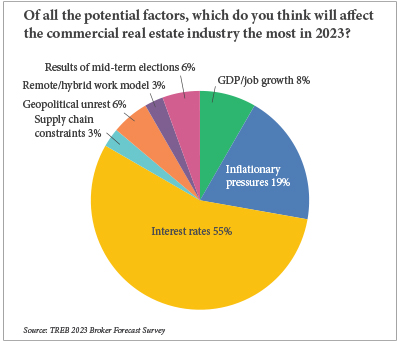

By Taylor Williams If inflation was the story of 2022, then basic economic theory dictates that interest rate hikes and their subsequent impacts will be the featured issue of 2023. For when it comes to whipping inflation, the Federal Reserve only has so many tools in its kit. The nation’s central bank can raise reserve requirements for lenders and sell Treasury notes all day long, but nothing has as direct and powerful of an effect on the monetary supply as movement in short-term interest rates. Simply put, higher interest rates discourage borrowing activity, which reduces the amount of money circulating in the system. In the past 12 months, the U.S. economy has seen no fewer than seven rate hikes totaling 425 basis points, with the Fed indicating that more increases are on the docket for 2023. Much like severe inflation itself, the rate hikes that inevitably follow rampant price escalation tend to touch nearly every facet of commercial real estate. Developers and investors respectively face higher interest rates on construction and acquisition loans. Brokers must adjust prices on properties they’re listing for sale or rent in response to these variables. End users tend to be somewhat insulated from these impacts, …

Texas

GEORGETOWN, TEXAS — Locally based firm Novak Commercial Development has acquired a six-acre tract in the northern Austin suburb of Georgetown for the development of a 300-unit multifamily project. The site is located within The Commons at Rivery mixed-use development, which will include 45,000 square feet of retail space, as well as open green space. Alex Makris of Partners, the Houston-based investment and brokerage firm formerly known as NAI Partners, internally represented the seller in the land deal. Kevin Murphy of Partners represented Novak Commercial. Completion is slated for 2025.

HOUSTON — CBRE has negotiated the sale of The Village at River Oaks, a seniors housing community in the River Oaks neighborhood of Houston that offers independent living, assisted living and memory care services. A partnership between Harrison Street and Bridgewood Property Co. sold the asset to a fund affiliated with Blue Moon Capital Partners. The sales price and number of units were not disclosed. John Sweeny, Aron Will, Garrett Sacco and Scott Bray of CBRE brokered the deal. CBRE also arranged a seven-year, floating-rate acquisition loan that carried 48 months of interest-only payments through a regional bank.

FRISCO, TEXAS — Locally based firm Centergy Retail will develop Lexington Village, a 90,000-square-foot retail project that will be located on the northern outskirts of Dallas in Frisco. Grocer Tom Thumb has committed to anchoring the center with a 58,000-square-foot store that will include a pharmacy and a coffee bar. The store, which is scheduled to open in spring 2024, will be located within a larger, 600-acre master-planned development that will ultimately feature about 4,700 single-family and multifamily residences. Bobby Weinberg and Mason Brower of Northmarq arranged a $25.4 million construction loan through an undisclosed bank on behalf of Centergy Retail. The financing was structured with a five-year term with three years of interest-only payments followed by a 25-year amortization schedule.

IRVING, TEXAS — The University of St. Augustine for Health Sciences (USAHS) has opened a 55,050-square-foot academic and office facility in Irving’s Las Colinas district. The space is located within the former Zale Corp. headquarters building. William Quinby of Savills represented USAHS, which is also planning a 20,979-square-foot expansion in Irving, in its site selection and lease negotiations. Classes at the new facility began in early January, and a ribbon-cutting ceremony will be held on Wednesday, Jan. 25.

COPPELL, TEXAS — Metropolitan Hardwood Floors has signed a 23,778-square-foot industrial lease renewal at Park West Crossing in Coppell, a northeastern suburb of Fort Worth. According to LoopNet Inc., the building at 435 Southwestern Blvd. sits on 4.9 acres and totals 61,399 square feet. Chicago-based investment firm ML Realty Partners owns Park West Crossing and was internally represented in the lease negotiations. Mike McElwee of Avison Young and Brian Bruininks of The Andover Co. represented the tenant.

HOUSTON — A joint venture between two Houston-based investment firms, LandPark Advisors and Sunset Capital, has acquired a portfolio of eight self-storage facilities totaling approximately 1,440 units. The facilities span 237,735 net rentable square feet and are scattered across several markets in East Texas, including Wylie, Hallsville, Flint, Longview and Carthage. The new ownership plans to implement a value-add program and has tapped Right Move Storage LLC to lead that initiative and manage the portfolio. Brandon Karr of Marcus & Millichap represented the seller, a private investment group based in East Texas, in the transaction, and procured the joint venture as the buyer. The sales price was not disclosed.

CYPRESS, TEXAS — St. Louis-based general contractor McCarthy Building Cos. has completed vertical construction at a 106-acre hospital campus in the northwestern Houston suburb of Cypress on behalf of the Houston Methodist health system. The campus will comprise a 570,700-square-foot, seven-story hospital and two medical office buildings totaling roughly 320,000 square feet that will be linked via a sky bridge. The development will also house a central utility plant and various open green spaces. Page is the project architect, and Walter P. Moore is the structural and civil engineer. Construction began earlier this year, and full completion is slated for late 2024. The site formerly housed 11 buildings totaling 600,000 that were occupied by Sysco Corp., all of which have been demolished.

HOUSTON — Berkadia has negotiated the sale of Cypress Parc, a 200-unit apartment complex in North Houston. The property offers two- and three-bedroom units that range in size from 926 to 1,420 square feet. Residences features walk-in closets, washer and dryer connections and private balconies/patios. Amenities include a pool, fitness center, business center, clubhouse, volleyball court and outdoor grilling and dining areas. Chris Young, Joey Rippel, Kyle Whitney, Jeffrey Skipworth, Chris Curry and Todd Marix of Berkadia represented the seller, Utah-based investment firm Lionel Partners, in the transaction. Cutt Ableson of Berkadia arranged acquisition financing on behalf of the buyer, Trinnium Equity Group, which is also based in Utah.

HOUSTON — Locally based multifamily developer CityStreet Residential has opened a 165-site RV park near Texas Medical Center in Houston. Jetstream RV Resort at The Med Center spans 15 acres at 2919 W. Orem Drive, about 10 miles south of the downtown area. Amenities include a pool, clubhouse, outdoor grilling and dining areas, fitness center, business center, beer garden, putting green, dog wash, shuffleboard courts, onsite laundry facilities and a playground.