MEMPHIS, TENN. — Marcus & Millichap has arranged the sale of Ashton Hills Apartments, a 200-unit complex in Memphis. Bryan Sisk, David Dorris and Brad Barham of Marcus & Millichap represented the seller, an Iowa-based limited liability company. The team also secured the buyer, an investment group out of Denver. The sales price was not disclosed. Built in 1975, Ashton Hills offers one-, two- and three-bedroom floorplans with a unit size range of 580 to 1,044 square feet. Unit features include washer and dryer hookups, vinyl flooring and walk-in closets. Community amenities include a pool, package service, maintenance onsite, property manager onsite, business center and a playground. The seller previously made significant upgrades to the property, according to Marcus & Millichap. Located at 4183 Troost Drive on 12.6 acres, Ashton Hills is situated 20.6 miles from Memphis International Airport and 13.9 miles from downtown Memphis.

Tennessee

After national media declared traditional brick and mortar retail to possibly be on it’s “last leg” due to the COVID-19 pandemic, the Nashville area has seem quite the opposite reaction. Already in an accelerated state of demand going into the shutdown of 2020 that extended into a malaise in 2021 in many places, Nashville is seeing all indicators of the hottest retail market in its history. Prior to the pandemic, rents and occupancy were already at historic highs. 2020 began with a continuance of that trend and ended the year higher with the most active submarkets closing the year below a 5 percent vacancy rate across all retail product types as the market absorbed more than 300,000 square feet of new product. During 2021, the region experienced further good news for landlords with rents increasing at one of the fastest rates in the United States (more than 8.8 percent). This continues a trend lasting more than 10 years where regional rent growth outpaced the national average. This growth was at least partially driven by a vacancy rate at year-end of only 3.7 percent. The primary driver of these metrics continues to be population growth and a low level of retail …

KNOXVILLE, TENN. — SRS Real Estate Partners’ Investment Properties Group has brokered the sale of Clinton Plaza, a 126,145-square-foot, grocery-anchored shopping center in Knoxville. LBD Properties LLC purchased the property for an undisclosed price. Kyle Stonis and Pierce Mayson of the SRS represented the undisclosed seller in the transaction. The buyer was self-represented. Anchored by Food City, Clinton Plaza’s tenant roster includes Advance Auto Parts, Dollar Tree, Gas ‘N Go, Rent-A-Center, ADMA Biologics, Metro by T-Mobile, 1st Heritage Credit and Cricket Wireless. Food City and Dollar Tree have been operating at the location for 22 years, and Rent-A-Center has been for 32 years. Advance Auto Parts, which is an outparcel at the property, has been a tenant since 1966. Located on Clinton Highway, the property is situated five miles from downtown Knoxville and 5.2 miles from the University of Tennessee campus.

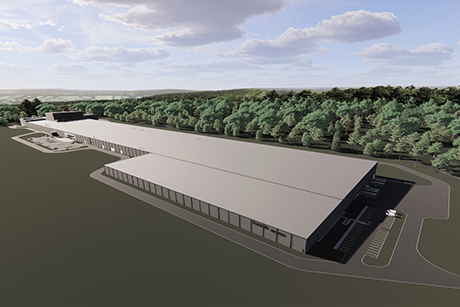

BAXTER, TENN. — Avison Young’s Capital Markets Group has arranged the sale-leaseback of a manufacturing facility in Baxter. The transaction totaled approximately $90 million. Timothy Hall, James Hanson and Tom Viscount of Avison Young arranged the sale-leaseback transaction. Chicago-based Oak Street Real Estate Capital will fund the construction and purchase the 965,000-square-foot facility, then lease it back to Portobello America, a tile manufacturer and distributor based in Brazil. Portobello America is building the plant and will use it to manufacture ceramic tiles and to house its U.S. headquarters. Portobello America will execute a long-term lease when construction is complete, which is expected in late 2022. The firm estimates the facility will create more than 200 local jobs and generate $150 million in annual revenue, as soon as the full capacity is reached, which is expected to occur by 2026. The 92-acre, build-to-suit project will include the main manufacturing, warehouse and office building, which will also contain the corporate headquarters and a showroom. The manufacturing plant will feature the latest green technologies to reduce the consumption of electricity, natural gas and water, according to the developer. The project site is situated on the south side of Interstate 40, about 70 miles …

KINGSPORT, TENN. — Marcus & Millichap has brokered the sale of Shoppes at East Stone, a 24,502-square-foot retail property in Kingsport. The property sold for $4.5 million. Michael Early of Marcus & Millichap represented the seller, an undisclosed family trust, and secured the buyer, a Maryland-based real estate investment corporation. Jody McKibben of Marcus & Millichap assisted in closing this transaction. Shoppes at East Stone is occupied by tenants including Polish Nail Bar, East Coast Wings + Grill, LL Flooring and Hertz Car Rental. Located at 2637 E. Stone Drive, the property is situated in northern Tennessee, about 102 miles from Knoxville. The property is also 13.6 miles from Tri-Cities Airport.

