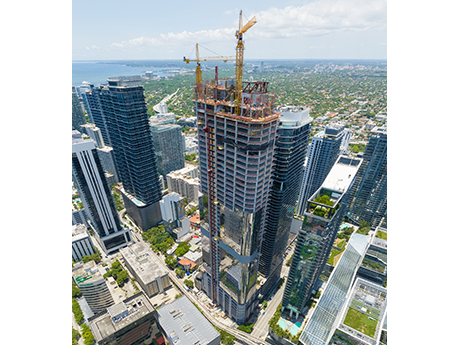

MIAMI — OKO Group and Cain International have topped off construction at 830 Brickell, a 55-story office tower underway in Miami’s Brickell Financial District. The 724-foot building is the first standalone office tower to break ground in Brickell in over a decade, according to the developers. Project partners include general contractor Civic Construction, architectural firm Adrian Smith + Gordon Gill and interior designer Iosa Ghini Associati. 830 Brickell will include a rooftop bar/lounge and restaurant, as well as a health and wellness center, conferencing facilities, an outdoor terrace, cafés and street-level retail space. 830 Brickell is more than 60 percent preleased ahead of its projected completion later this year. Cushman & Wakefield has executed leases with Microsoft, Thoma Bravo, A-CAP, CI Financial, Marsh Insurance, AerCap and WeWork.

LOUISVILLE, KY. — Skilken Gold has broken ground on Terra Crossing, a shopping center located on 10 acres at 2500 Terra Crossing Blvd. in Louisville. The grocery anchor, a 55,071-square-foot Publix, represents the first Publix location in Kentucky, the Lakeland, Fla.-based grocer’s eighth state of operation. The adjacent 3,200-square-foot Publix Liquors store at Terra Crossing is also the first location outside the state of Florida. Publix plans to open a second Publix grocery store and Publix Liquors store in Louisville in early 2024 at the northeast corner of Ballardsville and Brownsboro roads. In addition to the Terra Crossing groundbreaking, Publix announced it has signed a lease to anchor The Fountains at Palomar shopping center in Lexington, marking the third location announced in Kentucky for Publix. The 55,701-square-foot Publix store and 3,200-square-foot Publix Liquors store are set to open in late 2024.

CHARLOTTE, N.C. — CBRE has brokered the $37 million sale of Cordage, a Class A warehouse and distribution center located at 11540 Cordage St. in Charlotte’s Arrowood district. Boston-based TA Realty purchased the 212,000-square-foot property from local developer Childress Klein. Patrick Gildea, Matt Smith, Anne Johnson, Bryan Crutcher, Grayson Hawkins, Robert Hardaway, Frank Fallon and Trey Barry of CBRE represented the seller in the transaction. Built in 2020, Cordage features 15,519 square feet of office space, 30-foot clear heights, an ESFR sprinkler system, LED lights, 56 dock doors (including six drive-in doors) and 50- by 50-foot column spacing with a 60-foot speed bay. The property also includes a 130-foot truck court with a 60-foot concrete apron and 223 parking spaces. Cordage was fully leased to eight tenants at the time of sale.

MACON, GA. — SRS Real Estate Partners’ Investment Properties Group has arranged the sale of North Macon Plaza, a newly built, 151,987-square-foot shopping center in Macon. Chase Acquisitions LLC purchased the center from a joint venture between The Sembler Co. and Berkeley Development for $26.1 million. Kyle Stonis and Pierce Mayson of SRS represented the seller in the transaction, and the buyer was self-represented. Built in 2019, North Macon Plaza’s tenant roster includes Marshalls/HomeGoods, Michaels, Old Navy and Bealls Outlet. Situated on 18.8 acres along the Bass Road exit of I-75, the shopping center is located across the street from the only Bass Pro Shops in 100 miles, according to SRS.