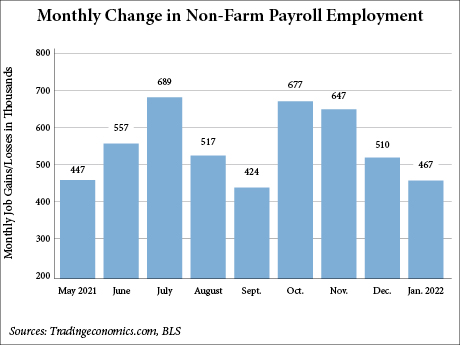

WASHINGTON, D.C. — Total nonfarm payroll employment rose by 467,000 jobs in January, while the unemployment rate changed little from 3.9 percent in December to 4 percent in last month, according to the U.S. Bureau of Labor Statistics. The latest job figures released Friday morning by BLS were significantly higher than Dow Jones’ estimate of nonfarm payroll employment of 150,000, according to CNBC. In addition, BLS revised the job gains for November and December upward by a combined 709,000. In January, job gains increased in leisure and hospitality (+151,000), professional and business services (+86,000), retail trade (+61,000) and in transportation and warehousing (+54,000). Additionally, employment in local government education increased by 29,000 last month but is still down by 359,000 from February 2020, a 4.4 percent difference. Jobs in healthcare increased by 18,000, and there was little change in employment for mining, construction, manufacturing, information, financial activities and other services. Additionally, the amount of employed people who worked from home due to the pandemic increased to 15.4 percent. This follows news of the spread of the Omicron variant of COVID-19 and a high number of cases during the holidays in December. The labor force participation rate increased to 62.2 percent, …

Southeast

ADAIRSVILLE AND CARTERSVILLE, GA. — Panattoni has sold a two-property, Class A industrial portfolio totaling 949,211 square feet in metro Atlanta. Dennis Mitchell, Matt Wirth, Britton Burdette and Jim Freeman of JLL represented Panattoni in the transaction. Affiliates of LXP Industrial Trust acquired the property for $112 million. The portfolio comprises Georgia North Industrial Park Building 100 and Bartow Commerce Center Buildings 1 and 2. Tenants at the properties include Wellmade, Airman USA Corp. and Textron. Both properties have easy access to Interstate 285, Hartsfield-Jackson Atlanta International Airport and the Appalachian Regional Port. Built in 2020, the rear-load Georgia North Industrial Park Building 100 provides 225,211 square feet of multi-tenant space and features tilt-wall construction, 32-foot clear heights, 36 loading positions, 50 trailer parking stalls, ESFR fire protection and LED lighting. Located at 95 International Parkway in Adairsville, the property is situated within one mile of Interstate 75. Constructed in 2021, Bartow Commerce Center Buildings 1 and 2 feature rear-load configurations, clear heights ranging from 32 to 36 feet, 84 dock-high doors, eight grade-level doors with ramps, ESFR fire protection, LED lighting and 161 trailer parking stalls. The buildings are situated at 41 and 51 Busch Drive NE in Cartersville, …

TAMPA, FLA. — JLL Capital Markets has secured a $72.5 million construction loan for the development of Altura Bayshore, a 73-unit high-rise condominium project in Tampa. Steve Klein, Brian Gaswirth, Reid Carleton and Drew Jennewein of JLL worked on behalf of the developer and borrower, Naples, Fla.-based The Ronto Group, to secure the loan from MSD Partners LP. Slated to be complete by 2024, Altura Bayshore will stand 22 stories high. Community amenities will include a sky deck and pool, fitness center, club and entertainment room, guest suites, multiple sports courts, a synthetic turf putting green, dog park and barbecue grills. Unit features will include private elevator foyers, designer-selected finishes throughout, open terraces and energy-efficient sliding glass windows and doors. Located at 2910 W. Barcelona St. directly off Bayshore Boulevard, the property is situated near SOHO District, Hyde Park Village and the Downtown Tampa Arts District. The property is also located 8.2 miles from the Tampa International Airport.

CONYERS, GA. — Chicago-based Dayton Street Partners has broken ground on a 212,232-square-foot speculative distribution center in Conyers. Construction is slated for completion by July. The distribution center will feature 32-foot clear heights, 41 trailer and 203 auto stalls with separate access for cars and trucks and a 185-foot truck court. Located at 2020 East Park Road, the property is situated 28.6 miles east of downtown Atlanta and 31.3 miles from Hartsfield-Jackson Atlanta International airport. Dayton Street most recently completed the development of DSP Rock Hill, a 188,000-square-foot distribution center near Atlanta’s airport. Brookfield acquired the asset in December 2021.

DELRAY BEACH, FLA. — Sleiman Enterprises has acquired Delray Square, a 160,000-square-foot shopping and dining destination in Delray Beach. Berkeley Capital Advisors represented the undisclosed seller in the transaction. The sales price was not disclosed. Built in 1976 on approximately 16 acres, Delray Square has tenants including Publix, Hobby Lobby, Walgreens, Chipotle and Chick-fil-A. Publix recently relocated to a newly constructed 45,600-square-foot space at the property, while Hobby Lobby recently signed a long-term lease with plans to open in the next few months. Redevelopments occurred in 2019 at Delray Square, which included new LED lighting for the parking lot, newly built anchor store and shops, roof renovation of Hobby Lobby and an overhauled façade. The property was 96 percent occupied at the time of sale. Located at 4771 W. Atlantic Ave., the property is situated 3.2 miles from Delray Beach and 10.4 miles from Boca Raton. The property is also 8.7 miles from the Boca Raton Airport and 7.9 miles from Florida Atlantic University.

