MIAMI — Bridge Industrial has received $77.6 million in permanent financing for Bridge Point AVE, a nearly 600,000-square-foot industrial park located within the master-planned development of AVE Aviation and Commerce Center in Miami. Steve Roth and Bill Jurjovec of CBRE’s Debt & Structured Finance group arranged the loan. According to public records, State Farm Life Insurance Co. is the lender. Bridge Point AVE features three buildings that span 199,800 square feet, 110,588 square feet and 279,499 square feet. Each building includes 24- to 36-foot clear heights, ESFR sprinkler systems and a mix of rear-load and cross-dock configurations to support tenant flexibility. The property was 95 percent occupied at the time of financing, with roughly 30,286 square feet available for lease. The AVE Aviation and Commerce Center spans 180 acres and features more than 2 million square feet of industrial warehouse and retail amenities.

Southeast

Berkadia Arranges $60.8M in Construction Financing for Mosaic Pooler Apartments Near Savannah

by John Nelson

POOLER, GA. — Berkadia has arranged $60.8 million in construction financing for Mosaic Pooler, a 333-unit multifamily community located within the Mosaic Town Center mixed-use development in Pooler, a western suburb of Savannah. The borrower, an affiliate of Bayline Group, acquired the 12-acre site at 800 High Ave. in 2023. Bank OZK provided a $47.5 million, three-year, floating-rate loan to Bayline Group. Berkadia also lined up $13.3 million in preferred equity through FCP. Mitch Sinberg, Scott Wadler, Bryan Brown, Robert Falese and Jake Adoni of Berkadia arranged the financing on behalf of Bayline Group. Upon completion, which is slated for May 2026, Mosaic Pooler will offer a mix of one-, two- and three-bedroom units, as well as three-story carriage houses with garages. Amenities at the property include a fitness center with a yoga room, game room and resident lounge, coworking spaces, a dog park and pet spa, package locker system, electric vehicle charging stations and a resort-style pool with a large outdoor patio, cabanas and grilling stations.

Curran Young Completes Construction of 412-Unit Multifamily Community in Cape Coral, Florida

by John Nelson

CAPE CORAL, FLA. — Curran Young Construction has completed Siesta Lakes, a 412-unit multifamily community located in Cape Coral, about nine miles west of Fort Myers, Fla. Construction for the project began in 2023 after the developer, a partnership between Shoreham Capital, Bridge Investment Group and Wynkoop Financial, received a $66 million construction loan. Siesta Lakes offers a mix of one-, two-, and three-bedroom floorplans with open-concept interiors, private balconies and direct views of a private central lagoon. Unit sizes range in size from 676 square feet to 1,195 square feet, according to Apartments.com. Monthly rental rates at the complex begin at $1,500. Leasing at the community began in early 2025 after the delivery of the first building and clubhouse. Onsite amenities include a resort-style pool, fitness center, electric vehicle charging stations, business center, multipurpose room, dog park, outdoor grilling areas and walking trails. Additionally, Siesta Lakes is situated within a Qualified Opportunity Zone and benefits from a long-term tax abatement from the city.

Trout Daniels & Associates Brokers $4.9M Sale of Bedford Square Office Portfolio in Metro Baltimore

by John Nelson

PIKESVILLE, MD. — Trout Daniels & Associates (TD&A) has brokered the $4.9 million sale of Bedford Square I and II, a 40,773-square-foot, two-building office portfolio located in Pikesville, roughly 15 miles northwest of Baltimore. Situated at the intersection of Bedford Avenue and McHenry Road, the complex was 93 percent leased to 20 tenants at the time of sale. Gilbert Trout of TD&A represented the seller, Bedford Square Equities, and procured the buyer, Tide Realty Capital, in the transaction.

Five years after the world shut down, the national multifamily market is still on a roller coaster ride. After the highs of 2021 quickly turned into the lows of 2023, the dust settled in 2024. Today, the market has begun to reactivate while continuing to grapple with the aftereffects of the run-up. While national multifamily transactions soared 22 percent in 2024, Atlanta transaction volume was flat year-over-year as the investment community shifted a favorable view of Atlanta toward ambivalence. Perceptions surrounding new supply and non-paying tenants contributed to the city falling out of vogue with some investors, but Atlanta is a resilient market. With new deliveries having peaked in 2024 and property-level fundamentals rapidly turning the corner, Atlanta may be beaten up, but the light at the end of the tunnel is coming into focus: Atlanta is still a long-term winner. Days of peak supply are over While Atlanta experienced a record 24,000 units delivered in 2024, that figure represents just 4 percent of its total inventory. When compared to other Sun Belt markets like Charlotte (10 percent of total inventory delivered in 2024), Nashville (8 percent) and Dallas (5 percent), the number doesn’t seem as jarring. Looking ahead to …

Hines, Urban Street Development Top Off Second Multifamily Building at $500M FAT Village in Fort Lauderdale

by John Nelson

FORT LAUDERDALE, FLA. — Hines and Urban Street Development (USD) have completed vertical construction of the second multifamily building at FAT Village, an 835,000-square-foot, $500 million mixed-use development in Fort Lauderdale’s Flagler Village neighborhood. Upon completion of Phase I, FAT Village will feature 80,000 square feet of experiential retail, a 1,200-space commercial parking structure and 600 residential units across two multifamily buildings, the first of which was topped out in March. Later this year, Hines and USD will top off T3 FAT Village, a 180,000-square-foot mass timber office building. T3 (which is named for timber, transit and technology) is slated for completion in 2026. Blanca Commercial Real Estate is leading pre-leasing efforts for the office space.

