HOUSTON — Houston Methodist has signed a 75,800-square-foot lease at Texas Medical Center in Houston. The provider will occupy two floors at the Dynamic One building at TMC Helix Park for various biomedical research initiatives. The building was completed last fall and offers a fitness center, outdoor terrace and a multi-purpose lounge. Scott Carter of CBRE represented Houston Methodist in the lease negotiations. Eric Johnson, Lisa Bovermann and Kaitlyn Harp of Transwestern represented the landlord, Beacon Capital Partners, which developed the building in partnership with Zoë Life Sciences.

Texas

PEARLAND, TEXAS — Dallas-based healthcare investment firm MedProperties Realty Advisors has purchased a 44,150-square-foot medical office building that is part of the Memorial Hermann Pearland Hospital on the southern outskirts of Houston. The two-story building was completed in 2023 and was fully occupied at the time of sale. Capital One and Siemens Financial Services provided acquisition financing for the deal. The seller was not disclosed.

PHARR, TEXAS — Partners Real Estate has brokered the sale of a 10,125-square-foot industrial building in the Rio Grande Valley city of Pharr. The property at 3329 S. Jackson Road was built in 1973, according to LoopNet Inc. Gustavo Torres and Carlos Marquez of Partners represented the seller, Texas-based construction firm Alamo Systems Industries, in the transaction. The buyer and sales price were not disclosed.

DALLAS — Locally based developer Palladium USA is nearing completion of Palladium Simpson Stuart, a $55 million, 270-unit mixed-income project in South Dallas. About 90 percent (243) of the units will be reserved for households earning between 40 and 80 percent of the area median income, while the remainder will be rented at market rates. Amenities will include a pool, dog park, walking trails, conference room, computer lab, kids’ playroom and a fitness center. HEDK is the project architect, and BBL Construction is the general contractor. PNC Bank provided construction financing for the project, and the Texas Department of Housing & Community Affairs issued 4 percent Low-Income Housing Tax Credit equity. A grand opening ceremony will take place on Thursday, Feb. 8.

DENTON, TEXAS — Colliers Mortgage has provided a $41.8 million HUD-insured loan for the refinancing of Village at Rayzor Ranch, a 300-unit multifamily property located in the North Texas city of Denton. The property offers studio, one- and two-bedroom units and amenities such as a pool, outdoor grilling and dining stations, a dog park, fitness center, sports court, coworking space, coffee bar, lounge, fitness center and package handling services. Fritz Waldvogel of Colliers Mortgage originated the loan through a partnership with Old Capital Lending on behalf of the undisclosed borrower.

DALLAS — Marcus & Millichap has arranged the sale of a nine-property, 1,080-bed seniors housing portfolio in the Dallas area. The locations were not disclosed. Eight of the properties are skilled nursing facilities totaling 992 beds, and the other is an 88-bed assisted living facility. Nick Stahler, Michael Mooney and Austin Diamond of Marcus & Millichap represented the seller, a regional private equity owner, in the transaction. The buyer was a family office private equity investor. Both parties requested anonymity. Tim Speck of Marcus & Millichap assisted in closing the deal as the broker of record.

FLOWER MOUND, TEXAS — Lee & Associates has brokered the sale of an eight-acre industrial development site located at the corner of Lakeside Parkway and Gerault Road in Flower Mound, located in the northern-central part of the metroplex. Alex Wilson of Lee & Associates represented the buyer, Canadian firm Hopewell Development, in the transaction. The seller was an entity doing business as P3 FM Development LLC.

AUSTIN, TEXAS — Harmony Public Schools has signed a 7,211-square-foot office lease extension in northwest Austin. The academic administrator will continue to occupy space at Building G at Amber Oaks, a 10-building park located along I-45. Patrick Ley and Jason Steinberg of Equitable Commercial Realty represented the undisclosed landlord in the lease negotiations. Nick Boyd of Nick Boyd Real Estate represented the tenant.

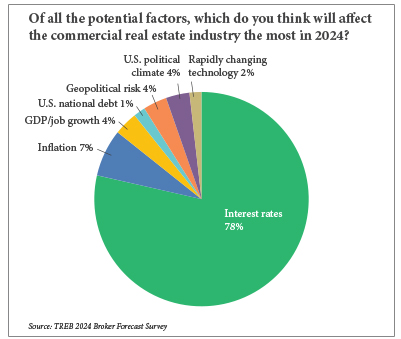

By Taylor Williams For the last several years, as COVID-19, inflation and interest rate hikes have chronologically rocked the commercial real estate industry, the term “dry powder” has increasingly factored into investment discussions. While the term generally refers to cash or capital that is parked on the sidelines, 2024 could well be the year for its deployment. There are several basic reasons for endorsing this notion. First, at its December meeting, the Federal Reserve signaled that it would cut rates three times this year, which should theoretically make debt financing more accessible and less expensive — though the extent of that depends on the magnitude of the reductions. Second, as evidenced by the stock market tear following that announcement, investors are itching to deploy capital and will rally around just about any reason to do so, proven or not. Third, there is roughly $537 billion in commercial real estate loans that will mature next year, according to New York City-based Trepp. This staggering volume of impending maturities in a high-interest-rate environment all but assures that some assets will be forced into sales, whether by owners pre-default or lenders post-default. And finally, the 10-year Treasury yield — the benchmark rate against …

MESQUITE, TEXAS — Dallas-based CapStar Real Estate Advisors will develop a 765,668-square-foot industrial project on a 40.4-acre site at 2800 Skyline Drive in the eastern Dallas suburb of Mesquite. The facility is already fully preleased to Canadian Solar, which will use the facility for distribution support for its manufacturing operation next door at 3000 Skyline Drive. Building features will include 40-foot clear heights, 190 dock-high doors and parking for 351 cars and 134 trailers. Jody Thornton, Trent Agnew, Tom Weber and Greer Shetler of JLL arranged joint venture equity for the project with an undisclosed partner on behalf of CapStar. Construction is scheduled to begin in the first quarter and to last about 12 months.