ALPHARETTA, GA. — National developer Portman Holdings has acquired Brookside Office Park, a 266,000-square-foot development located in the northern Atlanta suburb of Alpharetta with plans to undertake a mixed-use redevelopment. The seller and sales price weren’t disclosed, but the Atlanta Business Chronicle reports that an affiliate of Bridge Commercial Real Estate sold the property for $27 million. Brookside Office Park consists of two buildings on a 20-acre site that were originally constructed in the 1980s. Portman plans to retain one 130,000-square-foot building, raze the other and pave the way for a proposed vision that includes 335 multifamily residences, 70 townhomes and 60,000 square feet of retail and restaurant space. Townhome prices will start at roughly $650,000, according to reports from the Atlanta Business Chronicle. The redevelopment will also feature activated public gathering areas, pedestrian connections and outdoor amenities that promote walkability and community engagement. Portman received unanimous approval from the Alpharetta City Council in April to transform the site into a mixed-use destination. Construction is expected to begin in 2026, with completion anticipated in 2029. “With Brookside, we’re taking an older office campus and giving it new life, keeping the best of what’s there while bringing in housing, retail and spaces …

Southeast

ORLANDO, FLA. — Global energy technology leader Siemens Energy has signed a lease totaling more than 242,000 square feet to relocate its Orlando offices to 6876 Marwick Lane within Lake Nona Town Center’s newest office building. The company will transfer its existing Alafaya Trail workforce to Lake Nona by 2027. Siemens’ lease is now considered the largest office lease in Orlando since 2009 and among the top three biggest in the city’s history, according to CoStar Group. Lake Nona Town Center was planned and developed by Tavistock Development Co.

PORT ST. LUCIE, FLA. — PEBB Enterprises and Banyan Development have broken ground on a 134,000-square-foot Lowe’s Home Improvement store at Shoppes at Southern Grove, a 23-acre shopping center located in the master-planned community of Tradition in Port St. Lucie. The new Lowe’s store will feature a garden center and is scheduled for completion in 2026. In addition to Lowe’s, the Shoppes at Southern Grove will feature six outparcels that are currently under lease negotiations.

LAKE WORTH, FLA. — The Milestone Group has acquired Casa Brera at Toscana Isles, a 206-unit apartment complex located in Lake Worth, approximately 35 miles north of Fort Lauderdale. The purchase price was not disclosed. Hampton Beebe and Avery Klann of Newmark marketed the property on behalf of the undisclosed seller. Casa Brera at Toscana Isles offers one-, two- and three-bedroom floorplans, ranging in size from 870 square feet to 1,430 square feet, according to Apartments.com. Amenities include a resort-style swimming pool, fitness center, clubhouse, social lounge, private movie theater, entertainment bar, multi-purpose sports court and a dog park.

CONYERS, GA. — JLL Capital Markets has arranged a $44.1 million financing package comprising joint venture equity and debt for the development of Dogwood Logistics Center, a 388,960-square-foot industrial property under development in Conyers, about 24 miles east of downtown Atlanta. Bobby Norwood, Mark Sixour, Hamp Gibbs and Streeter Simmons of JLL secured a $25.4 million construction loan through Pinnacle Financial Partners on behalf of the developer, Holder Properties. Hartford Investment Management Co. (HIMCO) provided $18.7 million in joint venture equity. Scheduled to deliver in summer 2026, Dogwood Logistics Center will feature two shallow-bay, rear-load buildings spanning 205,265 square feet and 187,593 square feet. The facilities will offer 36-foot clear heights, concrete tilt-wall construction, 60-foot dock bay depths, 210- to 230-foot building depths and TPO roofing. Additionally, the property will provide two exits along I-20. Dogwood Logistics Center marks Holder Properties’ second industrial project in 2025 with Pinnacle Financial Partners and HIMCO.

