MACON, GA. — Carter Multifamily has acquired Adrian on Riverside, a 224-unit apartment community in Macon. The undisclosed seller sold the property for $41.1 million. Built in two phases in 2003 and 2009, Adrian on Riverside is located on 32.5 acres and offers one-, two- and three-bedroom floorplans with a unit size range of 850 to 1,438 square feet. Unit features include washer and dryer connections, walk-in closets, garden tubs and marble top vanities in the bathrooms. Community amenities include a resort-style swimming pool, fitness center, grill and sundeck, playground, game room and a movie theater. Located at 5243 Riverside Drive, the property is situated 14.8 miles from the Macon Downtown Airport and 8.9 miles from Mercer University. Carter Multifamily intends to renovate the property, including implementing institutionally based property management best practices, upgrades to community amenities, interior unit renovations and exterior plant improvements.

Southeast

ROCKVILLE AND WESTMINSTER, MD. — Tryko Partners has purchased two skilled nursing and assisted living real estate properties in Maryland, including Brighton Gardens of Tuckerman Lane in Rockville and Sunrise of Carroll in Westminster. The sales price and seller for the portfolio were not disclosed. Developed in 1998, Brighton Gardens of Tuckerman Lane is a 140-bed assisted living and skilled nursing community. Tryko will rename the property’s two components to The Terraces at Tuckerman Lane and Tuckerman Rehabilitation & Healthcare Center. Renovations to the property are planned, including the construction of a secure memory care unit. Located at 45 Washington Road, Sunrise of Carroll is a 62-bed assisted living and memory care community that was renamed The Terraces at Westminister. Built in 1999, the two-story structure was originally a historic mansion. The facility is situated close to the Westminster Senior Center and Carroll Hospital.

HOMESTEAD, FLA. — Sprouts Farmers Market, a Phoenix-based grocery chain, is opening a 20,000-square-foot store in Homestead on April 1. Located at 2631 NE. 10th Court, the store will be situated near other retailers and restaurants including T.J. Maxx, Planet Fitness, Menchie’s Frozen Yogurt, Ross Dress for Less, Olive Garden Italian and LongHorn Steakhouse. The store location is also about 31 miles south of Miami. Sprouts plans to hire 100 full and part-time employees at the Homestead store. Employment opportunities include department managers, assistant department managers, clerks, cashiers, courtesy clerks, backup receivers, administrative coordinators and scan coordinators. Sprouts offers competitive pay, team member discounts and career advancement opportunities. The grocer employs approximately 31,000 team members and operates more than 370 stores in 23 states nationwide.

Welltower Acquires 33-Property Seniors Housing Portfolio for $548M, Plans Two Developments in Silicon Valley

by Jeff Shaw

TOLEDO, OHIO — Welltower Inc. (NYSE: WELL), a Toledo-based healthcare REIT, has agreed to acquire 33 seniors housing communities totaling 2,787 units in Michigan, Ohio and Tennessee. The purchase price is $548 million. The communities will be acquired as three separate portfolios from undisclosed sellers. The communities were available for purchase because the lease-up process was heavily damaged by the onset of the COVID-19 pandemic. With occupancy at only 63 percent, Welltower expects the communities will greatly improve their performance in 2023 and beyond. Welltower will install Michigan-based senior living operator StoryPoint to manage the communities under a RIDEA agreement. The acquisition is expected to be funded through the issuance of partnership units, assumed debt and cash on-hand. Simultaneously with the acquisition announcement, Welltower unveiled a development partnership with a joint venture between Related Cos. and Atria Senior Living to develop two seniors housing communities in Silicon Valley. One will be located in Santa Clara and the other in Cupertino. Welltower suggests these developments are just the first projects of many for the partnership. The Santa Clara development will consist of 191 units next to a fully entitled, 9.2 million-square-foot urban development that Related began building in 2015. The larger project, …

LOUISVILLE, KY. — Kansas City-based Hunt Midwest has sold Blankenbaker Logistics Center, a 322,831-square-foot, cross-dock industrial facility, for $43 million. Newport Beach, Calif.-based Bixby Land Co. purchased the property. Piston Automotive signed a lease for the whole building prior to construction completion. Chris Riley and Kevin Grove of CBRE represented Hunt Midwest, and Bixby Land Co. was unrepresented in the transaction. Blankenbaker Logistics Center is located within Blankenbaker Station, a Class A, mixed-use business park in eastern Jefferson County. The property offers access to Interstates 64 and 265, UPS Worldport, Ford’s Kentucky Truck Plant, GE Appliance Park, Ford’s Kentucky Assembly Plant and an adjacent 300,000-square-foot FedEx Ground terminal.

