HOUSTON — Pocas International has purchased an industrial building at 8008 W. Sam Houston Parkway S. in southwest Houston that totals 27,893 square feet, according to LoopNet Inc. The move represents an expansion for the food-and-beverage products distributor, which simultaneously sold its previous building, a 16,675-square-foot facility located at 711 Buffalo Run in nearby Missouri City. Wes Williams of Colliers represented Pocas International in both transactions. Travis Land of Partners Real Estate represented the seller of the Sam Houston Parkway building, an entity doing business as Ultra Houston Group LP. Harry Lou of Fidelity Realtors represented the buyer of the Buffalo Run building, Wellcom Realty LLC. Sales prices were not disclosed.

Texas

AcquisitionsContent PartnerFeaturesLoansMidwestMultifamilyNAINortheastOfficeRetailSoutheastTexasWestern

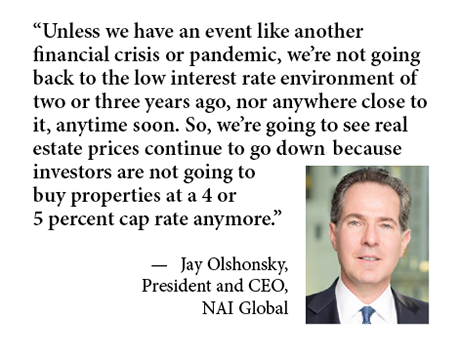

Previous Year’s Challenges Shape 2024 Outlook for Cap Rates, Investment Activity, Distressed Properties

If NAI Global president and CEO Jay Olshonsky had to use one word to sum up the 2023 commercial real estate market, it would be “inactive.” The interest rate-fueled bid-ask spread stifled investment sales of all property types, and in the office sector especially, tenants avoided making any space decisions if they didn’t have to. One month into 2024, not much has changed. From an investment sales perspective, Olshonsky still sees properties offered at capitalization rates between 4 and 5 percent while interest rates are 6 percent or higher, which is prolonging the disconnect between buyers and sellers. Meanwhile, robust job creation well beyond today’s levels is needed to create the leasing demand that will reverse the office sector’s troubles in the new era of hybrid work. But that’s not likely to happen in 2024 as the tech sector, in particular, continues to lay off workers. “I’ve been in the real estate business a long time, and this is a cycle unlike most others,” says Olshonsky. “The biggest problem we have right now is mainly record-high office vacancy just about everywhere — certainly in the large cities — which we’ve never really seen before. On the investment side, lenders cannot …

HOUSTON — Eastham Capital and Mosaic Residential have acquired a 318-unit apartment community in Houston’s Westchase neighborhood. Sola Westchase was built in 1999 and offers one-, two- and three-bedroom units that range in size from 626 to 1,436 square feet. Amenities include a pool, outdoor BBQ pavilion, fitness center, clubhouse lounge and a business center. Sola Westchase was 95 percent occupied at the time of sale. The seller and sales price were not disclosed.

BRENHAM, TEXAS — SRS Real Estate Partners has brokered the $10.3 million sale of a 63,224-square-foot retail building in Brenham, about 75 miles northeast of Houston, that is leased to Academy Sports + Outdoors. The newly constructed building sits on a six-acre site at 1041 Nolan St. Matthew Mousavi and Patrick Luther of SRS represented the seller, a Texas-based developer, in the transaction and procured the buyer, a San Antonio-based private investor. Both parties requested anonymity.

RED OAK, TEXAS — Alabama-based general contractor Brasfield & Gorrie has topped out a 103,000-square-foot manufacturing facility in Red Oak, about 20 miles south of Dallas. The facility is a build-to-suit for Schneider Electric, and the site is located near the campus of one of the company’s partners, Compass Datacenters. Full completion is scheduled for the second quarter.

DALLAS — Blueprint Healthcare Real Estate Advisors has arranged the sale of a 93-unit seniors housing complex in Dallas. The unnamed property is located in the Preston Hollow area and offers assisted living and memory care services. The buyer was the existing operator, Juniper Communities, and the seller was undisclosed. Alex Florea, Giancarlo Riso and Amy Sitzman handled the transaction for Blueprint.

HOUSTON — Keller Williams Metropolitan has signed a 20,656-square-foot office lease on the eighth floor at 4265 San Felipe Street, a 223,545-square-foot building in Houston’s River Oaks neighborhood. Ty Martin of McCann Commercial represented the tenant in the lease negotiations. Brad Fricks and Matt Asvestas of Stream Realty Partners represented the landlord, Woodbranch Management Inc. The building is now 90 percent leased.

By Taylor Williams The Houston industrial market has generally performed quite well over the past few years, even as a global pandemic, record inflation and hard-hitting interest rate hikes have rocked the commercial real estate industry as a whole. Demand for industrial space has held firm due to rebounding energy prices and expansions in infrastructure and traffic at Port Houston, as well as organic population growth and economic diversification that has elevated the market’s role as a distribution hub. According to data from CBRE, the market has a 6 percent vacancy rate and posted 5.1 million square feet of positive net absorption through the first three quarters of 2023. The volume of new construction was on track to outpace absorption in 2023 when the report was released. But that was not the case in 2021 and 2022, years in which net absorption equaled and exceeded 7 million square feet, respectively. New deliveries totaled approximately 5.6 million and 5.4 million square feet in each of those years, driven not only by the aforementioned factors but also by a temporary uptick in demand for e-commerce services in the wake of the pandemic. In any market or asset class, when absorption exceeds supply …

GALVESTON, TEXAS — Dallas-based investment firm RREAF Holdings, in partnership with Gulf Coast owner-operator Innisfree Hotels, will develop a $250 million Margaritaville Hotel & Resort in Galveston. The 334-room, 300,000-square-foot hotel will feature a 2.5-acre elevated waterpark, a lazy river, pickleball courts, family entertainment center, four restaurants and direct beach access, as well as other features activities and amenities with themes from the music of the late Jimmy Buffett. Construction is scheduled to begin in May or June. A tentative completion date was not disclosed.

PORTLAND, TEXAS — McLeod Cobb Investments has revealed construction updates and new tenant signings at Oliver’s Way, the firm’s $100 million multifamily and retail development in the South Texas city of Portland. A 128,500-square-foot Target store that will anchor the retail component is nearing completion and will open late this summer. Construction will also soon begin on a 13,800-square-foot freestanding retail building. McLeod Cobb has secured deals with retailers such as Jack in the Box, Brake Check, Raising Cane’s, Chipotle Mexican Grill, Aspen Dental, Five Guys, James Avery and Wells Fargo. The development team expects to begin construction on the apartments later this year.