FAYETTEVILLE, GA. — Continental Realty Corp. (CRC) has purchased Banks Crossing, a 255,101-square-foot shopping center in Fayetteville, a southern suburb of Atlanta. Baltimore-based CRC acquired the center, which is anchored by Kroger, for $24.4 million via its private equity fund. Newmark represented the seller, Nightingale Properties, in the transaction. Located at 100-240 Banks Crossing N., Banks Crossing is the third shopping center in CRC’s Georgia portfolio and was 91 percent leased at the time of sale to tenants such as JC Penney, Sally Beauty, Guitar Center and Planet Fitness. The shopping center was built in 1987 and renovated in 2013.

Southeast

MIRAMAR, FLA. — CBRE has brokered the sale of a three-building, 692,000-square-foot industrial portfolio in the Broward County city of Miramar. Metro Chicago-based CenterPoint Properties purchased the properties for an undisclosed price. José Lobón, Trey Barry, Frank Fallon, Royce Rose and Tom O’Loughlin of CBRE represented the undisclosed seller in the transaction. The portfolio includes a 500,000-square-foot facility at 3701 Flamingo Road, an 83,200-square-foot property at 2601 SW 145th Ave. and a 108,800-square-foot building at 2701 SW 145th Ave. The facilities feature dock doors, drive-in doors, ESFR sprinkler systems and clear heights ranging from 24 to 34 feet. The assets were fully leased at the time of sale to six tenants.

PORT ROYAL, S.C. — Vivo Living has purchased a hotel located at 1660 Ribaut Road in Port Royal, a coastal town situated north of Hilton Head, S.C. The California-based buyer plans to convert the hotel into an apartment community named Vivo Port Royal. This will be Vivo’s third adaptive reuse multifamily project in South Carolina. The property will feature a living room lobby with complimentary Wi-Fi, lounge areas, a pool and a fitness center. Vivo Living says that the property will command a 10 to 20 percent discount compared with market-rate rents in the trade area. The seller was not disclosed.

FORT MYERS, FLA. — Butters Group and BentallGreenOak have partnered to develop Gulf Landing Logistics Center, a 2.2 million-square-foot speculative industrial park in Fort Myers. The project will be situated on 284 acres. The partnership anticipates developing the Class A property in several phases, with the first phase consisting of seven buildings totaling 740,000 square feet. Construction is scheduled to begin this fall, with completion of the first buildings slated for the third quarter of 2023. “With the tremendous growth in Southwest Florida, we recognized an opportunity to produce a first-class logistics facility with the flexibility to meet the needs of many different types of users,” says Kyle Jones, director of investments at Butters. The current plan for Gulf Landing Logistics Center includes 14 buildings of various sizes and configurations. A portion of the site plan offers flex space for light industrial and office users, while the remainder of the site is geared toward bulk distribution, e-commerce and other light industrial users. Build-to-suit opportunities are available. Florida-based Butters, a vertically integrated real estate company engaged in construction, development, leasing and property management, has developed more than 22 million square feet totaling over $2 billion. BentallGreenOak is a global real estate …

MEMPHIS, TENN. — Carlisle Corp. plans to open the first Caption by Hyatt-flagged hotel this summer in downtown Memphis. Caption by Hyatt Beale Street Memphis will anchor Carlisle’s $200 million One Beale mixed-use development, which includes three Hyatt-branded hotels and the new Renasant Convention Center. Memphis Business Journal reports that the new hotel’s development costs hovered around $41 million. Situated along Memphis’ famous Beale Street and the Mississippi River, the upscale select-service hotel will be integrated into the historic main building of Wm. C Ellis & Sons Ironworks and Machine Shop, which is one of the longest-running businesses in the city. The historic building will house the hotel’s ground and second floors, and a new 136-room tower will rise above and give guests views of the river and Memphis skyline. Designed by HBG Design, the hotel will feature dual entrances and an all-day, multi-functional lounge space dubbed Talk Shop that will include a coffee shop, cocktail lounge, workstations and sundries market on the inside and a patio and beer garden with fire pits on the outside. Hyatt Hotels Corp. collaborated with Union Square Hospitality Group on the Talk Shop concept. Hyatt plans to expand the Caption by Hyatt brand to …

RICHMOND, VA. — CoStar Group Inc. has purchased a five-story, 117,448-square-foot office building in Richmond’s Manchester district. The locally based real estate information and analytics firm acquired the property for $20 million. The seller was not disclosed. Located at 901 Semmes Ave., the office building is situated across James River from CoStar’s planned corporate campus spanning 750,000 square feet. The property was vacant at the time of sale and was formerly anchored by SunTrust Bank (now Truist Financial Corp.), which relocated to an adjacent building. CoStar employs more than 1,200 people in the Richmond area. Over the next five to 10 years, CoStar expects to become the largest tech company and one of the largest private employers in Richmond.