NASHVILLE, TENN. — Oracle, an Austin-based computer technology corporation, will lease space at Radius, a 265,564-square-foot office building in Nashville’s Gulch neighborhood. The tech company will use the office space as its new regional headquarters campus in Davidson County. Dallas-based Stream Realty Partners, which handles the building’s leasing and property management, and Sandeema Co. represented Oracle in the lease transaction. Radius, which previously was known as the Lifeway Plaza, is a nine-story building with six full-floor office spaces averaging 31,580 square feet that are available for lease. Oracle will occupy the fourth floor of the building. The building offers resort-style fitness facilities with lockers and showers, a tenant lounge, outdoor terrace, onsite security, café with grab-and-go items and ample parking. Located at 601 11th Ave. N., the office building is located 9.9 miles from Nashville International Airport and 2.5 miles from Belmont University.

CLEVELAND — Cleveland-based KeyBank Community Development Lending and Investment has provided a $74 million bridge loan for the acquisition of four Section 8 subsidized affordable housing properties in Tennessee. Matthew Haas, Timothy Gerstmann and Jonathan Woodland of KeyBank originated the financing. SDG Housing Partners, a Manhattan Beach, Calif.-based affordable housing development company, received the loan. The four properties include Ramblewood in Clarksville (112 units); Margaret Robinson in Hermitage (100 units); Ridgebrook in Knoxville (144 units); and Hickory Forest in Nashville (90 units). The borrower will be seeking bonds and 4 percent LIHTC credits to be moderately renovated and units upgraded in the next 12 to 18 months with agency financing provided by KeyBank.

ATLANTA — Atlanta Property Group has acquired three distribution facilities in the metro areas of Atlanta, Nashville and Charlotte totaling 545,000 square feet. The sellers and sales price were not disclosed. The three properties include Oates Crossing in Mooresville, N.C.; 5470 Oakbrook Parkway in Norcross, Ga.; and 109 Kirby Drive in Portland, Tenn. Oates Crossing is a 240,000-square-foot industrial park that is fully leased to a diverse tenant base. The site also includes a fully zoned, 8.3-acre parcel that can support an additional 60,000-square-foot industrial building, which Atlanta Property Group plans to build soon. The property is situated along Interstate 77, about 29.7 miles north of Charlotte. The next property, 5470 Oakbrook Parkway, is an 85,000-square-foot shallow-bay industrial building. The facility is situated close to Interstate 85 and is about 21 miles north of downtown Atlanta. The property was 88 percent leased at the time of sale. Built in 1990, 109 Kirby Drive is a 220,000-square-foot, single-tenant warehouse that features 17 dock doors. The fully leased property is situated about 39.7 miles from Nashville and has immediate access to Interstate 65.

Welltower Acquires 33-Property Seniors Housing Portfolio for $548M, Plans Two Developments in Silicon Valley

by Jeff Shaw

TOLEDO, OHIO — Welltower Inc. (NYSE: WELL), a Toledo-based healthcare REIT, has agreed to acquire 33 seniors housing communities totaling 2,787 units in Michigan, Ohio and Tennessee. The purchase price is $548 million. The communities will be acquired as three separate portfolios from undisclosed sellers. The communities were available for purchase because the lease-up process was heavily damaged by the onset of the COVID-19 pandemic. With occupancy at only 63 percent, Welltower expects the communities will greatly improve their performance in 2023 and beyond. Welltower will install Michigan-based senior living operator StoryPoint to manage the communities under a RIDEA agreement. The acquisition is expected to be funded through the issuance of partnership units, assumed debt and cash on-hand. Simultaneously with the acquisition announcement, Welltower unveiled a development partnership with a joint venture between Related Cos. and Atria Senior Living to develop two seniors housing communities in Silicon Valley. One will be located in Santa Clara and the other in Cupertino. Welltower suggests these developments are just the first projects of many for the partnership. The Santa Clara development will consist of 191 units next to a fully entitled, 9.2 million-square-foot urban development that Related began building in 2015. The larger project, …

NASHVILLE — Xenia Hotels & Resorts (NYSE: XHR), an Orlando-based hospitality REIT, has agreed to acquire the 346-room W Nashville hotel for $328.7 million. The sales price equates to roughly $950,000 per room. The seller and developer of the 14-story hotel, which opened in October 2021 in the city’s Gulch neighborhood and is part of the Marriott family of brands, was not disclosed. The deal is scheduled to close by the end of the first quarter. The W Nashville features six food and beverage options, including two concepts by Chef Andrew Carmellini, as well as rooftop and pool bars. The property also offers 18,000 square feet of indoor meeting and event space and 26,000 square feet of outdoor amenity space, including a 10,000-square-foot pool deck and terraces contiguous with meeting, food and beverage and event spaces. The hotel’s offering of guestrooms includes 60 suites, representing about 17 percent of the total room count. “We are thrilled to have reached an agreement to acquire an outstanding, newly constructed luxury lifestyle hotel located in the desirable Gulch neighborhood in the heart of Nashville,” says Marcel Verbaas, Xenia’s chairman and CEO. “The W Nashville is extremely well-designed and perfectly situated to attract year-round …