LARGO, MD. — A partnership between investment firm FCP, developer Insight Property Group and Virginia-based nonprofit AHC has acquired Camden Largo Town Center, a 245-unit apartment community in Largo, just east of Washington, D.C. The sales price was $71.9 million, or roughly $293,500 per unit. At the time of sale, the garden-style community was approximately 93.5 percent occupied. The new ownership plans to upgrade common areas, rebrand the community as Haven Largo and introduce income restrictions to certain residences. Haven Largo features one-, two- and three-bedroom units that are furnished with kitchen pantries, rentable garages and private patios/balconies. Amenities include a pool, fitness center, and outdoor dining and lounge areas. In addition, Haven Largo offers proximity to Largo Town Center Metro Station and the Capital Beltway. “FCP is excited to continue investing in our home market with the acquisition of a well-maintained and high-performing asset in one of the top submarkets in suburban Maryland,” says Scott Reibstein, associate at FCP. “As part of our commitment to the preservation of moderately priced apartment communities in the region, we plan to offer resident services and implement affordability requirements to a portion of the units.” Chris Doerr and Will Harvey of Walker & …

Southeast

After national media declared traditional brick and mortar retail to possibly be on it’s “last leg” due to the COVID-19 pandemic, the Nashville area has seem quite the opposite reaction. Already in an accelerated state of demand going into the shutdown of 2020 that extended into a malaise in 2021 in many places, Nashville is seeing all indicators of the hottest retail market in its history. Prior to the pandemic, rents and occupancy were already at historic highs. 2020 began with a continuance of that trend and ended the year higher with the most active submarkets closing the year below a 5 percent vacancy rate across all retail product types as the market absorbed more than 300,000 square feet of new product. During 2021, the region experienced further good news for landlords with rents increasing at one of the fastest rates in the United States (more than 8.8 percent). This continues a trend lasting more than 10 years where regional rent growth outpaced the national average. This growth was at least partially driven by a vacancy rate at year-end of only 3.7 percent. The primary driver of these metrics continues to be population growth and a low level of retail …

ROCKVILLE, MD. — Comstock Holdings Cos. Inc. has acquired the Ansel at Rockville Town Center, a 250-unit apartment building in Rockville. Duball LLC sold the property for an undisclosed amount. Jorge Rosa and Anthony Liberto of Cushman & Wakefield arranged the sale, while Marshall Scallan, Michael Zelin and Bindi Shah of Cushman & Wakefield arranged an undisclosed amount of debt financing. Delivered earlier this year, Ansel at Rockville Town Center, which is being rebranded as BLVD Ansel, is an 18-story high-rise apartment community that offers studio, one- and two-bedroom floorplans. BLVD Ansel features 20,153 square feet of retail space, 611 parking spaces and amenity spaces, including a lobby with concierge service, penthouse club room, fitness center with a yoga studio and private workspaces. The outdoor amenity spaces include a ninth-floor swimming pool with outdoor cooking stations, TV lounge and a rooftop courtyard for outdoor dining. Located at 33 Monroe St., the property is located at the entrance to Metro’s Rockville Station and is situated 21.5 miles from Washington, D.C. CHCI Residential Management and ParkX Management, wholly owned subsidiaries of Comstock, will provide property management services for BLVD Ansel.

ATLANTA — Mesa West Capital has provided $92.5 million in bridge financing for the acquisition and repositioning of Magnolia Vinings, a 400-unit multifamily property in Atlanta’s Vinings district. Michael Riccio of CBRE Capital Markets Debt & Equity Finance arranged the financing on behalf of an undisclosed institutional real estate private equity fund. The four-year loan included interest-only payments and a floating interest rate. A portion of the loan proceeds will be used by the sponsor to continue the renovation program started by the seller, focusing largely on the interiors of 177 apartment homes that have not been significantly updated since the property was built in 1996. Magnolia Vinings is a garden-style apartment building that was 98 percent occupied at the time of the financing. The property offers one-, two- and three-bedroom units across five different floorplans, ranging in size from 572 to 1,408 square feet. Each unit offers nine-foot ceilings, walk-in closets and stainless steel appliances. Renovated units feature quartz countertops, vaulted ceilings, vinyl plank flooring, framed mirrors and a wood-burning fireplace. Community amenities include a resort-style swimming pool, clubhouse, fitness center, cyber lounge and a bocce ball court. Located at 2151 Cumberland Way on 21.6 acres, the property is …

ATLANTA — Cushman & Wakefield has secured $90 million in refinancing on behalf of Arya Peachtree, a 282-unit multifamily property in Atlanta. Mike Ryan, Brian Linnihan, Blake Cohen, Richard Henry and Taylor Crowder of Cushman & Wakefield secured the refinancing loan on behalf of the borrower, Perennial Properties Inc. Arya Peachtree offers studio, one-, two- and three-bedroom floorplans. Unit features include quartz countertops, stainless steel appliances, full-size washers and dryers and floor-to-ceiling windows. Community amenities include a pool, grills, fitness center, sport lawn, fire pit, putting green, dog spa, flexible workspace stations, bike room and controlled access parking. Additionally, the newly constructed 12-story building has 16,346 square feet of office and retail space on the first two floors. Located at 1777 Peachtree St. NE, the property is situated between Buckhead to the north and Midtown to the south with access to the Interstate 75-85 Connector.

