COLUMBIA, S.C. — Hunter Hotel Advisors has brokered the sale of a dual-branded hotel in downtown Columbia. An unnamed, institutional buyer purchased the asset from CN Hotels for an undisclosed price. Built in 2019 near the University of South Carolina and the South Carolina State House, the 223-room hotel is dually branded to Hilton Garden Inn and Home2 Suites and features an indoor pool, fitness center and an onsite restaurant. Mayank Patel of Hunter’s Atlanta office represented the seller in the transaction.

South Carolina

CHARLESTON, S.C. — Patterson Real Estate Advisory Group has arranged the refinancing of Charleston Tech Center, an 88,000-square-foot office building in Charleston. MetLife Investment Management, the institutional asset management arm of MetLife Inc., provided the undisclosed amount of financing. The borrowers, Iron Bridge Capital and Hunt Cos., delivered the six-story building in 2021. The property was 84 percent leased at the time of financing to tenants including Charleston Digital Corridor, a city-backed technology incubator that occupies the full second floor (17,000 square feet); Conrex, a single-family rental platform owned by Brookfield (15,000 square feet); and Insight Global, a tech staffing firm (7,000 square feet). Charleston Tech Center is located in Charleston’s Upper Peninsula adjacent to the city’s historic district and near I-26 and US Highway 17. In addition to modern offices, Charleston Tech Center includes ground-level retail space, rooftop amenity space, conference spaces, bike racks and showers.

PENDLETON, S.C. — QR Capital, a multifamily and student housing owner-operator based in Atlanta, has sold The Villages at Town Creek, a 244-bed student housing community located near Clemson University in Pendleton. Built in 2010, the property offers 61 townhome-style units in three-, four- and five-bedroom configurations. Shared amenities include a resort-style swimming pool, study lounge, coffee bar, fire pit, hammock garden, sand volleyball court and a car wash station. Jaclyn Fitts, William Vonderfecht, Casey Schaefer, David Lansbury and Erika Maston of CBRE arranged the sale on behalf of QR Capital. The buyer and sales price were not disclosed.

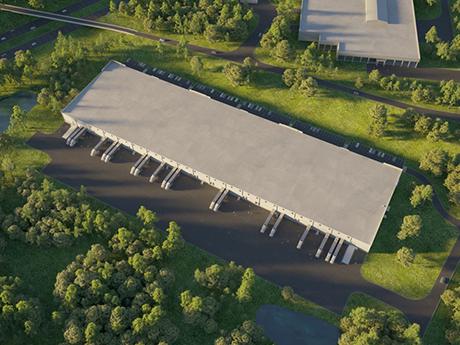

Hunt Midwest Breaks Ground on 258,801 SF Industrial Facility in Upstate South Carolina

by John Nelson

ANDERSON, S.C. — Kansas City-based Hunt Midwest has broken ground on a 258,801-square-foot industrial facility within the new Evergreen Logistics Park, an industrial campus spanning 200 acres in Upstate South Carolina. Located at 1105 Scotts Bridge Road in Anderson, the new facility will feature 36-foot clear heights, an ESFR sprinkler system, motion-sensor LED lighting, 26 dock doors, 60-foot speed bays, four drive-in doors, more than 200 parking stalls, up to 77 tractor-trailer parking spots and a 185-foot truck court. Hunt Midwest expects to deliver the building by the end of the year. At full capacity, Evergreen Logistics Park will span 2 million square feet and offer immediate access to I-85 and a major FedEx terminal. Hunt Midwest has selected Seamon Whiteside for civil engineering, LS3P for building design, CBRE for leasing and Evans General Contractors as the general contractor.

IPA Brokers $18.2M Sale of Port Royal Plaza Shopping Center in Hilton Head, South Carolina

by John Nelson

HILTON HEAD, S.C. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has brokered the $18.2 million sale of Port Royal Plaza, a 90,860-square-foot shopping center in Hilton Head. The property’s anchor tenants include Planet Fitness and AutoZone. The seller, an entity doing business as GFB Associates LLC, sold the center to Ronicks LLC, a private investor based in Tennessee. Zach Taylor of IPA brokered the transaction. “Port Royal Plaza is a landmark center on the north end of Hilton Head Island,” says Taylor. “The real estate is irreplaceable. We saw strong demand for this center and closed right at our guidance.”

