CORPUS CHRISTI, TEXAS — Whataburger, a Corpus Christi-based fast food burger chain, is opening its first metro Atlanta restaurants this year. The two locations will be situated at 705 Town Park Lane NW in Kennesaw and 9766 GA-92 in Woodstock. At its Kennesaw location, Whataburger plans to hire 180 employees, and to employ more than 1,400 employees in the metro Atlanta area restaurants by the end of 2023. In 2023, other Whataburger locations will open around metro Atlanta including at 503 Lakeland Plaza in Cumming; SEQ Buford Drive and Exchange Drive in Buford; 3321 Lexington Road in Athens; 3201 Atlanta Highway in Athens; 100 Pottery Road in Commerce; and 15 Wallace Blvd. in Dawsonville. Whataburger currently has one Georgia restaurant in Thomasville. The burger chain has over 880 locations across 14 states.

Southeast

Suburban household growth in metropolitan Nashville was already outpacing urban growth prior to the COVID-19 pandemic, but has accelerated since the outbreak due to corporate America’s acceptance of work-from-home staffing. Multifamily investors have followed this suburban household growth as well. Two recent examples are in Lebanon and Murfreesboro, both high-growth, high-quality suburbs of Nashville that have recently experienced record-setting transactions. The Pointe at Five Oaks recently sold for $243,000 per unit, setting a record for Lebanon. Vantage at Murfreesboro recently went under contract north of $270,000 per unit, also setting a record for Murfreesboro. We don’t see this activity and record-setting slowing down any time soon due to the lack of supply, overwhelming out of state demand and skyrocketing replacement costs. New multifamily development continues to follow the suburban trend, often times with a mixed-use component. Case in point, Highwoods Properties has completed the assemblage of all 145 acres of Ovation Franklin and is beginning the journey to reimagine and re-introduce one of the greatest opportunities for mixed-use development in the nation. This project will consist of 1.4 million square feet of Class A offices, 950 residential units, 480,000 square feet of retail and restaurants and 450 hotel rooms. Single-family …

By Steve Firestone, Crown Bay Group Why would anyone choose investing in an aging workforce housing property over razing it to make room for Class A apartments? Are these challenging properties worth the risk? Making this choice may not be right for everyone, but the returns can be unbelievably rewarding. The secret recipe for transforming Class B and C properties to benefit the community, local residents and your bottom line isn’t complicated. The key is entering into each deal with a genuine interest and desire to do what is right and what matters to the residents who call this property home. The age-old saying — by doing good, you will do well — still holds true today. There is an overwhelming demand for Class B and C assets. While a large portion of new development over the past decade has been Class A luxury, the Class A market makes up only 20 percent of the total rental market. New construction of affordable, market-rate units is just not financially feasible today. Consequently, meaningful workforce supply has rarely been added this past decade. Despite the pervasive need for workforce housing, the supply has decreased with older units being demolished to make room …

STATESVILLE, N.C. — CBRE has brokered the sale-leaseback of a 416,300-square-foot manufacturing facility in Statesville. Nevada-based CAI Investments purchased the property for $30.3 million. Patrick Gildea, Trey Barry, Matt Smith, Grayson Hawkins and John Christenbury of CBRE represented the seller and tenant, Kewaunee Scientific Corp., in the sale-leaseback transaction. Kewaunee Scientific Corp. is a designer and manufacturer of laboratory, healthcare and technical furniture products. The Statesville building serves as Kewaunee Scientific’s primary manufacturing facility. Situated on 21.3 acres at 2700 W. Front St., the property is located within three miles of the Interstates 40 and 77 and about 41.6 miles north of Charlotte.

MCLEANSVILLE, N.C. — CN Investors LLC, an affiliate of Raleigh-based APG Capital, has purchased a 176,778-square-foot office building in McLeansville. The Class A property sold for $17 million. Patrick Gildea of CBRE represented the undisclosed seller. Daniel Walser and James Anthony III at APG were responsible for sourcing the deal and closing the acquisition. Originally built in 2004 to house Citibank, the three-story office building is situated on 21 acres. Today, the property’s tenant includes LabCorp, a Burlington, N.C.-based lab test provider. Located at 5450 Millstream Road, the property is situated 36.2 miles from Winston-Salem and 45 miles from Durham.