KNOXVILLE, TENN. — SRS Real Estate Partners’ Investment Properties Group has brokered the sale of Clinton Plaza, a 126,145-square-foot, grocery-anchored shopping center in Knoxville. LBD Properties LLC purchased the property for an undisclosed price. Kyle Stonis and Pierce Mayson of the SRS represented the undisclosed seller in the transaction. The buyer was self-represented. Anchored by Food City, Clinton Plaza’s tenant roster includes Advance Auto Parts, Dollar Tree, Gas ‘N Go, Rent-A-Center, ADMA Biologics, Metro by T-Mobile, 1st Heritage Credit and Cricket Wireless. Food City and Dollar Tree have been operating at the location for 22 years, and Rent-A-Center has been for 32 years. Advance Auto Parts, which is an outparcel at the property, has been a tenant since 1966. Located on Clinton Highway, the property is situated five miles from downtown Knoxville and 5.2 miles from the University of Tennessee campus.

MCLEAN, VA. — Avison Young has arranged a $20 million loan to refinance a 47,000-square-foot medical office building in downtown McLean. Jon Goldstein, Mike Yavinsky and Wes Boatwright of Avison Young arranged the loan through an unnamed local bank on behalf of the borrower, a partnership between Stewart Investment Partners and Chestnut Funds. Built in 1985, the three-story property was converted from a general office building into a medical office building in 2021. Improvements included outfitting the atrium lobby, corridors, elevators and restrooms, as well as adding energy-efficient lighting and modernizing the parking garage. Located at 1420 Beverly Road, the property offers access to Interstates 495 and 66 and Dulles Toll Road. The property is also 11.2 miles from Washington, D.C.

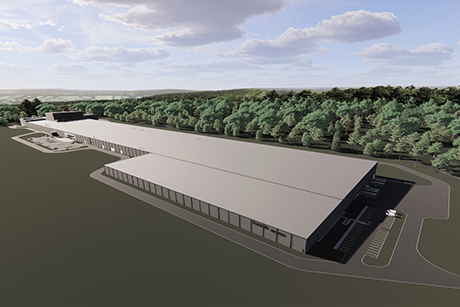

BAXTER, TENN. — Avison Young’s Capital Markets Group has arranged the sale-leaseback of a manufacturing facility in Baxter. The transaction totaled approximately $90 million. Timothy Hall, James Hanson and Tom Viscount of Avison Young arranged the sale-leaseback transaction. Chicago-based Oak Street Real Estate Capital will fund the construction and purchase the 965,000-square-foot facility, then lease it back to Portobello America, a tile manufacturer and distributor based in Brazil. Portobello America is building the plant and will use it to manufacture ceramic tiles and to house its U.S. headquarters. Portobello America will execute a long-term lease when construction is complete, which is expected in late 2022. The firm estimates the facility will create more than 200 local jobs and generate $150 million in annual revenue, as soon as the full capacity is reached, which is expected to occur by 2026. The 92-acre, build-to-suit project will include the main manufacturing, warehouse and office building, which will also contain the corporate headquarters and a showroom. The manufacturing plant will feature the latest green technologies to reduce the consumption of electricity, natural gas and water, according to the developer. The project site is situated on the south side of Interstate 40, about 70 miles …

ORLANDO, FLA. — Red Bank, N.J.-based Denholtz Properties has acquired a 106,966-square-foot, seven-story office building located at 618 East South St. in Orlando. The seller and sales price were not disclosed. Constructed in 2011, 618 East South St. is downtown Orlando’s first privately developed LEED-certified building, according to Denholtz. Additionally, the building features an integrated parking garage with a ratio of 3.1 spaces per 1,000 square feet. Currently fully leased, 618 East South St. serves as the Southeastern headquarters for GAI Consultants, an engineering, planning and environmental consulting firm with clients in the energy, transportation, development, government and industrial markets. In addition to GAI Consultants, the building is home to six additional tenants spanning the financial services and healthcare markets. The property is situated near a Publix and Thornton Park, a neighborhood with restaurants, luxury condominiums and apartments. The building is also located adjacent to SR 408 East-West Expressway. The acquisition allows Denholtz’s Orlando area portfolio to grow to nearly 1 million square feet. The investor also owns the nearby 100 East Pine St. property, an 80,010-square-foot, six-story office building that is currently 90 percent leased to 12 tenants.

JUPITER, FLA. — Northmarq has secured $16.8 million in acquisition financing for Fresh Market Village, a 55,046-square-foot, grocery-anchored retail property in Jupiter. Daniel Karp of Northmarq arranged the financing, which included a 10-year term with three years of interest-only payments followed by a 30-year amortization schedule. Northmarq secured the permanent, fixed-rate loan on behalf of the undisclosed borrower through its relationship with an unnamed life insurance company. Built in 1989 and last renovated in 2014, the property is anchored by The Fresh Market. Located at 287 East Indiantown Road, the property is situated 19.7 miles from Palm Beach and 20.6 miles from Palm Beach International Airport.