MIAMI — Cushman & Wakefield has arranged a 42,000-square-foot office lease at 800 Brickell, an office tower in Miami’s Brickell district. The tenant, IT management software provider Kaseya, is slated to officially move into the top three floors of the 15-story building next year. The 800 Brickell location will be Kaseya’s third office in Brickell. Tony Jones of Cushman & Wakefield represented Kaseya in the lease negotiations. The landlord is Naba Realty LLC.

Southeast

Content PartnerFeaturesHealthcareIndustrialLoansMidwestMultifamilyNAINortheastOfficeSoutheastTexasWestern

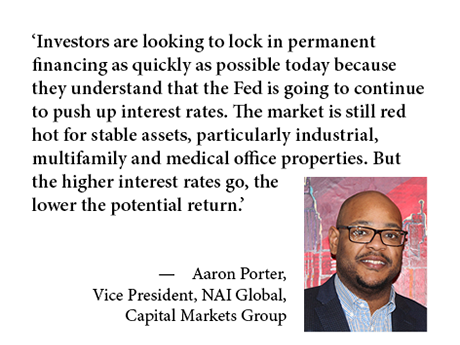

Rising Interest Rates and Inflation to Fuel Change in Property Markets

Beginning in the fourth quarter of 2020, commercial real estate buyers and sellers moved off the sidelines and began fueling an impressive investment sales rebound as many pandemic-related lockdowns and restrictions eased or ended. The rush to purchase hard assets hit its apex a year later when commercial property sales surged to a record $362 billion in the fourth quarter of 2021 alone, according to Real Capital Analytics, a part of MSCI Real Assets that tracks property transactions of $2.5 million or more. The strong market is continuing this year: Deals of $170.8 billion closed in the first quarter, a year-over-year increase of 56 percent, Real Capital reports. Buyers in the first quarter also pushed up prices 17.4 percent over the prior year, according to Real Capital’s Commercial Property Price Indices (CPPI). But given rising interest rates and other recent headwinds, will investors continue to drive robust investment activity and bid up prices? The 10-Year Treasury yield has spiked some 150 basis points to around 3 percent since the beginning of 2022, and fixed 10-year mortgage rates of between 3 percent and 4 percent are up about 100 basis points. For short-term variable loans, the benchmark secured overnight financing rate …

Prospect, Midtown Capital Begin Construction on 252-Unit Fort Lauderdale Apartment Tower

by John Nelson

FORT LAUDERDALE, FLA. — Prospect Real Estate Development Group and Midtown Capital have begun construction on a new 252-unit apartment building in Fort Lauderdale. The property, Advantis Station Flagler Village, will include a seventh-floor amenity deck with a pool and unique features such as a large mural, art columns and sections framed by synthetic wood. Advantis Station at Flagler Village is one of several ventures between Prospect and Midtown Capital. The partnership also broke ground on Advantis Lake Worth in November 2021. Advantis Station at Flagler Village is expected to be complete in fall 2024. BCC Construction is serving as general contractor on the project.

ATLANTA — Clarion Partners and Westbridge have broken ground on 926 Brady, an adaptive reuse project in Atlanta’s West Midtown district. The project will repurpose a 1930s-era warehouse into 36,000 square feet of creative office space, including a second-floor addition that gives the property a rooftop terrace. Architectural firm ai3 is the design lead for 926 Brady, and Gay Construction Co. is serving as the general contractor. The Transwestern team of Zach Wooten and Stephen Clifton is managing leasing. Construction is currently underway, with an estimated delivery in the second quarter of 2023. 926 Brady sits at the corner of 10th Street and Brady Avenue within Stockyards Atlanta, an adaptive reuse of the former stockyard and meatpacking plant called Miller Union Stockyards. Westbridge redeveloped the campus in 2017 and brought in a diverse tenant base, including Red Bull, Fitzco, Mannington Commercial, Painted Duck, Baffi Atlanta and Nick’s Westside.

LOUISVILLE, KY. — Middleburg Communities, a Vienna, Va.-based real estate investment, development, construction and management firm, has sold Vesta Derby Oaks, a 418-unit apartment community located at 3237 Utah Ave. in Louisville. Craig Collins and Austin English of Cushman & Wakefield | Commercial Kentucky, along with Travis Presnell and Mike Kemether of Cushman & Wakefield’s Multifamily Investment Sales Group, brokered the sale of the property. The buyer and sales price were not disclosed. Middleburg invested $17 million in an extensive renovation at Vesta Derby Oaks, including all new siding, windows, roofs, plumbing and HVAC and electrical systems, as well as improved sidewalks and landscaping. Interiors were also equipped with new Energy Star-rated appliances, LED lighting, cabinets, countertops, flooring, fixtures and finishes. Additionally, the property previously was 100 percent two-bedroom units, but Middleburg reconfigured the layouts for some units to now be one-bedroom apartments. At the time Middleburg acquired it, the property was approximately 15 percent occupied with most of the buildings in shell or uninhabitable condition. At the time of sale, Vesta Derby Oaks was 95 percent occupied.

