FARMERS BRANCH, TEXAS — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of Sola Galleria, a 330-unit apartment community in the northern Dallas metro of Farmers Branch. The property offers one- and two-bedroom units and amenities such as a pool, fitness center, computer lounge, coffee bar, clubhouse kitchen, zen lounge, outdoor grilling and dining stations and a gaming/media room. Joey Tumminello, Drew Kile, Taylor Hill, Michael Ware and Jack Windham of IPA represented the seller, a partnership between HLC Equity and The Hampshire Cos., in the transaction. Cameron Chalfant, Brian Eisendrath, Harry Krieger and Scott Arenzon, also with IPA, arranged an undisclosed amount of acquisition financing for the deal on behalf of the buyer, San Diego-based MG Properties. The new ownership has rebranded the property as Layers Galleria.

Texas

MIDLAND, TEXAS — A joint venture between Silverstone Partners and JSB Capital Group has purchased a portfolio of four build-to-rent properties totaling 277 homes in the West Texas city of Midland. The specific names and addresses of the properties, which are collectively known as The Seed Portfolio, were not disclosed. The portfolio features an average home size of 1,300 square feet. The seller was Related Cos. Silverstone affiliate Claireville Residential will manage the properties.

SAN ANTONIO — A joint venture between two Texas-based retail owner-operators, San Antonio-based Headwall Investments and Houston-based Fifth Corner, has acquired a 102,803-square-foot shopping center in San Antonio. Sunset Ridge Shopping Center was originally built in 1950 and was 96 percent leased at the time of sale to a roster of more than 25 tenants, including Jefferson Bank, Great Clips, Baskin-Robbins and Orangetheory Fitness. The seller and sales price were not disclosed.

HOUSTON — SunStrong Management has signed an 18,280-square-foot office lease at the 52-acre Greenway Plaza office complex in Houston. The solar asset management and service firm will occupy space on the fifth floor at 20 Greenway Plaza, a 433,132-square-foot building. Alvarez & Marsal represented the tenant in the lease negotiations. Steve Rocher and Rima Soroka of CBRE represented the landlord, Los Angeles-based Stockdale Capital Partners.

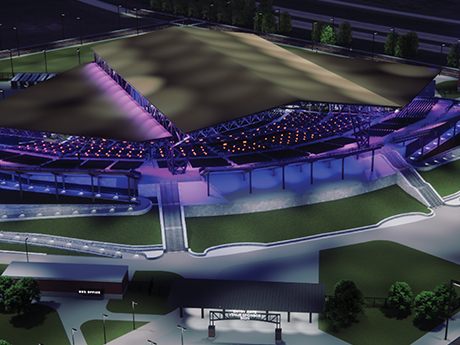

WEBSTER, TEXAS — Venu, a hospitality and entertainment owner-operator based in Colorado, has signed a letter of intent to open a 12,500-seat amphitheater in Webster, a southeastern suburb of Houston. According to local media sources, including Community Impact Newspaper and CultureMap Houston, the project is valued at $150 million. Known as Sunset Amphitheater Houston and spanning 34 acres, the venue will be located within Flyway, an 80-acre entertainment district that is anchored by Great Wolf Lodge. Former Dallas Cowboys quarterback Troy Aikman is a partner on the project via the Aikman Club, a 350-seat, membership-based elevated space that will be located at the center of the venue.

MIDLAND, TEXAS — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has brokered the sale of a portfolio of four multifamily properties totaling 277 units in the West Texas city of Midland. The properties, which are collectively known as the Midland Value-Add Portfolio, include Brighton Court, Delmar Villas, Enclave and Signature Place. All four properties were built in the early 1980s. Will Balthrope and Drew Garza of IPA, in association with Tommy Lovell III and Richard Robson of Marcus & Millichap, represented the seller and procured the buyer, both of which requested anonymity, in the transaction.

ROUND ROCK, TEXAS — Minnesota-based Broadway Street Development has completed The Preserve at Mustang Creek, a 252-unit affordable housing project in the northern Austin suburb of Round Rock. Designed by Merriman Anderson Architects and built by Cadence McShane, the property offers one-, two-, three- and four-bedroom units that are reserved for households earning between 30 and 60 percent of the area median income. Amenities include a pool, outdoor grilling and dining stations, a playground, fitness center, café kitchen and an activity room. The Texas Department of Housing and Community Affairs provided partial funding for the project. Construction began in fall 2023.

HOUSTON — Bank of America has signed a 70,914-square-foot office lease renewal at the 52-acre Greenway Plaza office complex in Houston. The banking giant will continue to occupy portions of the seventh and ninth floors at 20 Greenway Plaza, a 433,132-square-foot building. David Bale and Cody Little of JLL represented the tenant in the lease negotiations. Steve Rocher and Rima Soroka of CBRE represented the landlord, Los Angeles-based Stockdale Capital Partners.

MIDLAND, TEXAS — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has brokered the sale of The Everett at Ally Village, a 288-unit apartment complex in the West Texas city of Midland. Built in 2021, the property offers one-, two- and three-bedroom units and amenities such as a pool, fitness center, business center, clubhouse, pet park, golf simulator and outdoor grilling and dining stations. Will Balthrope and Drew Garza of IPA brokered the deal. The buyer and seller were not disclosed.

HOUSTON — Largo Capital, a financial intermediary based in upstate New York, has arranged a $13.2 million loan for the refinancing of a 125-room hotel in Houston. The specific name and address of the hotel were not disclosed, but the property is operated under the Homewood Suites by Hilton brand. The undisclosed borrower will use a portion of the proceeds to fund capital improvements. Ben Blanton and Max Downing led the transaction for Largo Capital.