ARLINGTON, VA. — Boeing (NYSE: BA) has chosen Arlington as the site for its new global headquarters due to the city’s proximity to Washington, D.C., and strong client and talent base in the region. The aerospace and defense giant is moving its headquarters from Chicago, where the firm plans to maintain a significant office presence. In addition to the corporate relocation, Boeing plans to develop a research and tech hub in Arlington to support and train Boeing employees in the areas of cyber security, autonomous operations, quantum sciences and software and systems engineering. Details about the campus and the construction timeline were not disclosed. Boeing’s stock price closed on Thursday, May 5 at $150.47 per share, down from $229.81 a year ago, a 34.5 percent decline.

Southeast

J.P. Morgan Provides $96.4M Construction Loan for Apartment Tower in Downtown West Palm Beach

by John Nelson

WEST PALM BEACH, FLA. — J.P. Morgan has provided a $96.4 million construction loan for the development of a 22-story apartment tower in downtown West Palm Beach. The borrower is a joint venture between the developer, Hyperion, and affiliates of Starwood Capital Group and Winter Properties. Located at 201 Clearwater Drive, the unnamed tower will include 457 apartments, 7,000 square feet of ground-floor retail space, a 628-space parking garage and more than 34,000 square feet of indoor and outdoor amenities. Hyperion is expected to begin construction soon, and the development is slated to be open to renters in early 2024.

NEW ORLEANS AND GONZALES, LA. — California-based Passco Cos. has purchased two apartment communities in Louisiana totaling 602 units in two separate transactions. The properties include the 330-unit Canal 1535 in downtown New Orleans and the 272-unit Sawgrass Point in the Baton Rouge submarket of Gonzales. Caleb Marten of KeyBank Real Estate Capital arranged acquisition financing for both transactions. Mike Kemether of Cushman & Wakefield and Larry Schedler, Cheryl Short and Christian Schedler of Larry G. Schedler & Associates Inc. were the brokers in the Canal 1535 transaction. Chad Rigby and Saban Sellers of Stirling Investment Advisors and Telly Fathaly of Walker & Dunlop were the brokers in the Sawgrass Point deal. The sellers and the sales prices were not disclosed. The acquisitions bring Passco’s Louisiana portfolio to nearly 1,700 units.

Franklin Street Brokers $8.8M Sale of Bealls-Leased Retail Building in Port Charlotte, Florida

by John Nelson

PORT CHARLOTTE, FLA. — Franklin Street has brokered the $8.8 million sale of a single-tenant retail property within Port Charlotte Town Center, a shopping center in Port Charlotte anchored by Target and Publix. The 91,498-square-foot store is leased to Bealls and is one of the retailer’s top 10 performing stores in the country, according to Franklin Street. Bryan Belk, John Tennant, Chris Adams and Sam Roe of Franklin Street’s Atlanta office represented the seller, an affiliate of RCG Ventures, in the transaction. Texas-based Ford & Sons Real Estate Investors is the buyer.

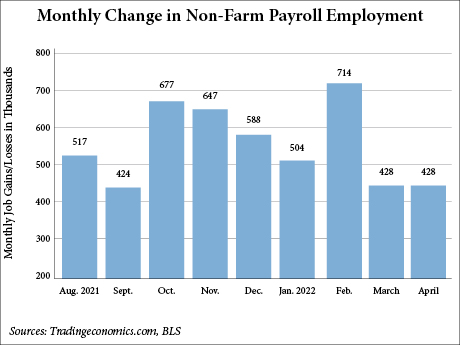

WASHINGTON, D.C. — Total nonfarm payroll employment rose by 428,000 in April, while the 3.6 percent unemployment rate was unchanged from the prior month, according to the U.S. Bureau of Labor Statistics (BLS). Dow Jones economists had projected job gains of 400,000 in April and were expecting the unemployment rate to drop to 3.5 percent, according to CNBC. Once again, the employment sector with the largest gain was leisure and hospitality, which posted 78,000 new jobs last month. The 4.8 percent unemployment rate in the leisure and hospitality sector was the lowest rate since September 2019, though employment remains down by 8.5 percent from February 2020. The BLS reports that average hourly earnings for leisure and hospitality workers was up 11 percent year-over-year last month. Other employment sectors with notable net gains in April included manufacturing (55,000 jobs), transportation and warehousing (52,000) and professional and business services (41,000). Construction, information and government sectors showed little employment change over the past month. Total nonfarm payroll employment in February was revised downward from 750,000 to 714,000, according to the BLS, and the March figure was revised downward from 431,000 to 428,000. With these revisions, employment in February and March combined was 39,000 lower …

Build-to-RentConference CoverageDevelopmentFeaturesMultifamilyNorth CarolinaSingle-Family RentalSouth CarolinaSoutheastSoutheast Feature Archive

