HOUSTON — NAI Partners has arranged the sale of an 82,053-square-foot industrial building located at 12218 Cutten Road in northwest Houston. According to LoopNet Inc., the single-tenant building was constructed in 2022. Travis Land and A.J. Williams of NAI Partners represented the seller, an entity doing business as Cutten Houston Investments LP, in the deal. Geoff Perrott and David Buescher of JLL represented the undisclosed buyer.

Texas

LONGVIEW, TEXAS — Gap Inc. (NYSE: GPS) has opened an 850,000-square-foot distribution center in Longview, about 120 miles east of Dallas. The facility is the San Francisco-based apparel retailer’s seventh in North America and first in Texas. With the opening of this center, Gap expects to hire roughly 500 full-time employees by the end of 2023 and 1,000 part-time and seasonal workers by 2026. Construction began in early 2021, at which time the company valued the total capital investment at $140 million.

SAN ANTONIO — Texas-based developer Presidium has completed Presidium Chase Hill, a 370-unit multifamily project located near La Cantera Resort on the north side of San Antonio. Designed by REES Associates, the property offers one-, two- and three-bedroom units that are furnished with stainless steel appliances, granite countertops, walk-in closets and smart technology features. Amenities include a pool with a lounge and outdoor kitchen, a two-story fitness center with a yoga studio, clubhouse with a leasing office, multiple Wi-Fi lounges, dog park with a grooming station, media room and a rooftop terrace. Rents start at approximately $1,400 per month for a one-bedroom unit.

MANOR, TEXAS — Atlanta-based developer RangeWater Real Estate is underway on construction of The Darby, a multifamily development in the northeastern Austin suburb of Manor that will consist of 326 apartments and 24 townhomes. Apartments will feature one-, two- and three-bedroom floor plans ranging in size from 757 to 1,400 square feet, and townhomes will come in three-bedroom formats with garages and private yards. The communal amenity package comprises a pool, fitness center, dog park and outdoor grilling and dining areas. Construction is scheduled to be complete in fall 2023.

SAN ANTONIO — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has brokered the sale of Pecan Springs, a 344-unit apartment community in northwest San Antonio. Built on 16 acres in 2013, Pecan Springs features one-, two- and three-bedroom units and amenities such as a pool, fitness center, business center, resident lounge, dog park, outdoor grilling stations and package lockers. Will Balthrope and Drew Garza of IPA represented the seller, Tampa-based American Landmark, and procured the buyer, Alabama-based StoneRiver Co., in the transaction. At the time of sale, Pecan Springs had an average occupancy rate of 96 percent on a trailing 12-month basis.

HOUSTON — ICC Cable Corp., a provider of wiring and cable services for the energy and construction industries, has signed a 59,376-square-foot industrial lease at 10300 FM 1960 Road in northwest Houston. Cotton Munson of Davis Commercial Real Estate represented the tenant, which is relocating from a smaller space on North Sam Houston Parkway, in the lease negotiations. Michael Foreman of Cushman & Wakefield represented the undisclosed landlord.

By Chris McCluskey, vice president of development, VanTrust Real Estate; and Robert Folzenlogen, senior vice president of strategic development, Hillwood In the past decade, the popularity of “live-work-play” developments has skyrocketed, making the concept a somewhat overused cliché in the commercial real estate world. However, the reasoning behind the acclaim remains true — people love convenience and a sense of community. And “live-work-play” is the reason that cities like Frisco that are located outside dense urban cores have thrived. According to the U.S. Census Bureau, Frisco’s population has grown by 71 percent over the last decade, consistently ranking as one of the fastest-growing cities in the nation. But this growth did not happen overnight; rather, a combination of ideal location and elected leaders’ vision has driven much of Frisco’s success. By prioritizing all real estate classes — office, residential, retail — Frisco has been able to find the right balance between bustling urban amenities and the serene background of suburbia, making it one of the most competitive landscapes today and for the foreseeable future. A Balanced Approach Suburbs are no longer known for just their family appeal, although this feature still remains a high priority for many households. Young professionals …

By Chris McCluskey, vice president of development, VanTrust Real Estate; and Robert Folzenlogen, senior vice president of strategic development, Hillwood In the past decade, the popularity of “live-work-play” developments has skyrocketed, making the concept a somewhat overused cliché in the commercial real estate world. However, the reasoning behind the acclaim remains true — people love convenience and a sense of community. And “live-work-play” is the reason that cities like Frisco that are located outside dense urban cores have thrived. According to the U.S. Census Bureau, Frisco’s population has grown by 71 percent over the last decade, consistently ranking as one of the fastest-growing cities in the nation. But this growth did not happen overnight; rather, a combination of ideal location and elected leaders’ vision has driven much of Frisco’s success. By prioritizing all real estate classes — office, residential, retail — Frisco has been able to find the right balance between bustling urban amenities and the serene background of suburbia, making it one of the most competitive landscapes today and for the foreseeable future. A Balanced Approach Suburbs are no longer known for just their family appeal, although this feature still remains a high priority for many households. Young professionals …

Arbor Realty TrustContent PartnerFeaturesLeasing ActivityMidwestMultifamilyNortheastSoutheastTexasWestern

Arbor: Multifamily Market Well-Positioned to Withstand Economic Headwinds

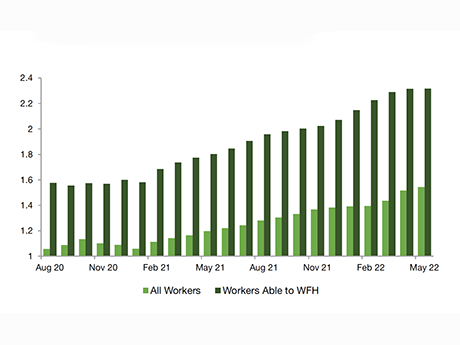

While rising interest rates, inflation and economic volatility have hurt many sectors of the economy, the rental housing market has maintained solid footing, according to Arbor Realty Trust’s Summer 2022 Special Report: Rental Housing Market Exhibits Cyclical Stability, Contains Structural Questions. The report was written by Ivan Kaufman, Arbor’s chairman and CEO, and Sam Chandan, founder of Chandan Economics. In a time of economic uncertainty, renting has become more appealing. Households seeking an affordable place to live, those who are delaying homeownership and others who prefer the flexibility and amenities associated with multifamily units all add to the increasing numbers of potential renters. Less traditional factors may also increase interest in renting, especially outside of tier-one markets. The expansion of work-from-home (WFH) culture is likely to be another reason rental demand is high right now. Meanwhile, the flexibility to work where the cost of living is lower and space is at less of a premium is pushing some renters who work remotely to explore living outside traditional hotspots. Economic Uncertainty Spreads as Interest Rate, Inflation Rise The Arbor Realty Trust report highlights a host of factors that are leading to economic uncertainty. Inflation (and its secondary effects) are contributing to …

CONROE, TEXAS — The Bauer Group, an international construction firm and machinery manufacturer, has unveiled plans for Northstar Industrial Park, a project in the northern Houston suburb of Conroe. The 79-acre site, which currently houses five warehouse and distribution buildings totaling approximately 200,000 square feet, formerly served as the U.S. headquarters for Bauer Group’s subsidiary, NEORig. The development team, which includes leasing agency Avison Young, will market the buildings to distribution and manufacturing users following NEORig’s departure from the site. The team also plans to construct build-to-suit facilities on the site’s 31.5 acres of undeveloped land, which could ultimately yield as much as 500,000 square feet of leasable product.