TAMPA, FLA. — Costis-Lifsey Development LLC and American Land Ventures LLC have announced plans to develop Residences at Rocky Point, a $187 million apartment high-rise located at 2425 Rocky Point Drive in Tampa. The 21-story tower is being constructed on the waterfront site of the Rusty Pelican restaurant. Designed by Cube 3 and RSP Architects, the 252-unit apartment tower will feature units with two-level floorplans averaging 1,175 square feet in size. Amenities will include a structured parking garage, two-story lobby, a waterfront infinity pool, beachside cabanas and a rooftop area headlined by an 8,000-square-foot restaurant. The design-build team, which includes civil engineer Kimley-Horn, plans to break ground in early 2027 and wrap up construction by mid-2028.

Southeast

Dwight Mortgage Trust Funds $110M Refinancing for LC Line and Low Apartments in Charleston

by John Nelson

CHARLESTON, S.C. — Dwight Mortgage Trust, an affiliate of Dwight Capital, has provided a $110 million bridge loan for the refinancing of LC Line and Low, a new 277-unit apartment development in Charleston. Brandon Baksh, Noah Greenwald and Talisse Thompson of Dwight Mortgage Trust originated the loan on behalf of the sponsor, Lifestyle Communities, which will use the loan to refinance existing construction debt and fund remaining construction expenses. LC Line and Low features a main residential building, train shed with loft-style apartments, historic single-family homes with private courtyards and seven retail suites totaling 15,000 square feet. The retail component houses tenants including The Goat Restaurant & Bar and Morning Ritual Coffee Shop, with another restaurant and a cocktail bar in the planning stages. Amenities include a resort-style pool, clubhouse, fitness center with saunas and cold plunges, coworking lounge and a parking deck.

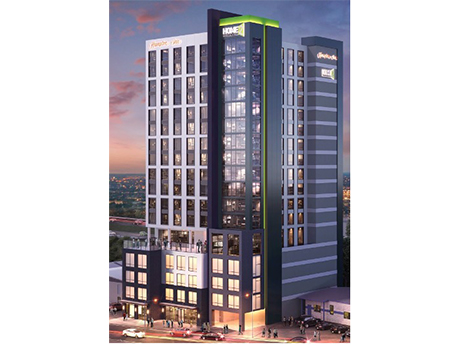

Arriba Capital Provides $67M Construction Loan for Dual-Branded Hotel Project in Nashville

by John Nelson

NASHVILLE, TENN. — Arriba Capital has provided a $67 million construction loan for a dual-branded hospitality project in Nashville’s East Bank district. The hotel development, which will sit adjacent to Oracle’s upcoming $2 billion campus, will feature rooms branded under Hilton’s Home2 Suites and Hampton Inn flags. The borrower is a Southeast-based developer that plans to deliver the hotel project in early 2027.

JACKSONVILLE, FLA. — Falcone Group has begun leasing Momentum Blanding, a 240-unit apartment development located at 6136 Blanding Blvd. in Jacksonville’s Westside neighborhood. The $50 million property will feature a mix of one-, two- and three-bedroom apartments featuring open-concept layouts. Monthly rental rates are expected to start from the $1,300s for one-bedroom units. Amenities will include a resort-style swimming pool, clubhouse with a game room, business center, coffee bar, resident lounge, yoga studio, fitness center, playground and a pet park. Falcone Group expects initial move-ins to begin in September, with preleasing incentives including up to three months of free rent for early residents. Construction is scheduled for completion in early 2026. Falcone has tapped Rentyl Apartments & Homes to oversee leasing and property management at Momentum Blanding.

APOPKA, FLA. — Wyld Oaks, a 255-acre mixed-use development underway in Central Florida, has announced new additions to its “co-creator” team. The project is located at the intersection of State Road 429/Western Beltway and West Kelly Park Road in Apopka. The company has added AdventHealth, a health system that operates 17 hospitals and freestanding emergency rooms, to the mix at Wyld Oaks. Other new additions include homebuilder Onx Homes and a retail market dubbed Wyld Provisions. “Having world-class organizations like AdventHealth, Onx Homes and Wyld Provisions join our community validates our position as Central Florida’s premier destination for forward-thinking partners who recognize the unique opportunity to be part of something transformative,” says Joseph Beninati, founder of Wyld Oaks.

