GOODLETTSVILLE, TENN. — OSB Holdings LLC, an entity controlled by Nashville-based Gorney Realty Co., has acquired the Old Stone Bridge Industrial Portfolio at 300 Old Stone Bridge Road in Goodlettsville. Situated about 14 miles south of Nashville via I-65, the property comprises two shallow-bay service centers totaling 45,000 square feet. The buildings were 96 percent leased to 14 tenants at the time of sale. Steve Preston, Jack Armstrong and Will Goodman of CBRE represented the undisclosed seller in the transaction, and Gorney was self-represented. The sales price was not disclosed.

Tennessee

NASHVILLE, TENN. — Turnberry plans to develop and operate The St. Regis Nashville and The Residences at The St. Regis Nashville, a 39-story hotel-condo tower at 805 Demonbreun St. in Nashville. The property will span 740,000 square feet and feature 177 hotel rooms and 111 for-sale residences, as well as a fine-dining restaurant, lobby bar, three-meal restaurant, full-service spa and two amenity decks — one for hotel guests and one for residents. The design team includes architectural firm Morris Adjmi, interior designer Meyer Davis and architect of record Smallwood, Reynolds, Stewart, Stewart. St. Regis Hotels & Resorts is a brand within the Marriott International family. The property will be situated adjacent to the JW Marriott Nashville, which Turnberry delivered in 2018. The South Florida-based developer plans to break ground on St. Regis Nashville in 2025.

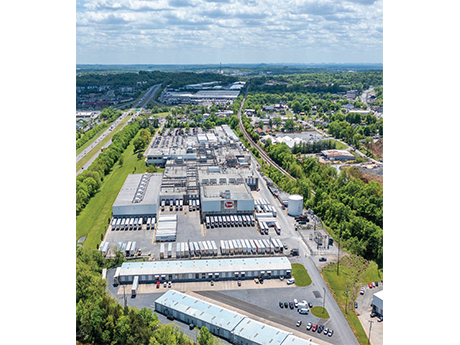

LOS ANGELES — Los Angeles-based PCCP LLC has provided a $102 million acquisition loan to Stoltz Real Estate Partners, a real estate fund manager based in Bala Cynwyd, Pa., for a five-property industrial portfolio in the Southeastern United States. John Alascio, Alex Hernandez, Chris Meloni, T.J. Sullivan and Mitch Rothstein of Cushman & Wakefield arranged the financing on behalf of Stoltz. The 1.6 million-square-foot portfolio is located within the Atlanta, Charleston, Charlotte, Louisville and Nashville MSAs. The properties were fully leased at the time of financing to seven tenants that had a weighted average lease term (WALT) remaining of 4.6 years. All five properties were developed between 2018 and 2023 and range in size from 157,000 to 636,000 square feet. The seller and sales price were not disclosed.

Annex Group, University of Memphis to Develop 540-Bed On-Campus Residence Hall for Student-Athletes

by John Nelson

MEMPHIS, TENN. — A public-private partnership between The Annex Group and the University of Memphis has announced plans to develop a 540-bed residence hall on the university’s campus in Tennessee. The community will offer a mix of studio, two- and four-bedroom units alongside 300 parking spaces. The property will target occupation by student athletes. Shared amenities will include study space, social gathering areas, outdoor living space and grab-and-go dining options. The community will be part of the university’s Park Avenue Campus development, which will include Tiger Park, an academic and athletic facilities complex that will be developed in phases over the next 10 years. “Living in the vicinity of where [our student-athletes] practice, compete and train will significantly enhance their experience, and a development like this sets our university apart when it comes to recruitment,” says Brooks Monaghan, the university’s head women’s soccer coach. The residence hall is expected for completion in fall 2026. The development team for the project includes architectural firm LRK.

