TAMPA, FLA. — Related Urban Development Group and the Tampa Housing Authority will host a ribbon cutting ceremony on Thursday, Feb. 19, for Canopy at West River, a new 384-unit affordable housing community in Tampa. Delivered in two phases, the community spans four towers and offers a mix of one-, two-, three- and four-bedroom floorplans. Amenities at the complex include a community room with a kitchenette; game room with a TV; business center with computer/internet access; fully equipped fitness centers; smart home technology; electric vehicle (EV) charging stations; and a future NFL Alumni Obstacle Course that “reinforces the development’s focus on active living.” Situated within the larger West River mixed-use development, The Canopy at West River apartments are reserved for residents earning between 22 percent and 80 percent of the area median income (AMI), with long-term affordability supported through a combination of Project-Based Vouchers (PBV), Rental Assistance Demonstration (RAD) programs, National Housing Trust Fund (NHTF) financing and Low-Income Housing Tax Credits (LIHTC).

Southeast

ZEPHYRHILLS, FLA. — Franklin Street has brokered the $6.4 million sale of Oakview Plaza, a 47,000-square-foot retail center located in Zephyrhills, roughly 30 miles northeast of Tampa. Justin Walker, Justin Sturdivant and Dylan Morse of Franklin Street represented the seller, South Florida-based Merrimac Ventures, in the transaction. New York-based New Hyde Park Fruit Corp. was the buyer. Originally built in 1990, the center will undergo façade improvements, parking lot enhancements and lighting updates. The property’s Winn-Dixie store is also being redeveloped into an Aldi that will act as co-anchor to Archwell Health, a senior-focused primary care provider. Both stores will operate on new 10-year leases upon opening.

Ardent Receives Civic Approval for Costco-Anchored Redevelopment of Metro Orlando Mall

by John Nelson

SANFORD, FLA. — The Ardent Cos. has received approval from the City of Sanford, a city in the Orlando MSA, for the redevelopment of Seminole Towne Center, a former shopping mall spanning 1.1 million square feet. The redevelopment includes construction of a new 164,585-square-foot Costco store on the 76-acre site. Taking place of the former Macy’s department store, the Costco location will include a gas station, tire center and liquor store. Ardent plans to begin site work and demolition this summer, with the Costco opening slated for second-quarter 2027. Over the past 12-plus months, the Atlanta-based owner and developer has acquired more than $115 million in six ground-up mixed-use development and redevelopment projects across the Southeast.

DURHAM, N.C. — Beacon Partners has purchased 119 acres of industrial-zoned land at the intersection of U.S. Highway 70 and Leesville Road in south Durham. Situated two miles south of Raleigh-Durham International Airport and near Research Triangle Park, the site will support the development of approximately 1.3 million square feet of Class A distribution, manufacturing and life sciences space. The project represents Phase I of Durham Gateway, a 308-acre master-planned campus that will also include 1,750 residential units, offices, shops and restaurants. The City of Durham granted Beacon entitlements for the full 308 acres in September. Durham Gateway is a joint venture between Beacon, HM Partners and SFRE Holdings. The project team includes Advanced Civil Design (civil engineer) and Merriman Schmitt (architect). Ann-Stewart Patterson, Austin Nagy and John Hogan of CBRE will lead leasing and marketing efforts for the industrial space at Durham Gateway.

Ocean Bank Provides $70M Construction Loan for Mixed-Use Building in Aventura, Florida

by John Nelson

AVENTURA, FLA. — Ocean Bank has provided a $70 million construction loan for Central Aventura, a nine-story mixed-use building located at the corner of Biscayne Boulevard and 209th Street in the Miami suburb of Aventura. Jesus Garcia of Ocean Bank originated the loan on behalf of the borrower, an entity doing business as Central Aventura LLC that is led by Jacobo Cababie Dichi. Central Aventura will comprise 75,270 square feet of retail space on the first three levels, four levels of parking and 63,883 square feet of offices on the top two floors. Additionally, the property will feature the first multi-story digital billboard in Aventura. The construction timeline for the project was not released.

SUMMERVILLE, S.C. — Avison Young has brokered the sale of 479 Trade Center Parkway, a 448,765-square-foot warehouse and distribution facility located within Charleston Trade Center in Summerville. The facility’s sole tenant at the time of sale was IFA Rotorion, an automotive supplier of prop shafts and joint competencies for auto manufacturers such as BMW, Mercedes-Benz, Porsche and Ferrari. California-based Goldrich Kest purchased the 32-acre property for an undisclosed price. Erik Foster, Michael Wilson and Alex Irwin of Avison Young brokered the transaction. The seller was also not disclosed.