Speed to Market is ‘Almost the Only Priority’ for Multifamily Developers Looking to Avoid Cost Risks, Say InterFace Panelists

by John Nelson

CHARLOTTE, N.C. — Multifamily developers are pushing their chips in and aggressively looking for new development deals, especially for sites in and around high-growth markets in the Southeast. Michael Tubridy, senior managing director of Crescent Communities, said his firm isn’t leaving anything to chance and is looking to move quickly on development opportunities. “We’re trying to get as many units on the ground today as possible, because tomorrow will be more expensive,” said Tubridy. “I like the chances of today’s cost environment a lot better than I like the unknown of where we’ll be a year from now or two years from now. Putting a premium on speed to market is something that we are much more focused on; it’s almost the only priority right now.” Tubridy’s comments came during the development panel at InterFace Carolinas Multifamily 2022. The half-day event was held on April 14 at the Hilton Uptown Charlotte hotel and attracted more than 260 attendees from all facets of the multifamily industry in North Carolina and South Carolina. Michael Saclarides, director of Cushman & Wakefield’s Multifamily Advisory Group, moderated the discussion. Crescent Communities is far from the only multifamily developer pursuing ground-up construction opportunities in earnest. In …

In many ways, metro Atlanta is a tale of two office markets. Google, Microsoft, Papa John’s, Visa and FanDuel are just some of the heavy hitters that have signed major deals over the last year and a half, fueling leasing activity that is getting closer to pre-pandemic norms. Much of that action has been centered in the Central Business District (CBD), which registered a 68 percent year-over-year increase in leasing volume compared to first-quarter 2021. According to research from CoStar Group, leasing volume for the entire market totaled 3.2 million square feet in the first quarter, which is on par with the 10-year quarterly average. Midtown, where more than 2 million square feet of new product is under construction and the majority of corporate heavyweights have planted their flag, led all submarkets in leasing activity, with Cushman & Wakefield reporting nearly 314,000 square feet of new leases signed in the first quarter. Midtown’s overall walkability, abundance of high-rise residential units, new office buildings and access to talent from local universities and mass transit have enabled it to become a talent magnet for major employers and one of the nation’s premier submarkets. However, the vast majority of office tenants in metro …

CONYERS, GA. — JLL has brokered the $82 million sale of Conyers Crossroads, a 465,993-square-foot shopping center in the east Atlanta suburb of Conyers. Valley Stream, New York-based Serota Properties acquired the asset from a joint venture between Hendon Properties and Harbert Management Corp. Built in phases between 2000 and 2005, Conyers Crossroads was fully leased at the time of sale to tenants such as Kohl’s, Belk, AMC Theatres, T.J. Maxx, Best Buy, HomeGoods, Michaels, Old Navy, Five Below and Shoe Carnival. Jim Hamilton, Brad Buchanan and Taylor Callaway of JLL represented the seller in the transaction.

LAND O’ LAKES, FLA. — New York City-based brokerage firm Rosewood Realty Group has arranged the $71 million sale of The Lakes at Collier Commons, a 252-unit multifamily property in Land O’ Lakes. Rosewood Realty represented the buyer, Triwest Development, a multifamily investment company based in El Segundo, Calif. Rosewood Realty also represented the seller, Primerica Group One, a Tampa-based real estate development firm. Located approximately 20 miles north of downtown Tampa, Lakes at Collier Commons was built in 2004 and consists of 10 buildings spanning more than 200,000 square feet. The average unit size is over 1,100 square feet. The development features a pool, fitness center, business center, spa, playground, clubhouse, volleyball court and a pond.

NASHVILLE, TENN. — Amazon plans to invest a total of $10.6 million to help build and renovate more than 130 affordable housing units in Nashville. The investment is in partnership with the Metropolitan Development and Housing Agency (MDHA) and supports the social work of the local nonprofit CrossBridge Inc., which provides housing and supportive services to adults overcoming addiction. The investment is part of the Amazon Housing Equity Fund, which has earmarked more than $2 billion to create and preserve 20,000 affordable homes in Nashville, Washington state’s Puget Sound region and the Arlington, Va., region, which is home to Amazon’s HQ2 campus. The Seattle-based e-commerce giant has committed more than $94 million over the past two years to affordable housing efforts in Nashville. Amazon’s commitment to MDHA consists of a $7.1 million low-rate loan to support the construction of Cherry Oak Apartments, a mixed-income residential development in the Cayce Place neighborhood of east Nashville. Cherry Oak will feature 96 apartments, including 53 that are affordable at or below 80 percent of area medium income (AMI). MDHA has a 99-year ground lease at the site. Amazon is also providing a $3.5 million grant to support CrossBridge’s housing projects on Lindsley Avenue …