PIEDMONT, S.C. — Atlanta-based MDH Partners has acquired 301 Grove Reserve, a 158,886-square-foot industrial building in Piedmont, about 12.5 miles from Greenville. Joe DeHaven served as the acquisition lead for MDH Partners. Clay Williams and Grice Hunt of NAI Global represented the undisclosed seller in the transaction. The sales price was also not disclosed. Built in 2021, 301 Grove Reserve is fully leased to an undisclosed pharmaceutical company that uses the facility to distribute cosmetic and pharmaceutical goods across the country. Situated in the Upstate’s I-85 West submarket, 301 Grove Reserve is located off Grove Reserve Parkway and is located only 16 miles southwest of Greenville-Spartanburg International Airport and 22 miles southwest of Inland Port Greer.

ATLANTA — The Radco Cos. has purchased The American Hotel, a 315-room, full-service hotel in downtown Atlanta. Legacy Ventures sold the property for an undisclosed price but will stay on to manage the property. Opened in 1962 as the American Motor Hotel, the property was the first racially integrated hotel in downtown Atlanta. In the past, The American Hotel also hosted meetings of influential civil rights leaders such as Martin Luther King Jr. Legacy Ventures completed a $16 million renovation program in 2017, including rebranding the property as The American Hotel, to restore and revitalize the property. The Radco Cos. plans to build on these upgrades and rebrand the asset to Hilton’s new Tapestry Collection brand. Located at 160 Ted Turner Drive NW, The American Hotel is situated 12.1 miles from Hartsfield-Jackson Atlanta International Airport. The hotel is also directly across the street from the AmericasMart, a wholesale trade show center.

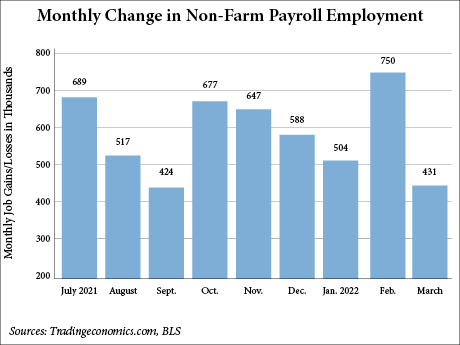

WASHINGTON, D.C. — Total nonfarm payroll employment rose by 431,000 in March, while the unemployment rate decreased from 3.8 percent in February to 3.6 percent last month, according to the U.S. Bureau of Labor Statistics (BLS). Dow Jones economists predicted approximately 490,000 jobs with a 3.7 percent unemployment rate, according to CNBC. Total employment remains down by 1.6 million from what it was in February 2020, or 1 percent. The BLS also reports that the average hourly earnings for all employees on private nonfarm payrolls increased by 13 cents to $31.73 last month. This figure was much higher than what it rose to in February, which only saw an increase of 1 cent in February over the prior month. Over the past 12 months, the average hourly earnings have grown by 5.6 percent. Wages are still being outstripped by inflation as the BLS found that the consumer price index (CPI) rose by 7.9 percent in February compared to February 2021. As it was in previous months, the biggest job growth was led by gains in leisure and hospitality (+112,000), including growth in food services and drinking places (+61,000). However, since its pre-pandemic level in February 2020, employment in the sector …

CARY, N.C. — JLL Capital Markets has arranged the sale of Twin Lakes Center, a multi-tenant shopping center in Cary anchored by Wegmans. Thomas Kolarczyk and Ryan Eklund of JLL represented the seller, Leyland Alliance. Dallas-based L&B Realty Advisors acquired the property on behalf of an institutional client. The sales price was not disclosed. Built in 2020, Twin Lakes Center was fully leased at the time of sale to tenants including Hollywood Feed, Great Clips, Mezeh Mediterranean Grill, Premier Martial Arts, PM Pediatrics, Paris Nail Bar, Bul Box and Gulli Boys. Situated on 1.7 acres at 1125 Hatches Pond Lane, Twin Lakes Center is situated 16.1 miles from Raleigh and 14.1 miles from Durham.

AUSTIN, TEXAS — Newmark has brokered the sale of a four-property portfolio of mid-rise student housing properties totaling 1,441 beds. The properties are situated adjacent to public universities in the Southeast and Illinois. Ryan Lang, Jack Brett, Ben Harkrider, Tim McKay, Debra Corson, Blake Pera and Dean Smith of Newmark represented the seller, Rael Corp., in the transaction. The sales price and the buyer were not disclosed. The properties include: Gather Illinois, which is located near the University of Illinois at 410 North Lincoln Ave. in Urbana, Ill.; Gather Uptown located near East Carolina University at 400 South Greene St. in Greenville, N.C.; Gather Dickson located near the University of Arkansas at 333 St. Charles Ave. in Fayetteville, Ark.; and Gather Southern located near the University of Memphis at 3655/3695 Southern Ave. in Memphis.