DURHAM, N.C. — ZOM Living and AEW Capital Management have purchased a site at 500 E. Main St. in downtown Durham for the development of Maizon Durham, a 248-unit apartment community. The co-developers also secured $49 million in construction financing from Santander Bank. The project team includes architect Hord Coplan Macht, interior designer One Line Design Studio and general contractor LeChase Construction. Set to break ground this summer, Maizon Durham will feature studio, one-, two- and three-bedroom units ranging in size from 555 to 1,450 square feet, as well as coworking and conference spaces, a fitness center, dog spa, clubroom, 13,000 square feet of retail space and a swimming pool and sundeck.

Southeast

Northmarq Secures $29M Refinancing of Arlington West Apartments in Jacksonville, North Carolina

by John Nelson

JACKSONVILLE, N.C. — Northmarq has arranged the approximately $29 million refinancing of Arlington West Apartments, a 324-unit multifamily community located at 5049 Western Blvd. in Jacksonville, a city near North Carolina’s coast. Built in 2009, Arlington West spans 14 apartment buildings and features a resort-style saltwater swimming pool, playground, two dog parks, fitness center, game room and a business center. Bob Harrington and Paul Whalen of Northmarq arranged the 10-year, Freddie Mac loan on behalf of the undisclosed borrower. The interest-only loan was underwritten with a fixed interest rate in the mid-3 percent range.

WASHINGTON, D.C. — Berkadia has negotiated the $21 million sale of The Normandy Hotel, a boutique hotel located at 2118 Wyoming Ave. NW in Washington, D.C.’s Kalorama neighborhood. The hotel features 75 guest rooms and 900 square feet of meeting space, as well as immediate access to several upscale restaurants, stores and museums. Dan Hawkins and Kyle Stevenson of Berkadia represented the seller, California-based Blu Hotel Investors, in the transaction. The buyer was an entity doing business as SONO International Co. Ltd.

CHATTANOOGA, TENN. — SRS Real Estate Partners’ Investment Properties Group has brokered the sale of Towne Center North, an 89,327-square-foot shopping center located on 12.2 acres along Tenn. Highway 153 in Chattanooga. An entity doing business as Credi Bakersfield LP purchased the shopping center from an entity doing business as Towne Center North LLC for $16.7 million. Built in 2006, Towne Center North’s tenant roster includes Best Buy, Bed Bath & Beyond and PetSmart. Target shadow-anchors the property. Kyle Stonis and Pierce Mayson of SRS’ Atlanta office represented the seller in the transaction. Matt Berres, Samer Khalil, Karick Brown and Eric Tomchik of Newmark represented the buyer.

GARNER, N.C. — Newmark has arranged the sale of an 11,400-square-foot retail property located at 932 Heather Park Drive in Garner, approximately seven miles south of Raleigh. The property is triple-net-leased to KinderCare, an early childhood education and childcare provider with 1,500 learning centers nationwide. KinderCare has 12 years remaining on its lease term, which features four five-year extension options. Matt Berres, Samer Khalil, Karick Brown and Bert Sanders of Newmark represented the seller, an undisclosed public REIT, in the transaction. Clark Everitt of Investment Real Estate Associates (IREA) represented the private buyer, which purchased the facility for an undisclosed price.

Build-to-RentContent PartnerFeaturesLeasing ActivityMidwestMultifamilyNortheastNorthmarqSingle-Family RentalSoutheastTexasWestern

Build-to-Rent (BTR) Property Type Offers Positive Demand Outlook

By Jeff Erxleben, president, debt & equity at Northmarq Liquidity and an incredibly positive outlook for single-family build-to-rent (BTR) properties is helping to offset some of the turbulence developers are experiencing from rising interest rates. Developers have been ramping up the pace of single-family BTR construction over the past five years with forecasts that call for a record high 60,000 new units to be completed in 2022. That volume shows a steady increase over the 53,000 units completed in 2021 and 49,000 in 2020, according to Northmarq’s recently released Single-Family Build-to-Rent Properties Special Report. Although financing across all property types has been impacted by upward movement in both short- and long-term borrowing rates, the BTR sector is in a good position to shake off those challenges and maintain its growth momentum. Higher construction and financing costs are being offset by rising rents with year-over-year rent increases, that in many areas of the country, are quite substantial. Developers also are finding good access to both debt and equity. The number of lenders that are active in the space is expanding as developers move into new markets and continue to prove out business models and performance with successful lease-up and dispositions. For …