Core Spaces, Tom Winkopp Development Plan 4,000-Bed Clemson Student Village at The Pier

by Jeff Shaw

CLEMSON, S.C. — Core Spaces and Tom Winkopp Development have formed a joint venture to develop Clemson Student Village at The Pier, a 4,000-bed student housing community located on a 140-acre plot near Clemson University. The project is an extension of The Pier, a project that has already added 1,400 beds to Clemson’s student housing supply. Amenities at the new project include athletic and fitness facilities, pools, outdoor grills, student clubhouses, beachfront access to Lake Hartwell and waterfront trails. Once fully constructed, the site will feature “a new downtown locale that is walkable, charming and accessible to all students and the local community,” according to the developers. “This project is among the most ambitious in our history,” says Daniel Goldberg, president of Core Spaces. “Clemson, South Carolina has experienced significant population growth due to its high quality of living, affordability, picturesque downtown and favorable year-round climate, as well as Clemson University’s strong enrollment rates.” In addition to the more traditional student housing beds, the development will feature clusters of single-family homes for rent as the builders seek to create student neighborhoods within the project. Each of these will feature nine bedrooms. The student village is one piece of a larger …

CREC Real Estate, Rincon Capital Partners Acquire Planters Trace Apartments in Charleston

by John Nelson

CHARLESTON, S.C. — CREC Real Estate LLC and Rincon Capital Partners have acquired Planters Trace Apartments, a 96-unit, Class B multifamily community located in the West Ashley submarket of Charleston. The seller and sales price were not disclosed. The 10.6-acre property, built in 1974 and located at 2222 Ashley River Road, has convenient access to nearby jobs, retail and entertainment. The buyers plan to invest $2.8 million in value-add renovations to update common areas, amenities and unit interiors. The property currently features a pool, communal firepit and garden, laundry room, grilling area and a dog park.

Build-to-RentConference CoverageDevelopmentFeaturesMultifamilyNorth CarolinaSingle-Family RentalSouth CarolinaSoutheastSoutheast Feature Archive

Speed to Market is ‘Almost the Only Priority’ for Multifamily Developers Looking to Avoid Cost Risks, Say InterFace Panelists

by John Nelson

CHARLOTTE, N.C. — Multifamily developers are pushing their chips in and aggressively looking for new development deals, especially for sites in and around high-growth markets in the Southeast. Michael Tubridy, senior managing director of Crescent Communities, said his firm isn’t leaving anything to chance and is looking to move quickly on development opportunities. “We’re trying to get as many units on the ground today as possible, because tomorrow will be more expensive,” said Tubridy. “I like the chances of today’s cost environment a lot better than I like the unknown of where we’ll be a year from now or two years from now. Putting a premium on speed to market is something that we are much more focused on; it’s almost the only priority right now.” Tubridy’s comments came during the development panel at InterFace Carolinas Multifamily 2022. The half-day event was held on April 14 at the Hilton Uptown Charlotte hotel and attracted more than 260 attendees from all facets of the multifamily industry in North Carolina and South Carolina. Michael Saclarides, director of Cushman & Wakefield’s Multifamily Advisory Group, moderated the discussion. Crescent Communities is far from the only multifamily developer pursuing ground-up construction opportunities in earnest. In …

GAFFNEY, S.C. — Jalaram Hotels Inc. has opened the Holiday Inn Express Gaffney, an 81-room hotel located in Gaffney, a South Carolina town along Interstate 85 that is equidistant between Greenville and Charlotte. Providence, R.I.-based TPG Hotels, Resorts & Marinas operates the hotel, which is situated across from the Gaffney Outlet Mall. The Holiday Inn Express Gaffney features meeting space, complimentary breakfast, Wi-Fi, a business center, fitness center and an outdoor swimming pool. Jalaram Hotels is based in St. Augustine, Fla., and has several hotels in northeast Florida in its ownership and management portfolio.

PORT ROYAL, S.C. — Vivo Living has purchased a hotel located at 1660 Ribaut Road in Port Royal, a coastal town situated north of Hilton Head, S.C. The California-based buyer plans to convert the hotel into an apartment community named Vivo Port Royal. This will be Vivo’s third adaptive reuse multifamily project in South Carolina. The property will feature a living room lobby with complimentary Wi-Fi, lounge areas, a pool and a fitness center. Vivo Living says that the property will command a 10 to 20 percent discount compared with market-rate rents in the trade area. The seller was not disclosed.