MIAMI — JLL has arranged a 75,000-square-foot office lease at Quattro Miami, a four-building office park in the city’s Airport West submarket. The tenant, medical research firm Evolution Research Group (ERG), is relocating its South Florida regional headquarters to Quattro Miami from Hialeah. The move expands ERG’s office footprint by 45,000 square feet, according to JLL. The New Jersey-based firm leased four full floors at Quattro East, located at 700 NW 107th Ave. Doug Okun of JLL represented the landlord, an entity owned by Guy Sharon and Yoav Merary that is doing business as Four 700 LLC, in the lease negotiations. David Herbert, Donna Abood and Joseph Abood of Avison Young represented ERG. Quattro Miami was recently renovated with updated façades, lobbies, common areas and restrooms, a revamped café, new elevator controls and cabs, a renovated fitness center and a new conferencing center. The park’s tenant roster includes Farelogix/Accelya, State’s Title and Alliance for Aging, in addition to other traditional office tenants and medical and research companies.

Haven Realty Capital, Yieldstreet Acquire Build-to-Rent Community in Chattanooga for $28.6M

by John Nelson

CHATTANOOGA, TENN. — Los Angeles-based Haven Realty Capital, in a joint venture with funds managed by New York City-based Yieldstreet, has closed on the first phase of a $28.6 million acquisition of Hartman Hill, a 71-home build-to-rent (BTR) residential community in Chattanooga. The Haven-led joint venture will close on the remaining homes in phases over the next seven months. Hartman Hill is being developed on a 26-acre site at 5005 Dayton Blvd. in the Red Bank neighborhood, approximately eight miles north of downtown Chattanooga. At full buildout, the property will offer three- and four-bedroom homes ranging in size from 1,538 to 2,515 square feet. Each of the two-story homes will offer custom cabinetry with soft-close drawers, quartz countertops, tile backsplashes, stainless steel appliances, private backyards and direct access garages. Common area amenities will include a sports court, bark park and a pet washing station. The new ownership will maintain the landscaping for all homes and common areas.

Like much of the rest of the country, the Atlanta multifamily market has been white-hot with strong occupancies and rent growth that is contributing to outsized returns for owners, investors and developers. Recent increases in financing costs does not mean the music is stopping, but the tempo is slowing a bit. Atlanta’s multifamily fundamentals are still outstanding. Occupancies are holding strong and rents are continuing to rise. According to Northmarq’s fourth-quarter 2021 research, occupancy improved by 90 basis points while asking rents spiked by 15.9 percent at year-end. The compelling story fueling investor interest — growing demand and limited supply of housing options — remains firmly in place. In addition, there is plenty of investor appetite and capital available for multifamily assets for both debt and equity financing. The big change that has occurred over the past several weeks is the increasing cost of debt that will likely take some of the edge off what has been an ultra-aggressive investment sales market. The 10-year Treasury was 1.73 percent on March 1, 2022. At the end of April, it was 2.91 percent, a 118-basis-point increase in less than two months. Additionally, lender spreads have widened over this same period — 30 …

BRYAN COUNTY, GA. — Hyundai Motor Group will open a $5.5 billion manufacturing plant near the coastal Georgia city of Savannah that will be fully dedicated to production of electric vehicles, including batteries. Hyundai expects the facility to be operational within three years. In addition to Hyundai’s direct investment, various suppliers of the South Korean automaker will invest another $1 billion in the project. Between these initiatives, more than 8,000 new jobs are expected to be added to the local economy. Known as the Bryan County Megasite, the plant’s location spans nearly 3,000 acres. The site is adjacent to Interstate 16 and is proximate to both Interstate 95 and the Port of Savannah. The Port of Savannah is the fastest-growing container terminal in the country, according to the development team, and is served by two Class I railroads. A partnership between the Savannah Harbor-Interstate 16 Corridor Joint Development Authority (JDA) and the State of Georgia owns the Bryan County Megasite. The former entity comprises the development authorities of Bryan, Bulloch, Chatham and Effingham counties. The partnership has spent the last several years making infrastructural improvements to the site in order to improve speed-to-market functionalities for the end user. “From initial …

Aztec Group Arranges $81M Construction-to-Perm Loan for Metro Miami Mixed-Use Development

by John Nelson

HIALEAH, FLA. — Aztec Group has arranged an $81 million construction-to-perm loan for the development of Residences and Shoppes of Highland, a mixed-use development underway in the Miami suburb of Hialeah. The developer/borrower is an affiliate of South Florida-based Dacar Management, a development firm led by Alberto Micha. An affiliate of New York Life Insurance Co. provided the non-recourse, fixed-rate loan, which has an initial three-year term and converts to a 27-year self-amortizing loan. Upon completion, Residences and Shoppes of Highland will feature 244 garden-style apartments in four- and five-story buildings and a shopping center spanning 190,000 square feet. The retail component will house a Publix grocery store and Publix Liquors, HomeGoods, dd’s Discounts, Burlington, Five Below, Famous Footwear and Taco Bell, among others. Sitework has already commenced on the 70-acre project, which is scheduled for completion in the third quarter of 2023.