JONESBORO, ARK. — CLK Properties has purchased Willow Creek, a 324-unit apartment community located at 6 Willow Creek Lane in Jonesboro. The seller, Montana-based Braxton Development, sold the property to CLK Properties for an undisclosed price. Aaron Jungreis and David Wildes of Rosewood Realty represented both the buyer and the seller in the transaction. Built in 2011 by Braxton Development, Willow Creek features 10 three-story buildings, as well as two resort-style swimming pools, a playground, two modern fitness centers and a clubhouse with a business center. Willow Creek is the second property in Jonesboro for CLK Properties, as the New York City-based firm purchased the 264-unit Landing at Greensborough Village last year. CLK Properties owns more than 19,000 apartments in its portfolio, including 2,300 in Memphis where the firm keeps a regional headquarters.

ALABASTER, ALA. — Growth Capital Partners (GCP) and Highline Real Estate Partners have acquired Shelby West, a 404,000-square-foot industrial park in suburban Birmingham. The property represents the third investment for the GCP-Highline investment platform, which also includes strategic equity placements from the McWane Family and other third-party investors. The facilities at Shelby West include a 250,000-square-foot building at 175 Airview Lane and a 154,000-square-foot property at 1840 Corporate Woods Drive. The Airview building was built in 2006 and recently leased to MailSouth and AGC. The Corporate Woods building was built in 2009 and leased to The Home Depot and U.S. AutoForce. Adam Eason of Cushman & Wakefield | EGS Commercial Real Estate represented the seller in the transaction. Brad Moffatt of Cushman & Wakefield | EGS is handling the leasing at Shelby West. The sales price was not disclosed but the sellers were entities doing business as Shelby West Industrial Enterprises and Shelby West Industrial Enterprises II.

HUNTINGTON, W.VA. — Time Equities Inc. (TEI) has purchased a 363,000-square-foot industrial facility located at 550 27th St. in Huntington. Sierra Corp. sold the property to the New York City-based firm for $9 million. The property was fully leased at the time of sale to a combination of national, regional and local tenants. The facility is located adjacent to the CSX Transportation rail hub and the Port of Huntington, which is situated along the Ohio River. Sal Ramundo of Marcus & Millichap represented the seller in the transaction. Max Pastor and Brian Soto led the TEI acquisitions team internally.

Affordable HousingArbor Realty TrustContent PartnerDevelopmentFeaturesMidwestMultifamilyNortheastSoutheastTexasWestern

As Affordability Crisis Deepens, Policies and Market Shift to Assist the Underserved

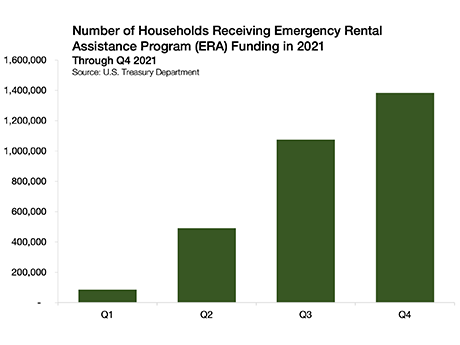

By Omar Eltorai, Arbor Realty Trust To understand the affordable housing market in spring 2022, one needs to first assess how this sector weathered the pandemic and then assess the current state of housing affordability across the country. In-depth findings on these trends are included in the Arbor Realty Trust-Chandan Economics Affordable Housing Trends Report, from which this article is excerpted. Weathering the Pandemic When it comes to the pandemic response, federal policymakers proved effective at defusing a large-scale increase in homelessness from financially insecure households. The Center for Disease Control and Prevention’s (CDC) eviction moratorium, while unpopular among industry advocates, prevented an estimated 1.6 million evictions, according to an analysis by Eviction Lab. After the Supreme Court struck down the federal moratorium in August 2021[1], the wave of evictions that many were forecasting did not immediately materialize. Nationally, tracked eviction filings ticked up but remained well below their pre-pandemic averages, according to Eviction Lab. A key reason why many at-risk renters have remained in their homes is the deployment of funds allocated in the Emergency Rental Assistance Program (ERA) — a funding pool designed to assist households that are unable to pay rent or utilities. The ERA Program was …