BRANDON, FLA. — Tampa-based ZMR Capital has acquired two multifamily properties in Brandon in two separate transactions totaling $53.3 million. The two adjacent properties, Brandon Oaks and Palms at Paradise, total 285 units. The seller(s) was not disclosed. Built in 1974, Brandon Oaks is a 160-unit community located near the intersection of North Parson and East Clay avenues at 110 Summerfield Way, about 12.2 miles east of Tampa. Built in 1981, Palms at Paradise is a 125-unit community that is located adjacent to Brandon Oaks at 512 Camino Real Court. Both communities feature one-, two- and three-bedroom floorplans with community amenities such as swimming pools, barbecue and picnic areas, playgrounds and resident clubhouses. ZMR Capital plans to combine the two properties and renovate the exterior to improve curb appeal, as well as upgrade apartment interiors with new countertops and cabinetry, stainless steel appliances and plank flooring.

Southeast

ATLANTA — Fin & Feathers, an American soul food restaurant owned by Damon Johnson, will open in a new 5,400-square-foot location at 1136 Crescent Ave. in Midtown Atlanta. The new location will be the restaurant’s fourth in metro Atlanta. Bryan Davis of Atlanta-based Ackerman & Co. represented Fin & Feathers in the transaction. Fin & Feathers will open in the space formerly occupied by Tin Lizzy’s Cantina. The restaurant is slated to open in February. The interior of the Midtown Atlanta location will be completely redesigned to fit the Fin & Feathers’ style, which usually has colorful recessed lighting, a welcoming bar, wood tables and chairs and wall artwork. Additionally, the new location will have an outdoor patio for dining. The first Fin & Feathers location opened at 360 Edgewood Ave. in downtown Atlanta. Other locations near Atlanta include 7430 Douglas Blvd. in Douglasville and Ga. Highway 85 in Riverdale.

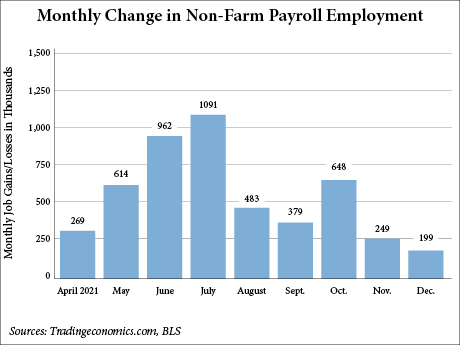

WASHINGTON, D.C. — Total nonfarm payroll employment rose by 199,000 jobs in December, while the unemployment rate declined from 4.2 percent in November to 3.9 percent, according to the U.S. Bureau of Labor Statistics (BLS) report that came out Friday, Jan. 7. A closer look at the data shows that employers added 211,000 private sector jobs, while the government shed 12,000 jobs. The employment numbers were much lower than the Dow Jones’ estimate of nonfarm payroll employment of 422,000 but the unemployment rate was below the predicted 4.1 percent rate, according to CNBC. In February 2020, the last full month not impacted by the COVID-19 pandemic, the unemployment rate was 3.5 percent. The news outlet also noted the BLS report included data from Dec. 12, which is when some of the highest reported cases of Omicron variant were found. The highest amount of job gains last month was in the leisure and hospitality sector, which increased by 53,000 jobs. Other notable job gains occurred in professional and business services (+43,000), manufacturing (+26,000), construction (+22,000) and in transportation and warehousing (+19,000). Last month, little to no change occurred in employment for the retail trade, financial activities, healthcare, government and information and …

CHARLOTTE, N.C. — Manhattan Beach, Calif.-based Magma Equities, in a joint venture with funds managed by Franklin Templeton, has purchased Cameron SouthPark, a 309-unit apartment community in Charlotte. The sales price was $79.3 million. Arel Capital was the seller. Constructed in 1984 and renovated in 2016, Cameron SouthPark’s one- and two-bedroom apartments are housed in 26 three-story residential buildings on a 35-acre site. Community amenities include two swimming pools, a clubhouse, fitness center, sand volleyball court, basketball courts, tennis courts and a dog park. The property was 95 percent occupied at the time of sale. The two companies plan to upgrade the property with improved management operations and physical improvements that include upgrades to the property’s exterior, common areas and unit interiors. Located at 6316 Cameron Forest Lane, the property is close to the 1.6 million-square-foot SouthPark Mall, 8.2 miles from downtown Charlotte and 2.5 miles from Park Road Park, a recreational park with a basketball court, tennis court and baseball fields.

MANASSAS, VA. — Bethesda, Md.-based Finmarc Management Inc. has disposed of a six-building portfolio comprising 212,000 square feet of warehouse and flex space in Manassas for $45.6 million. Boston-based The Davis Cos. and West Palm Beach, Fla.-based Davin Holdings were the buyers. Marc Tasker, Ryan Moody and Christopher Kubler of NAI KLNB represented Finmarc Management. Joseph Hoffman and Aaron Rosenfeld of Kelley Drye provided legal services. The portfolio was located at 7345, 7663 and 7795 Coppermine Drive and 7201, 7301 and 7401 Gateway Court. The portfolio was 86 percent leased at the time of sale to tenants including Aimpoint, Capital Lighting & Supply, Cedar F&B, Eaton Corp., DH Cos., Lennox Industries and Notal Vision. The six properties were part of a 26-building portfolio containing approximately 950,000 square feet of commercial office, flex/office and warehouse space.