Equitas Management Completes Renovation of 57,000 SF Office Building in Chattanooga, Tennessee

by John Nelson

CHATTANOOGA, TENN. — Equitas Management Group has completed renovations for One Park Place, a 57,000-square-foot office building located at 6148 Lee Highway in Chattanooga. The property is fully leased to tenants including Equitas Management and EMJ, a general contractor that oversaw the renovations as well as constructed the building originally in 1984. Other tenants include medical, legal and financial services tenants, among others. Designed by HK Architects, the renovations include a new sleek black exterior, updated atrium, modernized offices and conference spaces and a grand balcony.

NASHVILLE, TENN. — Noble Investment Group has acquired the Holiday Inn Express | Nashville Downtown hotel. The seller, number of rooms and sales price were not disclosed, but the Nashville Business Journal reports that the Atlanta-based investment firm paid approximately $82 million for the property. The publication also reports that the price is nearly a third less than what the previous owner paid for the property. Located at 920 Broadway in the city’s entertainment district, the hotel is located within walking distance of more than 100 live music venues, the Music City Center, Bridgestone Arena, more than 500 bars and restaurants and over 100 shopping outlets. The hotel’s physical amenities include an outdoor pool and a business center. “Nashville remains among the most dynamic growth markets in the country, with a highly diversified demand base across multiple segments,” says Dustin Fisher, vice president at Noble Investment Group. Nashville has been a consistent growth center in the Southeast for over 30 years, growing by more than 2 percent every year from 1991 to 2020, according to Macrotrends. The metro-area population more than doubled in that time, from 643,000 in 1994 to more than 1.3 million in 2024. — Taylor Williams

CHATTANOOGA, TENN. — Urban Story Ventures has acquired a 169,000-square-foot manufacturing facility located at 3800 Amnicola Highway in Chattanooga. New York City-based Arcade Beauty sold the property, which includes two buildings comprising 130,000 and 39,000 square feet, respectively. The larger building features climate-controlled areas and fire suppression, and the second building offers office and industrial flex space. Additionally, the site includes 9.8 acres of undeveloped land zoned for manufacturing. Urban Story will serve as the landlord and property manager for the site as Arcade Beauty transitions to a new location in Chattanooga. The sales price was not disclosed.

ALCOA, TENN. — SRS Real Estate Partners has brokered the $7.2 million sale of Alcoa Commons, a newly built retail center in Alcoa, a city roughly 14.5 miles south of Knoxville, Tenn. Situated at 1010-1020 Alcoa Market St., the 13,890-square-foot property was fully leased at the time of sale to tenants including Orangetheory Fitness, Eyeglass World, The Joint Chiropractic and a freestanding outparcel building occupied by First Watch. Patrick Nutt and William Wamble of SRS represented the seller, a Tennessee-based developer, in the transaction. The private buyer, a Chicago-based company, purchased Alcoa Commons in a 1031 exchange.

Cushman & Wakefield | Commercial Advisors Arranges Sale of 12-Story Memphis Office Building

by John Nelson

MEMPHIS, TENN. — Cushman & Wakefield | Commercial Advisors has brokered the sale of a Class B office building located at 2670 Union Ave. in the Midtown submarket of Memphis. According to LoopNet Inc., the 12-story property spans 119,213 square feet and tenants include Pearson Vue, Shelby County Community Service Agency and Lipscomb & Pitts Insurance LLC, which has exterior signage on the building. Landon Williams and Katie Hargett of Cushman & Wakefield | Commercial Advisors represented the sellers, an entity doing business as Union Office Center LLC and private investor Brett Kaye, in the transaction. The buyer, an entity doing business as 2670 Union Avenue Extended Building Owner LLC, purchased the building for an undisclosed price.

Capstone Real Estate Sells Former Student Housing Community in Murfreesboro, Tennessee

by John Nelson

MURFREESBORO, TENN. — Capstone Real Estate Investment has sold Landmark Apartments, a 264-unit community located near the Middle Tennessee State University campus in Murfreesboro. The property was acquired as a student housing project by the company in 2020 and underwent significant renovations, including the transformation of the community into traditional multifamily. Landmark Apartments offers one-, two- and three-bedroom units. The buyer in the transaction was not disclosed.