FRANKLIN, TENN. — A joint venture between Boyle Investment Co., Northwood Investors and Northwood Ravin has opened Block E, a new 300,000-square-foot mixed-use building in Franklin, a city in Nashville’s Cool Springs district. The nine-story, $125 million property is one of the anchors of the McEwen Northside mixed-use development. Block E features a modern training room, full-service fitness center, offices, ground-level retail space and a parking garage. Office tenants include TMPartners PLLC, also the project’s architect, and Designed Conveyor Systems, a supply chain company. Retail tenants include Culinary Dropout, Oak Hall and Hawkers Asian Street Food. In addition to TMPartners, the design-build team includes civil engineer Kimley-Horn and general contractor Hoar Construction. Northwestern Mutual partnered with Boyle Investment, Northwood Investors and Northwood Ravin on the project.

Tennessee

Embrey Secures Construction Financing for 296-Unit Luxury Apartment Community in Franklin, Tennessee

by Abby Cox

FRANKLIN, TENN. — San Antonio-based Embrey has secured financing for Thatcher at Aureum, a 296-unit luxury apartment complex located within the master-planned development of Aureum in Franklin, a suburb in Nashville’s Cool Springs neighborhood. Garrett Karam and Brad Knolle of Embrey internally originated the loan through Texas Capital. Construction of the development will begin immediately, with first occupancies anticipated for third-quarter 2027. Thatcher at Aureum will span roughly 3.8 acres and will offer studio, one-, two- and three-bedroom floorplans. Residents will have access to a private clubhouse and lounge with micro-offices and conference space, a podcast studio, game room and grab-and-go market. Other amenities will include a resort-style swimming pool with a spa, private cabanas and grilling areas, as well as a rooftop terrace, gaming lawn, fitness center and yoga studio. The community will also feature a pet spa, pet park, bike storage, repair shop and a 24-hour package room with refrigeration. Additionally, the project will restore and preserve a historic stone wall on the site to commemorate the City of Franklin’s heritage.

Brookdale Senior Living, Largest U.S. Seniors Housing Operator, Names Nick Stengle as CEO

by John Nelson

BRENTWOOD, TENN. —Brookdale Senior Living Inc. (NYSE: BKD), the country’s largest seniors housing operator, has named Nick Stengle as its new chief executive officer. Stengle will assume the role, as well as join the Brookdale board of directors, effective Oct. 6. Denise Warren, who has served as interim CEO beginning in April of this year following the departure of president and CEO Lucinda “Cindy” Baier, will step down and reassume her role as non-executive chairman of the board. According to Brookdale, Stengle’s selection was the result of a comprehensive search led by the board’s search committee. Stengle previously served as president and chief operating officer of Gentiva, a role he assumed in 2022. Gentiva, which employs more than 12,000 associates, provides hospice, palliative and home health services at 550 locations across 38 states. Prior to his tenure at Gentiva, Stengle served as executive vice president and chief operating officer for Sunrise Senior Living, leading community operations, sales, marketing and clinical operations for roughly 250 seniors housing communities. His experience also includes an 11-year career with the U.S. Air Force. “While I have enjoyed my time as interim CEO, I am confident Nick has the strategic acumen, vision and leadership skills …

Hunter Hotel Advisors Facilitates Sale of 131-Room Courtyard by Marriott Hotel in Collierville, Tennessee

by Abby Cox

COLLIERVILLE, TENN. — Hunter Hotel Advisors has negotiated the sale of the 131-room Courtyard by Marriott Memphis Collierville hotel located within the Carriage Crossing lifestyle shopping center in Collierville. Tim Osborne and Adeel Amin of Hunter facilitated the transaction and secured a $8.7 million bridge loan on behalf of the buyer, a Texas-based investor. The seller was an entity doing business as Southern Hospitality LLC. Situated near the FedEx World Technology Center, the four-story hotel includes 1,624 square feet of meeting space, an indoor swimming pool, fitness center and a full-service restaurant called The Bistro.

Boulder Group Brokers $2.9M Sale of Retail Property Near Nashville Leased to Tractor Supply

by Abby Cox

SMYRNA, TENN. — The Boulder Group has brokered the $2.9 million sale of an 18,750-square-foot, single-tenant retail property in Smyrna leased to Tractor Supply. Located along U.S. Highway 41, Tractor Supply has operated at the site since 1999 and recently signed a 10-year lease extension. Randy Blankstein and Jimmy Goodman of The Boulder Group represented the buyer, a high-net-worth family engaging in estate planning, in the transaction. Andrew Ragsdale of Colliers represented the undisclosed seller. Founded in 1938, Tractor Supply operates more than 2,300 stores across 49 states.