SANDY SPRINGS, GA. — A partnership between High Street Residential (HSR), the residential subsidiary of Trammell Crow Co. (TCC), and Third & Urban have announced plans for the development of Hillcrest, an 8.1-acre mixed-use development located in the Atlanta suburb of Sandy Springs. Scheduled to break ground this month, the project will feature 362 apartment units, 30 for-rent townhomes and more than 18,000 square feet of retail space. In collaboration with the seller, Sandy Springs United Methodist Church, proceeds from the sale will fund capital improvements to the church’s primary campus. Improvements will also be made to the surrounding street infrastructure, adding on-street parking and connected walkability to the area. The project team will include Cooper Carry (architect), Square Feet Design (retail consultant and interior designer), New South Construction (general contractor), Citizens Bank (lender) and Wesley Community Development (church advisor). Amy Fingerhut of CBRE is handling leasing negotiations. The townhomes will offer two- and three-bedroom floorplans with two-car garages and rooftop patios, while the apartment building will measure up to five stories tall and feature a parking garage with more than 100 public parking spaces. Amenities at the apartment will include a rooftop swimming pool and clubroom, golf simulator lounge, …

WASHINGTON, D.C. — Pearlmark has provided a $58 million mezzanine loan for the development of Portals IV, a 356-unit multifamily project underway in the Southwest Waterfront neighborhood of Washington, D.C. Pearlmark originated the loan via its investment fund, Pearlmark Mezzanine Realty Partners VI LP. David Webb and John Rehberger of CBRE arranged financing for the development, along with Mark Witt of Pearlmark. Kennedy Wilson provided the senior loan. The borrower and developer is Republic Properties, a subsidiary of the Republic Family of Cos. Portals IV is situated within walking distance of two Metro stations and will be the final addition to the Portals complex, a 3 million-square-foot mixed-use development that comprises three office buildings, one luxury apartment building and a hotel. Amenities at Portals IV will include a rooftop swimming pool and walkway, resident package locker room with dry cleaning pickup, fireplace lounge, fitness center and spin room, library, golf simulator, game room, coworking spaces, concierge services and a rooftop amenity lounge on the 13th floor. Outdoor grilling stations, private dining rooms, commercial laundry facilities and a coffee bar will also be available for resident use.

MIAMI — JLL Capital Markets has arranged the sale of Airport Trade Center, a 371,976-square-foot light-industrial portfolio in Miami. Situated adjacent to the Miami International Airport, the site features three cross-dock buildings that sit on 13.8 acres. Luis Castillo, Cody Brais and Taylor Osborne of JLL’s Investment Sales and Advisory team represented the undisclosed seller in the transaction. Melissa Rose and Jovi Rodriguez of the firm’s Debt Advisory team secured acquisition financing on behalf of the buyer, East Capital Partners.

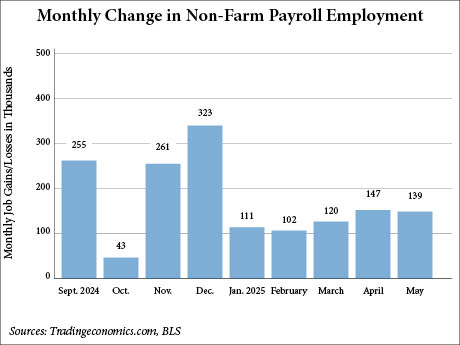

WASHINGTON, D.C. — The U.S. Bureau of Labor Statistics (BLS) has reported that U.S. employment growth totaled 139,000 jobs in May, slightly ahead of the 125,000 jobs that Dow Jones economists predicted, according to CNBC. The figure is also in line with the average monthly gain of 149,000 over the previous 12 months. The U.S. unemployment rate remained unchanged from April at 4.2 percent. The federal government lost 22,000 jobs in May, according to the BLS. Employment for the U.S. government has dwindled by 59,000 since January. The Trump administration, aided by its newly established Department of Government Efficiency (DOGE), has cut federal government jobs in an effort to improve efficiency and reduce government spending. The healthcare sector led all categories at 62,000 jobs added in May, with jobs gains occurring in in hospitals (+30,000), ambulatory health care services (+29,000) and skilled nursing care facilities (+6,000). The average monthly job gain in the healthcare sector over the previous 12 months is 44,000. Other sectors that saw job growth in May include leisure and hospitality (+48,000), local government (+21,000) and social assistance (+16,000). Employment showed little change in industries including mining, quarrying, and oil-and-gas extraction; construction; manufacturing; wholesale trade; retail trade; …