AUSTIN AND BEE CAVE, TEXAS — JLL has negotiated the sale of three self-storage facilities totaling approximately 1,600 units that are located in the Austin area. Two of the properties are located within the city limits at 8200 S. I-35 Service Road and 8327 S. Congress Ave., and the third is located in the western suburb of Bee Cave. The properties traded as part of a portfolio sale that totaled 6,550 units across 11 facilities, with the other eight assets being located in California and Oregon. Brian Somoza, Steve Mellon, Matthew Wheeler, Adam Roossien and Jake Kinnear of JLL represented the seller, Pegasus Group, in the portfolio sale to California-based SecureSpace Self Storage.

Texas

AUSTIN, TEXAS — Newmark has arranged the sale of Barton Creek Villas, a 250-unit multifamily property in West Austin. Built in 1998, the property features one-, two- and three-bedroom floor plans with an average size of 1,049 square feet. Amenities include a pool, fitness center, clubhouse with a coffee bar, outdoor grilling stations, a dog park and walking trails. The Connor Group sold Barton Creek Villas, which was 99 percent occupied at the time of sale, to a fund backed by Goldman Sachs Asset Management for an undisclosed price. Patton Jones and Andrew Dickson of Newmark brokered the deal.

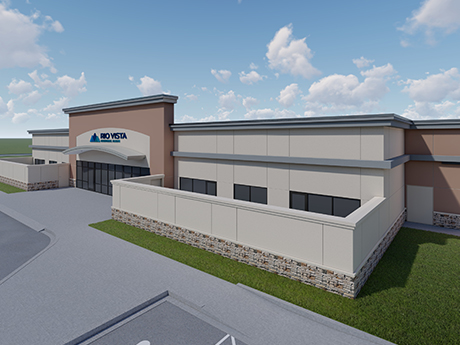

EL PASO, TEXAS — General contractor Adolfson & Peterson has topped out a 52,000-square-foot healthcare project in El Paso that is an expansion of the Rio Vista Behavioral Hospital. The project will add 40 beds, outdoor recreation spaces, an outpatient center and 14,000 square feet of parking space to the existing facilities. Full completion is slated for spring 2023. Tennessee-based Acadia Healthcare Co. Inc. owns Rio Vista Behavioral Hospital.

DALLAS — Northwood Retail has signed leases with four new tenants at Hillside Village, the Dallas-based owner’s outdoor shopping and dining plaza in the city’s Lakewood neighborhood. Phoenix-based grocer Sprouts Farmers Market and spa and salon concept Alchemy 43 will open this fall. Sugared + Bronze, which offers hair removal and tanning services, will open this winter, and California-based veterinary clinic Modern Animal will follow in 2023.

SOUTH TEXAS — VIUM Capital has provided a $17.1 million bridge-to-HUD loan for the refinancing of an undisclosed skilled nursing facility in South Texas. The financing also provides equity-out proceeds and covers transaction costs. The loan features a 60 percent loan-to-value ratio and partial recourse that disappears upon submission to HUD. The borrower leased the property in 2017, exercised its purchase option in 2018 and continued to improve operating performance during the COVID-19 pandemic. The name and location of the facility were not disclosed.

BROOKSHIRE, TEXAS — Stream Realty Partners has completed Phase II of Empire West Business Park, a project in the western Houston suburb of Brookshire that added roughly 2.3 million square feet of Class A industrial space to the local supply. Stream broke ground on the second phase, which comprised six buildings that can support users with footprints from 50,000 to 1 million square feet, in November 2021. Phase I of Empire West Business Park consisted of three buildings totaling roughly 1 million square feet that were delivered in April 2021. Stream, which acquired the 300-acre site in late 2019, is also marketing the development for lease.

EL PASO, TEXAS — A fund backed by New York-based investment firm Clarion Partners has acquired Rojas East Distribution Center, a 369,310-square-foot distribution center in El Paso. The two-building facility was built on 21.2 acres in 2021 and was fully leased at the time of sale. Building features include 28- to 32-foot clear heights, 56 dock doors, ESFR sprinkler systems and combined parking for 42 trailers and 292 cars. Dustin Volz led a JLL team that marketed the property on behalf of the seller and developer, Dallas-based Hunt Southwest.

HOUSTON — Locally based investment firm VIV Real Estate has acquired Envue Square, a 135-unit apartment complex in southeast Houston. The property offers one-, two- and three-bedroom units and amenities such as a pool, playground, clubhouse with a coffee bar, outdoor grilling and dining stations and onsite laundry facilities. VIV acquired the property in partnership with Texas Valley Group, and the new ownership plans to continue the value-add program put in place by the previous ownership. The seller and sales price were not disclosed.

MISSION, TEXAS — Northmarq has arranged the sale of Bella Rose, an 84-unit apartment complex located in the Rio Grande Valley city of Mission. Built in 2008, the property features units with renovated interiors and amenities such as a pool, fitness center and onsite maintenance and management. Zar Haro, Moses Siller, Phillip Grafe and Bryan VanCura of Northmarq represented the seller in the transaction. The buyer, an entity doing business as AZTEX RE Investments LLC, plans to combine Bella Rose with the neighboring 80-unit property that it purchased earlier this year.

HOUSTON — NAI Partners has negotiated a 50,995-square-foot industrial lease at 6410 Langfield Road in northwest Houston. According to LoopNet Inc., the property was built in 2015. Travis Land and A.J. Williams of NAI Partners represented the landlord, an entity doing business as HOU IND 2 LLC, in the lease negotiations. Patrick McKiernan and Jason Mashni of First Houston Properties represented the tenant, Legion Piping Fabricators Inc.