ATHENS AND CLEVELAND, TENN. — SVN Multifamily LLC has arranged the $32.5 million sale of Park Oak and Park Crest Apartments, two multifamily properties with a total of 410 units located in Athens and Cleveland. Andrew Agee and Joseph Shaw of SVN Multifamily represented both the seller, Park Properties, and the buyer, New Jersey-based C.J. Lombardo Co. The buyer plans to renovate the units including upgrading interiors with LVT flooring and new appliances, as well as painting the exterior. Built in 1990, Park Crest offers 160 units with features such as washer and dryer hookups, a security system, storage units, dishwasher, walk-in closets and a balcony. Community amenities include laundry facilities, a car wash area, clubhouse, fitness center, pool and a picnic area. Located at 2108 Congress Parkway S. in Athens, the property is situated adjacent from the Tennessee College of Applied Technology and 56.5 miles from Chattanooga. Built in 1989, Park Oak offers 250 units with unit features including washer and dryer hookups, a security system, dishwasher, walk-in closets and balconies. Community amenities include a pool, fitness center, laundry facilities, car wash area, business center, playground and a basketball court. Located at 1159 Harrison Pike in Cleveland, the property …

ST. PETERSBURG, FLA. — An affiliate of Walton Street Capital LLC in partnership with St. Petersburg-based Stoneweg US LLC has acquired Waterview Echelon, a 226-unit, Class A multifamily property located in St. Petersburg. The sales price and seller were not disclosed. Built in 2021, the Waterview Echelon features a mix of one-, two- and three-bedroom apartments that were 99 percent occupied at the time of sale. Unit features include quartz countertops, stainless steel appliances, full-size washers and dryers in-unit and floor to ceiling windows with views of Tampa Bay. Community amenities feature an infinity pool with cabanas, gas grills and fire pits, fitness center, club lounge, single-use workspaces, covered parking and a private conference room. Located at 100 Main St. N., the property is situated adjacent to a Publix-anchored shopping center, 14.3 miles from downtown Tampa and 10.9 miles from downtown St. Petersburg. The property is also located within one mile of Carillon Office Park, which houses over 3 million square feet of office space.

BRASELTON, GA. — Foxfield Industrial has sold a 455,602-square-foot bulk distribution facility at 1001 Cherry Drive in Braselton, about 49.3 miles from downtown Atlanta. Dennis Mitchell, Matt Wirth, Mitchell Townsend and Britton Burdette of JLL Capital Markets represented the seller. Birmingham-based Growth Capital Partners acquired the property for $27.4 million. Completed in 1985 and expanded in 1996, the property is fully triple-net leased to two tenants: YearOne Inc. and TransSouth Logistics. The building’s amenities include clear heights ranging from 22 to 28 feet, 45 dock-high doors, eight drive-in doors and 486 auto spaces. The 30.5-acre site provides excess land for potential building expansion and/or additional outdoor and trailer storage. The property is situated adjacent to Interstate 85 and is 56 miles from Hartsfield-Jackson Atlanta International Airport.

Joint Venture to Break Ground on $1B Life Sciences Campus in North Carolina’s Research Triangle

by Katie Sloan

MORRISVILLE, N.C. — A joint venture between Starwood Capital Group and Trinity Capital Advisors has announced plans to develop Spark LS, a $1 billion life sciences campus located within North Carolina’s Research Triangle in Morrisville. The 109-acre development will be located at the intersection of McCrimmon Parkway and Airport Boulevard, four miles from Raleigh-Durham Airport and five miles from Apple’s new $1 billion office campus. The 1.5 million-square-foot project is set to include 12 to 15 buildings with lab and bio-manufacturing space, green spaces, restaurants, retail, a STEM education and amenity center, and several multi-use outdoor recreation areas. “We’re excited to continue investing in the Raleigh life sciences market, one of the top clusters in the country,” says Mark Keatley, managing director at Starwood Capital. “The Raleigh life sciences market benefits from record levels of public- and private-sector funding, which is driving increasing demand for high-quality lab and bio-manufacturing space.” Architectural firm Hanbury has been tapped to design the campus, with Doug Cook and Suzanna Nichols of Cushman & Wakefield heading up leasing efforts for the project. A timeline for the development was not announced. Starwood and Trinity have acquired or developed 5.1 million square feet of office and life …

LOUISVILLE, KY. — Stoneweg US has acquired Middletown Landing and Mallard Crossing at St. Matthews, two multifamily properties in metro Louisville, for $230 million. The deal added 1,246 units to the company’s portfolio. Jay Weiner of Rosewood Realty Group represented the buyer and the seller, Columbus, Ohio-based Lifestyles Communities. Middletown Landing comprises 646 units in mostly townhome-style floorplans with an average unit size of nearly 1,100 square feet. Unit features include granite countertops, nine-foot ceilings, subway tile backsplashes and wood-style plank flooring. Community amenities include a two-story fitness center, pool, volleyball courts, and The Goat, an onsite restaurant. Built in 2014 and 2016, Middletown Landing is located near employers including UPS, Amazon and Ford Motor Co., as well as retailers such as Target and Kroger. Mallard Crossing at St. Matthews contains 600 units. Built in 1988, Lifestyles Communities previously completed renovations on 20 percent of the units, including installing quartz countertops, walk-in showers, upgraded cabinetry and new lighting fixtures. Community amenities include a pool, gym and storage. Located at 400 Mallard Creek Road, the property is situated 10.9 miles from downtown Louisville and 8.7 miles from Louisville Muhammad Ali International Airport. As a new owner, Stoneweg US will make capital …