PHOENIX — Florida and Texas dominated the list of top 25 growth cities highlighted in the U-Haul Growth Index, an annual metric tracked by the Phoenix-based moving giant. Together, Florida and Texas accounted for 15 of the top 25 markets for one-way U-Haul moving trips in 2021. Kissimmee-St. Cloud, a Central Florida metro situated less than 30 miles south of Orlando, came in at No. 1 for 2021 after finishing second in both the 2019 and 2020 rankings. Rounding out the top five in-migration markets for 2021 are Raleigh-Durham, N.C.; Palm Bay-Melbourne, Fla.; North Port, Fla.; and Madison, Wis. Arrivals of U-Haul trucks into Kissimmee-St. Cloud climbed 31 percent from 2020, while departures rose 29 percent. Arriving trucks accounted for 53.2 percent of all one-way U-Haul traffic in Kissimmee-St. Cloud, which was one of Florida’s 10 markets in the 2021 list. “Florida remains competitive, especially during the COVID era,” says Miguel Caminos, president of U-Haul Co. of Orlando. “We’ve pushed through and business is thriving. It’s not just people moving to Florida, but businesses moving because they see better opportunities here.” “Florida has always been a destination location for retirees, but more so (in 2021), a lot of people took …

Southeast

TAMPA, FLA. — Current Rocky Point LLC, an affiliate of Tampa-based Caspers Co., has acquired The Current Hotel, an Autograph Collection hotel by Marriott in Tampa. The price was $85 million. Dave Weymer, Michael Weinberg, Preston Reid and Wyatt Krapf of Berkadia Hotels & Hospitality represented the seller, Rocky Point Holdings LLC, in the transaction. American Momentum Bank provided a $55 million loan to the buyer. Built in 2019, The Current Hotel features 180 rooms, the Julian Restaurant, Rox Rooftop Bar and a lobby bar. The hotel property also includes a private beach, infinity pool and waterfront views from every guestroom. Located at 2545 N. Rocky Point Drive, the hotel is 4.8 miles from the Tampa International Airport, 0.5 miles from East Tampa Beach and 15 miles from Clearwater. The property is also situated near restaurants such as Whiskey Joe’s Bar & Grill and Oystercatchers.

CHARLESTON, S.C. — Los Angeles-based Trion Properties has acquired Latitude at West Ashley, a 312-unit multifamily community in Charleston, for $51.8 million. The seller was not disclosed. Constructed in two phases in 1968 and 1973, Latitude at West Ashley offers one-, two- and three-bedroom floorplans averaging 954 square feet with approximately half of the units set up as townhomes. The apartment community includes 22 two-story wood-framed buildings. Community amenities include a pool deck with BBQ grills and cabanas, a fitness center and onsite laundry facilities. Located at 1735 Ashley Hall Road, Latitude at West Ashley is situated by the Ashley and Stono rivers. The property is also situated seven miles west of downtown Charleston, 2.8 miles from Citadel Mall, the area’s only indoor mall, and near Interstate 526.

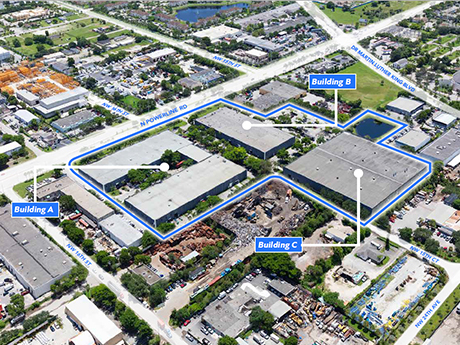

POMPANO BEACH, FLA. — Bridge Industrial has purchased Pompano Beach Commerce Park, a 336,852-square-foot industrial campus in Pompano Beach. Jose Lobon of CBRE National Partners represented the undisclosed seller in the transaction. The price was not disclosed. Located on Powerline Road, Pompano Beach Commerce Park comprises three buildings spanning 140,094 square feet, 124,894 square feet and 71,864 square feet, respectively. The facilities include features such as 24-foot clear heights and multiple points of ingress and egress along its 800 feet of linear frontage on Powerline Road. Following the acquisition, Bridge Industrial plans to launch a comprehensive capital improvement program at the property, including upgrades to the landscaping, parking lot, signage and roof. The campus is located less than two miles from Interstate 95 and just 1.4 miles from the Florida Turnpike. The property also sits 15 miles from Port Everglades and the Fort Lauderdale-Hollywood International Airport, and approximately 40 miles from the Port of Miami and Miami International Airport.

MIAMI — Cushman & Wakefield has arranged the sale of a 51,392-square-foot industrial facility located at 7480 NW 48th St. in Miami. Wayne Ramoski and Miguel Aclivar of Cushman & Wakefield represented the seller, DFJ Properties West LLC, in the transaction. RLIF East 5 LLC was the buyer. The price was $14.8 million. Sitting on more than four acres, 7480 NW 48th St. is a warehouse and showroom property that is fully leased to Ferguson Enterprises, a Newport News, Va.-based distributor of plumbing supplies, waterworks and fire and fabrication products. The facility is situated on two lots offering a variety of industrial and commercial uses in South Florida’s airport submarket. The property includes features such as 23.8-foot clear heights, more than 50 striped parking spaces and proximity to Miami International Airport. The property is currently zoned for industrial and heavy manufacturing use.