NASHVILLE, TENN. — The Clear Blue Co. has opened Highland East, a 238-unit affordable housing community located at 301 Ben Allen Road in east Nashville. The seven-building property has direct access with the Metro Greenway and the city’s expanding trail and greenway network thanks to a partnership with Metro Parks. Highland East features a mix of one-, two- and three-bedroom units available to individuals earning up to 60 percent of the area median income (AMI). Ten units will be reserved for those earning up to 30 percent of AMI, and five units will be dedicated as permanent supportive housing to serve individuals who formerly experienced homelessness. Amenities include a clubhouse, business center, playground, indoor fitness center, outdoor fitness circuit, dog park, art installations and decks with fire pits and grilling areas. Clear Blue broke ground on Highland East in June 2023. The development is supported by Amazon, the Tennessee Housing Development Agency through Low-Income Housing Tax Credits (LIHTC) generating $36.7 million in equity and construction and LIHTC equity investment from JP Morgan. Regions Bank provided a $24.8 million construction loan and a $23.6 million equity bridge loan for the project. Walker & Dunlop is also providing permanent financing. The Metropolitan …

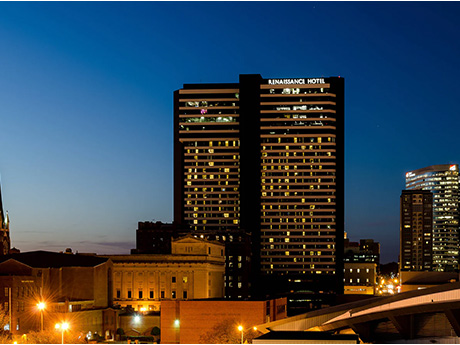

Ashford Hospitality Trust Obtains $218.1M Loan to Refinance Renaissance Hotel in Nashville

by John Nelson

NASHVILLE, TENN. — Ashford Hospitality Trust Inc. has obtained a $218.1 million loan to refinance Renaissance Hotel, a 673-room hotel located at 611 Commerce St. in Nashville. Built in 1987, the hotel features meeting and event space, a club lounge, Little Fib Bar, a 24-hour market and a third-floor bar and restaurant in a glass atrium called Bridge Bar, according to the hotel website. The two-year, non-recourse loan refinanced the existing $267.2 million mortgage. The undisclosed lender underwrote the loan with three one-year extension options and a floating interest rate of SOFR + 2.26 percent, which is 172 basis points lower than the interest rate on the previous loan. In conjunction with the debt refinancing, Ashford Hospitality increased the preferred equity investment on the hotel by $53 million.

Landmark, Manulife Investment Complete 833-Bed Student Housing Development Near University of Tennessee

by Abby Cox

KNOXVILLE, TENN. — A joint venture between Landmark Properties and Manulife Investment Management has completed The Mark Knoxville, an 833-bed student housing development located at 124 S. Concord St. near the University of Tennessee campus in Knoxville. The development team for the project included BKV Group and Landmark Construction. The property offers fully furnished units with bed-to-bath parity, ranging in size from studios to five-bedroom floorplans. Amenities include a rooftop clubhouse and outdoor pool with a jumbotron, 24-hour study lounge, pickleball court and a fitness center, as well as a 25,000-square-foot courtyard with grilling stations, fire pits and hammock groves. The property also features an onsite parking garage and a private shuttle service to campus.

Matthews Negotiates Sale of 224,139 SF Greeneville Commons Shopping Center in Northeast Tennessee

by John Nelson

GREENEVILLE, TENN. — Matthews has negotiated the sale of Greeneville Commons, a 224,139-square-foot shopping center located in Greeneville, a city in northeast Tennessee near the North Carolina border. Kyle Stonis, Pierce Mayson and Boris Shilkrot of Matthews represented the undisclosed seller, a repeat institutional client, in the transaction. Matthews also procured the buyer, an affiliate of Hackney Real Estate Partners. The sales price was not disclosed. Greeneville Commons was more than 90 percent leased at the time of sale to tenants including Ross Dress for Less, Hobby Lobby, Five Below, Marshalls, Bath & Body Works, Workout Anytime, Xfinity, GNC and Rack Room Shoes.

MURFREESBORO, TENN. — A public-private partnership between Middle Tennessee State University (MTSU) and The Annex Group has announced plans for Wommack Lane Commons, a 554-bed residence hall project on the MTSU campus in Murfreesboro. The community would replace the existing Wommack Lane Apartments, which were built nearly 50 years ago at the corner of Homecoming Drive and Blue Raider Circle. The partnership will be seeking approval for a ground lease to begin development with the State Building Commission in November. If approved, the community will offer semi-suite and suite-style units with a combination of shared and private bedrooms. Shared amenities will include an entry lounge and lounge space on each floor; a community kitchen and laundry room; private and small group study spaces; and a landscaped courtyard. The development will also include office space. Construction is expected to begin in January 2026 with completion scheduled for fall 2027. The development team includes Smith Gee Studios and SCB. The Annex Group will act as developer, general contractor, facility manager and asset manager for the community, with MTSU providing residence life and leasing services upon completion.