GRENADA, MISS. — Stan Johnson Co. has arranged the sale of a single-tenant, 288,000-square-foot industrial facility in Grenada. Mike Sladich and Maggie Holmes of Stan Johnson Co. represented the seller, an Illinois-based industrial developer, Agracel Inc. The buyer, a Dallas, Texas-based REIT, purchased the property for approximately $21.3 million. The property is leased to Advanced Distributors Products (ADP), a producer of residential evaporator coils. The industrial facility serves as the distribution center for the tenant’s manufacturing plant, which is located less than one mile east of the property. Originally built in 2017 as an 84,000-square-foot warehouse, the property was expanded by 70 percent to its current size. Prior to leasing the property, ADP was using part of its neighboring 379,000-square-foot manufacturing facility for warehouse and distribution space. The tenant spent approximately $20 million moving into the new distribution center and repurposing the existing facility into a full manufacturing plant. Adjacent industrial park tenants include Novipax, Resolute Forest Products, Ice Industries and Averitt. Located at 445 American Way, the property has access to Interstate 55, the Grenada Municipal Airport and the Grenada Railroad.

INDIAN LAND, S.C. — CrossRidge Development has completed CrossRidge One, a 120,000-square-foot, Class A office building in Indian Land. CrossRidge One is located within CrossRidge Center, a 190-acre, mixed-use development situated about 23 miles south of Charlotte. Charley Leavitt of JLL is leading office leasing, while Margot Bizon and Lindsay Stafford of JLL are marketing the retail component. Architectural firm Perkins Eastman designed CrossRidge One, and Edifice Inc. served as the general contractor. The next phase of development for CrossRidge Center, which includes 55,000 square feet of retail space, is slated to begin construction in the fourth quarter. Phase I of CrossRidge Center’s retail expansion will deliver in the summer of 2023. The center encompasses six retail parcels available for ground lease, build-to-suit and multi-tenant buildings. CrossRidge Center’s first phase also includes a 120-room hotel. Phase II will deliver an additional 150,000 square feet of space over the course of three years.

DULUTH, GA. — Trenton Systems has signed a 50,000-square-foot office lease at 3100 Breckinridge Building 1200 in Duluth. David Shockley of Progressive Realty LLC represented Trenton Systems, which is a computer hardware manufacturer providing secure computing solutions for the aerospace and defense industries. With the new tenant, the property is now fully occupied. Hunter Henritze, Matt Fergus and Seabie Hickson of Dallas-based Lincoln Property Co. Southeast represented the landlord, TerraCap Management, in the lease deal. 3100 Breckinridge is a 30-acre office park featuring seven buildings totaling 253,307 square feet. Located between Pleasant Hill and Old Norcross roads, the complex offers direct access to Interstate 85 and resides within the Gwinnett Opportunity Zone. The building amenities include ample surface parking, floor-to-ceiling windows and a landscaped campus.

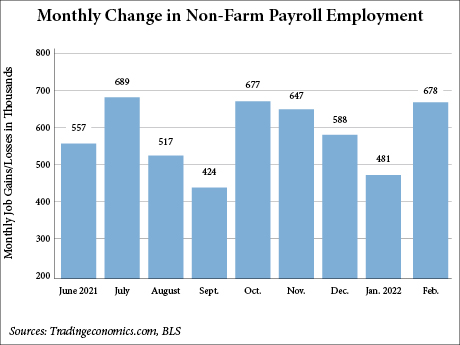

WASHINGTON, D.C. — Total nonfarm payroll employment rose by 678,000 in February, while the unemployment rate decreased from 4 percent in January to 3.8 percent last month, according to the U.S. Bureau of Labor Statistics (BLS). Still, the total nonfarm employment is down by 2.1 million, or 1.4 percent, from its pre-pandemic level in February 2020. The BLS reports that average hourly earnings for all employees on private nonfarm payrolls rose by 1 cent in February over the prior month, or 0.03 percent. The year-over-year wage increase was 5.13 percent. The biggest job growth was led by gains in leisure and hospitality (+124,000). However, since February 2020, employment in the sector is still down by 1.5 million, or 9 percent. Other notable gains were in professional and business services (+95,000), healthcare (+64,000) and construction (+60,000). Additionally, jobs in transportation and warehousing rose by 48,000 last month and is 584,000 higher than two years ago. Employment changed very little in information and government jobs.

ATLANTA AND FORT LAUDERDALE, FLA. — Atlanta-based furniture retailer The Aaron’s Co. Inc. has entered into a definitive agreement to acquire BrandsMart U.S.A. Founded in 1977, BrandsMart is one of the leading appliance and consumer electronics retailers in the Southeast, with 10 stores in Florida and Georgia. For the 12 months that ended Dec. 25, 2021, BrandsMart generated revenues of $757 million. Total consideration is approximately $230 million in cash, subject to certain closing adjustments, and the transaction is expected to close in the second quarter of 2022. Upon closing of the transaction, the BrandsMart business will report to Aaron’s president, Steve Olsen, and continue to be headquartered in Fort Lauderdale, Fla. Additionally, Aaron’s will acquire 100 percent of the outstanding equity interests of Interbond Corp. of America, which does business as BrandsMart U.S.A., from the Perlman family for consideration at closing of $230 million in cash, subject to certain post-closing adjustments. BofA Securities Inc. is acting as financial advisor to Aaron’s and Jones Day is acting as legal advisor. Cassel Salpeter & Co. LLC is acting as financial advisor to BrandsMart and Cooley LLP is acting as legal advisor.