CHAPEL HILL, N.C. — Ready Capital has closed a $16.4 million acquisition loan for an unnamed student housing property near the University of North Carolina at Chapel Hill. The non-recourse, interest-only, floating-rate loan features a 36-month term, two extension options, flexible prepayment and is inclusive of a facility to provide future funding for capital expenditures. Upon acquisition, the sponsor will implement a capital improvement plan to fix deferred maintenance, renovate unit interiors and exteriors and make common area upgrades.

PHILADELPHIA — Equus Capital Partners has acquired a 5.4 million-square-foot industrial portfolio located across the Sun Belt and East Coast. The properties were purchased from Prologis for $900 million, according to the Philadelphia Business Journal. The 75-property portfolio primarily comprises multi-tenant, infill, shallow-bay assets located across seven major distribution markets in Texas, Florida, Georgia, South Carolina and Virginia. The acquisition was made on behalf of the company’s sponsored value-add fund, Equus Investment Partnership XII L.P. The portfolio was 98 percent leased to 250 tenants at the time of sale, which included e-commerce, logistics providers, manufacturing, business-to-business and business-to-consumer users. Equus made headlines with another large-scale industrial acquisition in October of last year, buying a 7.3 million-square-foot industrial portfolio in Arizona for $1.1 billion. “We remain disciplined in our approach to appropriately scaling our industrial holdings across the U.S. on behalf of our investment partners,” says Kyle Turner, partner and director of investments for the Philadelphia-based firm. “This most recent investment further diversifies our platform holdings in the industrial sector and provides access to dynamic distribution locations poised to benefit from improving industrial fundamentals and sustained population growth,” he continues. Kyle Turner, Tim Feron, Laura Brestelli, Joe Felici, Scott Miller and Ryan Klancic …

Content PartnerFeaturesFinance InsightMidwestMultifamilyNortheastSoutheastTexasWalker & DunlopWestern

Web-Based Multifamily Valuation Enhances Speed, Builds Better Predictions

The future of multifamily valuation requires flexibility and the use of technology to process data faster and more reliably. Meghan Czechowski, managing director and valuation lead for Apprise by Walker & Dunlop, spoke to Finance Insight about why multifamily valuations in particular are well suited to a web-based machine learning approach, resulting in faster appraisals with increased reliability. Finance Insight: How does the Walker & Dunlop Apprise program differ from traditional residential valuation programs? Czechowski: We’re focused on multifamily with our tech-enabled process. Most appraisal reports on the commercial side (multifamily included, that is, five units and up) are completed using a web-based database, and those databases are typically blank slates. When you’re entering sale comparables, rent comparables or other data, most people are starting from scratch and usually using an analyst to record that comparable information that then feeds into a database. The Apprise team of appraisal experts uses our Apprise application, which is a proprietary web-based system. It uses the property record database; therefore, it is not a blank slate. It has over 2.5 million multifamily records flowing into it from a public record aggregator and various industry resources like REIS, RCA and Yardi, using direct integration and …

ST. PETERSBURG, FLA. — KeyBank Community Development Lending and Investment and KeyBank Real Estate Capital have provided a total of $69.8 million for the redevelopment of Jordan Park Apartments in St. Petersburg. Norstar Development USA-CDL, a Buffalo, N.Y.-based affordable housing developer, and the St. Petersburg Housing Authority are working together on the project, the timeline of which was not disclosed. KeyBank provided a $42.7 million construction bond. KeyBank funded the financing via Fannie Mae’s unfunded forward commitment execution that allows KeyBank to issue a mortgage-backed security (MBS) upon completion of the construction that will convert to a permanent mortgage loan. This Fannie Mae execution is referred to as MBS as Collateral for Tax-Exempt Bonds (MTEB), which is available for 4 percent LIHTC transactions. Jordan Park Apartments was originally built in 1939 on land donated by businessman Elder Jordan Sr. The 24-acre site contains single-family, duplex, triplex and quadplex buildings. The property’s former residents will have first right to return as the redeveloped property begins to reopen. The first phase includes the new construction of a six-floor midrise building for seniors ages 62 and older, as well as the rehabilitation of 41 buildings containing 97 units of affordable housing for families. …

CHESAPEAKE, VA. AND ELIZABETH CITY, N.C. — Marcus & Millichap has arranged the sale of the Templeton Portfolio, a three-property apartment portfolio in Chesapeake and Elizabeth City. Altay Uzun of Marcus & Millichap facilitated the transaction and secured the buyer, MRKT Capital. The undisclosed seller sold the portfolio for $61 million. The properties within the Templeton Portfolio include Green Tree Apartments and Oak Grove Apartments in Chesapeake and Emerald Lake Apartments in Elizabeth City. Green Tree is a 208-unit apartment community that offers one- and two-bedroom floorplans. Community amenities include a pool, fitness center, clubhouse, volleyball court, walking and biking trails, controlled building access, onsite laundry facilities and a package receiving service. Located at 749 Green Tree Circle, the property is situated 10.6 miles from Norfolk. Oak Grove is a 132-unit apartment community that offers one- and two-bedroom floorplans. Community amenities include onsite laundry facilities, controlled building access, a volleyball court and ample parking. Located at 408 Trotman Way, the property is situated near Chesapeake Regional Medical Center and the Great Bridge Lock Park. Emerald Lake is a 132-unit apartment community that offers three-bed/two-bath floorplans. Community amenities include a pool, clubhouse, parking, onsite management and a package receiving service. Located …