ECI, Phoenix Capital Begin Construction on $101M Apartment Community in Roswell, Georgia

by John Nelson

ROSWELL, GA. — A joint venture between ECI Group and Phoenix Capital has broken ground on Averly East Village, a $101 million luxury apartment and townhome community in the Atlanta suburb of Roswell. The developers expect to deliver the property in late 2024. Truist Financial provided construction financing for the project, which Rule Joy Trammell Rubio Architects designed. The multifamily project is part of a mixed-use redevelopment of East Village Shopping Center, and Ardent Cos. will continue to own the retail component. Amenities will include a pool with a sun shelf, pool deck with cabanas, two outdoor kitchens, clubroom, synthetic turf dog park and dog spa, two-story fitness center, outdoor gym, coffee lounge with individual work spaces and secure bicycle storage. At full buildout Averly East Village will include one-, two- and three-bedroom apartments and townhomes, as well as 75,000 square feet of retail space and a large central green space.

BIRMINGHAM, ALA. — Cushman & Wakefield has arranged the $71.4 million sale of Colony Woods, a 414-unit apartment community in the Cahaba Heights submarket of Birmingham. Andrew Brown and Craig Hey of Cushman & Wakefield represented the seller, Denver-based Forum Investment Group, in the transaction. The buyer was Arcan Capital, a multifamily investment firm based in Marietta, Ga. Built in 1991 and 1995, Colony Woods was 96 percent occupied at the time of sale. The property features units averaging 1,088 square feet with wood-burning fireplaces, walk-in closets, in-unit washers and dryers and private patios or balconies.

BUFORD, GA. — Seefried Industrial Properties and Clarion Partners plan to develop Buford North Distribution Center, a 969,620-square-foot logistics park in the Atlanta suburb of Buford. The speculative project will include three buildings located along I-985 in Hall County. All three buildings will include 185-foot concrete truck courts, 36-foot clear heights and ESFR sprinklers. Seefried and Clarion recently purchased an 80-acre site about 40 miles northeast of Atlanta near I-85. The first facility is slated to break ground in August and full completion is anticipated for the fourth quarter of 2023. The project team includes civil engineer Eberly & Associates and architect Atlas Architecture. Joseph Kriss, Tripp Ausband and Doug Smith of Seefried will oversee leasing efforts.

Hunt Midwest Breaks Ground on 258,801 SF Industrial Facility in Upstate South Carolina

by John Nelson

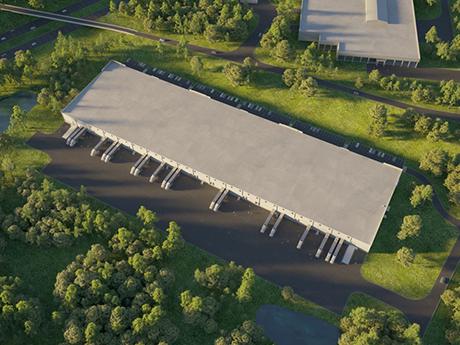

ANDERSON, S.C. — Kansas City-based Hunt Midwest has broken ground on a 258,801-square-foot industrial facility within the new Evergreen Logistics Park, an industrial campus spanning 200 acres in Upstate South Carolina. Located at 1105 Scotts Bridge Road in Anderson, the new facility will feature 36-foot clear heights, an ESFR sprinkler system, motion-sensor LED lighting, 26 dock doors, 60-foot speed bays, four drive-in doors, more than 200 parking stalls, up to 77 tractor-trailer parking spots and a 185-foot truck court. Hunt Midwest expects to deliver the building by the end of the year. At full capacity, Evergreen Logistics Park will span 2 million square feet and offer immediate access to I-85 and a major FedEx terminal. Hunt Midwest has selected Seamon Whiteside for civil engineering, LS3P for building design, CBRE for leasing and Evans General Contractors as the general contractor.