Walker & Dunlop Arranges $371.5M in Development Financing for The Nashville Edition Hotel & Residences

by John Nelson

NASHVILLE, TENN. — Walker & Dunlop Inc. has arranged $371.5 million in development financing for The Nashville Edition Hotel & Residences, a luxury mixed-use property that will be located in the heart of Nashville’s Gulch neighborhood. Positioned at 11th Avenue and Grundy Street, The Nashville Edition will comprise a 28-story tower with 261 hotel rooms and 84 for-sale residences. The project will include chef-led restaurant and bar concepts, multiple floors of amenity spaces and fully separate hotel and residential lobbies and gyms. Shared amenity offerings will include a spa, golf simulator, 8,300 square feet of combined ballroom and pre-function space, conference rooms and a rooftop pool and bar. Keith Kurland, Aaron Appel, Jonathan Schwartz, Adam Schwartz, Dustin Stolly, Ari Hirt and Michael Ianno of Walker & Dunlop’s capital markets team collaborated with Jay Morrow, Carter Gradwell and Jack Hughes of the firm’s hospitality team to arrange the financing through Madison Realty Capital and KSL Capital Partners. The borrower was Tidal Real Estate Partners, which is developing The Nashville Edition Hotel & Residences in collaboration with Left Lane Development and Marriott International. Tidal has obtained a total of $400 million in construction financing for the development.

ATLANTA — BKM Capital Partners and Kayne Anderson Real Estate have purchased a six-property industrial portfolio in metro Atlanta totaling 404,424 square feet. JLL represented the sellers, Berkeley Partners and Brookfield Secondaries Group, in the transaction. The sales price was not disclosed. The portfolio of shallow-bay properties was 89 percent occupied at the time of sale, with a weighted average lease term (WALT) of 2.7 years. The assets include three properties in the northeast Atlanta region — 3400 Corporate Way, Peachtree Industrial Boulevard and Young Court — as well as two properties in northwest Atlanta — Rubicon Business Center and Cobb International. The sixth property was an infill facility located in the city’s Upper Westside district at 4938 S. Atlanta Road. BKM and Kayne Anderson plan to make capital improvements across the portfolio, including exteriors, landscaping, roofs and HVAC systems and renovating vacant space to accelerate the lease-up process.

Swinerton Breaks Ground on $5.5M Medical Office Building in Pineville, North Carolina

by John Nelson

PINEVILLE, N.C. — Swinerton Builders’ Carolinas division has broken ground on a $5.5 million medical office building located at 10425 Good Sell Court in Pineville, about 14 miles south of Charlotte. Locally based Metrolina Dermatology will occupy the 8,000-square-foot property upon completion, which is expected in early spring. Situated on 1.2 acres, the medical office building will feature 11 exam rooms, two aesthetic rooms, four Mohs exam rooms, one Mohs lab, a sterilization room, four offices and up to five medical assistant/nursing stations, as well as a welcoming lobby/waiting area and an employee breakroom. (Mohs is a specialized technique used to remove skin cancers.) Outside, the property will feature an asphalt parking lot for 40 to 50 cars. The design-build team includes Nelson Worldwide Architects, Cornerstone Architecture, LJB Engineering and Kimley-Horn.

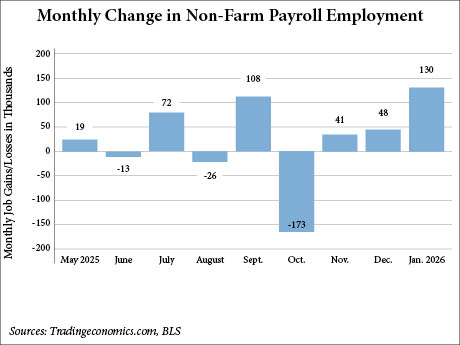

WASHINGTON, D.C. — The U.S. economy has added 130,000 new jobs in January, according to the delayed employment summary from the U.S. Bureau of Labor Statistics (BLS). The gain more than doubles the expectations from Dow Jones economists, who forecasted 55,000 new jobs to be added, according to CNBC. The unemployment rate also came in better than expected, declining by 10 basis points to 4.3 percent. Additionally, the BLS made minimal revisions from November and December. Combined the revisions totaled 17,000 fewer jobs. Among employment sectors, healthcare led the pack in January by adding 82,000 jobs. Within the sector employment was concentrated in ambulatory services (50,000), hospitals (18,000) and nursing and residential care (13,000). Job growth in healthcare averaged 33,000 jobs in 2025, according to the BLS. Other sectors that saw significant gains in January include social assistance (42,000) and construction (33,000). Federal government employment continued to decline, with 34,000 job losses registered in January. The BLS notes that some federal employees who accepted a deferred resignation offer in 2025 officially came off federal payrolls last month. Since reaching a peak in October 2024, federal government employment is down by 327,000, or 10.9 percent. Many of the job cuts can …