ORLANDO, FLA. — CrossMarc Services has signed a lease with Sky Zone to anchor Waterbridge Downs, a 124,997-square-foot shopping center located in Orlando. The 42,000-square-foot active indoor entertainment park is slated to open in spring 2026 and will backfill the space formerly occupied by Big Lots. Sky Zone South Orlando will feature expanded launch slides, an enlarged toddler zone and dedicated space for after-school programs. Gabrielle Garcia will operate the new franchise location. Sky Zone South Orlando will join a mix of tenants at Waterbridge Downs that includes Family Dollar, The UPS Store, Aji Express Ceviche Bar and El Tenampa Mexican Restaurant.

Core Spaces, Capstone to Break Ground on 1,600-Bed Student Housing Development Near Georgia Tech

by Abby Cox

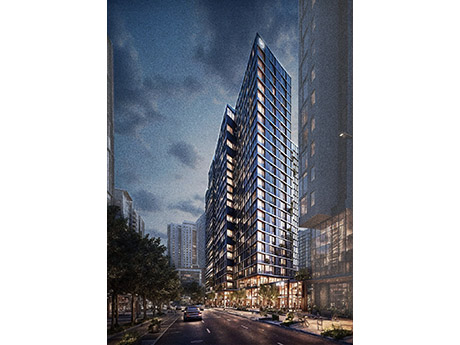

ATLANTA — A joint venture between Core Spaces and Capstone Communities is set to break ground on a multi-phase mixed-use project located near the Georgia Tech campus in Midtown Atlanta. The first phase of the development — which is being led by Core Spaces — will include 1,600 beds of student housing and 5,000 square feet of ground floor retail. The community will also feature a third-floor amenity deck. Dwell Design Studio has been selected as the architect for Phase I, which is scheduled for completion in 2029. Capstone Communities will lead Phase II of the project, a timeline for which was not released.

ORLANDO, FLA. — JLL Capital Markets has brokered the sale of M2 at Millenia, a 403-unit mid-rise, multifamily apartment complex in Orlando, which is adjacent to The Mall at Millenia. Ted Taylor and Kyle Butler of JLL’s Investment Sales and Advisory team represented the sellers, JSB Capital Group and BLD Group. The buyer, Independence Realty Trust, purchased the property for an undisclosed price. Built in 2019, M2 at Millenia is a five-story property offering a mix of one-, two- and three-bedroom floorplans ranging in size from 714 square feet to 2,214 square feet, according to Apartments.com. Amenities include a resort-style swimming pool, 24-hour fitness center, yoga studio, entertainment lounge with a kitchen and bar, outdoor grilling areas and 4,216 square feet of ground-floor retail space.

CHARLOTTE, N.C — CBRE has negotiated the sale of INQ @ 2401, a 162,372-square-foot office building located in the Crown Point neighborhood of Charlotte. Patrick Gildea, Matt Smith, Joe Franco and Stephanie Spivey of CBRE represented the sellers, DRA Advisors and Mainstreet Capital, in the transaction. Messer Financial, a long-term tenant that brought the property to full occupancy, was the buyer. The sales price was not released. Originally constructed in 1989 and renovated in 2016 with nearly a $6 million investment, the single-story building can now accommodate larger, back-office users and features 25-foot vaulted ceilings and direct tenant access.

ST. JOHNS, FLA. — SRS Real Estate Partners has arranged the $5.6 million sale of Beachwalk Shoppes, an 8,200-square-foot retail strip center located in St. Johns, a suburb of Jacksonville. The newly constructed retail center is part of the larger 1,200-acre mixed-use Beachwalk project currently under development. The property was fully leased at the time of sale to five tenants: Bagels R Us, Goin’ Postal, Fancy Sushi, Deca Dental and Playa Bowls. Patrick Nutt and William Wamble of SRS Capital Markets represented the seller, a national development and investment firm, in the transaction. The buyer was an Atlanta-based private investor. Both parties requested anonymity.