When people think of Memphis, they often picture its musical legacy, its storied riverfront and its role as a logistics powerhouse. But fewer realize that Memphis is also quietly becoming one of the Southeast’s most dynamic retail markets. Despite headwinds that have impacted large-format retailers nationally, Memphis continues to attract new-to-market brands, redevelop aging assets and create spaces that resonate with today’s consumers. Economic foundations Memphis is riding a wave of transformational investment across multiple sectors. Ford Motor Co.’s $5.6 billion Blue Oval City, where the company’s all-electric truck and battery plant will be built, is already reshaping the regional economy. Google’s announcement of a 1,178-acre, $10 billion data center and office campus in nearby West Memphis in Arkansas adds another layer of momentum, as does the creation of the world’s largest supercomputer by xAI. Coupled with St. Jude’s $10 billion expansion, these projects underscore the region’s growth trajectory and long-term employment base. In retail, the past year brought a temporary pause in net absorption, with approximately 317,000 square feet coming back to the market — primarily due to national big-box closures like Macy’s, Joann Fabrics and Big Lots. Yet these macro shifts don’t tell the whole story. By the …

ALPHARETTA, GA. — National developer Portman Holdings has acquired Brookside Office Park, a 266,000-square-foot development located in the northern Atlanta suburb of Alpharetta with plans to undertake a mixed-use redevelopment. The seller and sales price weren’t disclosed, but the Atlanta Business Chronicle reports that an affiliate of Bridge Commercial Real Estate sold the property for $27 million. Brookside Office Park consists of two buildings on a 20-acre site that were originally constructed in the 1980s. Portman plans to retain one 130,000-square-foot building, raze the other and pave the way for a proposed vision that includes 335 multifamily residences, 70 townhomes and 60,000 square feet of retail and restaurant space. Townhome prices will start at roughly $650,000, according to reports from the Atlanta Business Chronicle. The redevelopment will also feature activated public gathering areas, pedestrian connections and outdoor amenities that promote walkability and community engagement. Portman received unanimous approval from the Alpharetta City Council in April to transform the site into a mixed-use destination. Construction is expected to begin in 2026, with completion anticipated in 2029. “With Brookside, we’re taking an older office campus and giving it new life, keeping the best of what’s there while bringing in housing, retail and spaces …

ORLANDO, FLA. — Global energy technology leader Siemens Energy has signed a lease totaling more than 242,000 square feet to relocate its Orlando offices to 6876 Marwick Lane within Lake Nona Town Center’s newest office building. The company will transfer its existing Alafaya Trail workforce to Lake Nona by 2027. Siemens’ lease is now considered the largest office lease in Orlando since 2009 and among the top three biggest in the city’s history, according to CoStar Group. Lake Nona Town Center was planned and developed by Tavistock Development Co.

PORT ST. LUCIE, FLA. — PEBB Enterprises and Banyan Development have broken ground on a 134,000-square-foot Lowe’s Home Improvement store at Shoppes at Southern Grove, a 23-acre shopping center located in the master-planned community of Tradition in Port St. Lucie. The new Lowe’s store will feature a garden center and is scheduled for completion in 2026. In addition to Lowe’s, the Shoppes at Southern Grove will feature six outparcels that are currently under lease negotiations.

LAKE WORTH, FLA. — The Milestone Group has acquired Casa Brera at Toscana Isles, a 206-unit apartment complex located in Lake Worth, approximately 35 miles north of Fort Lauderdale. The purchase price was not disclosed. Hampton Beebe and Avery Klann of Newmark marketed the property on behalf of the undisclosed seller. Casa Brera at Toscana Isles offers one-, two- and three-bedroom floorplans, ranging in size from 870 square feet to 1,430 square feet, according to Apartments.com. Amenities include a resort-style swimming pool, fitness center, clubhouse, social lounge, private movie theater, entertainment bar, multi-purpose sports court and a dog park.