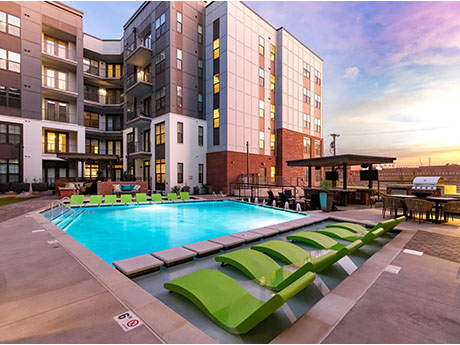

NASHVILLE, TENN. — Newmark has secured the sale of Alta Foundry, a newly built, 231-unit apartment community located at 640 21st Ave. N in Nashville’s Midtown district. Tarek El Gammal and Vincent Lefler of Newmark represented the seller and developer, Wood Partners, in the transaction. Blacksburg, Va.-based HHHunt purchased Alta Foundry, which was in lease-up and 75 percent occupied at the time of sale, for $86.6 million. Amenities include a rooftop sky lounge, resort-style saltwater pool and a covered outdoor entertainment and gaming lawn. Alta Foundry’s floor plans range from studio to two-bedroom units, and rental rates start at $1,751 per month, according to Apartments.com.

Tennessee

CHATTANOOGA, TENN. — Rise Partners has broken ground on North River Commerce Center, an 800,000-square-foot industrial park located on 88 acres in the northern portion of Chattanooga just south of Hixson, Tenn. The park, which will feature four buildings on three adjacent parcels, will be situated near downtown Chattanooga, I-75, I-24 and the existing Kordsa plant (formerly housing DuPont). The development will be able to accommodate distribution and manufacturing uses. Rise Partners, which has offices in Chattanooga and Charlotte, expects to deliver North River Commerce Center by fall 2023.

NASHVILLE, TENN. — Walker & Dunlop has negotiated the sale of Park Central, a 200-unit apartment community located at 220 25th Ave. N in Nashville’s Midtown district. Russ Oldham of Walker & Dunlop represented the unnamed seller and the buyer, Houston-based Dinerstein Cos., in the transaction. The sales price was not disclosed. Built in 2013 a couple blocks north of Vanderbilt University, Park Central features studio, one- and two-bedroom apartments, as well as a clubroom, fitness center and a sky deck with a heated rooftop pool overlooking Centennial Park. The eight-story apartment community also includes an adjacent parking garage.

Blue Vista, Westmount Realty Capital Buy 480,911 SF Shelby Oaks Industrial Park in Memphis

by John Nelson

MEMPHIS, TENN. — Blue Vista Capital Management and Westmount Realty Capital have acquired Shelby Oaks Industrial Park, a 480,911-square-foot portfolio of light industrial and flex properties located in the Northeast submarket of Memphis. Situated near the interchange of I-240 and I-40, the 50-acre park spans 16 buildings and was more than 95 percent leased at the time of sale to 78 tenants across the technology, telecommunications, manufacturing, service and food-and-beverage industries. Shelby Oaks’ buildings feature distribution, warehouse, office and showroom space with a total of 76 dock-high doors and 90 grade-level doors, as well as clear heights ranging from 14 to 22 feet. The seller and sales price were not disclosed.

Tennessee Titans, Local Government Agree to Terms for New $2.1B Enclosed Stadium in Nashville

by John Nelson

NASHVILLE, TENN. — The NFL’s Tennessee Titans and the Metropolitan Government of Nashville and Davidson County (Metro) have agreed to terms to bring a new $2.1 billion football stadium to Nashville’s East Bank district. The enclosed stadium will span 1.7 million square feet and will be situated near the Cumberland River to the east of the Titans’ current arena, Nissan Stadium. The site for the new stadium currently comprises surface parking lots. Once complete, the project will represent the largest building project in the Metro’s history and will attract marquee events such as the Super Bowl and CMA Fest country music festival, according to ESPN. “When my father brought this team to Tennessee 25 years ago, I don’t think he could have imagined a better home for our organization,” says Titans controlling owner Amy Adams Strunk. “The way the people of Tennessee have embraced this team as their own is truly something special, and I am thrilled that with this new agreement, we will cement our future here in Nashville for another generation.” Funding for the new stadium comprises four categories, with football-related sources (i.e. the Titans, the National Football League and personal seat license sales) representing the largest source …

