SAN ANTONIO — Locally based investment firm The Lynd Group has acquired Parc 410, a 344-unit apartment community in San Antonio’s Leon Valley submarket. Built in 1985, the garden-style property offers one- and two-bedroom units with an average size of 716 square feet. Amenities include two pools, a clubhouse, fitness center, outdoor grilling and picnic areas, a dog park and a basketball court. As part of a $6 million capital improvement program, Lynd will install package lockers and a children’s playground, as well as upgrade unit interiors and other common areas.

Texas

COLUMBUS, TEXAS — DWG Capital Partners has sold a 35,835-square-foot light industrial facility in Columbus, located west of Houston. The investment and advisory firm acquired the asset in April 2021 via a sale-leaseback with the tenant, The Theut Co., a division of Denver Glass Interiors. Simon Miller of Endaxi Capital Partners represented DWG Capital Partners and the buyer, a private partnership based in Oregon, in the off-market transaction.

IRVING, TEXAS — Engineering firm Kimley-Horn has signed a 25,767-square-foot office lease at Mandalay Tower 2, a 16-story building within Irving’s Las Colinas district. Rodney Helm, Zach Bean and Chris Taylor of Cushman & Wakefield represented the landlord, Parmenter Realty Partners, in the lease negotiations. Kimley-Horn plans to move into Mandalay Tower 2, which offers a restaurant, fitness center, sundry shop and conference facilities, in May 2023.

DRIPPING SPRINGS, TEXAS — Avison Young has brokered the sale of a 19,472-square-foot office building in the western Austin suburb of Dripping Springs. Giovanni Palavicini of Avison Young represented the buyer, locally based coworking concept FUSE Workspace, in the transaction. Dan Lewis and David Alsmeyer of TIG Real Estate Solutions represented the seller, private developer Steve Herren. FUSE Workspace also plans to occupy the building and is targeting a first-quarter 2023 opening.

OKLAHOMA CITY — JLL has arranged a $100 million construction loan for OAK, a mixed-use project in Oklahoma City. Jeremy Sain of JLL arranged the financing through an undisclosed lender on behalf of the borrower, Veritas Development. At full build-out, the development will consist of 320 residential units, 260,000 square feet of office space, 250,000 square feet of retail space, a 133-room boutique hotel and 7,000 square feet of public green space, all connected by walking paths. Retail tenants that have already committed to OAK include RH, Arhaus and Capital Grille.

HOUSTON — Locally based developer Lovett Industrial has broken ground on a 388,793-square-foot industrial project in South Houston. The project represents Phase I of 610 Business District, a 113-acre speculative development. Phase I will comprise a 291,459-square-foot, cross-dock building with 36-foot clear heights and a 97,223-square-foot, front-load building with 32-foot clear heights. Completion is slated for August 2023. More Architecture Studio designed the development, and Alston Construction is serving as the general contractor. Associated Bank provided construction financing for the project. CBRE has been tapped as the leasing agent.

DUNCANVILLE, TEXAS — Houston-based investment firm Venterra Realty has acquired Bella Ruscello, a 216-unit apartment community in Duncanville, a southern suburb of Dallas. Built in 2007, the property features one- and two-bedroom units ranging in size from 655 to 1,074 square feet. Amenities include a pool, fitness center, community room with a theater and a paved walking trail. The seller was not disclosed. Venterra plans to implement a value-add program.

GRAND PRAIRIE, TEXAS — Locally based developer Proterra Properties has begun construction of Carrier/360 Distribution Center, a 114,400-square-foot industrial flex facility that will be located near Dallas-Fort Worth International Airport in Grand Prairie. The rear-load facility will feature 32-foot clear heights, 120-foot truck court depths, 32 dock-high doors, two drive-in ramps and a high office finish. Completion is slated for July 2023. Proterra Properties will also handle leasing of the property.

HOUSTON — Dallas-based Henry S. Miller Brokerage (HSM) has arranged the sale of a 32,886-square-foot warehouse in northwest Houston. According to LoopNet Inc., the property at 3724 Dacoma St. was built in 1976. Bill Bledsoe of HSM represented the buyer, an affiliate of Grubbs Volvo Cars Central Houston, in the transaction. Heath Donica and Jack Rathe of Stream Realty Partners represented the seller, an entity doing business as 3724 Dacoma Partners Ltd. The buyer will use the property to facilitate its expansion.

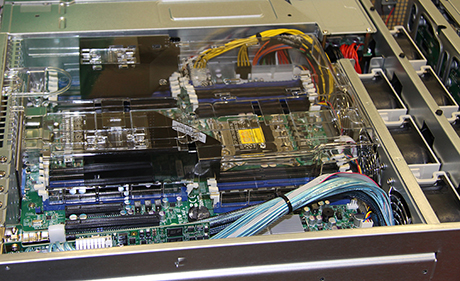

Fiber networks built with multifamily properties in mind offer network resilience while maximizing ROI for owners and operators. Well-constructed fiber networks are at the heart of meeting and exceeding residents’ growing Internet needs, especially when work-from-home culture and the constant need for online connection have made Internet slowdowns and downtime unacceptable for end users. Fiber can also strengthen connectivity across multifamily properties, shoring up the Wi-Fi services residents have come to know and on which they’ve come to depend. How does a national fiber network integrate with multifamily properties? By focusing just on the needs of the multi-dwelling unit (MDU). “Instead of building out 200-mile routes of duct and fiber, we build out ‘miracle miles’ in densely populated MDU areas. From that point, we’re able to easily grow or expand out from that area,” says Michael O’Linc, president of fiber services & campus communications at Pavlov Media. O’Linc stresses the importance of a more planned, methodical approach for MDUs. A network that serves multifamily buildings must be a network focused on backups and fail safes. The “miracle mile” method creates a main line with laterals — creating a ring shape as it expands. This approach to fiber makes networks easier to …