BURLINGTON, N.C. — Several new tenants are set to open at Church Street Commons, a recently constructed shopping center located at the intersection of Huffman Mill Road and Church Street in Burlington. Morgan Cos. purchased the 9.6-acre property where Church Street Commons now stands in February 2019. The property was formerly the site of a Sears department store. The owner and developer of the center, Morgan Cos., recently welcomed a new Publix supermarket. My Eyelab, an optical retailer, also opened at the center in December. The retailers that will soon open at Church Street Commons includes The Habit Burger Grill, a burger restaurant; Aspen Dental, a dental services provider; Popeye’s, a New Orleans-based fast food chain; uBreakiFix, a same-day electronics repairs provider; and Church Street Nails, a nail salon and spa. The retailers are expected to open in the first quarter of this year.

Atlanta remains an incredibly active market for multifamily demand from both a renter and investor standpoint. The Atlanta metropolitan statistical area (MSA) boasts a population estimate by the U.S. Census Bureau of more than 6.1 million people, an increase of 14.3 percent over the past 10 years, and ranks consistently as one of the top recipients of in-migration in the country. The continued influx of new residents and rising home pricing have led to a vacancy rate of 4.9 percent, the lowest recorded in the MSA since 2000. In the third quarter, rents reached the highest average in Atlanta’s history of $1,561 per unit, an increase of 21.3 percent year-over-year. While on average apartment communities tend to see an average occupancy rate around 95 percent, eviction moratoriums have pushed occupancies at many to as high as 99 percent leased as property managers seek to make up for lost revenue. Residents are flocking toward urban infill projects in walkable parts of the city, such as in the micro-market along the Atlanta BeltLine Eastside Trail where effective rents reached $2,052 per unit, commanding a 31.5 percent premium over the metro Atlanta average. However, there has also been substantial rent growth recorded in …

The current state of the New Orleans industrial real estate market can best be described as “dichotomic.” On the one hand, New Orleans has the stability of a mature market featuring one of the largest and oldest ports in North America, traditionally serving heavy industry that continues to perform. On the other, you have two new proposed container port projects that could significantly alter the landscape of the industrial real estate market for the foreseeable future. Like so many other markets across the country, the New Orleans area is gaining its fair share of distribution facilities, with Amazon and the like scrambling for sites to service increased consumer and business-to-business demand. That said, the real game-changer for the distribution sector will ensue when at least one of the two announced container port projects in the New Orleans area comes on line. The Port of Plaquemines and the Port of New Orleans have both identified sites with access to rail, major roadways and water-based transport options that would fundamentally alter the opportunity for distribution emanating out of the New Orleans area. Either project would instantly create a great demand for warehousing and distribution space and further diversify the industrial asset class …

ATLANTA — Kaplan Residential has sold Generation Atlanta, a 336-unit, 17-story high-rise apartment building located in downtown Atlanta. Frankforter Group purchased the community for $126.9 million. The sales transaction marks the largest multifamily sale in downtown Atlanta’s history, according to Kaplan Residential. Located at 369 Centennial Olympic Park Drive, Generation Atlanta offers studio apartments to two-bedroom units, spanning from 459 to 1,512 square feet, with monthly rents ranging from $1,600 to $3,650. Units feature quartz countertops, custom cabinetry, kitchen islands, stainless steel appliances, full-size washers and dryers, private balconies and smart keyless entry. Community amenities include an outdoor theater, rooftop pool and sundeck, bowling alley, EV charging stations, coffee bar, fitness center, yoga studio and a rooftop lounge that offers views of the Atlanta skyline. The property is located on a 1.8-acre land parcel close to Atlanta’s most notable landmarks, including Centennial Olympic Park, World of Coca-Cola, National Center for Civil & Human Rights, Georgia Aquarium, CNN Center, State Farm Arena and Mercedes-Benz Stadium.

TAMPA, FLA. — Altman Cos. has broken ground on Altís Grand at Suncoast, a 449-unit apartment community in Tampa. Rockpoint Group provided equity for the project, and PNC Bank provided debt. Construction is slated for completion by 2023. Altís Grand at Suncoast will offer one-, two- and three-bedroom floor plans. Unit features include bathrooms equipped with dual sink vanities, a soaking tub, quartz countertops, 39-inch cabinets, frontload washers and dryers, stainless steel and energy-efficient appliances. Community amenities include a fitness center, Starbucks cyber cafe, multiple coworking lounges, wellness treatment room, pool, private conference room, game room, indoor air-conditioned dog grooming spa, a multipurpose trail, pet park, hobby/craft room and a 24/7 automated package pickup station. Residents will enjoy membership to The Club, an onsite clubroom that will host activities including daily continental breakfast, Sunday brunch and “Wine Down Wednesdays.” Altman plans for Altís Grand at Suncoast to achieve National Green Building Standard (NGBS) certification, and the property’s sustainable initiatives will include 100 percent energy-efficient designer lighting, Energy Star refrigerators and dishwashers, high-efficiency water heaters and sub-metered water stations and electric car charging stations.