NASHVILLE, TENN. — Alliance Residential Co. has opened Broadstone SoBro, a 226-unit apartment community located at 800 4th Ave. S. in Nashville. The property comprises studio, one- and two-bedroom luxury apartment units that are renting at $1,851 per month, according to the community’s website. Designed by Brock Hudgins Architects, Broadstone SoBro’s community amenities include a resort-style saltwater pool; an outdoor courtyard with grilling stations, fire pit, dining and lounge space; a fitness room featuring a local artist-commissioned mural; a terrace-level library featuring private and coworking spaces; dog spa; and a sky lounge wine bar including private seating areas, fireplace, record lounge and oversized balcony. The development is Alliance Residential’s sixth in the Nashville market.

CHATTANOOGA, TENN. — Colliers has arranged the sale of a 689,614-square-foot, single-tenant distribution center located at 960 Wauhatchie Pike in Chattanooga. New York-based W. P. Carey purchased the single-tenant property from locally based logistics firm Kenco Group for an undisclosed price. Tyler Ziebel, Jack Rosenberg, Fred Regnery, Todd Steffan and Andy Cates of Colliers brokered the deal. The property is fully leased to Chattem Chemicals Inc., a subsidiary of the French multinational pharmaceutical company Sanofi Aventis. The company recently signed a long-term lease extension at the facility, which W. P. Carey plans to expand by 120,000 square feet. The warehouse currently features 79 docks, 30-foot clear height ceiling and 10,000 square feet of office space. Once the $18 million expansion is complete, the facility will be Sanofi Aventis’ largest distribution facility in the world, according to Colliers.

CBRE Arranges Construction Financing for 12-Story Seniors Housing Development in Nashville

by John Nelson

NASHVILLE, TENN. — CBRE has arranged an undisclosed amount of financing for construction of The Crestmoor at Green Hills, a 12-story seniors housing community in Nashville’s Green Hills neighborhood. A joint venture between Bridgewood Property Co. and Harrison Street are developing the property, which will feature 117 independent living units, 45 assisted living units and 29 memory care units. Aron Will and Tim Root of CBRE National Senior Housing arranged the five-year construction loan through a regional bank. Bridgewood’s wholly owned management company, The Aspenwood Co., will operate the community upon completion.

Newmark Brokers $96.5M Sale of Alta Union Apartments in Nashville’s The Nations Neighborhood

by John Nelson

NASHVILLE, TENN. — Newmark has brokered the $96.5 million sale of Alta Union, a newly constructed, 283-unit apartment community located at 5800 Centennial Blvd. in Nashville. Weinstein Properties purchased the property from the developer, Wood Partners. Tarek El Gammal and Vincent Lefler of Newmark represented the seller in the transaction. Located in The Nations neighborhood, Alta Union features a two-story clubhouse with outdoor terraces on the second level, a swimming pool, courtyard, private offices for rent and individual and group coworking spaces.

Foundry Commercial Arranges 125,008 SF Office Lease at McEwen Northside in Nashville’s Cool Springs District

by John Nelson

FRANKLIN, TENN. — Foundry Commercial has arranged a 125,008-square-foot office lease at McEwen Northside, a 45-acre mixed-use campus in Nashville’s Cool Springs submarket. Located in the city of Franklin, the development features 1 million square feet of office space, 113,000 square feet of restaurants and specialty retail, a 150-room hotel, 770 luxury apartment units and green spaces. The tenant, procurement and supply chain management organization OMNIA Partners, will occupy all five floors of office space at the project’s Block A building starting in early 2023. The building also houses 19,000 square feet of retail and restaurant space on the ground level. OMNIA is relocating from its current headquarters, which is also in Franklin. Vince Dunavant of Foundry Commercial represented the tenant in the lease negotiations. The landlord is Boyle Investment Co., co-developer of McEwen Northside alongside Northwood Ravin.