MANASSAS, VA. — Regional grocer Giant Food has opened an 82,000-square-foot e-commerce fulfillment center in Manassas. The new facility allows Giant to expand its delivery service to 140 zip codes across Northern Virginia and support 200 new jobs. Giant is offering free delivery for orders made Tuesday through Thursday and for a $3.95 charge on the weekends, according to Gregg Dorazio, director of e-commerce at Giant. The grocer will continue to operate its other existing fulfillment center in Hanover, Md. Giant is headquartered in Landover, Md., and operates 165 supermarkets in Virginia, Maryland, Delaware and Washington, D.C., with approximately 20,000 associates.

Virginia

ROANOKE, VA. — Montecito Medical has acquired a 209,000-square-foot medical office property located in Roanoke. Situated within Tanglewood Center — an 800,000-square-foot mixed-use development that also features retail, dining and entertainment space — the building is leased to Carilion Children’s Clinic. The seller and sales price were not disclosed.

ALEXANDRIA, VA. — Berkadia has brokered the $52 million sale of Del Ray Central, a 141-unit apartment community located at 3501 Mount Vernon Ave. in Alexandria. Walter Coker, Brian Crivella, Yalda Ghamarian and Bill Gribbin of Berkadia represented the undisclosed seller in the transaction. The buyer is a partnership led by Caruthers Cos. The property, which was 97 percent occupied at the time of sale, is situated approximately a half-mile from the Potomac Yard Metro Station and near the Old Town Alexandria and National Landing neighborhoods of metro Washington, D.C. Del Ray Central features a unit mix of studio, one- and two-bedroom apartments, as well as 2,670 square feet of ground-floor retail space, a pool, clubhouse, business center, bike storage, roof terrace, walking/biking trails and a courtyard, according to Apartments.com.

ARLINGTON, VA. — Jamestown has signed three new office tenants to join Ballston Exchange, a mixed-use campus located in the Washington, D.C., suburb of Arlington. The newcomers include Management Sciences for Health (MSH), EPIGEN and COMTO. Cresa represented MSH and COMTO in their lease negotiations, and Cushman & Wakefield represented Jamestown in all three deals, as well as EPIGEN. All together the three new tenants will occupy 30,000 square feet of space. Other tenants at Ballston Exchange include Booz Allen Hamilton, Insurance Institute for Highway Safety (IIHS) and CENTRA Technology. Retailers and restaurants include Shake Shack, Orangetheory Fitness, CorePower Yoga, Greenheart Juice Shop, Dunkin’, Cava, The UPS Store and Bearded Goat Barber, among others.

RICHMOND, VA. — Cushman & Wakefield|Thalhimer’s Capital Markets Group has brokered the $7.3 million sale of Wistar Center in Richmond. Located at 8101-8157 Staples Mill Road, the portfolio comprises 49,092 square feet of industrial and retail space. Fully leased to 20 tenants, the retail property features 20,436 square feet. Totaling 28,656 square feet across two buildings, the industrial space was also fully leased at the time of sale. Bo McKown, Catharine Spangler and Eric Robison of Cushman & Wakefield|Thalhimer arranged the sale on behalf of the seller, Fernau LeBlanc Investment Partners. Prudent Growth Partners was the buyer.

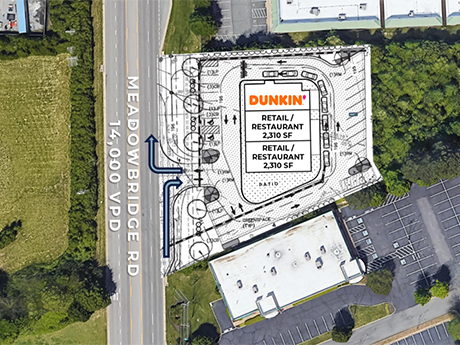

MECHANICSVILLE, VA. — WEDGE Acquisitions LLC has purchased a 1.7-acre parcel in Mechanicsville for $690,000 for the development of a retail strip center. Upon completion, the property, located at 8527 Meadowbridge Road, will comprise 6,500 square feet. Dunkin’ will anchor the center. Nathan Shor of S.L. Nusbaum represented WEDG in the transaction, and Douglas Tice III, also with S.L. Nusbaum, represented the seller, Lisa G. Waitman.

S.L. Nusbaum Breaks Ground on 119-Unit Affordable Housing Development in Williamsburg, Virginia

by John Nelson

WILLIAMSBURG, VA. — S.L. Nusbaum Realty Co. has broken ground on 2 Rivers Apartment Homes, a two-phase, 119-unit affordable housing community in Williamsburg. Phase I of the development will comprise 59 one-, two- and three-bedroom apartments. Amenities will include a clubhouse with a fitness center, business center with Wi-Fi access, free parking, children’s play area, dog park, multiuse field, cabana and a grilling patio. The design-build team for 2 Rivers includes TS3 Architects PC, Siska Aurand Landscape Architects Inc., Details Interior Design, AES Consulting Engineers and Harkins Builders Inc. S.L. Nusbaum worked with AGM Financial Services and TowneBank to secure construction financing. Overall construction costs will total approximately $26 million, according to S.L. Nusbaum.

RICHMOND, VA. — Capital Square has broken ground on a 352-unit apartment development in the Scott’s Addition neighborhood of Richmond. The development site is within an opportunity zone at 2929 W. Clay St. and 2922 and 2925 W. Marshall St. The project will include three-seven story buildings developed atop podium parking with more than 5,350 square feet of ground-level retail space. The design-build team includes civil engineer Timmons Group, architect Poole & Poole Architecture, general contractor Hourigan Construction, interior designer ENV and landscape architect Marvel Designs. Construction of the development is expected to be completed by spring 2025. Locally based Capital Square has developed three other apartment communities in Scott’s Addition and has another one nearing completion.

ASHBURN, VA. — GI Partners Real Estate has purchased a data center located at 43915 Devin Shafron Drive in Ashburn, a city in North Virginia known as “Data Center Alley.” According to LoopNet Inc., the facility spans 138,600 square feet. Starwood Capital Group and minority owner and property manager Digital Realty sold the facility to GI Partners for an undisclosed price. CBRE’s Data Center Capital Markets team represented the sellers in the transaction. Built in 2010, the property was fully leased at the time of sale to two undisclosed “creditworthy tenants.” The 98-acre property offers 9 megawatts (MW) of critical power and can be expanded in the future.

ALEXANDRIA, VA. — Harbor Group International has sold Sussex at Kingstowne, a 556-unit apartment community located in Alexandria, about eight miles south of Washington, D.C. The buyer and sales price were not disclosed, but Harbor Group purchased the property in 2018 for $144 million. Prior to the sale, Harbor Group implemented a multimillion-dollar capital improvement program for Sussex at Kingstowne’s interiors, common areas and amenities, including the community’s two swimming pools, fitness center, cyber café and a resident’s lounge.